Annual Reporting for Representative Offices in Vietnam

Feb. 5 – One of the simplest and most common ways for foreign businesses to develop a presence in a potential market is to open representative offices (ROs).

As the legally permissible business lines for ROs differ from foreign-owned entities (FOEs), namely that ROs are not allowed to directly conduct profit-generated business activities, the annual reporting requirements are different for ROs as well. Prior to the final working day of January of the following year, ROs must submit a report of their operations during the previous year to the Department of Industry and Trade in the province in which the RO is based.

RELATED: Dezan Shira & Associates’ Accounting and Reporting Services

RELATED: Dezan Shira & Associates’ Accounting and Reporting Services

This report, which must follow a form issued by the Ministry of Industry and Trade, is generally comprised of the information described here, namely:

- Basic information;

- Human resources situation; and

- Annual operation activities.

In addition, ROs should handle personal income tax finalization and annual social insurance obligations.

Basic Information

Basic information about the RO to be stated in the report includes:

- Full name: In the case that foreign businesses have only one RO in Vietnam, the name of the RO can include the word: “… in Vietnam”. In the case that foreign businesses have more than one RO in Vietnam, the name of each RO must also include the name of the city or province where the ROs are located. For example, the name of a RO in Hanoi should include: “… in Hanoi, Vietnam”.

- Address: This must be the address shown on the license of the RO. In case the RO changes the address, authorities may pass by without prior notice to check whether or not the RO actually operates at that address.

- Telephone and fax number

- Email (if any)

- Bank account details of a bank registered and operating in Vietnam.

Human Resources Situation

The annual RO report should state the policies which an RO applies for employees such as salary, bonus, insurance and other operations.

During operation, the human resources situation of an RO can change for different reasons, such as the Chief Representative of the RO returning to their country, the resignation of employees, or the recruitment of new employees. If there are any changes relating to the number of employees in an RO, the RO must report these changes to competent authorities for their update within 10 working days. The report should declare the number of Vietnamese staff and the number of foreign staff with information of their full name, gender, nationalities, identity card/passport number, date and place of issuing, position, etc.

Annual Operation Activities

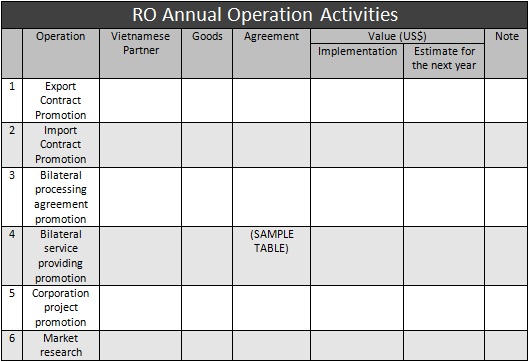

An RO has to report its operation status for the preceding year as applicable in the accompanying table. Other activities such as advertising, fair, exhibition, display or other social activities (if any) should also be stated in the report.

At the bottom of the report, the RO should provide an evaluation on its operation activities during the year, as well as recommendations for the next year. This report has to be made following Form BC – 1 attached to Ministry of Industry and Trade Circular 11/2006/TT-BTM dated September 28, 2006.

PIT Finalization

An RO is responsible for declaring and paying personal income tax (PIT) on behalf of its employees throughout the year, and conducting PIT tax finalization procedures on their behalf at the end of the year.

PIT finalization procedures for ROs are similar to the procedures of an FOE, with two major differences. The first is that ROs must submit this documentation within 90 days of the end of the calendar year, while WFOEs must do so within 90 days of the end of the fiscal year (which may be different from the calendar year).

Furthermore, ROs must submit a tax finalization dossier in the licensing agency, i.e. the Department of Trade and Industry of the province in which the RO is based, rather than the Department of Tax for that province.

Social Insurance

As with WFOEs, the only related activity that ROs must conduct at the end of the year is the distribution of health insurance cards to employees.

Portions of this article were taken from the December 2012 issue of Vietnam Briefing Magazine titled “Annual Compliance and Audit.” In this issue, we address a number of annual compliance topics relevant to foreign investors in Vietnam. Namely, annual reporting for foreign-owned enterprises and representative offices, as well as annual tax finalization (corporate income tax and personal income tax), and annual financial statements (structure, general accounting treatments, deductible expenditures, submission).

Portions of this article were taken from the December 2012 issue of Vietnam Briefing Magazine titled “Annual Compliance and Audit.” In this issue, we address a number of annual compliance topics relevant to foreign investors in Vietnam. Namely, annual reporting for foreign-owned enterprises and representative offices, as well as annual tax finalization (corporate income tax and personal income tax), and annual financial statements (structure, general accounting treatments, deductible expenditures, submission).

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email vietnam@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Vietnam by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

An Introduction to Doing Business in Vietnam

An Introduction to Doing Business in Vietnam

Asia Briefing, in cooperation with its parent firm Dezan Shira & Associates, has just released this 32-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in Vietnam.

- Previous Article Vietnam as a Manufacturing Base for Sales to China

- Next Article Trans-Pacific Partnership Agreement to Boost Vietnam–U.S. Textile Trade