The EVFTA: Understanding Rules of Origin

- Investors looking to taking advantage of the recently ratified EVFTA must understand and comply with rule of origin guidelines.

- Rules of origin guidelines can be complex and manufactures should harmonize them according to rules of the EVFTA.

- While sourcing materials from third party states may decrease the overall cost of production, they will compromise competitiveness if entering EU markets.

Recently ratified by Vietnam’s National Assembly, the European Union Vietnam Free Trade Agreement (EVFTA) presents exciting opportunities in a multilateral trading partnership between both parties.

Not only has the agreement slashed tariffs on nearly 99 percent of all Vietnamese exports to the EU, but measures have also been taken to ensure that the FTA stays updated in the face of future agreements on both sides. For those seeking to tap into the agreement’s cost-saving measures, an important consideration, and the focal point of this article, are the EVFTA’s rules of origin.

In the face of low-cost sourcing options in close proximity to the Vietnamese market, and increasing regional integration on the part of the Association of Southeast Asian Nations (ASEAN) – of which Vietnam is a member, existing producers, and newcomers to the region alike will be hard-pressed to deny the benefits of regionally integrated supply chains.

However, while sourcing materials from third party states may decrease the overall cost of producing a given good, the introduction of third party inputs may compromise coverage under the EVFTA – leading to reduced competitiveness upon export to European markets.

The following paragraphs highlight the conditions under which goods will be granted coverage under EVFTA and outline the documentation that should be expected as part of the customs compliance process.

Qualifying for tariff reductions

Products will benefit from the tariff preferences under the EVFTA rules of origin provided that they can prove that they are “originating”. Products are considered originating under the agreement if they meet one of the following requirements:

- Wholly obtained in Vietnam; and

- Products produced in Vietnam incorporating materials which have not been wholly obtained there, provided that such materials have undergone sufficient working or processing within Vietnam.

While raw materials from Vietnam and goods produced in Vietnam using Vietnamese inputs easily fall into the wholly obtained category, many goods contain materials or components imported from countries not party to a trade agreement.

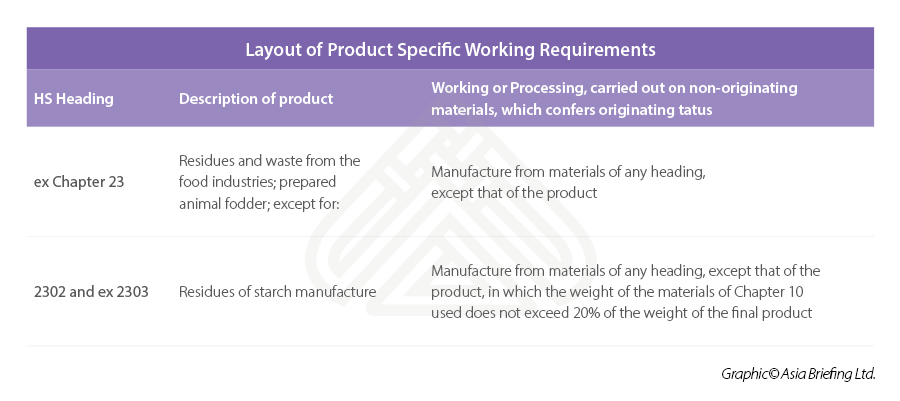

These goods must prove that the inputs that have been inputted have undergone specific levels of alteration within Vietnamese borders to tap into the benefits of the EVFTA. Many goods have set procedures – outlined in Protocol 1 of the EVFTA text – that must be completed within Vietnam for the good in question to be considered originating. The chart below provides an example of the layout of product-specific working requirements found within the EVFTA text.

In addition to these procedures, certain areas of working are specifically noted for their inability to qualify as goods for originating status. These exemptions include the following:

- preserving operations to ensure that the products remain in good condition during transport and storage;

- breaking-up and assembly of packages;

- washing, cleaning; removal of dust, oxide, oil, paint or other coverings;

- ironing or pressing of textiles and textile articles;

- simple painting and polishing operations;

- husking and partial or total milling of rice;

- operations to color or flavor sugar or form sugar lumps;

- peeling, stoning, and shelling of fruits, nuts, and vegetables;

- sharpening, simple grinding or simple cutting;

- sifting, screening, sorting, classifying, grading, matching (including the making-up of sets of articles);

- simple placing in bottles, cans, flasks, bags, cases, boxes, fixing on cards or boards, and all other simple packaging operations;

- affixing or printing marks, labels, logos, and others like distinguishing signs on products or their packaging;

- simple mixing of products, whether or not of different kinds; mixing of sugar with any material;

- simple addition of water or dilution or dehydration or denaturation of products;

- simple assembly of parts of articles to constitute a complete article or disassembly of products into parts; and

- slaughter of animals

EVFTA compliance

Under the EVFTA, all firms exporting goods from Vietnam to the EU have two options concerning compliance. Depending on their status with the Vietnamese government, exporters must either complete a certificate of origin and origin declaration form or a specialized origin declaration form. Compliance associated with these alternatives is outlined below:

a) Certificate of Origin

EU based exporters should compile information available as per Protocol 1 of the EVFTA to obtain a certificate of origin. Those seeking to export to the EU from Vietnam will have to meet requirements that, while similar to those mentioned above, are outlined in Vietnamese legislation.

Vietnam’s Ministry of Industry and Trade issued Circular No. 11/2020/TT-BTC implementing the rules of origin in the EVFTA. Vietnam’s goods exported to the EU market will be granted the certificate of origin (C/O) form EUR 1 to enjoy preferential tariffs under the EVFTA. The circular will take effect on August 1, 2020.

In addition to the application forms listed above, it may be necessary to produce any of the following supporting information:

- direct evidence of the manufacturing or other processes carried out by the exporter or supplier to obtain the goods concerned, contained for example, in his accounts or internal book-keeping

- documents proving the originating status of materials used, issued or made out in a party, where these documents are used in accordance with domestic law

- documents proving the working or processing of materials in a party, issued or made out in a party, where these documents are used in accordance with domestic law

- proof of origin proving the originating status of materials used, issued or made out in a party in accordance with this protocol

Note: Certificates of origin may be issued retroactively for goods that have already been exported under limited circumstances such as technical errors or limited information on the ultimate destination of a product.

b) Origin declaration

Made out by any exporter for consignments the total value of which is to be determined in the national legislation of Vietnam and will not exceed US$6,600 (EUR 6000).

Or

c) Origin declaration

Exporters that have been approved by the Vietnamese government may forgo the issuance of a certificate of origin once their approval status has been relayed to relevant EU authorities. Instead, an Origin Declaration will be required upon export.

Note: Producers in the EU exporting to Vietnam may forgo all requirements above if they file electronic origin documentation with a database in the EU after their participation in this database has been notified to Vietnamese authorities.

Editor’s Note: This article was first published in March 2016 and has been updated to include the latest developments.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Vietnam’s Southern Key Economic Region: Opportunities for Investment

- Next Article Why EVFTA’s Success Will Depend on Vietnam’s Administration Reforms