Personal Income Tax in Vietnam: Deadlines, Requirements, and Preparation

- All individuals including foreigners working in Vietnam are subject to personal income taxes in the country.

- Foreigners should ensure they are aware of the regulations and deadlines or risk hefty fines by the tax authorities.

- Vietnam Briefing gives an overview of PIT regulations and guidelines and steps on how to prepare.

Individuals working in Vietnam (including foreigners) are required to pay personal income tax (PIT) in Vietnam based on their tax residency.

According to the Law on Personal Income Tax, PIT is levied on the worldwide income of Vietnam residents and on Vietnam-sourced income of non-residents, irrespective of where the income is paid. The tax calculation and finalization procedure for Vietnamese locals and expatriates is the same, but differs for residents and non-residents.

Tax resident

A tax resident is an individual satisfying one of the following conditions:

- Is staying in Vietnam for an aggregate of 183 days or more within one calendar year or a consecutive 12-month period from the first date of arrival;

- Has a permanent residence that has been registered pursuant to the Law on Residence; or

- Has a leased residence to stay in Vietnam where the lease contract has a term of 183 days or more within the tax assessment year. Leased residences include hotels, boarding houses, rest houses, lodgings, and working offices.

If an individual stays in Vietnam for more than 90 days but fewer than 183 days in a tax year, or they can prove that they are a tax resident of another country in the 12 consecutive months following the date of arrival in Vietnam, that individual will be treated as a non-resident in Vietnam for tax purposes. If they cannot prove that they are a tax resident of another country, they will be treated as a tax resident of Vietnam.

PIT submission

Foreign-invested enterprises (FIEs) have to conduct PIT finalization on behalf of their employees at the beginning of the year for taxable incomes arising from the previous year.

If an employee has more than one source of income and wishes to conduct tax finalization on their own, FIEs can issue a certificate of deduction at the request of the employee. If an expatriate’s labor contract in Vietnam expires before the end of a calendar year, they should conduct tax finalization before their departure.

Important note: For employees who have had more than one employer during 2021 (for example due to a job change), the individual must submit the PIT finalization themselves and request the following documents from the previous employer:

- Annual income confirmation letter (Thư xác nhận thu nhập); and

- Personal income tax deduction letter (Chứng từ khấu trừ thuế thu nhập cá nhân).

The above documents will also be required from the current employer for submission.

The taxpayer pays PIT to the state treasury in one of two ways: cash or bank transfer. The taxpayer can pay cash directly to the state treasury to receive the voucher from state officials. Otherwise, they can transfer money to a tax office bank account at the state treasury. The deadline for tax payment is the same as tax finalization, meaning no later than 90 days from the end of the calendar year.

Why it’s important to start early?

Tax authorities are strictly enforcing tax deadlines and require that PIT declarations are filed for each month in the previous year. Under Decree 125, penalties for non-compliance can range from VND 2 million US$87) to VND 25 million (US$1,092) depending on the severity and delay.

PIT finalization deadlines

For individuals submitting PIT returns directly to the tax authorities, the deadline is the last day of the fourth month from the end of the calendar year. Thus for PIT finalization for 2021, the deadline is April 30, 2022. If the deadline falls on a national holiday or weekend the deadline is the previous day.

For businesses submitting on behalf of their employees, the annual PIT finalization is the last day of the third month from the end of the calendar year or financial year. Thus for the 2021 finalization, the deadline is March 31, 2022.

Taxable income

There are 10 types of earnings that are subject to PIT, as follows:

- Income from business activities;

- Wages received from employers;

- Capital investment;

- Capital transfer;

- Property transfer;

- Prizes;

- Royalties;

- Commercial franchising;

- Inheritances in the forms of securities, capital contribution in companies or economic organizations, real estate, and other assets requiring the registration of ownership or use right; and

- Gifts in the forms of securities, capital contribution in companies or economic organizations, real estate, and other assets requiring the registration of ownership or use right.

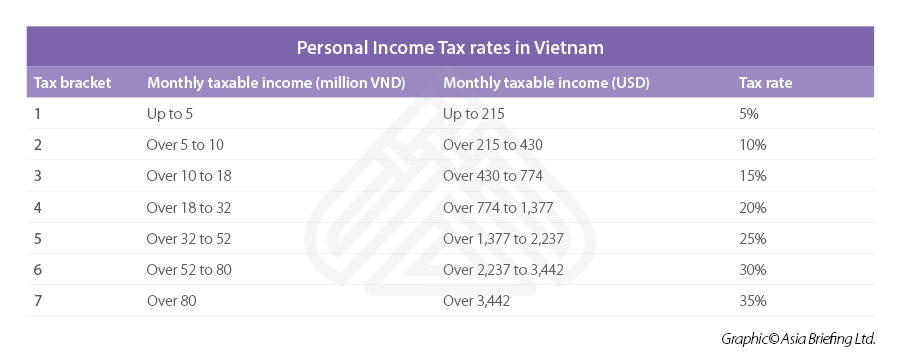

PIT rates for employment

Resident taxpayers are subject to PIT at progressive rates ranging from five percent to a maximum of 35 percent. Employment income includes salaries, wages, allowances and subsidies, remuneration in all forms, benefits earned for participation in business associations, boards of directors, control boards, management boards, and other organizations, premiums, and bonuses in any form except those received from the State.

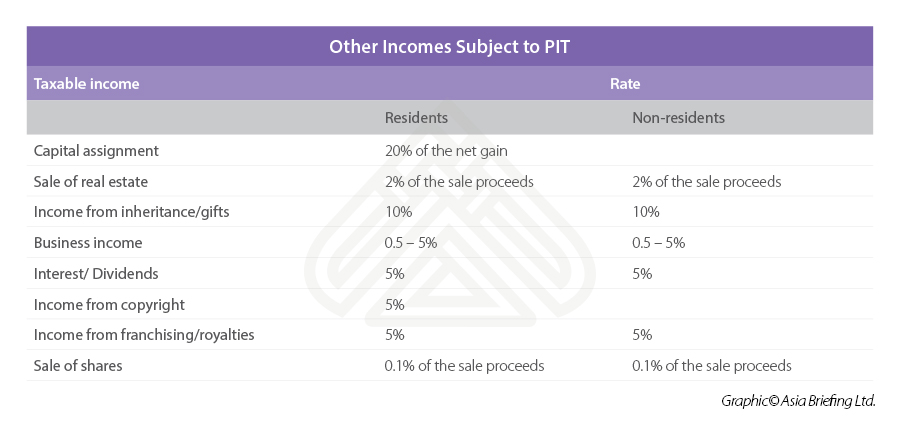

Non-resident taxpayers are subject to PIT at a flat rate of 20 percent on their Vietnam-sourced income. Other incomes are subject to PIT with different rates for residents and non-residents.

For further information on PIT deductions and exemptions, please see our article here.

FAQs about personal income tax in Vietnam

What is the personal income tax rate in Vietnam?

Vietnam’s personal income tax rates are progressive with the highest rate being 35 percent.

Does Vietnam have low taxes?

Vietnam has relatively high taxes as a percentage of GDP. According to the World Bank , the tax revenue to GDP ratio of Vietnam is relatively stable at 18 percent.

Do expats pay tax in Vietnam?

Yes, expats pay tax in Vietnam. Individuals working in Vietnam (including foreigners) have to pay personal income tax (PIT) based on their tax residency.

How much tax do foreigners pay in Vietnam?

How much tax foreigners pay in Vietnam depends on their tax status. Resident taxpayers are subject to PIT at progressive rates ranging from 5 percent to a maximum of 35 percent, while non-resident taxpayers are subject to personal income tax at a fixed rate of 20 percent on their Vietnam-sourced income.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam’s PM State Visit to Singapore Underscores Increasing Trade, Investment

- Next Article An Introduction to Vietnam’s Import and Export Industries

Hi,

I am planning to start work at Vietnam soon. My jobs required to set up whole operations in vietnam. Can i know what is the tax structure for me? Do I need to pay the tax rate monthly, quarterly or yearly?

Regards,

Leonard Tan