Understanding How to Hire and Pay Staff in Vietnam

By Edward Barbour-Lacey and Hoang Thu Huyen

HCMC – Having a clear understanding of how to hire and pay your employees in Vietnam is crucial to ensuring your company’s success. In this article we take you through the regulations surrounding the hiring of employees and provide a discussion on wages.

The number of foreign workers coming to Vietnam has steadily increased in recent years, surging to over 77,000 at the end of 2013. The vast majority of these workers are employees of foreign contractors, working for, or establishing, FDI projects. A Vietnamese entity is permitted to recruit foreigners to work as managers, executive directors, experts, and skilled labor where local candidates are not yet able to meet production and business requirements. It is important to note that unlike in some other Asian countries, such as China, Vietnamese representative offices are able to hire staff directly.

RELATED: Dezan Shira & Associates’ Payroll and Human Resources Services

RELATED: Dezan Shira & Associates’ Payroll and Human Resources Services

Annually, employers (except for contractors) determine the demand for foreign workers for every position in which no competent Vietnamese workers can be found; they then send a report to the President of the People’s Committee of the province or central-affiliated city where the head office of the employee is situated. During the process, any change in the labor demand for foreign workers should be reported to the President of the People’s Committee of the province. The President will issue written approval to the employer for the employment of foreign workers for each position.

The company is required to get approval for the employment of foreign workers in each position before official recruitment. The approval occurs 30~40 days from the date of application by the President of the People’s Committee of the province and is included in the application dossiers of the work permit, which should be submitted no later than 15 working days before the foreigner is to begin work in Vietnam.

![]() RELATED: A Guide to Understanding HR Trends in Vietnam

RELATED: A Guide to Understanding HR Trends in Vietnam

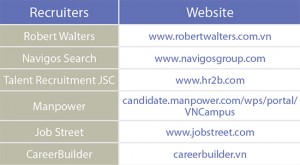

Due to the many difficulties involved, it is common for foreign companies to choose to outsource the process of finding suitable candidates for employment. As a result of this trend, there are a growing number of recruitment firms specializing in the Vietnam labor market.

Wages

Wages vary depending upon the location of employment and the type of skills and experience needed to complete the assignment.

In Vietnam, there are two kinds of minimum wages. The first type is the common minimum wage (VND1,150,000 or US$55) which is used to calculate salaries for employees in state-owned organizations and enterprises, as well as to calculate the social contribution for all enterprises (i.e. the maximum social contribution is 20 times the common minimum wage). The second type of minimum wage is used for employees in all non-state enterprises based on zones as defined by the government. Currently, Vietnam divides its minimum wage in to four different zones.

The country’s minimum wages only apply to Vietnamese employees doing the most basic work under normal working conditions. For those who have passed vocational training courses, including company training, wages are at least seven percent higher than minimum wage rates.

A Vietnam wage comparison

In order to understand the wage differences between a place like China and Vietnam, it is useful to see a side by side comparison. In this case, we have compared the salaries for both a Junior Accountant and an Accountant who has two years of working experience.

Social Security

It should also be noted that, in addition to the payment of basic wages, another key obligation that an employer has in Vietnam is the payment of social security. Please see our article here for a clearer understanding of the requirements involved, such as the total minimum employer social security contribution.

The information contained in this article is excerpted from the September 2014 edition of Vietnam Briefing Magazine, titled “Vietnam: A Guide to HR in Asia’s Next Growth Market“. In this new issue of Vietnam Briefing, we attempt to clarify human resources (HR) and payroll processes in Vietnam. We first take you through the current trends affecting the HR landscape and then we delve into the process of hiring and paying your employees. We next look at what specific obligations an employer has to their employees. Additionally, we guide you through the often complex system of visas, work permits, and temporary residence cards. Finally, we highlight the benefits of outsourcing your payroll to a “pan-Asia” vendor.

The information contained in this article is excerpted from the September 2014 edition of Vietnam Briefing Magazine, titled “Vietnam: A Guide to HR in Asia’s Next Growth Market“. In this new issue of Vietnam Briefing, we attempt to clarify human resources (HR) and payroll processes in Vietnam. We first take you through the current trends affecting the HR landscape and then we delve into the process of hiring and paying your employees. We next look at what specific obligations an employer has to their employees. Additionally, we guide you through the often complex system of visas, work permits, and temporary residence cards. Finally, we highlight the benefits of outsourcing your payroll to a “pan-Asia” vendor.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

- Previous Article Vietnam-U.S. Relationship Shows Continued Signs of Improvement, TPP Progressing

- Next Article PIT Update: Vietnam Implements 50 Percent Reduction in Personal Income Tax for Individuals Working in Economic Zones