Vietnam’s Luxury Market: An Appetite for High-End Products

Vietnam’s luxury market is expected to grow significantly thanks to a growing middle class and the increasing number of high-net-worth individuals. Luxury brands have started to inject investment in retail outlets where clients are underserved. Vietnam Briefing highlights opportunities available in the luxury market industry for investors considering the country’s growing middle class, robust economic growth, and an appetite for luxury goods.

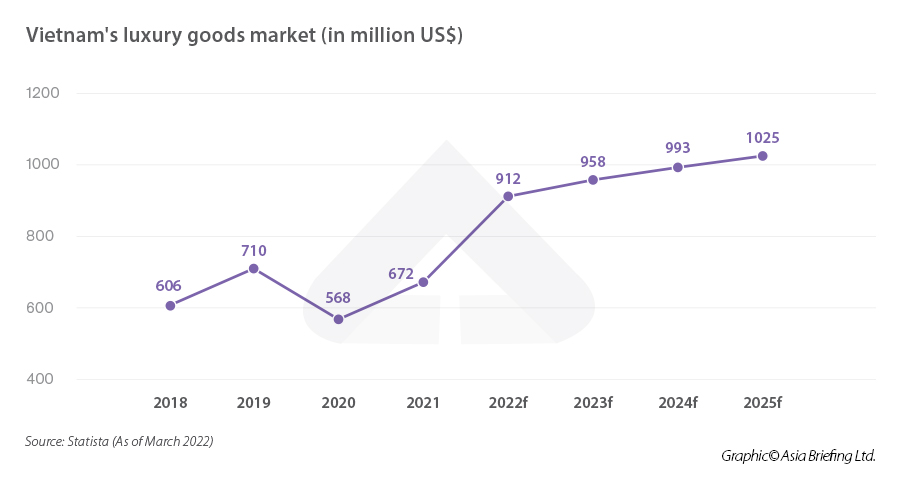

Vietnam’s personal luxury goods market reached US$976 million in 2021 and is expected to grow 6.67 percent annually as per Statista. By 2025, it is forecast to cross the US$1 billion.

By 2026, the country will have 25,812 high-net-worth individuals (UHNW) with liquid assets of at least US$1 million. It is set to rise sharply by more than 59 percent by 2026 from 72,135 individuals last year.

Growth of high net worth individuals and increasing middle class

The number of ultra-high-net-worth individuals in Vietnam with a worth of at least US$30 million is also forecast to increase by 26 percent to more than 1,500 by 2026; such growth is equivalent to that in Hong Kong and Taiwan, according to an annual report by UK property consultancy Knight Frank. Similar to in China, the highly affluent in Vietnam are constantly looking for opportunities not only for investing their money, but also to spend it.

Meanwhile, the country has a relatively young population, with a median age of 32.5 years. As per Worldometer 37.7 percent of the population is urban. A young, educated, and urban population is the backbone of consumption.

Further, Vietnam’s middle-class population has expanded massively in the past years. Market research firm Nielsen forecasts that it will climb to 95 million by 2030. Additionally, a report prepared by the World Bank expects Vietnam to reach upper-middle-income status by 2035 with a per capita income of more than US$7,000.

The luxury sector can also benefit from Vietnam’s free trade agreements (FTAs). Vietnam recently has signed several new-generation FTAs such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the EU-Vietnam FTA (EVFTA), the UK-Vietnam FTA (UKVFTA), and most recently the Regional Comprehensive Economic Partnership (RCEP), where tariffs and regulatory barriers are reduced. Thanks to these FTAs, luxury goods can become more affordable, allowing more access to shoppers.

Automobiles

Luxury car brands are expanding their presence in Vietnam. Particularly, Italian luxury car brand Lamborghini announced its return this month after a year of inactivity. The Porsche Center Saigon opened last year in Ho Chi Minh City’s District 7 and regards Vietnam as one of its fastest-growing markets in the Asia Pacific.

The company also launched Southeast Asia’s second Porsche Studio in Hanoi last year, with the CEO of Porsche Asia Pacific attributing the capital’s vibrant young population to the presence of the store while mentioning that Vietnam also has the youngest demographic among the company’s markets.

The future is also bright for VinFast, the Vietnamese automaker, which has begun delivering its battery-electric SUV – the VF-31- to customers in its home market. This will set the trend for the car market in Vietnam as other electric vehicle models have also launched in the Vietnamese market in the first half of 2022 such as the Kia EV6, Mercedes Benz EQB, Mercedes Benz EQE, and Mercedes Benz EQS.

Wine

Vietnam already accounts for the third-largest ASEAN wine consumer market. Although beer remains the most popular alcoholic beverage, the country’s growing middle class is beginning to have an appetite for more sophisticated and premium wine.

In addition, Vietnam’s wine consumption accounted for 15.3 million liters in 2020. According to the World’s Top Exports data, from 2018 to 2019, wine consumption increased by 173.6 percent.

Vietnam’s high spenders choose premium, expensive wines mostly from France, Italy, Chile, the US, and Australia with French wines representing 35 percent of the market share.

Fashion

Fashion is valued as the biggest luxury segment, followed by leather goods, cosmetics and fragrances.

Several luxury brands want to enter or expand their presence in Vietnam since its retail market is growing, while rentals are low compared to other Asian locations such as Singapore and Hong Kong.

As per World Data Lab, with a middle-class forecast to reach 56 million by 2030, Vietnam is set to leap eight places from its current 26th in the global ranking of 30 economies with the largest middle-class populations.

Tiffany & Co and Montblanc, and Christian Louboutin have also begun to open their first stores in Hanoi and Ho Chi Minh City. In the meantime, brands that have not been popular in Vietnam such as Off-White, Ambush, and Amiri have also started to open their first flagship store in Ho Chi Minh City.

Vietnamese are also buying more watches. The country’s import of watches increased by 28.2 percent annually from 2016-to 2020. Car sales and wine imports, before being impacted by the pandemic, had maintained consistent growth of 12.9 percent and 9.8 percent between 2016 and 2019.

Luxury property

The increase in privately-owned cars also significantly impacts the demand for some segments of high-end apartments, resort real estate, and land plots. This year, Vietnam has witnessed prime apartment selling prices exceed the US$10,000 per square meter barrier, driven by local demand.

The VND 350 trillion (US$15.3 billion) economic support package, which was implemented earlier this year with nearly VND 114 trillion (US$4.9 billion) allocated for the infrastructure sector, has not only had a direct impact on the real estate market in the short term but also works as a driving force for the development of the market in the coming years.

Takeaways

The luxury industry in Vietnam is still underserved and underestimated despite the country’s growing demographic of high income and the country’s distinct favor of luxury brands. Smart retailers have the potential to benefit from the burgeoning consumer class in Vietnam. Brands that understand how to build long-term relationships with their customers will also learn how to serve them better in the future when they reach peak earning potential.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam Extends CIT, VAT, Land Rent Payment to Aid Business Recovery

- Next Article Vietnam’s Health Supplement Market: Trends, Opportunities, Market Entry