China Plus One: Understanding Vietnam’s Appeal to Investors in Asia

In recent years, Vietnam has exploded in popularity for “China plus one” investors.

Facing rising costs in China and trade tensions with the US, many foreign investors have sought to complement their China operations by shifting some production to other lower-cost countries.

Vietnam has emerged as perhaps the biggest beneficiary of this trend, boasting a low-cost business environment, geographic proximity to China, and numerous trade agreements with foreign countries. The influx of foreign direct investment into Vietnam has made it one of Asia’s fastest-growing economies, growing by seven percent in 2019.

In light of Vietnam’s continually rising popularity, we offer an overview of Vietnam’s business landscape for foreign investors exploring a China plus one solution.

Labor market

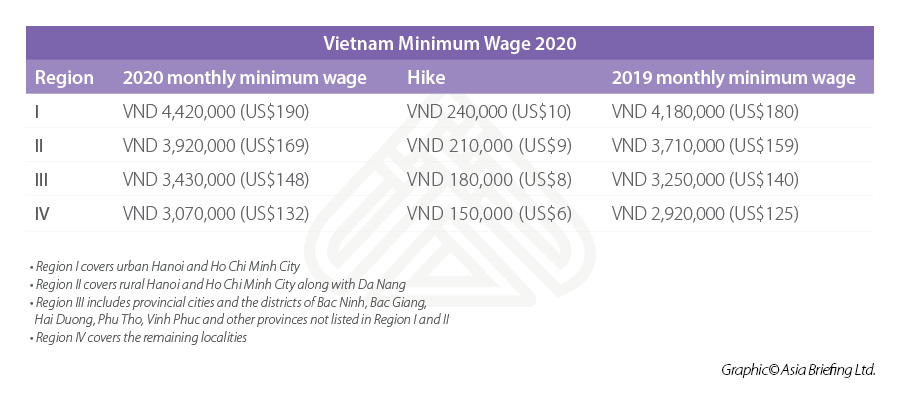

Vietnam has competitive labor costs compared to other manufacturing destinations in Southeast Asia, with minimum wages falling between US$132 and US$190 per month. There are four different levels of minimum wage in Vietnam, which generally reflect a given region’s level of development.

Vietnam’s wage levels compare favorably to its competitors in Southeast Asia.

Malaysia’s minimum wages range from US$270 to US$295, Thailand’s from US$248 to US$265, and Indonesia’s from US$120 to US$298.

Vietnam’s minimum wages are even competitive with its less-developed neighbor Cambodia, which has a minimum wage of US$190 in its garment industry.

Taxation

Vietnam levies a standard corporate income tax (CIT) rate of 20 percent. This rate is identical to those of Thailand, Cambodia and lower than Malaysia (24 percent), Indonesia (25 percent), and the Philippines (30 percent).

Besides the standard CIT rate, some industries engaged in natural resource extraction are subject to higher rates. Businesses in oil and gas, however, face CIT rates between 32 and 50 percent, and those in the mineral resource sector have a rate of either 40 or 50 percent.

Vietnam also offers preferential CIT rates for businesses that qualify for various incentive schemes. The preferential CIT rates are 10, 15, or 17 percent depending on the particular incentive.

The Vietnamese government has been very active in signing double taxation agreements. Vietnam has signed over 80 double taxation agreements, including with Australia, Canada, China, France, Germany, Hong Kong, India, Indonesia, Italy, Singapore, the UK, and the US, among many others.

Trade agreements

Like with double taxation agreements, the Vietnamese government has been proactive in signing free trade agreements (FTAs). Vietnam currently has 13 FTAs in effect – either as a member of ASEAN or bilateral – and has six more either signed but not yet in effect or under negotiation.

As a member of ASEAN, Vietnam is part of the economic bloc’s free trade zone. Additionally, Vietnam is party to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which is a mega-trade agreement between Vietnam and 10 other countries, namely Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, and Singapore.

Other notable agreements include the ASEAN-China FTA, the ASEAN-India FTA, the Vietnam-South Korea FTA, and the Vietnam-Eurasian Economic Union FTA.

Vietnam is also in the final stages of completing the EU-Vietnam Free Trade Agreement (EVFTA), which would be yet another major FTA for the Southeast Asian country. The European Parliament ratified the agreement on February 12, 2020, making ratification by Vietnam’s National Assembly the final step before the agreement is finalized. Vietnam was expected to ratify the agreement in May, though it is unclear whether this could be delayed as a result of the COVID-19 pandemic.

Special economic zones

Vietnam has 18 coastal economic zones, which include 325 industrial parks, where investors can benefit from economic incentives like lower CIT and value-added tax (VAT) rates as well as exemptions on some tariff and land costs. These areas are similar to special economic zones (SEZs) found in countries like China, though are a separate category in Vietnam.

In addition to these coastal economic zones, the Vietnamese government in recent years has sought to establish SEZs to attract foreign investment, particularly in areas relating to high-tech and knowledge industries. Compared to coastal economic zones, the Vietnamese government aimed for SEZs to offer especially high-quality services and economic conditions, including more efficient government institutions than found elsewhere in the country.

Vietnamese authorities initially intended to adopt a law on SEZs in 2018, which would have led to the establishment of three SEZs in the coastal areas of Van Don in the Gulf of Tonkin, Bac Van Phon in the province of Khanh Hoa, and Phu Quoc Island in the Gulf of Thailand. However, this law was shelved in the face of public anger over fears that it would lead to outsized Chinese influence through a provision allowing 99-year leases on Vietnamese land.

The future of SEZs in Vietnam remains unclear. The government has not formally disavowed its SEZ plans, but they have been put on the back burner due to opposition. Due to the government’s interest in attracting foreign investment, it is possible that SEZs will eventually return to Vietnam in a slightly different form than before, or have similar policies enacted under a different name or in a more diffusible manner.

Business environment

Vietnam boasts of a business environment that is roughly in line with its level of development. According to the World Bank’s latest Ease of Doing Business rankings, Vietnam ranks 70 out of 190 economies.

This ranking places Vietnam slightly ahead of fellow ASEAN member Indonesia (73), and well ahead of the Philippines (95) and Cambodia (144). However, it lags significantly behind Malaysia (12) and Thailand (21), two other ASEAN countries that are magnets for foreign investment.

While Vietnam’s ease of doing business ranking is reasonable for its level of development, progress on further improvements have seemingly stalled, as the country’s 2020 rank is a spot lower than in the previous year. In contrast, both China and India made massive progress in their rankings through the introduction of numerous economic and administrative reforms.

Two key areas where Vietnam’s business environment struggles are – in starting a business (115) and paying taxes (109), though the government has made progress in the latter area. Vietnam performs well, however, in dealing with construction permits (25), getting electricity (27), and getting credit (25).

An attractive investment destination

Vietnam has become an incredibly popular destination for China plus one investors for good reason.

The country offers a low-cost business environment and a government that has been highly proactive in deepening ties with countries throughout the world, such as through the signing of double tax agreements and FTAs.

Further, its close proximity to China – and especially the manufacturing powerhouse Guangdong – and its extensive coastline make it particularly convenient for China plus one structures as well as for any business that needs to source goods from China.

As well, compared to more mature regional alternatives like Thailand and Malaysia, Vietnam is at an earlier stage of development and in the midst of a rapid economic boom. While Vietnam lacks the massive potential domestic market of countries like Indonesia and India, its own population is relatively sizeable in its own right and a middle class is in the process of emerging.

One of Vietnam’s biggest current downsides in fact speaks to its strength. Particularly since US-China trade tensions boiled to the surface in 2018, Vietnam has attracted so much foreign investment that much of its infrastructure and industrial space is near capacity. This issue, however, reflects the widely held optimism about Vietnam’s future and should be only a short-term concern for foreign investors looking to enter one of Southeast Asia’s most exciting markets.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article COVID-19 and the Effects on Supply Chains in Vietnam

- Next Article Vietnam will Anreize zur Bekämpfung der Auswirkungen von COVID-19 schaffen