How to Set Up an E-Commerce Business in Vietnam

- E-commerce companies have been increasing their market share in Vietnam aided by increased internet connectivity, smartphones, and most recently, lockdowns related to the COVID-19 pandemic.

- With over 60 million internet users, the e-commerce industry is expected to reach close to US$9 billion by 2025.

- Vietnam Briefing outlines the basic guidelines for those interested in starting an e-commerce business.

With Vietnam’s e-commerce industry showing strong potential thanks to recent lockdowns due to the pandemic, as well as a rising middle class, it makes sense for companies to show interest in this fast-growing market. Most recently, the likes of several large corporations such as Alibaba have also shown interest in wanting a piece of the pie with investments in Vietnam’s Masan Group Corp.

Vietnam’s digital economy is forecast to grow by US$52 billion by 2025, an annual 29 percent increase from 2020 as per a study by Google, Temasek Holdings, and Bain & Co. The government also wants to reduce cash payments owing to a more transparent economy, increasing cashless payments for public services while improving the regulatory environment for e-payments.

Nevertheless, Vietnamese customers are skeptical and distrust remains about products bought online. Therefore, customers like to open products to check the quality and any defects with most transactions resulting in cash on delivery (COD). Nonetheless, the pandemic increased online shopping by 30 percent with products sold ranging from foods to electronics in 2020 as per Infocus Mekong Research.

Investors that are interested in Vietnam’s e-commerce industry and want to start an e-commerce business must be aware of Vietnam’s regulations and the nuances of its laws. In addition, Vietnam has introduced a draft decree on e-commerce, which will eventually amend Decree 52/2013/ND-CP (Decree 52) – a law that regulates e-commerce activities in Vietnam.

E-commerce defined

As per Decree 52, e-commerce activity means conducting part or the whole of the process of commercial activity by electronic means connected to the internet, mobile telecommunications network, or other open networks.

As per the law, there are three different types of e-commerce activities in Vietnam, which are:

- Online marketplace: This is a place where different merchants gather to sell their products. The online marketplace mediates ads and payments for products that go through the site. Examples include Amazon, Shopee, and Lazada.

- Online classifieds: Online classifieds are similar to an online marketplace, however, the payments go directly to the seller. Examples include craigslist or purchases on Instagram.

- Online retailer: Online retailers sell and store their own products. Retailers sell their own products from their own stock. Several online retailers are also regular retailers that sell their products online and have moved to this model given the pandemic. Examples include Walmart and in Vietnam Lotte Mart and Bach Hoa Xanh.

Before setting up an e-commerce website the investor should decide how they will accept payments. For example, if they want customers to pay them directly, they will need to apply for an intermediary payment license. Otherwise, they would have to work with local partners such as banks or e-wallets such as MoMo or Zalo Pay.

Businesses that own websites are required to register online with the Ministry of Industry and Trade (MoIT).

To register an e-commerce business, an investor needs an investment registration certificate (IRC), followed by an enterprise registration certificate (ERC), then a trading license (for those selling directly to customers) followed by the website notification or registration. The whole process can take between three to four months but can take longer depending on the business lines and specific situation.

While there are no minimum capital requirements when setting up a company, investors should note that their capital contribution should cover all business expenses otherwise authorities may deny approval or ask for additional documents for proof on how they can sustain their business.

Since e-commerce is a conditional business line, investors should ensure they have the appropriate approvals from the Ministry of Planning and Investment (MPI) and the MoIT. In addition, depending on the specific business line, it may be subject to additional conditions as per the government’s conditional sector list.

What is the registration process?

In order to register an e-commerce website or app, investors need to follow these general guidelines:

- Step 1 – Register for an account to access the online system by providing the following information:

- Name of applicant;

- Certificate of incorporation number;

- Business lines;

- Head office address of the applicant; and

- Contact information.

- Step 2 – If the information is adequate, the MoIT will grant access to the online system. The applicant can then log on and register their e-commerce website or application and fill in the forms as instructed and submit.

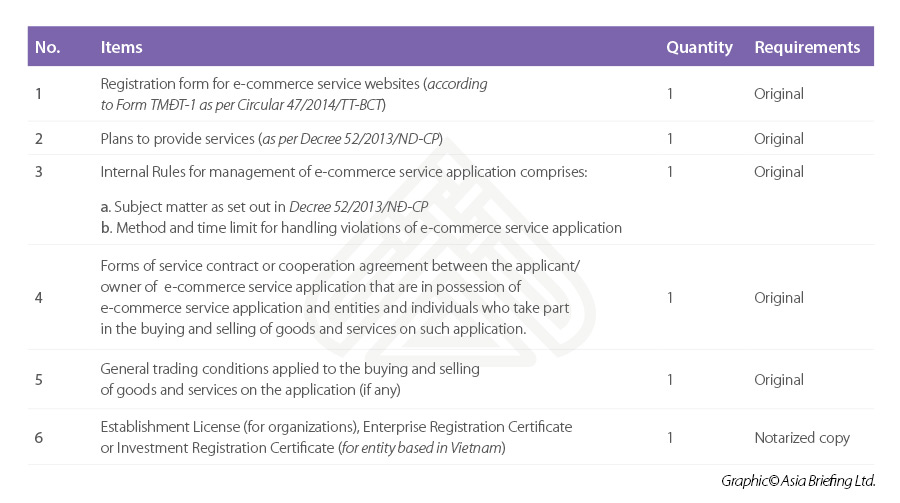

- Step 3 – If the information is adequate, the MoIT will approve the submission, the applicant then needs to send an original registration dossier to the MoIT (sample dossier below).

- Step 4 – If the information is adequate, the MoIT will issue an official code that is used to display the ‘registered’ sign on the e-commerce website or app.

An example of a registration dossier to be submitted to the relevant government authorities for an e-commerce website is shown below:

Investors also need to be aware of the relevant laws which include the Cybersecurity Law, Decree 52 on e-commerce, Circular No. 47 on the management of e-commerce websites, and Circular 59 on the management of e-commerce activities via apps on mobile equipment.

Banned activities in e-commerce

As per Decree 52, there are four groups of banned e-commerce activities, which are:

- Organizing e-commerce services in which each participant is required to pay an X amount of money to buy the service and receive a commission.

-

- Use e-commerce to trade in counterfeit goods or provide services that infringe on intellectual property rights.

- Give fake registration information or fail to comply with regulations regarding the registration information on e-commerce sites.

- Deceive customers on websites including falsifying information of traders, organizations, or individuals that participate in e-commerce activities.

- Other violations include stealing, using, revealing, and transferring of business secrets of other traders, individuals, or organizations as well as copying a competitor’s website to make a profit or cause confusion to customers/users.

Be prepared for changes once draft decree approved

It is highly recommended that investors set up a representative office and legal representative for e-commerce activities. While several multinational companies have engaged in cross-border activities and don’t have an office in Vietnam, the Vietnamese government is likely to tighten regulations; the draft decree on e-commerce specifies that e-commerce firms will have to appoint a legal representative or set up a representative office for operations. This is being done to ensure that foreign e-commerce firms pay the necessary taxes.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam Encourages Further Singaporean Investments in Da Nang

- Next Article Проект Постановления Вьетнама об Электронной Торговле: Влияние на Иностранных Инвесторов