Survey Reveals Japanese Investor Confidence in Future of Vietnam

HCMC – The Japan External Trade Organization (JETRO) has released its annual survey of Japanese-affiliated companies operating in Asia and Oceania. It has found uniformly positive attitudes from Japanese companies operating in Vietnam, particularly in the areas of human resources, customs, and exports.

The survey included 458 companies operating in Vietnam, of which 286 are manufacturers, and 172 are involved in non-manufacturing activities. Of the respondents in Vietnam, 240/458 were Large enterprises, and 218/458 were small and medium-sized enterprises (SMEs). One hundred and twenty-nine of the companies had been established since 2011, 289 since 2006, and 376 since 2001.

Vietnam was shown in a favorable light by the survey, and often outperformed regional averages. For example, 80.6 percent of Japanese-affiliated respondents in Vietnam in the electric machinery industry expected profit in 2014, compared to the 64.5 percent regional average.

Human Resources

The challenge of finding skilled workers was identified by a World Bank report in 2014 as being “central to Vietnam’s economic modernization”. The report identified a skills gap in managerial, professional, and technical positions. Despite this, less than half of JETRO survey respondents identified the quality of employees as a problem. 57.8 percent saw a year-on-year increase in terms of hiring local employees, and 59.5 percent planned to hire employees in the next year.

The biggest human resource issue for employers in Vietnam was wage increases, at 74.4 percent, compared to 70.2 percent in Thailand, and 83.8 percent in Indonesia. Increasing wages was deemed the most serious management problem regionally, accounting for over 80 percent of the most commonly selected problem in Cambodia, China, and Indonesia.

![]() RELATED: Payroll and Human Resource Services

RELATED: Payroll and Human Resource Services

Customs and exports

The average export-to-local sales ratio of Japanese-affiliated firms in Vietnam was 54.3 percent, and the proportion of firms with an export ratio of 100 percent was 32 percent. 58.3 percent of exports from such firms in Vietnam were destined for Japan, 19.7 percent to ASEAN, 4.2 percent to China, 5 percent to the USA, and 3.4 percent to Europe.

As exporters made up such a large proportion of the firms, it may come as a surprise to know that only 36 percent made use of free trade agreements (FTAs) or economic partnership agreements (EPAs), compared to a 43.7 percent regional average.

![]() RELATED: Understanding Vietnam’s Import and Export Regulations

RELATED: Understanding Vietnam’s Import and Export Regulations

Complicated customs and clearance procedures were identified as a problem by 61.1 percent of respondents. Despite this, there was confidence that the ASEAN Economic Community would reduce the procedural burden, with 69.6 percent expecting that the Community will simplify customs clearance through a unified declaration and introduction of a single window system for import and export. 64.1 percent expect the Regional Comprehensive Economic Partnership agreement to have a similarly beneficial effect on simplifying customs-related systems and procedures.

For those settling export payments, the vast majority, 78.3 percent, used the US dollar, compared to 17.8 percent using the yen, and only 2.3 percent used the Vietnamese dong. Investors would be wise to carefully compare the engineered collapse of the yen through Japan’s quantitative easing policies and the relative stability of the dong, which is loosely pegged to the US dollar.

China and Vietnam Divergence

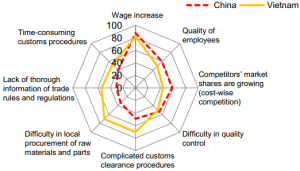

Top Five Problems for Japanese-Affiliated Manufacturers in China and Vietnam

Source: JETRO Survey of Japanese-Affiliated Firms in Asia and Oceania (FY2014 Survey)

JETRO’s survey also revealed a number of changes taking place in Vietnam’s larger neighbor in the region, China. Since the survey began in 1998, firms with an intention to expand business in China dropped below 50 percent of respondents for the first time. It is thus illuminating to do a side-by-side comparison of the current attitudes in both countries.

|

China (%) |

Vietnam (%) |

|

|

Large companies with forecast 2014 profit |

71.3 |

72.5 |

|

SMEs with forecast 2014 profit |

50.9 |

51.4 |

|

Businesses planning expansion over next 1-3 years |

46.5 |

66.1 |

|

Businesses planning reduction over next 1-3 years |

6.5 |

1.3 |

|

Businesses planning to withdraw from local markets or transfer to a third country |

1 |

0.2 |

Japan-Vietnam Bilateral Cooperation

Bilateral relations between the two countries are going from strength to strength. Ministries in Vietnam are taking part in the “Action Plan for the Vietnam Industrial Strategy within the framework of Vietnam-Japan cooperation towards 2020 and vision to 2030”, an effort to develop the six priority industries of agricultural machinery, agricultural and fisheries processing, automobiles and parts, electronics, environment and energy saving, and shipbuilding. According to Deputy Prime Minister Hoang Trung Hai, Chairman of the Vietnam Industrialization Strategy, the framework promotes technological innovation, labor productivity growth, to develop higher value-added products and meet high standards for exports. The plan also has the strong support of Japan’s Prime Minister, Shinzo Abe.

![]()

RELATED: Dezan Shira & Associates’ Pre-Investment and Entry Strategy Advisory

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Import and Export: A Guide to Trade in Vietnam

In this issue of Vietnam Briefing Magazine, we provide you with a clear understanding of the current business trends related to trade in Vietnam, as well as explaining how to set up your trading business in the country. We also attempt to give perspective on what will be Vietnam’s place in the Association of Southeast Asian Nations (ASEAN) in 2015, and look at some of the country’s key import and export regulations.

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition) provides readers with an overview of the fundamentals of investing and conducting business in Vietnam. Compiled by Dezan Shira & Associates, a specialist foreign direct investment practice, this guide explains the basics of company establishment, annual compliance, taxation, human resources, payroll, and social insurance in the country.

- Previous Article Privatization of Vietnam’s Port Infrastructure to Boost Efficiency and Lower Prices

- Next Article Vietnam Leads Global Coffee Production Despite Lower 2015 Harvests