Representative Office Dissolution Part 1: Tax Compliance Challenges

In this three-part series, Vietnam Briefing highlights and discusses the tax compliance process when closing down a Representative Office.

A Representative Office (RO) offers a simple and low-cost option for companies seeking to gain a better understanding of the Vietnamese market. As such, this option is among the most common for first-time entrants to the Vietnamese market and often precedes a larger presence within the country.

Due to the limited scope of operations, the mandatory tax and licensing procedures of an RO are often simple compared to those of a wholly foreign-owned company. As an RO cannot generate revenue and is not subject to an audit, most foreign investors assume that they are subject to minimal taxes, thereby not paying attention to bookkeeping and adequate documentation.

However, companies may choose to close down an RO depending on their financial situation or due to non-financial factors such as upgrading into a foreign-owned enterprise in order to expand business activities.

Tax obligations for dissolving an RO

In this article, we look at the tax obligations associated with the dissolution of an RO.

It is common for the ROs’ chief representative officers (CRO) to think that their tax status is in compliance, as long as they fulfill their statutory obligations on annual reporting, personal income tax (PIT) and social health and unemployment insurances (SHUI) for their employees. That is until they are audited by the tax authorities and receive significant penalties, often due to a lack of required documentation for business expenses.

A tax audit is unlikely unless the authorities suspect the RO is engaging in illegal activities. If nothing is out of place, audits will only happen when the RO goes into dissolution, which may occur years after the RO began operations.

In practice, while an RO is not subject to a declaration of business taxes (like VAT and CIT), they are still required to maintain adequate bookkeeping records as well as supporting documents of business expenses incurred during their operation. This is similar to a company’s accounting documentation to support deductible expenses that are claimed.

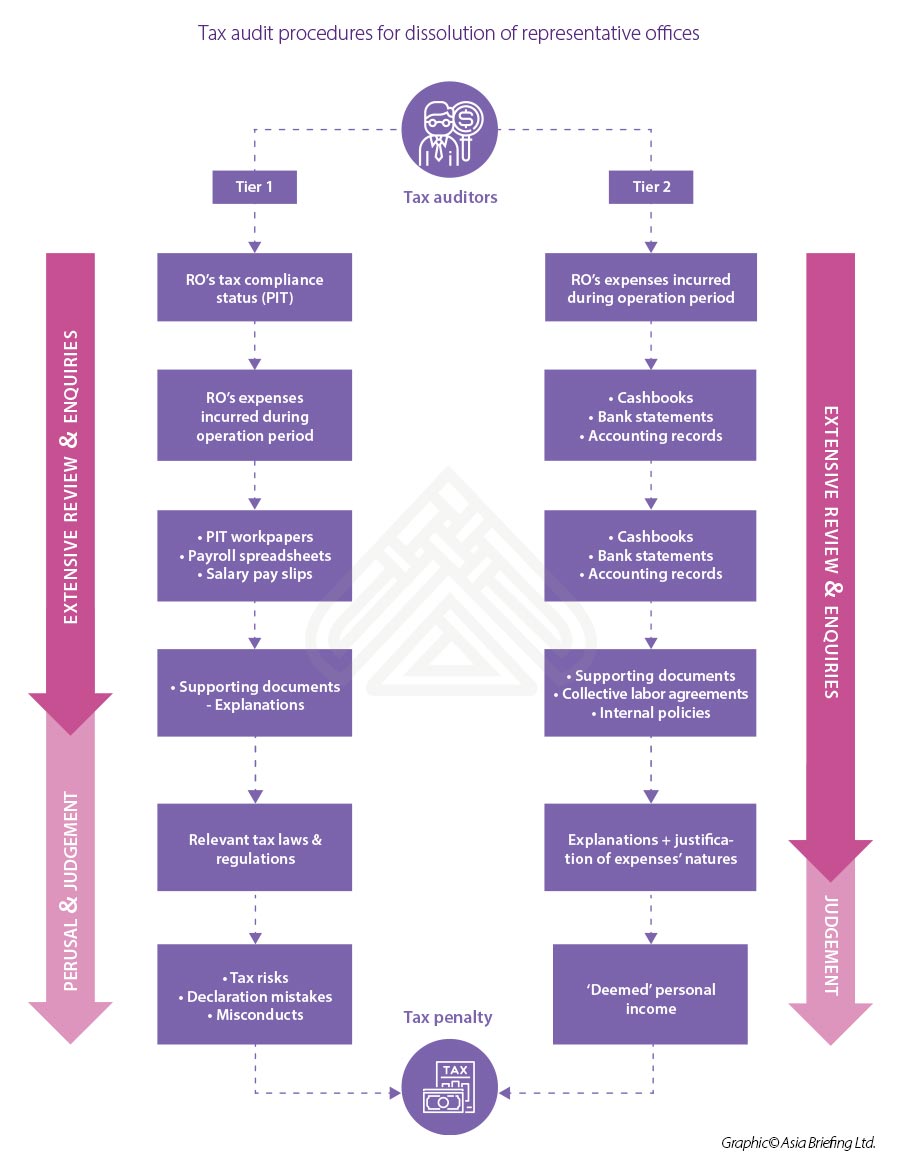

Tax audit for dissolution

In addition to examining the PIT declaration and remittance status, tax officers also look at the RO’s cashbooks, bank statements, and bookkeeping records to review expenses incurred during its operation period.

The expenses are subject to review on a sample basis and the RO will be asked to show relevant supporting documents and provide an adequate explanation to justify the nature of expenses incurred.

If the RO fails to establish the link between the incurred expenses and the RO’s operational activities, then it will result in such expenses deemed as additional benefits-in-kind provided to individuals. As per tax authorities, such benefits should be taxed and penalized accordingly.

The common procedures of tax audit for the dissolution of RO are summarized as follows:

Based on our experience of doing tax finalization during the closure of an RO, most of the unpaid taxes and corresponding penalties are imposed on expenses with either insufficient supporting documents or no direct connection with the RO’s operations and are therefore treated as “deemed” personal income.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Einführung der IFRS in Vietnam – ein Überblick

- Next Article Representative Office Dissolution Part 2: Tax Documentation