Vietnam and Bangladesh: Bilateral Trade and Investment

Vietnam Briefing explores the Vietnam – Bangladesh trade relationship and examines key strengths powering both these export-led countries. We further highlight trade between both countries, their growing relations, and how they have benefitted from the US-China trade war.

Vietnam and Bangladesh are both economic powerhouses that have been growing their GDP significantly thanks to an export-led growth model. Bangladesh has had one of the fastest-growing economies in Asia for years. The country averaged close to 7 percent growth over the past decade, achieving an 8.1 percent growth rate in 2019. Per capita income reached nearly $2,000 last year, growing more than three-fold since 2006.

Vietnam has been the same, averaging close to 7 percent growth and achieving a 7 percent growth rate in 2019. Per capita income reached US$7,900 in 2019. Its middle class has been growing, contributing to increased consumption and retail sales.

In some sense, they are even competitors as Vietnam surpassed Bangladesh to become the second-largest garment exporter as per the World Trade Organization in 2020.

Vietnam – Bangladesh relations

Yet Vietnam and Bangladesh remain close partners and established ties in February 1973. In 2013 the two nations celebrated the 40th anniversary of the establishment of diplomatic ties.

In 2018, former Vietnamese President Tran Dai Quang during a three-day visit to Bangladesh said “Vietnam and Bangladesh enjoy an excellent traditional friendship on the basis of historical similarities and the shared values of independence, peace, cooperation, and development.”

Vietnam and Bangladesh are striving to double bilateral trade to US$2 billion by 2021. Both countries have identified 11 priority areas including agricultural trade and pharmaceutical exports from Bangladesh to Vietnam. Trade between Vietnam and Bangladesh has grown since the first Joint Trade Committee meeting in 2015.

Both Vietnam and Bangladesh have large and young populations which means a significant labor pool that businesses can use. Both countries also benefit from geographical advantages. Bangladesh is located between China and India and touches ASEAN, it also has access to the Bay of Bengal, allowing ships access to trade into the country.

Vietnam in contrast has a long coastline exposing it to the East Asian trade corridor. It has ports, airports, and borders China, making it an ideal China plus one location.

Vietnam – Bangladesh trade

Vietnam has made several investments in Bangladesh to date: these include investments in Bangladesh’s special economic zones, ICT sector cooperation, bilateral cooperation in textile and garments sector, trade in halal products, trade in software services, direct air link, promotion of trade in jute and jute goods, banking sector cooperation and tourism sector cooperation.

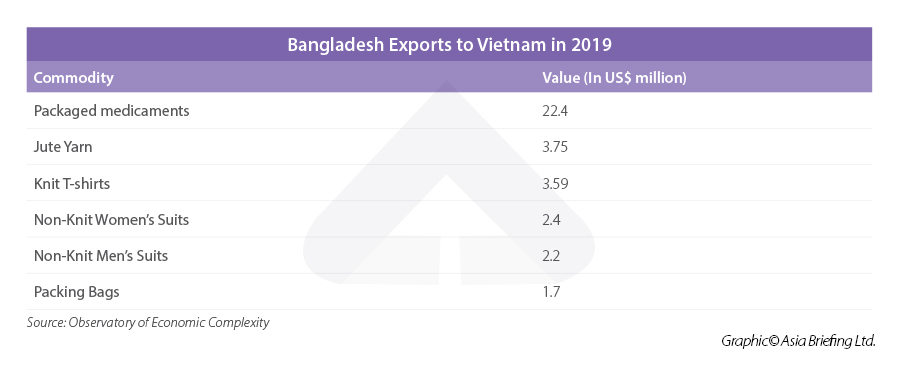

The main export products from Vietnam to Bangladesh include clinker, cement, steel billet, and mobile phones. In contrast, Vietnam mainly exports textile, leather, shoe materials, medicine, and sesame from Bangladesh.

In terms of investment, by April 2019, Bangladesh’s total investment in Vietnam reached $1.18 million, ranking 43 out of 80 countries and territories investing in Vietnam.

Meanwhile, Vietnam has one investment project in Bangladesh with a total capital of US$27,900. Bangladesh currently ranks 68 out of 72 countries and territories in which Vietnam has invested in.

Future outlook

Both Vietnam and Bangladesh have open trade policies, a competitive labor force, and incentives for foreign businesses. Vietnam has pursued an open trade policy through several free trade agreements. The recent Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), EU-Vietnam free trade agreement (EVFTA), and the UK-Vietnam free trade agreement (UKVFTA) are a testament to this. Vietnam has also changed domestic laws to make the country attractive to investors with foreign firms competing for local business. Several multinational firms such as Samsung, Google, Adidas, Nike, Foxconn, and H&M have moved production to Vietnam boosting Vietnam’s exports and investments.

In Bangladesh, large export of apparel to the EU and the US make most of the country’s exports. The EU has allowed production from least developed countries (LDC) like Bangladesh duty-free. However, as Bangladesh’s economy improves and per capita income rises it stands to lose its LDC status.

Bangladesh foreign minister also noted that Vietnam-Bangladesh bilateral trade is yet to reach its full potential and sough more investment in Bangladesh’s special economic zones and hi-tech parks.

Bangladesh and Vietnam share common objectives in major multilateral international forums such as the United Nations (UN), Non-Aligned Movement (NAM), and South-South Co-operation. Leaders from both countries have paid regular visits enhancing bilateral relations as well as extended their mutual co-operation in various multilateral forums.

While Vietnam and Bangladesh do not have a free trade agreement, both countries have emphasized trade and the need to create the best conditions for entrepreneurs and business communities of the two countries to explore business and investment opportunities in both countries.

As both Vietnam and Bangladesh look to further their economies there are ample opportunities for trade between the two countries. Both Vietnam and Bangladesh have benefitted from the US-China trade war and this is unlikely to change any time soon. In addition, as China moves up the value chain, manufacturing in the country is much more expensive than it was several years ago. And while China’s manufacturing industries, infrastructure, and supply chain is unmatched, Vietnam and Bangladesh have excelled in industries such as garment and textiles, creating opportunities.

However, Vietnam is attempting to attract hi-tech investment and move up the value chain from just simple assemblies. Bangladesh is attempting to do the same by diversifying its manufacturing. Rather than just garments, it needs to move into electronics manufacturing like Vietnam and move up the value chain. Bangladesh also has China as a large trading partner and is part of the Belt and Road Initiative; this is likely to help further grow its economy. While Bangladesh has a long way to go, it’s on the way to become a middle-income country

While COVID-19 has affected these plans to a certain extent, long-term goals remain on track as both countries are poised to become economic powerhouses.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article US Vice President Visit Underlines Growing US-Vietnam Ties

- Next Article Warum Da Nang für ausländische Investoren weiterhin attraktiv bleibt