Vietnam’s Annual Tax Finalization – Challenges and Recommendations

The three-month period from January 1 to March 31 of a calendar year is often referred to as the “high season” for most accountants since this is a period of preparation and submission of Corporate Income Tax (“CIT”) and Personal Income Tax (“PIT”) finalization returns. The deadline for these returns is 90 days from the end of the previous financial year.

Annual tax finalization is typically regarded as a “heavy-duty” job for accountants and involves significant levels of both technical and non-technical issues, which can affect the taxpayers’ compliance status years after the submission of tax returns.

This article will explain why annual tax finalization involves significant challenges and provide a brief outline of how taxpayers can be well-prepared for the upcoming tax finalization for the financial year that ended in 2019.

Why is annual tax finalization challenging and involves risks?

1. Technical vs non-technical issues in tax finalization

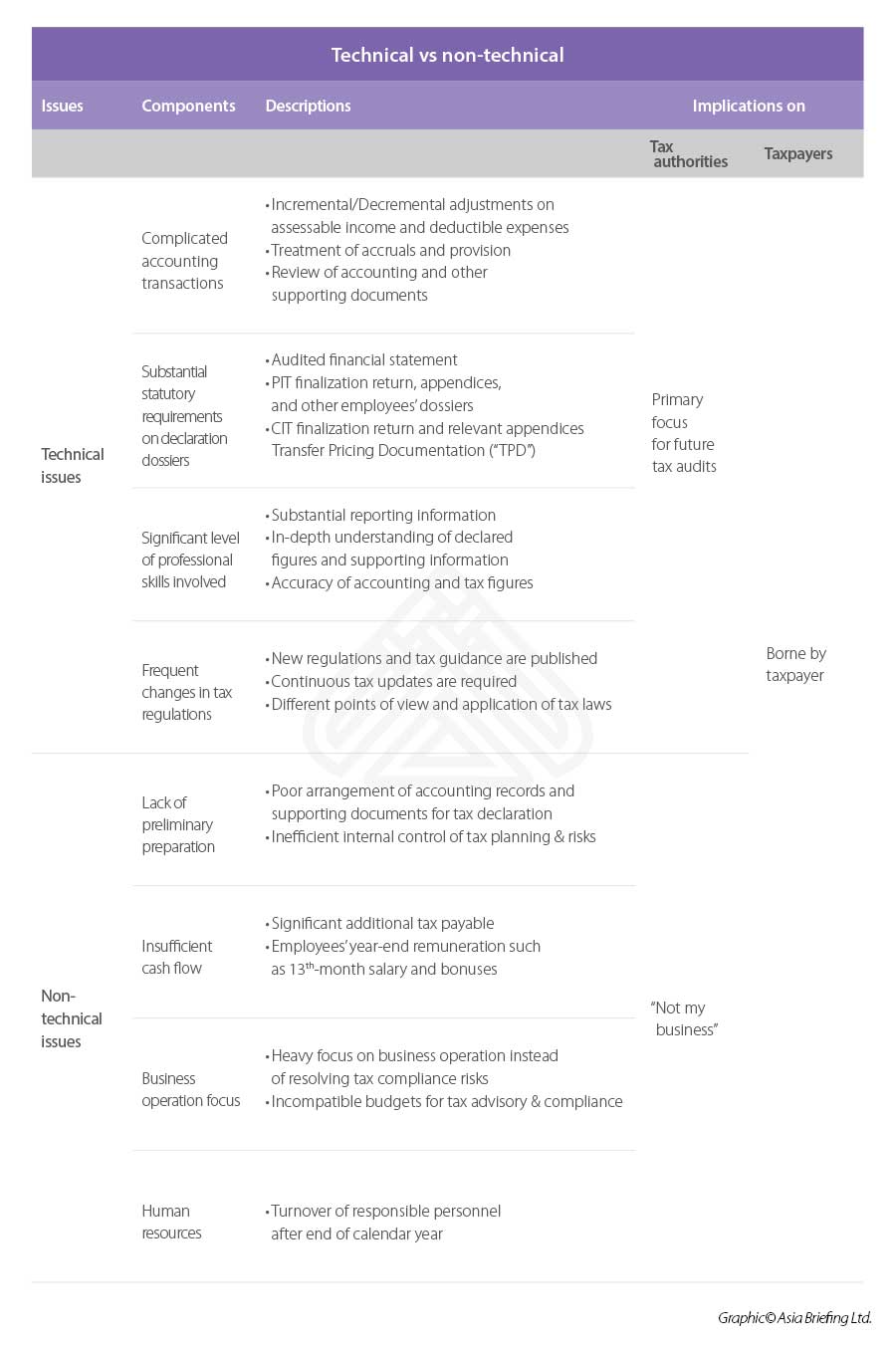

Practically speaking, both technical, as well as non-technical issues, are borne by the taxpayer as illustrated in the below table.

Technical issues involve complicated accounting transactions & adjustments, substantial requirements on documentation and frequent changes in applicable tax guidance, which are the primary focus of the tax authorities in future tax inspections or tax audits. Whereas, non-technical issues are the taxpayers’ internal problems within the business that can affect their tax compliance status.

2. Tax finalization information is the primary focus of future tax audits

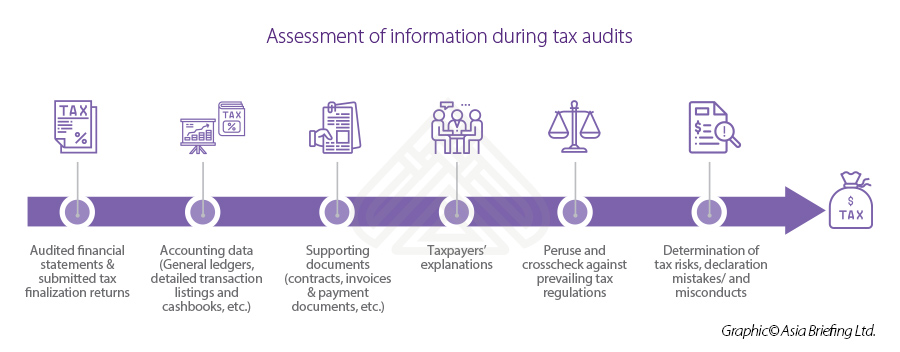

Information declared in the submitted tax finalization returns as well as the audited financial statements will be the first things that are looked at by the tax auditors. Any inconsistency or discrepancy between such information and the taxpayers’ accounting books, supporting documents and explanations will be subject to further challenges and the possibility of additional tax owed to the tax auditors.

The procedures for assessing tax finalization information during a tax audit are summarized as follows:

3. Contradiction of expectations and goals between taxpayers and tax authorities

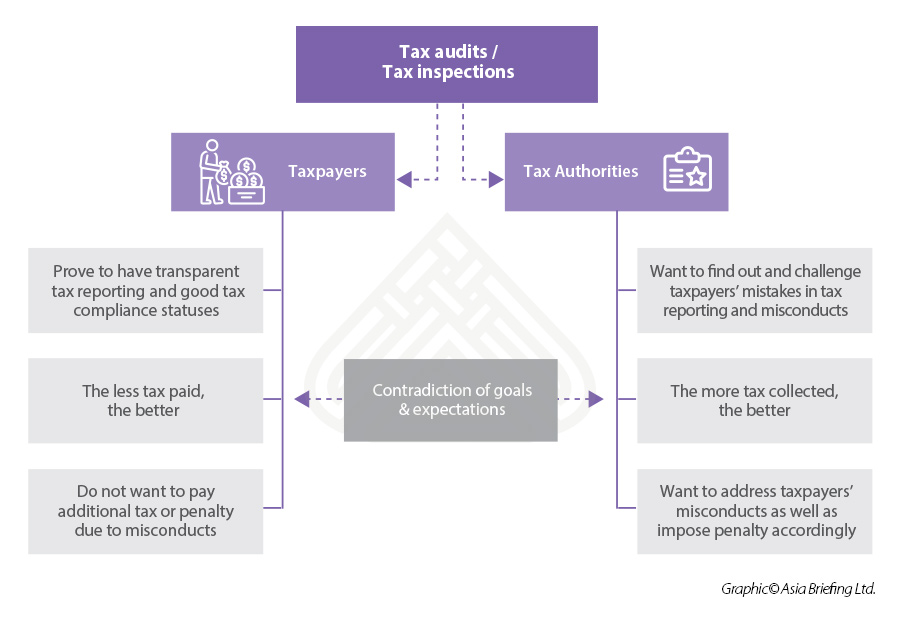

Unfortunately, the professional goals and expectations of taxpayers are almost different than that of tax authorities.

Taxpayers always want to show the tax authorities that they are fully compliant with the prevailing tax regulations and their tax reporting statuses are transparent. Practically speaking, many businesses apply KPIs for their accounting departments. The accountant’s performance is therefore measured based on the degree of tax compliance status, level of tax paid, as well as corresponding administrative penalty on misconducts. Therefore, most accountants will do their best to balance the businesses’ needs for the reduction of tax paid as well as to prove their tax compliance status at the same time.

The tax authorities’ goals, on the other hand, are to find out and challenge taxpayers’ mistakes in tax declarations as well as impose additional tax and penalties on misconduct. Frankly speaking, the tax authorities do have KPIs for their tax officers. The tax officers’ performance is measured on the level of additional tax and penalty that they can impose as well as the level of taxpayers’ mistakes or misconduct found during tax inspections or tax audits at the taxpayers’ premises.

How can you be well prepared for tax finalization?

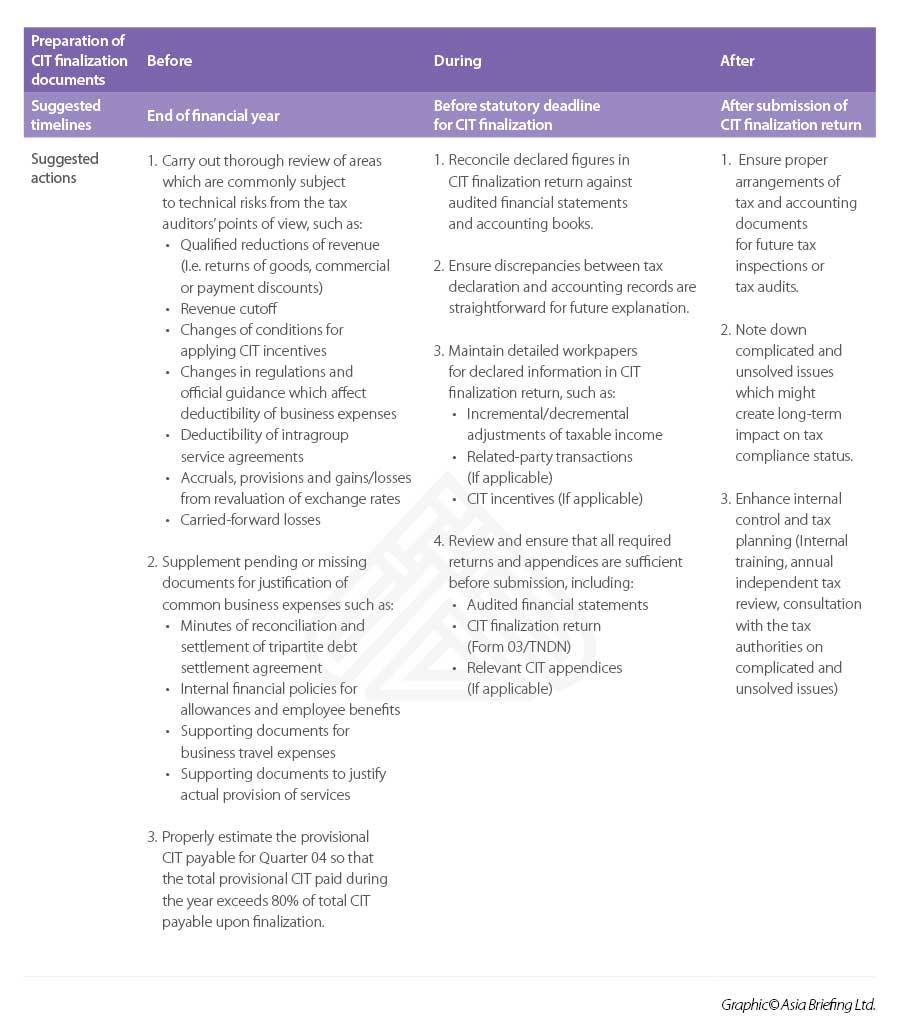

In light of the above analysis, taxpayers should ensure they are prepared for the annual tax finalization, not only to comply with the statutory regulations but also to mitigate the risks of being challenged by the tax authorities in future tax audits.

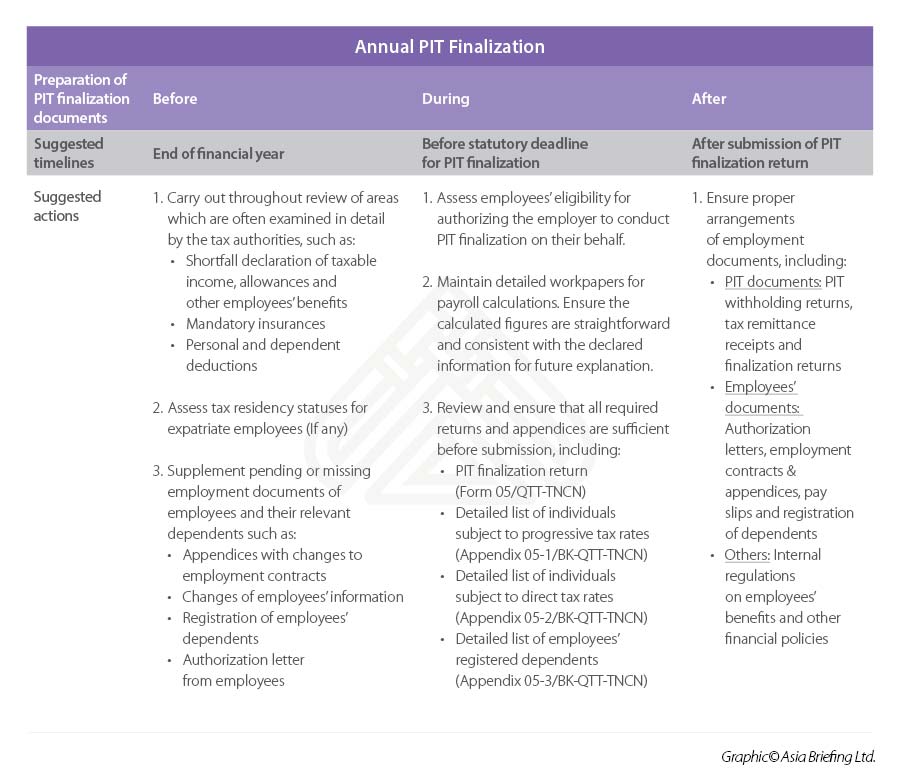

The below tables are brief outlines of suggested steps to be carried out to enhance the tax finalization process.

Annual CIT finalization

Annual PIT finalization

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Tax Compliance in Vietnam: Decision 2413 on Information Sharing

- Next Article Audit and Compliance in Vietnam: A Guide for Foreign Investors