Vietnam’s Medical Devices Industry: Key Market Entry Considerations

- Vietnam’s medical device industry is one of the most promising sectors for foreign investment due to the country’s economic development and rising demand for adequate medical care and equipment.

- Opportunities in Vietnam’s medical device industry are ripe due to the country’s aging population, a shortage of medical devices, and government support in terms of tax incentives and industry prioritization.

- However, foreign suppliers should also be aware of the challenges regarding high competition and strict government regulations in the market.

During the last decade, Vietnam has been experiencing rapid economic and population growth, making the country an attractive investment destination for foreign investors in the public healthcare sector. The Vietnamese healthcare industry is one of the country’s development priorities, having received an increasing level of financial support and incentives for investment from the government over the years.

Apart from economic development, the COVID-19 pandemic has also influenced the rising demand of the Vietnamese healthcare sector. Throughout the epidemic, the industry fortified its stance as a top priority due to the increased government support in terms of healthcare expenditures and healthcare access.

In the healthcare sector, the medical device industry is one of the most promising subsectors for foreign investors since most medical equipment in Vietnam is imported from international multinational companies.

More specifically, Vietnam’s scarcity of low-cost generic drugs, along with the country’s inadequacy in meeting local demands for medical devices’ production and innovation, have provided bright prospects for foreign corporations to dominate the Vietnamese medical devices industry.

Reports indicate that over 90 percent of medical devices in Vietnam are imported from foreign countries, of which 55 percent are from Japan, Germany, the US, China, and Singapore. The domestic market contributes less than 10 percent to the market share, coming from 50 domestic manufacturers.

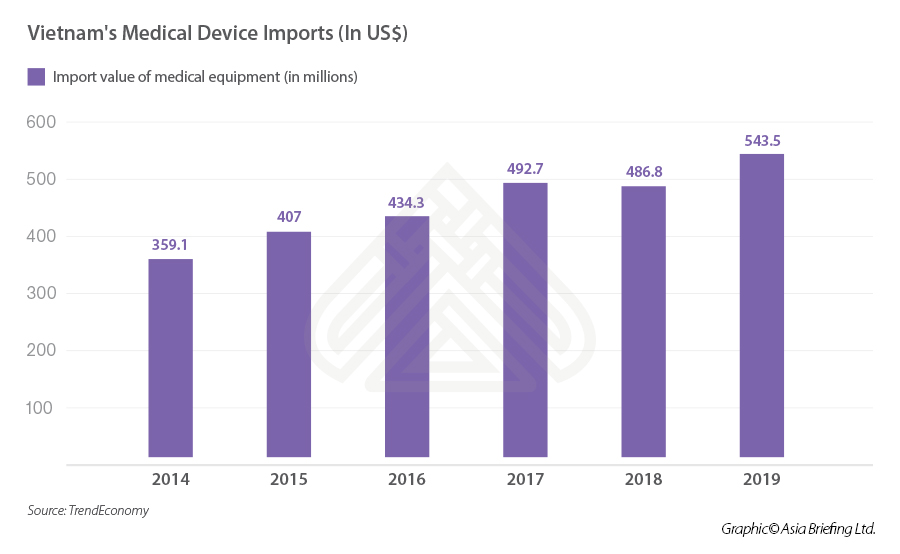

The value of imported medical devices into Vietnam has been increasing for the previous five years, surging from 359.1 million in 2014 to 543.5 million in 2019, demonstrating a substantial growth of 51 percent.

Experts predict the Vietnamese medical device industry to continue to improve from 2020 to 2025, demonstrating a bright outlook for foreign investors to enhance their investment activities in Vietnam.

Vietnam Briefing provides an analysis of the Vietnamese medical device industry in terms of market entry conditions as well as opportunities and challenges for foreign investors looking to enter the market in the near term.

Market entry requirements

Requirements and registration process

Vietnam’s healthcare sector, particularly the medical device industry, is strictly regulated by the Vietnamese authorities. Specifically, imported medical devices have to comply by the regulations and licensing requirements administered by the Ministry of Health (MOH).

According to the MOH’s policies, foreign companies are required to register a legal business entity in Vietnam and obtain an import license in order to be eligible to sell medical devices in the Vietnamese market. To meet this requirement, foreign companies usually distribute their products through local distributors or agents.

Further, although imported medical devices are not obliged to be registered, the MOH requires exporters to provide a Certificate of Free Sale, certified by the Embassy of Vietnam in the foreign supplier’s country.

In addition, the Vietnamese government issued Decree 36, stating that all medical equipment imported into Vietnam are required to register for marketing authorization (MA) licenses. A marketing authorization license is an application submitted by a foreign manufacturer seeking approval of the host country to bring a medical device to the market.

Entry strategy and market considerations

Due to the high complexity and rapid growth of the industry, foreign companies looking to enter the Vietnamese medical device market should consider the following factors:

- Build a specific and strategic plan before entering the market and keep a persistent and resilient attitude since it might take one or two years to thrive in this market;

- Build strong relationships and partnerships with domestic companies (such as joint ventures or mergers & acquisitions) to gain a comprehensive understanding of the market as well as approaching substantial networks and establish a customer foundation. This is a critical factor determining the success of the foreign player in this market;

- Understand that the Vietnamese medical device is divided into two distinct markets: the north and the south, with separate practices and local institutions. The northern part of the country has more government ministries, regulatory agencies, and national healthcare institutions. On the other hand, the southern part of Vietnam has a higher concentration of private institutions and is considered a dominant industry hub; and

- Foreign companies can enter the Vietnamese market indirectly through an agent or a distributor. If investors want to enter the market directly, they should establish a commercial operation by setting up a representative office, a branch office, or a foreign investment project license under Vietnam’s revised Law on Investment.

Competition

Since a majority of the market is dominated by foreign suppliers, the competition between foreign companies is intense. More than 400 businesses from 25 countries and territories have shown interest in this billion-dollar market by attending the annual Vietnam Medi-Pharm Expo in 2020. This is a sign demonstrating that a considerable number of foreign competitors may enter the market in the near future. The primary existing manufacturers and competitors come from the US, Japan, Germany, Italy, the Netherlands, South Korea, Taiwan, and China.

Although local manufacturers are not dominant suppliers, foreign investors should be aware that about 50 domestic firms produce approximately 600 products licensed by the MOH, including implantable devices, surgical instruments, diagnostic imaging equipment, hospital beds, scalpels, cabinets, scissors, and consumables.

Tax incentives

Vietnam has one of the most competitive tax regimes in Southeast Asia, where foreign investors in the medical device industry can benefit from several investment incentives such as:

- Corporate income tax (CIT) incentives;

- Reduction on import duty and exemption of quota restriction; and

- Exemption or reduction of land rental fee.

Due to the inadequate production and quality of domestic medical devices, the Vietnamese government encourages foreign companies to enhance their exportation to Vietnam by enforcing low import duties and no quota restrictions on imported medical equipment.

With regards to CIT, foreign companies will receive a CIT rate of 10 percent throughout the entire project life span, a four-year tax exemption, and a 50 percent tax cut in the following five to nine years, depending on the location of the project.

Further, foreign investors are also offered a reduction or exemption on land rental fees for at least seven years.

Opportunities and challenges for foreign investors

Opportunities

According to the United States International Trade Administration (ITA), the healthcare sector is the best prospect industry sector for foreign investors looking to invest in Vietnam. The reason lies in three factors: Vietnam’s aging population, insufficient quantity and quality of medical devices, and government support.

As of 2020, Vietnam had a population of over 97 million, with around 60 percent participating in the country’s labor force. With rapid social and economic development, Vietnam’s working population will continue to increase. As more women are engaged in the workforce, the country’s birthrate is projected to drop, while the aging population will rise substantially.

It is forecast that the number of people from 60 years old and over in Vietnam will surge more than double, from 11.9 million to 29 million, by 2050. The age group of over 80 will triple to account for around six percent of the country’s population.

The shift in demographics in Vietnam’s population presents development prospects for the Vietnamese healthcare sector, specifically the medical device industry.

Also, Vietnam’s healthcare system faces major challenges in overcrowding and poor quality of care and equipment, presenting the medical device market as an attractive investment for market entry and distribute up-to-date equipment to improve the country’s healthcare sector as a whole.

As mentioned above, the Vietnamese government offers low import duties and no quota restrictions for imported medical devices, and foreign suppliers also receive attractive tax incentives to enhance their trade and investment in the Vietnamese medical device industry.

Challenges

Foreign investors should be aware of the challenges they might encounter when entering the market, regarding high competition and strictly regulated policies and procedures.

All activities in the Vietnamese medical device industry are strictly governed by legal documents related to technical standards and regulations on the import and distribution of medical equipment. However, the current legal framework has not yet provided clear policies or procedures for foreign investors, bringing them uncertainties regarding regulatory issues.

It is expected that in the near future, the Vietnamese government will make amends on the strict regulations, enhance tax incentives, and formulate clearer policies, encouraging more foreign investors to establish a business in the Vietnamese medical device industry.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Why Investors Should be Optimistic About Vietnam’s Healthcare Industry

- Next Article L’Industria Solare in Vietnam: Ottime Prospettive per gli Investitori