Vietnam’s Shipping Industry: Proposed Upgrade to Regional Container Fleet

- Vietnam is located on an important maritime transport route in the East-West hemisphere, accounting for more than 80 percent of global freight volume.

- In 2021, despite the effects of the pandemic, the volume of container cargo through the country’s seaports reached 24 million TEUs, up 7 percent year on year.

- Nevertheless, with higher freight rates and supply chain issues, significant investment is needed to develop the country’s shipping fleet and ports.

Vietnam benefits from a long coastline that borders the Gulf of Thailand, the South China Sea, and the Gulf of Tonkin. The country has the second-highest number of international ports in ASEAN after the Philippines. While the speed of goods through the country’s seaports typically increases by 10-15 percent per year on average more investment is needed to overcome challenges.

There are three main port cities along Vietnam’s coastline – Hai Phong in the North, Ho Chi Minh City in the South, and Da Nang in the central region. Among the leading container ports based on cargo capacity in Asia, the Ho Chi Minh City port handles the largest share of cargo in Vietnam.

Meanwhile, the northern port of Hai Phong is a major port for international container traffic. The Hai Phong International Container Terminal (HICT) can accommodate large container ships, reducing time and cost for shipments to northern Vietnam. With its strategic location, the Da Nang port manages cargo in the central region and connects Vietnam to Myanmar, Thailand, and Laos.

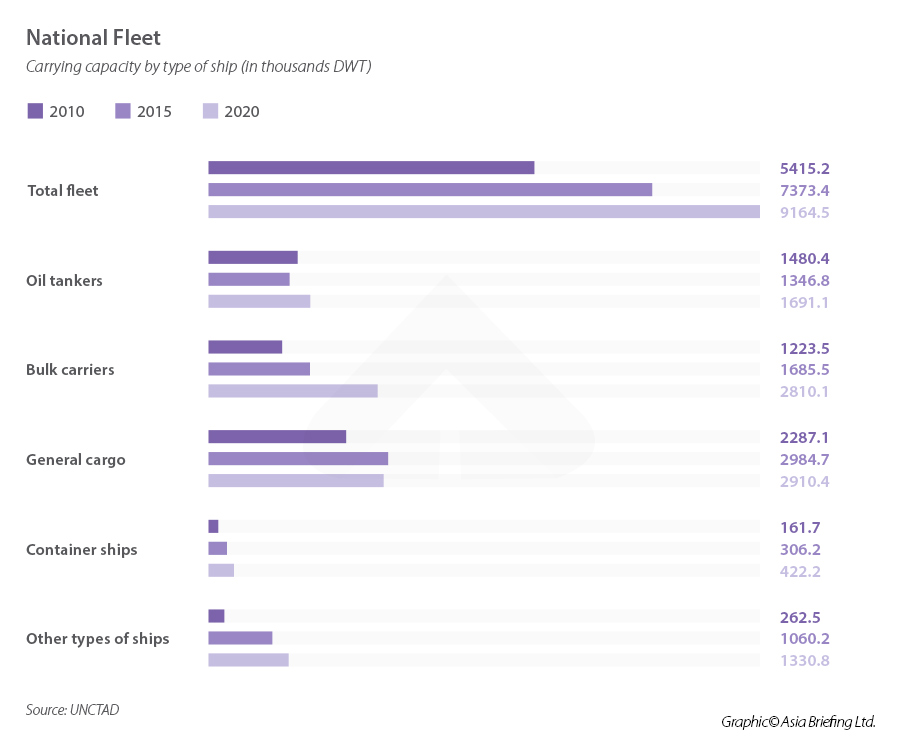

As of March 2022, the global container fleet has 6,346 ships with a total capacity of 25.5 million 20-foot equivalent units (TEUs) with a total tonnage of 305,902,000 deadweight tonnage (DWT).

Meanwhile, Vietnam’s container fleet has 10 container shipping companies, that own 48 container ships with a total capacity of 39,519 TEUs, and a total tonnage of 548,236 DWT.

Currently, Vietnam’s shipping fleet is responsible for transporting about 7 percent of the market share and mainly operates on domestic routes and short routes in the intra-Asia region; the rest is handled by foreign shipping lines.

Challenges

The key challenges faced by the Vietnamese shipping industry include national policy and legislation, underdeveloped infrastructure, and low investment accessibility.

Most Vietnamese shipping companies are small-sized businesses and mainly transport cargo but do not provide logistics services, leading to low efficiency in business activities. Vietnamese shipping enterprises only have ships with a capacity of 1,800 TEUs while foreign firms have vessels of over 20,000 TEUs.

Compared to other developed countries, the maritime shipping time and costs are still higher in Vietnam due to its smaller capacity. In addition, due to underdeveloped port facilities, and a shortage of port operators, several ports are not able to operate at full capacity.

Another challenge that concerns the Vietnamese shipping fleet is the composition of mainly older cargo ships with relatively small tonnage making them less competitive. Such ships do not meet the safety and security requirements to operate in large markets such as Europe and North America.

Another concern is that the transport of goods in Vietnam and on intercontinental routes is dominated by foreign shipping lines. According to the Ministry of Industry and Trade (MoIT), the percentage of import and export goods transported by local shipping companies fell by half from 10 percent in 2015 to 5 percent in 2020.

This means foreign shipping companies transported 95 percent of Vietnam’s import and export goods and consequently, Vietnam has had to spend a significant amount of foreign currency every year.

Besides, the trends of a merger or joint alliances between large international container shipping lines have made it further challenging for Vietnamese container shipping businesses to be competitive.

Vietnam’s regional container fleet

For now, Vietnam has 17 ships with a tonnage of 600 TEU or more, of which there are 14 ships with a tonnage of 1,000 to 1,800 TEU, which typically operate on routes in Asia.

The remaining fleet consists of 13 ships that are more than 25 years old, three ships more than 20 years old, and 15 ships with tonnage from 300 TEU to 600 TEU. Such ships can only run within the country making them less competitive

The Vietnam Logistics Business Association (VLA) has proposed a total investment of US$1.5 billion to buy new ships as well as rent and buy containers to expand shipping and ease supply chain issues.

Having a fleet of container ships would limit the pressure of foreign shipping lines on freight rates and surcharges. It would also help ensure the country’s economic security as well as take full advantage of free trade agreements (FTAs) in the long term.

As per the VLA, the investment plan will be divided into two development phases. Phase 1 will be implemented in about three to five years, focusing on investing in ships suitable to operate on intra-Asia routes such as Japan, South Korea, China, India, and the Middle East, which account for more than 60 percent of the total volume of dry goods for imports and exports.

The VLA said that in the first phase, Vietnam should not only buy new assets but also cooperate with partners who have large shipping lines to share infrastructure and exchange management as well as operation technology.

In the second phase, which could last about five years, after successfully operating in inner Asia with partners, investment would be needed in large container ships that can operate on major intercontinental routes globally such as the Asia – America route, Asia – Europe route, East-West route and so on.

According to the VLA, to attract Vietnamese crewmen to work on ships, the government should also introduce policies to encourage training and exempt them from personal income tax, while allowing the hiring of foreign crew members to work on Vietnamese flagged ships.

And finally, to translate investment into growth, the plan would need the cooperation of different ministries and enterprises in different sectors in order to trade goods in large volumes as well as import and export businesses.

The government has also responded by approving a Masterplan for the development of Vietnam’s seaport system in the period of 2021 – 2030 with a vision to 2050 with emphasis on encouraging private investment sources to improve infrastructure capacity.

An overview of supply chains, increased freight rates, and logistic costs

According to the VLA, the transport of import and export of goods by sea is facing several challenges, especially due to congestion at ports and supply chain disruption, which have caused a shortage of ships and containers. Such congestion has dramatically increased freight rates, which impacts the competitiveness of all businesses.

However, container availability was already a major issue in Vietnam prior to the pandemic, which has created difficulties in locating goods, as well as loading and unloading times.

This has led to a compounding effect. Increased delays at European and US ports are impacting returning vessels to Asian ports, creating an imbalance. The late arrival of vessels into Asia significantly adds to wait times in Asian countries, including Vietnam’s Vung Tau port.

Being a manufacturing hub, the situation could get worse if shipping capabilities are not able to keep up. Further, once China’s major cities emerge from a lockdown, pent-up demand is likely to lead to an increase in goods piling up at ports waiting to be unloaded.

In addition, shipping companies have continuously increased surcharges and freight rates during the pandemic, leading to higher transportation costs. This has tremendously impacted Vietnamese enterprises, leading to higher goods prices.

Due to the pandemic, the growth volume in 2020 was 4 percent, slower than the annual average. Of which, the volume of container cargo through local seaports was estimated at 22.1 million TEUs, up 13 percent compared to 2019.

Potential tax incentives for foreign investment

This year, to improve the growth prospects of the country’s shipping industry, the MoIT has proposed several tax incentives to the government in order to further attract foreign investment.

Particularly, the MoIT proposed the reduction of corporate income tax for shipping enterprises from 20 percent to 15 percent within three years and personal income tax for mariners by increasing the threshold of wages that are subject to tax.

To encourage shipping companies to retire old ships that are less efficient, the ministry has proposed exemption or reduction of taxes and fees, such as registration fees and VAT, when building or buying new and specialized ships suited for transport needs.

It has also suggested that the government should have coastal fleet management policies to meet the domestic transport demand, promote freight by sea, and improve connection among modes of transport.

To encourage the development of specialized ships, the MoIT had requested enterprises to build or buy ships to replace foreign-nationality vessels because Vietnam would only license foreign-nationality ships until the end of 2023 to operate on domestic routes.

Takeaways

The shipping industry is expected to continue to grow strongly this year thanks to active import and export activities as the pandemic eases and the fact that Vietnam remains an attractive destination for FDI inflows. Although the lack of appropriate infrastructure and container capability remains the key obstacle for the country’s shipping industry to meet higher demand, major investment plans from the government have been introduced to develop its regional container fleet.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article What is Vietnam’s Mining Capacity for EV Batteries?

- Next Article Vietnam Strives for Full Public Investment Disbursement for 2022-2023