Each week we summarize the most recent, developing, and important Vietnam news into one easy to read digest. Here are the top recent Vietnam news summaries.

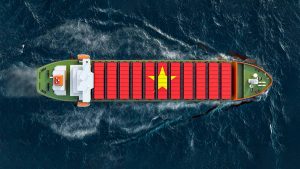

Vietnam Exports to the US in Q1 2024 Reach US$25.77 Billion

Vietnam exports to the US in the first quarter (Q1) of 2024 accounted for 27.7% of the entire export turnover of the Southeast Asian economy.

Vietnam’s Extended Producer Responsibility Policy: Company Recycling Obligations

Vietnam’s amended Environment Protection Law (EPL) in 2022 introduced a new “extended producer responsibility” (EPR) policy which places the burden of responsibility to recycle on companies.

Applying for a Vietnam Work Permit: Guidelines for Foreigners and Employers

Vietnam has amended certain provisions regarding hiring foreign workers and the issuance of work permits. We provide the details.

Unlocking Investment Opportunities: Vietnam’s Q1 Business Activity Rebound

We note the increased business activity seen in Q1 2024 across key sectors in Vietnam and briefly discuss the opportunities it presents for investors.

ESG Focus Among Foreign Businesses in Vietnam: VBF Report Highlights

We discuss findings from the VBF’s survey of foreign business stakeholders in Vietnam, including progress and concerns over ESG priorities.

Vietnam-Spain Bilateral Relations: Trade and Investment

We look at the latest data on bilateral trade and investment and discuss the various tax and investment treaties signed by Spain and Vietnam.

Vietnam Advisory on Swapping of Working Days Around April 30 and May 1, 2024 Holidays

Vietnam’s labor authority MOLISA has proposed a swap of workdays for the 2024 Reunification Day and International Workers’ Day holiday.

Judicial Record Card in Vietnam: Guide to Obtaining a Police Clearance Check

A criminal record check certificate (Judicial Record Card) is required for foreign employees when they apply for a work permit in Vietnam.

Vietnam Decree 23 Outlines Bidding Processes for Key Sectors Projects

Vietnam has introduced comprehensive regulations via Decree 23 on the bidding processes for project implementation and investor selection. It follows the New Bidding Law that came into force beginning of 2024.

Vietnam Adopts Hydrogen Energy Strategy to Boost Energy Transition

In a new strategy, Vietnam has laid out a range of development targets for the hydrogen industry for the period to 2030 and with a vision to 2050, which will support the country’s sustainability and decarbonization goals. The Hydrogen Energy Strategy came into effect on February 7, 2024, and will be of interest to international investors and R&D stakeholders in the energy domain.