UNDP Releases Vietnam PAPI 2023 Report: Progress on Anti-Corruption, E-Governance

In the PAPI 2023 Rankings, Thua Thien-Hue Province in central Vietnam claimed the top spot among 63 localities with 46.04 points. Thai Nguyen and Bac Ninh Provinces secured second and third positions with 45.78 and 45.7 points, respectively.

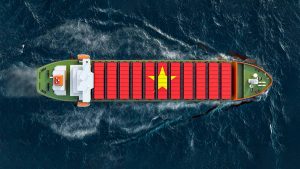

Vietnam Exports to the US in Q1 2024 Reach US$25.77 Billion

Vietnam exports to the US in the first quarter (Q1) of 2024 accounted for 27.7% of the entire export turnover of the Southeast Asian economy.

Unlocking Investment Opportunities: Vietnam’s Q1 Business Activity Rebound

We note the increased business activity seen in Q1 2024 across key sectors in Vietnam and briefly discuss the opportunities it presents for investors.

ESG Focus Among Foreign Businesses in Vietnam: VBF Report Highlights

We discuss findings from the VBF’s survey of foreign business stakeholders in Vietnam, including progress and concerns over ESG priorities.

Vietnam-Spain Bilateral Relations: Trade and Investment

We look at the latest data on bilateral trade and investment and discuss the various tax and investment treaties signed by Spain and Vietnam.

Why Cambodia’s Funan Techo Canal Project is Worrying Vietnam

The Funan Techo Canal project linking Phnom Penh to the coastal province of Kep has socioeconomic, political, and environmental implications for Vietnam.

An Investor’s Guide to Vietnam’s Bắc Ninh Province

Despite being the smallest province in Vietnam, Bắc Ninh province is emerging as an industrial powerhouse in the Red River Delta region.

Vietnam’s State of the Economy: Q1 2024 Report

Vietnam’s economy saw GDP y-o-y growth at 5.66% and an FDI uptick at 13.4% (as of March 20) in the January-March quarter of 2024 (Q1 2024).

Vietnam’s National Electricity Development Plan 2021-2030: Roadmap Approved

Vietnam’s government has approved a roadmap to implement the National Electricity Development Plan 2021 to 2030, with a vision to 2050. We discuss key points in the plan and ongoing regulatory efforts in the power sector.

Vietnam-Canada Bilateral Relations, Trade, and Investment Outlook

We discuss key factors making Vietnam an attractive investment destination for Canadian businesses amidst rapid economic expansion.