Indian Investment in Vietnam – How to Structure Operations for Success

- India and Vietnam relations have been steadily growing, marked by economic, commercial, and strategic engagement in the past four decades.

- Vietnam’s rise in ease of doing business rankings has helped its business environment enabling Indian investors to structure their operations in its vibrant economy.

- Vietnam Briefing highlights the India-Vietnam relationship and how Indian investors can structure their operations for success in Vietnam.

India and Vietnam relations have been marked by growing economic, commercial, and strategic engagement in the last few years. India ranks among the top ten trading partners of Vietnam.

By 2020, both countries had aimed to achieve trade worth US$15 billion with trade growing sharply from US$5 billion to US$13.7 billion between 2016 and 2019. This year, however, disruption caused by COVID-19 shrunk India-Vietnam trade to nearly US$12.4 billion.

Major areas of focus include energy, mineral exploration, agro-processing, sugar, tea, coffee manufacturing, agro-chemicals, IT, and auto components.

Entry strategy

Foreign entities may establish their presence in Vietnam as a limited liability company with one or more members, a joint-stock company, a partnership, a branch, a business cooperation contract, or a representative office.

Limited-liability company

It may take the form of either:

- A 100 percent foreign-owned enterprise; or

- A foreign-invested joint-venture enterprise between foreign investors and at least one domestic investor.

Joint-stock company

A joint-stock company is a limited liability legal entity established through a subscription for shares. By law, this is the only type of company that can issue shares. A joint-stock company either may be 100 percent foreign-owned or a joint venture between both foreign and domestic investors.

Partnerships

A partnership can be established between two individual general partners.

Representative offices

Foreign companies with investment projects in Vietnam may apply to open representative offices in Vietnam. A representative office cannot conduct commercial or revenue-generating activities. This is the most common form of presence in Vietnam for foreign companies, particularly those in the first stage of a market entry strategy.

Business cooperation contract (BCC)

A BCC is a cooperation agreement between foreign investors and at least one Vietnamese partner in order to carry out specific business activities.

Public and private partnership contracts

A public and private partnership (PPP) contract is an investment form carried out based on a contract between the government authorities and project companies for infrastructure projects and public services.

Indian investments in Vietnam

India has over 270 projects in Vietnam with total investments of close to US$2 billion. In the energy sector, Tata Power, part of India’s Tata Group, is building a US$2.2 billion thermal power project in Soc Trang province. This plant will cater to about two percent of Vietnam’s power needs when it becomes fully operational by 2030. In 2017, the same group inked a US$54 million deal to build a 49-MW solar park in Vietnam’s southern province of Binh Phuoc.

In the agriculture sector, Tata International Vietnam signed an MoU with Agribank in 2017 to support Vietnamese farmers, cooperatives, and plantations in terms of credit support, equipment insurance, and access to a wide range of mechanization solutions.

In 2019, Tata Coffee inaugurated its US$50 million freeze-dried coffee plant in the Binh Duong. To facilitate investment projects and SMEs, India’s state-owned Bank of India opened its first branch in Ho Chi Minh City in 2016.

The Indian government has been actively engaged in stimulating business with Vietnam. In 2014, it offered a US$300 million line of credit to Vietnam as an impetus to accelerate textile trade and investment between the two countries. In 2017, it approved a Project Development Fund of Rs 500 crore (US$ 75 million) for supporting Indian companies to build production and supply chains in Cambodia, Laos, Myanmar, and Vietnam. This should benefit India’s industries in terms of business expansion, maintaining cost-competitive supply chains, along with increased integration with global production networks.

Bilateral agreements and trade

Both India and Vietnam are members of the ASEAN–India Free Trade Area (AIFTA), which came into effect in 2010. This free trade agreement (FTA) eliminates tariffs for over 80 percent of goods traded between ASEAN and India. The last period for tariff reduction or elimination under the various tariff categories for Vietnam is set for 2024.

India recently opted out of the 15-nation Regional Comprehensive Economic Partnership (RCEP), a trade agreement facilitating the diversification of supply chains, as its issues and concerns were not sufficiently addressed by the current terms of the agreement.

There is scope for the addition of a clause that will allow India to rejoin in the future. Despite this, India and ASEAN countries are exploring ways to increase trade between themselves.

Key imports

Key imports from Vietnam include mobile phones, computers, electronics hardware, machinery, chemicals, rubber, metals, wood, fibers, pepper, means of transport, steel products, coffee, footwear, chemicals products, polymers, and resins.

Key exports

Key exports from India include machinery & equipment, seafood, pharmaceuticals, cotton, automobiles, textiles & leather accessories, cattle feed ingredient, chemicals, plastic resins, chemicals products, fibers, steel, fabrics, metals, jewelry, and precious stones.

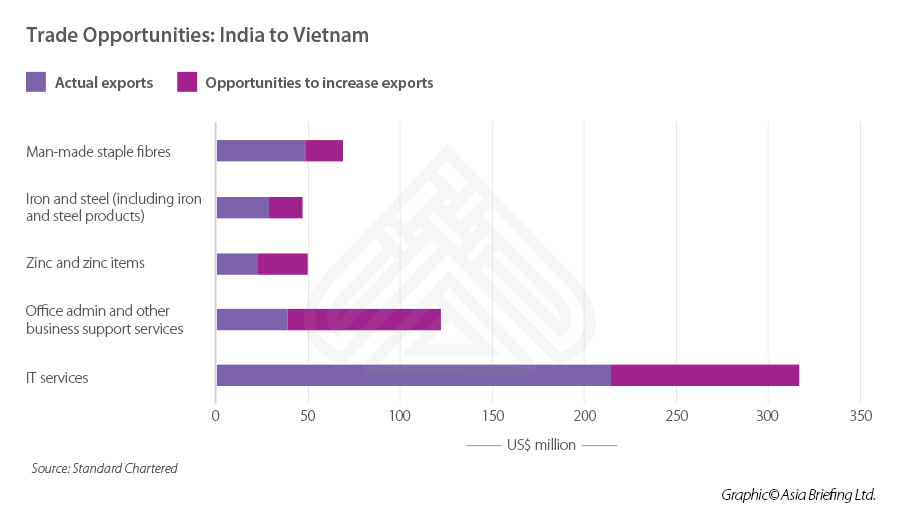

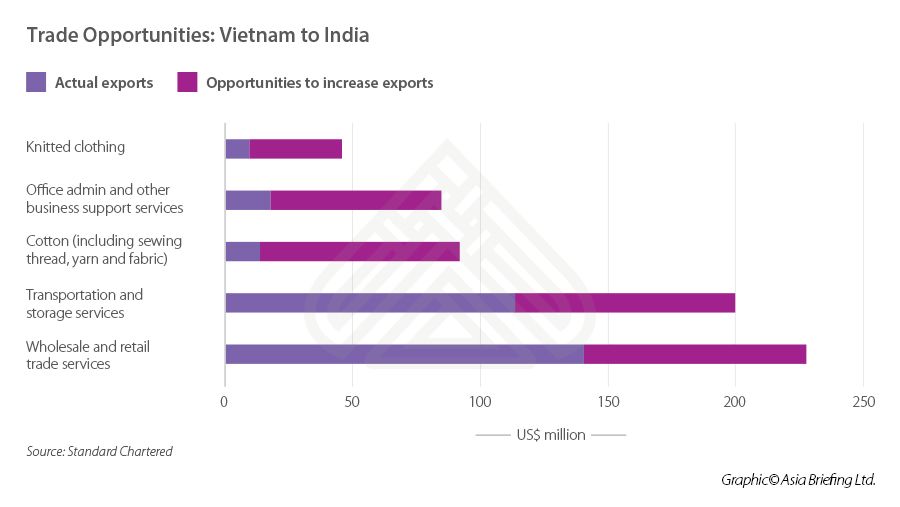

Trade opportunities

India has enormous growth potential to provide IT and business services, zinc, steel, and fibers to Vietnam. Vietnam’s exports to India have a remarkable scope to increase in cotton, business support, and knitted clothing in addition to an already strong transport, storage, and trade services sector.

Reasons to invest

Increased market access

Both governments are actively working on key issues to facilitate trade and investment such as increasing air connectivity and direct containerization. These efforts have materialized into the launch of direct flights by Vietnamese and Indian carriers Vietjet Air & Indigo, which connect India’s New Delhi and Kolkata with Vietnam’s Hanoi and Ho Chi Minh City.

Vietnam’s recently ratified an FTA with the EU named the EVFTA and which came in effect this August. The FTA removes duties from 99 percent of the goods traded between the two regions.

Favorable investment policies

To encourage FDI, Vietnam has put in place a series of incentives for foreign investors. These include preferential corporate income tax rates, import duty exemptions, exemption from taxes on royalties, exemption or reduction of land use or land rental fees, and privileges awarded to build-operate-transfer (BOT), build-transfer-operate (BTO), and build-transfer (BT) projects and projects in special economic zones. The incentives are meant to promote FDI in the high-tech sector, underprivileged regions, labor-intensive industries, and other priority sectors such as education and health.

Infrastructure

Vietnam has over 325 state-supported industrial parks in the country that offer incentives and fewer restrictions. 17 more industrial parks are expected to open in the next few years. The economic zones tend to be closer to main roads, ports, and airports for easier movement of goods. Most of the foreign investments in such zones are from the manufacturing and export-oriented sectors.

Stable and growing economy

Economic and political reforms under Đổi Mới, launched in 1986, have spurred rapid economic growth and development, transforming Vietnam into one of the most dynamic emerging economies in the region. For the last two years, the country achieved a GDP growth of over 7 percent and is forecast to be between 2 to 3 percent in 2020 and 6.7 percent in 2021 due to the pandemic. Despite uncertainties in the global environment, Vietnam’s economy remains resilient.

Rise in global rankings

In terms of ease of doing business, Vietnam has made numerous amendments to their regulations to make investing in Vietnam more transparent, which led its rankings to rise by nine spots to 70 amongst 190 economies in the World Bank’s Doing Business 2020 report. India ranked 63 in the rankings.

In the recent Global Innovation Index 2020, Vietnam ranked 42nd among 131 economies, and first among the 29 lower-middle-income economies. The country’s impressive growth is being attributed to its improved business environment and competitiveness. India ranks 48th amongst 127 economies, and first in central and southern Asia.

Favorable demographics

The median age in Vietnam is 30.5 years and the workforce is not just young but skilled with about 45 percent of them in their working age. Government expenditure on education is over 4 percent of the GDP as of 2018.

Low costs

In contrast to many other countries, there are no minimum capital requirements for most business lines in Vietnam. This provides a wide range of possibilities for new businesses in Vietnam. However, note that the amount of capital declared must be fully paid within 90 days of the date of company registration.

In terms of labor, despite the yearly increase in the minimum wage, Vietnam is still a country with low labor costs. Although in the long term, low wage rates may become unsustainable, for now, low wages will complement the growth of its manufacturing sector.

Sector opportunities

Agriculture

Agriculture provides several opportunities especially in rice, coffee, and tea production, which are major exports of the country. Investments in new science and breeding technology, irrigation technology, storage facilities, and development of the value chain offer a huge market for investors. Besides, Vietnam has the natural advantage of climate conditions, soil with high yield from the central highlands suitable for coffee plantations.

Seafood

A significant potential lies for Indian seafood processing companies to establish a value chain in exploration, processing, and trade units in Vietnam, especially the Mekong Delta region. Although Vietnam’s seafood exports are significant, they also import large volumes of seafood products for export processing because of limited domestic production from the fishing industry. Indian companies can take benefit from several incentives for investments, credit, insurance, and preferential tax available for organizations operating in the fisheries sector.

Information technology

As Vietnam strives to digitize its economy, there is a significant opportunity for Indian IT companies that have expertise in areas such as e-commerce, digital payments, smart energy, and smart logistics.

Automotive components

Vietnam’s automotive manufacturing industry is growing rapidly, but the development of supporting industries providing spares and parts has been slow. This offers an opportunity for Indian auto components manufacturers, who are already amongst the top exporters in the world. Last year, automobile components industry exports constituted 4.9 percent of India’s overall exports, and expanding overseas will help firms in diversification.

Assembling and manufacturing of agriculture machinery

With Vietnam giving greater importance to agriculture sectors and various incentives, assembling and manufacturing of the agricultural machinery and farming implements are potential areas that can be explored for investment.

Infrastructure

With a growing economy that is urbanizing fast, Vietnam’s infrastructure needs are on the rise. Indian firms can support and explore opportunities in projects such as road, renewable energy, and vessel-building. Other sectors of interest include hospitality and healthcare.

Note: This article was first published in July 2017 and has been updated to include the latest developments.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Wie profitiert Vietnam durch den Beitritt zum RCEP?

- Next Article Devisenmanagement in Vietnam: Zirkular 6