Laying Foundations for Growth: The Future of Vietnamese Infrastructure

By: Eugenia Lotova

By: Eugenia Lotova

With the signing of several free trade agreements, Vietnam is expected to see significant uptakes in trade with nations around the globe. In addition to presenting opportunities for investors and promising to increase wealth for Vietnam’s growing middle class, the ramping up of global interconnections is likely to increase strain on national infrastructure. Although presenting a salient risk for operations within the country, these issues have not gone unnoticed by officials, which have increasingly turned to the private sector as a source of funding.

This turn in itself presents investment opportunities for companies seeking to invest in Public Private Partnerships and bodes well for traditional manufacturing operations that will likely see improved logistics in the medium term. The key for successful short term investment, however, lies in the ability to identify where infrastructure is set to improve and the ability create strategies to capitalize on these emerging changes.

Presently, there are a number of infrastructure related challenges that investors should be particularly aware of. These include the railway connecting Hanoi and Ho Chi Minh City that is in desperate need of an upgrade, the threat that ports will reach maximum capacity in the face of increased trade volume, and the reality that just 20% of national roads are paved.

Despite these challenges, the current state of Vietnam’s national infrastructure is standard for a country at its stage of development; however, if Vietnam wants to remain competitive, it must develop quickly. According to the World Economic Forum Global Competitiveness Report 2016-2017, Vietnam ranks 79th out of 138 in terms of overall quality of infrastructure, 89th in quality of roads, and 77th in quality of port infrastructure.

A quick look at the rest of ASEAN makes clear that improved infrastructure will be required if growth is to continue. Singapore for example, with its more substantial import and export volume, has risen to its current position as a result of seamless logistical support. The city state currently ranks second in overall infrastructure, and second in road and port quality.

The Vietnamese government is currently working to increase the efficiency and scope of infrastructure projects through foreign and private investment via public-private partnerships and equitisation. For the country to maintain its status as a manufacturing hub, the government is emphasizing transport and power projects in industrial zones. To decrease the traffic congestion in large cities such Hanoi and Ho Chi Minh City, major public transportation projects are also being undertaken.

In 2016, the leadership released a list of projects that have been opened for foreign investments including:

- Upgrades and construction of roads, bridges, and railways

- Expanding capacity and reliability of power grids in Hanoi and Ho Chi Minh City

- Construction and development of industrial parks and complexes

- Expansion of existing port capacity

A full list of specific projects currently calling for foreign investment can be found at http://vietnamembassy-usa.org/Projects/List.

RELATED: Dezan Shira & Associates’ Corporate Establishment Services

RELATED: Dezan Shira & Associates’ Corporate Establishment Services

Ports

Because international trade is conducted mainly via sea based transport, increasing the number of ports and the capacity of existing ports is critical for manufacturers seeking to speed up transport times and reduce costs. While plans to expand the nations current capacity are encouraging, Vietnam must also be strategic in port placement and consider the supply-demand of the specific region to ensure that the network of ports is well integrated and each port is appropriately utilized.

For companies considering investment in the near future, It should also be noted that industrial zones will likely benefit from better roads connecting operations to ports and large cities. Industries with extensive supply chains and complex sourcing needs will profit from these locations that are often well connected internally and internationally.

Based on current expectations, once the EU-FTA go into effect, at least one port in southern Vietnam will reach capacity in two years, showing the critical need for an upgrade in port infrastructure.

A major project intended to increase Vietnam’s trade capabilities has recently been revived—the Van Phong Port. The building of the part initially began in 2007, but soon ran out of funds. Even though there are several technical challenges in its construction, for investors looking to finance major infrastructure projects, this can be a key investment. If completed, Van Phong would be the largest Vietnamese port.

Related: Privatization of Vietnam’s Port Infrastructure to Boost Efficiency and Lower Prices

Related: Privatization of Vietnam’s Port Infrastructure to Boost Efficiency and Lower Prices

Railways

Perhaps the most ambitious goal the government has undertaken is building the high speed North-South railway system, which will drastically cut down on the amount of time required to travel from Hanoi to Ho Chi Minh City. The project is expected to begin in 2030, but the tremendous amount of money required puts the feasibility of the task in question.

Although the North-South speed railway is an ambitious goal for the future, current projects involve upgrading the existent railway to better suit the needs of passengers and enterprises. In the present-day, there is a strong push to update the railroad system so that it can so that trains can go from travelling at speeds of 60-70 kph to 80-90 kph and add several new stations along the railway line by 2020. For corporations looking to invest in Vietnam’s infrastructure, this BOT project would improve the link between the two major cities.

Those companies that source textiles from China and have manufacturing facilities in the Ho Chi Minh City areas would benefit from a faster and more efficient railway system. With an express railway system connecting Vietnam’s two major cities, railroad travel time from Hanoi to Ho Chi Minh City would be reduced from 32 to 7 hours.

Infrastructure investment forecasts

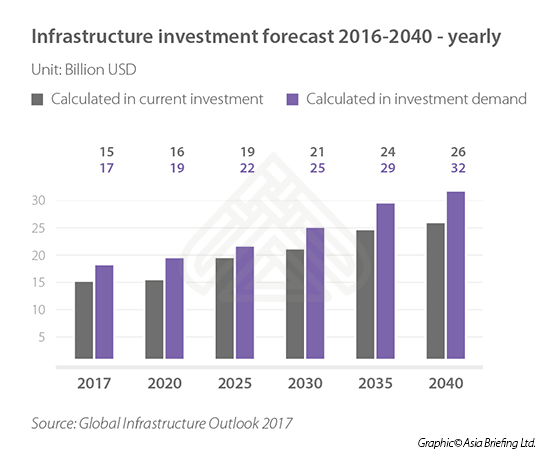

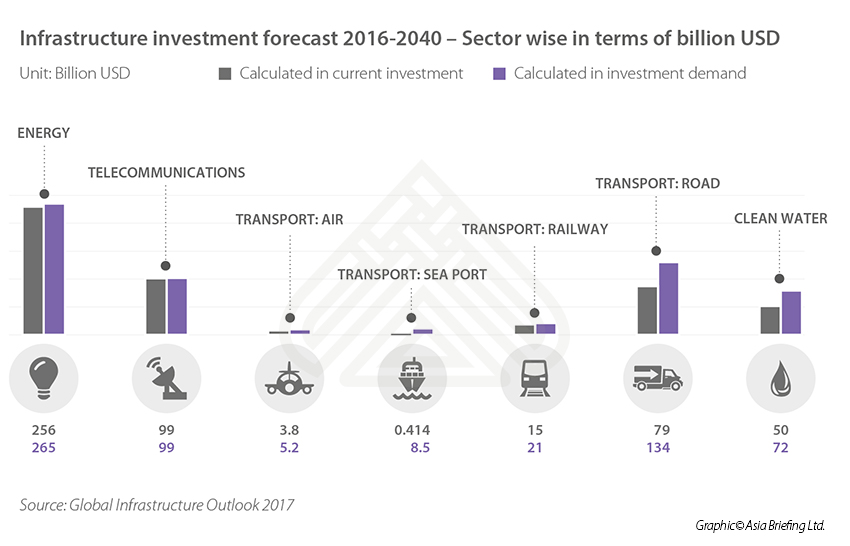

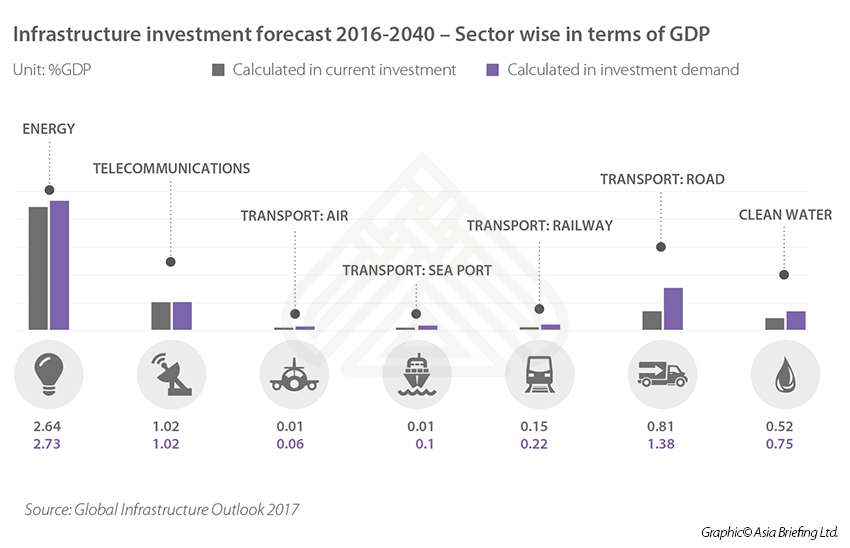

According to the recent G20 Global Infrastructure Outlook 2017 report, Vietnam will be able to meet 83 percent of its infrastructure needs by 2040, if it maintains its current investment trend. The country will require US$605 billion for all infrastructure projects across all sectors, while according to current trends; investments will reach US$503 billion; an investment gap of US$102 billion.

Road sector will have the largest investment gap and will require an additional 70 percent funding. Investment gap is forecasted to be around US$55 billion. In second, water based infrastructure projects is forecasted to face an investment gap of US$23 billion by 2040.

Editor’s note: This article was originally published in June 2016 and incorporates recent data and information.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Annual Audit and Compliance in Vietnam 2016

In this issue of Vietnam Briefing, we address pressing changes to audit procedures in 2016, and provide guidance on how to ensure that compliance tasks are completed in an efficient and effective manner. We highlight the continued convergence of VAS with IFRS, discuss the emergence of e-filing, and provide step-by-step instructions on audit and compliance procedures for Foreign Owned Enterprises (FOEs) as well as Representative Offices (ROs).

Navigating the Vietnam Supply Chain

Navigating the Vietnam Supply Chain

In this edition of Vietnam Briefing, we discuss the advantages of the Vietnamese market over its regional competition and highlight where and how to implement successful investment projects. We examine tariff reduction schedules within the ACFTA and TPP, highlight considerations with regard to rules of origin, and outline the benefits of investing in Vietnam’s growing economic zones. Finally, we provide expert insight into the issues surrounding the creation of 100 percent Foreign Owned Enterprise in Vietnam.

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

This edition of Tax, Accounting, and Audit in Vietnam, updated for 2016, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate Vietnam’s complex tax and accounting landscape in order to effectively manage and strategically plan their Vietnam operations.

- Previous Article Vietnam Startup Ecosystem

- Next Article Vietnam Proposes Numerous Tax Hikes