Korean Investment in Vietnam

By: Dezan Shira & Associates

Editor: Koushan Das

The year 2017 marks 25 years of Vietnam and South Korea’s diplomatic relations. During this period, the focus of trade and investments has shifted from labour intensive sectors such as garments and textiles, to capital intensive sectors such as electronic goods, and finally at present to consumer goods and services. Bilateral trade jumped from US$0.5 billion in 1992 to US$45 billion in 2016, while in terms of investments, South Korea has emerged as the largest foreign investor in Vietnam.

![]() RELATED: Pre-Investment Advisory Services from Dezan Shira & Associates

RELATED: Pre-Investment Advisory Services from Dezan Shira & Associates

Bilateral agreements and trade

Free Trade Agreements

Both South Korea and Vietnam are members of the ASEAN – Korea FTA (AKFTA), which came into effect in 2007. Along with the AKFTA, both countries are parties to the Vietnam Korea FTA (VKFTA), which came into effect in 2015. VKFTA focuses on a higher level of commitment and liberalization than AKFTA. It removes an additional 506 tariff lines for Vietnamese products and 265 tariff lines for South Korean products, in addition to the ASEAN-Korea FTA. South Korea will remove 95 percent of its tariff on Vietnamese imports, while Vietnam reduced 90 percent of tariffs on South Korean imports.

Effect of the Vietnam Korea Free Trade Agreement

Companies in both countries will benefit from the reduced tariffs. Vietnam will eliminate 90 percent of tariff lines on Korean imports within 15 years from the date of effect, while South Korea will remove 95 percent of tariff lines on Vietnam’s imports.

Within a year of implementation, the VKFTA led to an increase of 19 percent year-on-year bilateral trade in 2016 in comparison to 2015. This year, bilateral trade is witnessing a further increase in comparison to 2016. Imports from South Korea for the first seven months of 2017, has increased by almost 50 percent for the same period last year, while Vietnamese exports to South Korea for the first seven months in 2017 have increased by 30 percent. With the rapid growth in trade in the last two years, bilateral trade is expected to reach US$ 70 billion by 2020.

South Korea reduced import duties on Vietnamese products such as shrimp, fish, crab, tropical fruits, garment and textiles, and wooden products. South Korean companies have been more aggressive in comparison to Vietnamese companies in taking advantage of the lower tariffs of the VKFTA, leading to a growing trade deficit.

Trade

As of 2016, South Korea was the third largest trading partner to Vietnam, while Vietnam was the fourth largest trading partner to South Korea. Trade volume quadrupled from US$9.5 billion in 2009 to US$ 45.1 billion in 2016.

![]() RELATED: Customs Procedures in Vietnam

RELATED: Customs Procedures in Vietnam

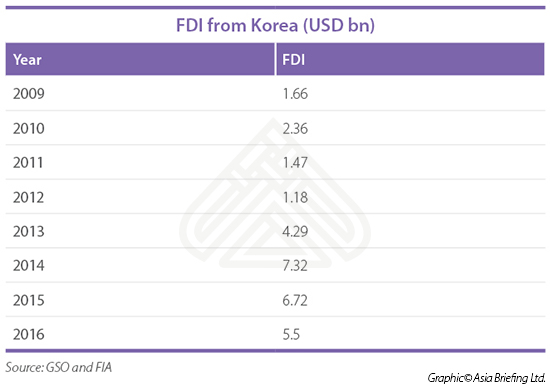

Korean FDI in Vietnam

South Korean FDI in Vietnam has occurred in three waves. The first wave occurred after the lifting of the US embargo, which focused on labor-intensive sectors such as textiles and garments, followed by Vietnam ascension to the WTO wherein investors focused on the manufacturing of electronic goods. The third wave currently focuses on manufacturing as well as consumer goods, retail, and services.

Cumulative Korean investment in the last 28 years has increased rapidly, rising to US$50 billion as of 2016, accounting for 17.2 percent of the total FDI in Vietnam between 1988 and 2016. Around 12.5 percent of the total FDI was invested in Bac Ninh province, followed by Dong Nai province, and Hai Phong at 10.8 percent and 10.6 percent respectively. Hanoi accounted for 10.5 percent of the total FDI.

Around 5,000 South Korean companies have invested in Vietnam in the last 25 years. According to the Vietnam Chamber of Commerce and Industry, Korean-invested firms in Vietnam in 2016 contributed almost a third of Vietnam’s exports and provided around 700,000 jobs domestically.

In 2016, South Korean investments accounted for a third of the total FDI. The manufacturing sector accounted for 82.3 percent of the investment, led by large-scale investments from Samsung and LG Electronics. Electric and electronic manufacturing accounted for the largest portion of the manufacturing and processing sector at 65 percent, followed by textile and fabric manufacturing at 20 percent.

Major Sectors

Manufacturing accounts for 70 percent of the cumulative South Korean investments since 1988, followed by real estate management and construction sector at 14.8 percent and 5.4 percent respectively.

Apart from manufacturing, which accounted for 82.3 percent of investments in 2016, there has been a growing interest by South Korean companies in the services and distribution sectors along with, wholesale and retail, culture, and science and technology. In addition, 2017 has seen a considerable interest in the food and finance & banking sectors.

South Korean firms are also looking to increase their investments in the agriculture, forestry, and fishery sectors, taking advantage of the preferential tariffs of VKFTA.

Major Korean Investors

Samsung leads the pack amongst South Korean investors in Vietnam. It manufactures almost half of its smartphones at its two factories in Vietnam. Samsung is also setting up a third complex focusing on home appliances and displays with an investment of US$2.5 billion. Some of the existing production lines in South Korea and Malaysia will also be shifted to Vietnam in the near future. LG, another electronic giant also has setup a production hub in Vietnam to manufacture smartphones and televisions. The company will be spending around US$1.5 billion in the new hub by 2028.

Seoul Semiconductor Co. recently won a license to build a new $300 million semiconductor, while LED manufacturer Lumens will begin manufacturing operations later this year.

CJ Group, a South Korean conglomerate is also in the midst of a large-scale expansion in Vietnam. It’s business interest range from food processing, fertilizer and feed production, TV shopping, film production, and distribution. In 2016, it invested US$500 million into new projects and M&A. Another conglomerate, Lotte Group plans to expand its retail operations five-fold to 60 shopping malls in Vietnam by 2020.

![]() RELATED: Indian Investment in Vietnam

RELATED: Indian Investment in Vietnam

Going forward

Bilateral trade will continue to grow further in the next few years. Total trade is expected to reach US$70 billion by 2020. Although South Korean manufacturing investments have reduced in the last few years, sectors such as retail, real estate, finance, and infrastructure have witnessed a growth in investments.

Export-oriented manufacturers are also refocusing their investments in the domestic markets. With an expanding middle class, increase in urbanization, and a growing consumer demand, the Vietnamese market offers immense potential for investors especially in sectors such as retail, technology, finance, and healthcare.

|

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Eurasia, including ASEAN, China, India, Indonesia, Russia & the Silk Road. For editorial matters please contact us here and for a complimentary subscription to our products, please click here. Dezan Shira & Associates provide business intelligence, due diligence, legal, tax and advisory services throughout the Vietnam and the Asian region. We maintain offices in Hanoi and Ho Chi Minh City, as well as throughout China, South-East Asia, India, and Russia. For assistance with investments into Vietnam please contact us at vietnam@dezshira.com or visit us at www.dezshira.com

|

![]()

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in Vietnam 2017

An Introduction to Doing Business in Vietnam 2017

An Introduction to Doing Business in Vietnam 2017 will provide readers with an overview of the fundamentals of investing and conducting business in Vietnam. Compiled by Dezan Shira & Associates, a specialist foreign direct investment practice, this guide explains the basics of company establishment, annual compliance, taxation, human resources, payroll, and social insurance in this dynamic country.

Managing Contracts and Severance in Vietnam

In this issue of Vietnam Briefing, we discuss the prevailing state of labor pools in Vietnam and outline key considerations for those seeking to staff and retain workers in the country. We highlight the increasing demand for skilled labor, provide in depth coverage of existing contract options, and showcase severance liabilities that may arise if workers or employers choose to terminate their contracts.

- Previous Article Vietnam to Introduce Customs Bond to Facilitate Customs Clearance

- Next Article Vietnam FDI Real Estate Report- Streamlining Efficiency Part 1