Overtime Regulations and Compensation in Vietnam

- Overtime hours and regulations refer to time worked in excess of regular working hours in Vietnam

- Understanding overtime can be of critical importance for calculating costs for businesses operating in the country.

- Vietnam Briefing briefly discusses the laws and compensation that regulate overtime hours as well as a comparison with Vietnam’s neighboring countries.

When companies turn to Vietnam to establish their manufacturing operations, it is important to not only consider the laws on regular wages, but also the policies on overtime that will be applicable to the workforce and style of a given operation. One of the benefits of Vietnam is that wages are low in comparison to the rest of the region, particularly China.

Overtime and night work policies in the socialist republic are essentially the same as those currently employed in China. The Vietnamese government enumerates all of these regulations in the new Labor Law of 2019 (Law No. 45/2019/QH14) and Decree 145/2020/ND-CP. Understanding how these laws and guidance shape costs is of utmost importance for investors seeking to maximize Vietnam’s potential as a low-cost destination for manufacturing.

Triggering overtime

The first consideration that an employer must make is to ensure a thorough understanding of when overtime is applied. Understanding this threshold will allow for the optimization of production targets to customers’ cost and time constraints.

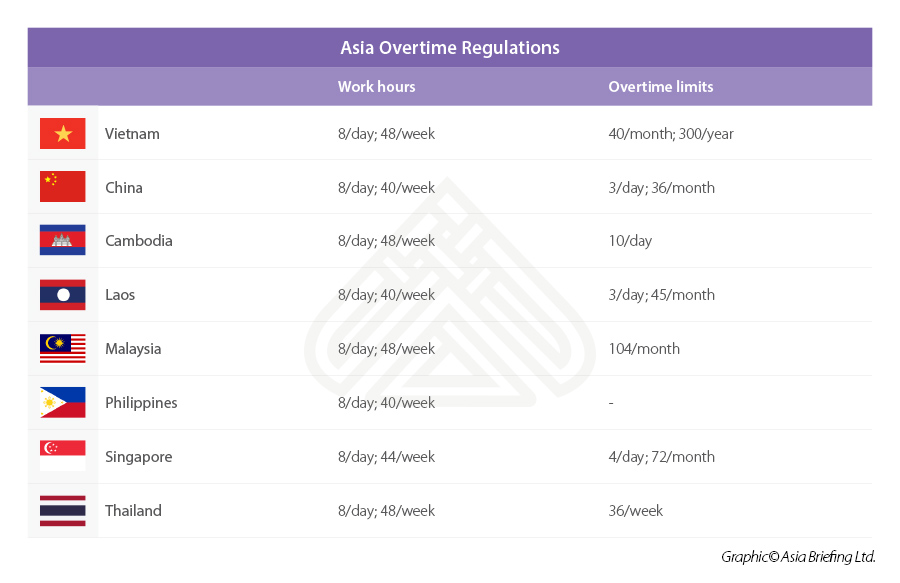

Pursuant to the regulations mentioned above, regular working hours cannot exceed eight hours a day, 48 hours a week. For employees working in heavy or hazardous conditions, the law stipulates that employers are responsible for limiting their working limit due to exposure to dangerous substances or chemicals as per the national technical regulations and relevant laws. If a worker exceeds these limits, overtime compensation will be applied.

In addition to working beyond a set threshold of hours, overtime compensation may be triggered and influenced by the time and date that employees are engaged. Key triggers of overtime beyond hours worked include weekends, public holidays, and night hours – defined as between 22:00 and 6:00.

Overtime compensation

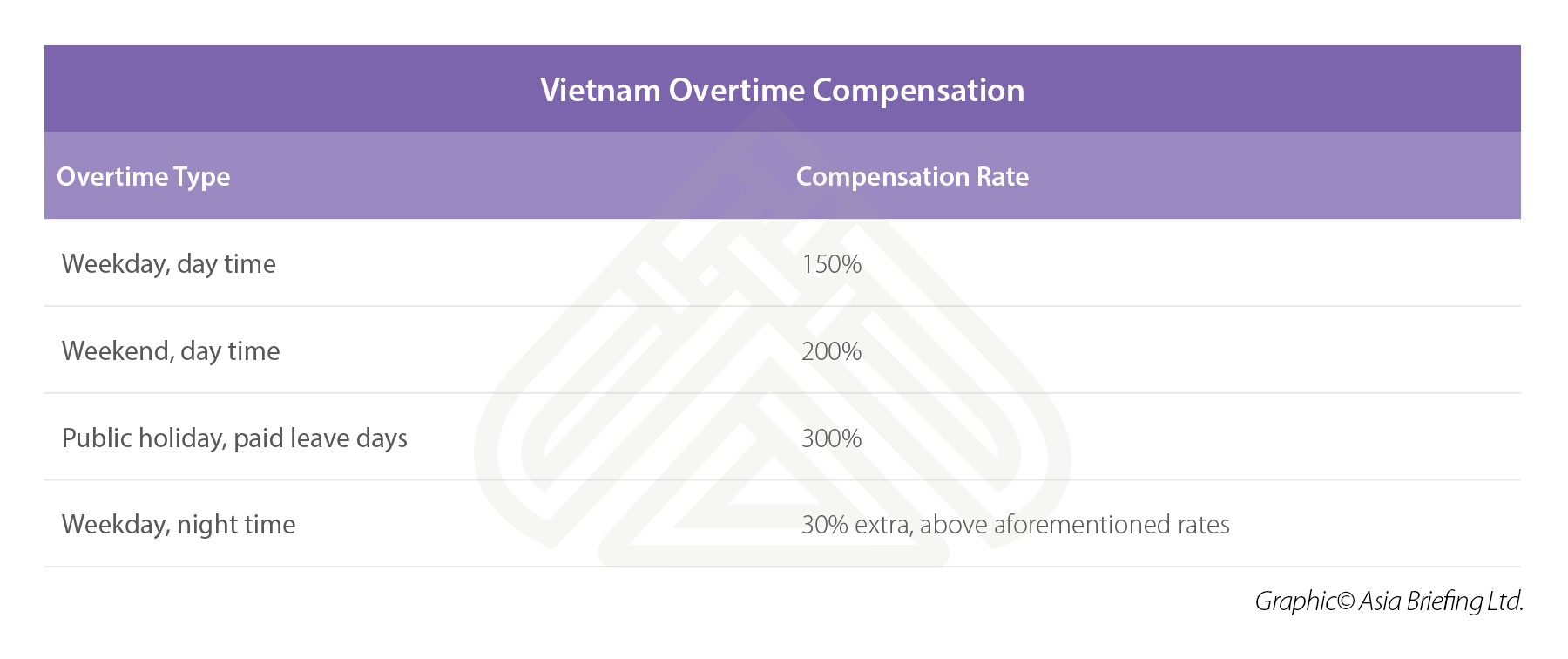

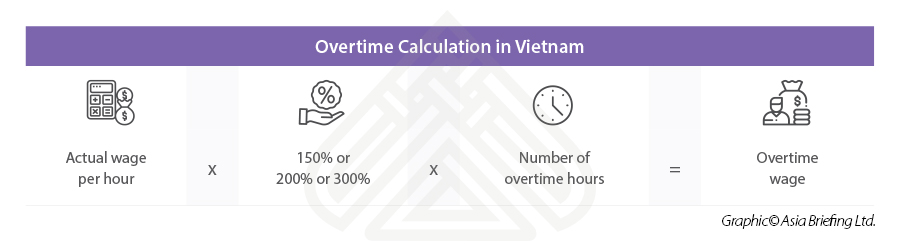

In the event that a company triggers overtime, they will be obligated to compensate employees beyond the wages that are outlined in their contract. This is applicable to all employees regardless of the wages that are offered. The following are the percentages in excess of standard that are to be applied in the event that certain work-related thresholds are crossed.

Note: there are limitations on the number of overtime hours an employee is allowed to work. As per the new labor code, overtime hours cannot exceed 40 hours per month from the previous 30. The new labor code also supplements cases where employers are permitted to organize overtime work for up to 300 hours per year these include – manufacturing and export of electric and electronic products as well work requiring high technical qualifications.

In cases where an employee works extra hours at night, they are paid extra in accordance to the applicable regulations. Further, employees who are given time off in compensation for working extra hours will need to be paid the difference between their wages during normal working hours and overtime work. Finally, employees who work night shifts should be paid at least 30 percent higher than normal.

Pregnant women, women with babies, and minor employees

Women that are in their 7th month of pregnancy and women with babies under 12 months are not allowed to work overtime, work at night, or take long-distance business trips. Further, pregnant women that are performing heavy work, must either be transferred to lighter work or decrease daily work time by an hour, while maintaining the same total pay.

The Vietnam Labor Code also establishes strict regulations for minor employees, which are workers under the age of 18. They are prohibited from working in dangerous conditions or with potential exposure to toxic substances. The Ministry of Labor, Invalids and Social Affairs (MoLISA) also establishes a limit on which industries and what kind of work minors can undertake.

Minor employees between the ages of 15 and 18 can work a maximum of eight hours a day and 40 hours a week. They are only permitted to do overtime and night work in certain industries, as specified by the Ministry. For workers under the age of 15, regulations establish maximum hours at four hours a day and 20 a week, with no overtime or night work permitted. Working hours for those under 13 years of age is further reduced to one hour per day.

Vietnam vs China

The Labour Law of China establishes similar regulations for their employees. Employees working overtime must be paid at a rate of at least 150 percent; for work done during rest day/weekend, 200 percent; for work during a holiday, 300 percent. China has stricter rules regarding the amount of overtime work than Vietnam. Chinese workers are limited to only an hour of overtime work per day and three hours if it is a special circumstance. The monthly limit is 36 hours.

As Chinese wages continue to rise and the economy transitions towards a more efficiency-based structure of production, Vietnam and the wider ASEAN region has increasingly been tapped as the next factory of the world. Those looking to explore opportunities in ASEAN’s growing manufacturing base must be aware of the nuances found within the region and tailor their operations accordingly.

Note: This article was first published in August 2016 and has been updated to include the latest developments

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam’s Improving Business Environment Amid Pandemic: Provincial Competitive Index 2020

- Next Article Vietnam Unveils Support for Vocational Training: Decision 17