Setting Up and Opening a Bank Account in Vietnam

- Banking is one of the first decisions that will determine how investors choose to remit their profits to their parent companies.

- Understanding which kind of banking account to operate is crucial for investors doing business in Vietnam.

- Vietnam Briefing guides investors on the various types of bank accounts and the processes required for set up.

In the event that a company has established operations and turned a profit within the Vietnamese market, challenges will remain with respect to ensuring that its proceeds may be sent abroad without a hitch.

Whether it be a decision over the method of repatriation or when to take profits, the ways in which investors choose to approach the remittance process can have a significant impact on the quantity and timeframe under which profits will become accessible.

One of the first decisions that will have to be made by investors is that of banking. Upon entering the Vietnamese market, foreign investors who wish to remit profits to their home markets will be required to open a foreign currency bank account. This account is to be utilized for all foreign currency transactions carried out within the country.

For companies that have already established operations in Vietnam, foreign currency accounts will have been set up during the transfer of funds to capitalize on given projects.

Alternatively, those considering Vietnam as a destination for future investment should note that, while the use of foreign bank accounts is important at the latter stage of the remittance process, it is nonetheless crucial to finalize banking arrangements on the front end of the investment.

Understanding which actions require the use of a foreign currency account, where restrictions are placed upon these types of accounts, and what documents must be prepared will all ensure that operations are optimized effectively.

Actions requiring foreign currency accounts

The following are transactions that require the use of a foreign currency bank account:

- Receipt of charter capital;

- Increased capital expenditure in which the funding of such expenditure originates in third party countries;

- Receipt of financing via loans from foreign sources;

- Disbursement of loan payments to third parties outside of Vietnam (inclusive of interest); and

- Disbursement of dividends and other profits to shareholders, the origins of which have been derived from Vietnam-based operations.

Restrictions

When selecting and operating a foreign currency account, investors are faced with a number of restrictions. The following are some of the most pressing issues that investors should prepare for when opening foreign currency accounts:

Institutional selection

When opening a foreign currency account, investors are limited to the selection of a single account with a bank that has been licensed by the SBV. In practice, the only banks that will be able to operate foreign currency accounts for investors are those with this license. While limiting the selection of institutions, a number of large international banks such as Standard Chartered and HSBC are able to host foreign accounts. Individual banks should be contacted in order to ascertain their status with Vietnamese officials.

Currency limitations

When opening foreign currency accounts, investors must select the account’s denomination. At present, foreign firms are limited to one foreign currency account in a single currency. Exceptions to this rule may be made in the event that investors can prove that the denomination of their overseas loans differs from the currency utilized in funding FDI projects within the country.

Switching banks

Pursuant to the aforementioned limitations on foreign accounts, those seeking to switch banks may be required to close existing accounts prior to establishing relations with new financial institutions. In the event that this course of action is taken, the closure of accounts must be conducted in compliance with procedures outlined by respective banks.

Requisite documentation

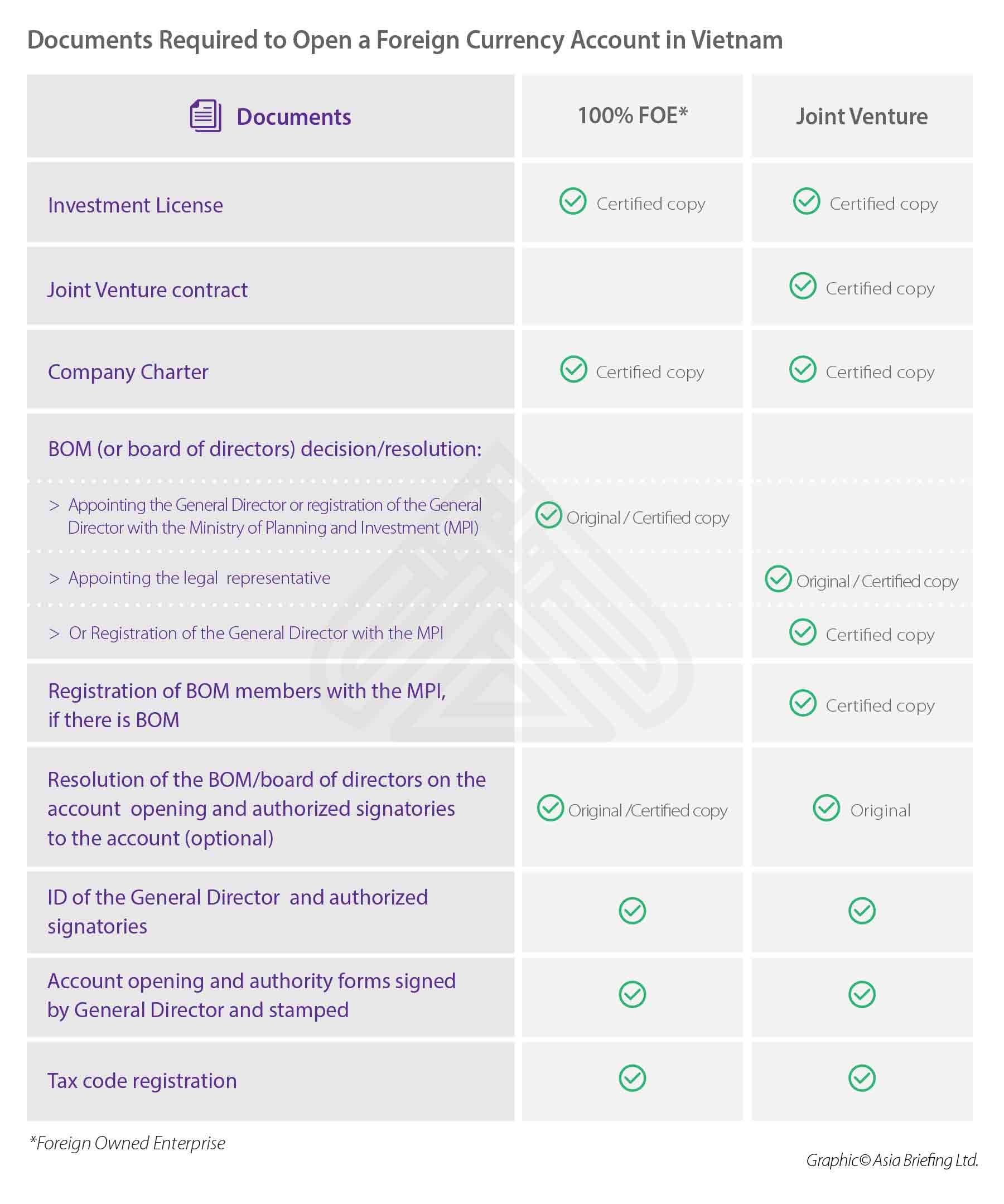

Upon the selection of a government-approved bank, the following documentation should be prepared in order to open the foreign currency account. It should be noted that the specific requirements of banks may vary and that requirements may differ depending on the nature of FDI projects within the country (i.e. 100 percent Foreign-Owned Enterprise vs Joint Venture).

Under Circular 6 an FIE can open two types of banks accounts: direct investment capital accounts (DICA) and deposit accounts at an authorized bank.

(I) Direct investment accounts

a. Direct investment accounts in a foreign currency or Vietnamese dong

FIEs are required to open a direct investment account to conduct foreign investors’ capital transfer transactions.

This application dossier includes:

- Bank account opening form;

- A written justification (signed by authorized representatives) of the necessity to identify account holder;

- Notarized photocopies of documents proving legal status, including Decision of Enterprise Establishment, and Business License or Investment License;

- A notarized copy of the original Certificate of Off-shore Investment;

- A copy of the approval on investment in the foreign language and its translation in Vietnamese issued by the authorities;

- The original copy of the document specifying the anticipated progress of investment capital contribution of an FIE; and

- The original copy of the document issued by credit institutions granting foreign investors to right to open an off-shore direct investment capital account

A direct investment capital account can be used to perform the following transactions:

- Deal with foreign investors’ charter capital contributions, investment capital implementations, medium and long-term foreign loans;

- Pay foreign currency into Vietnam-based FIE accounts;

- Pay all costs of medium and long-term foreign currency loans overseas (principal, interest and fees, and other related costs);

- Transfer capital, profit, and other legal revenues out of the country;

- Sell foreign currency to credit institutions for foreign exchange; and

- Other revenue and expenditure transactions related to investment.

b. Overseas foreign-currency accounts

FIEs may open foreign-currency accounts at overseas banks to borrow medium-term and long-term foreign loans.

In addition, as per Circular 20/2015/TT-NHNN an overseas foreign bank account can also be used for:

- To meet conditions for granting licenses for establishment and operation of their branches and ROs as per laws of the host countries;

- To serve operations of their overseas branches and ROs; and

- To open and use overseas accounts to fulfill their commitments, agreements, and contracts with foreign partners.

The application dossier includes (submitted to the State Bank of Vietnam, Foreign Exchange Management Department):

- An application to open and use overseas accounts;

- Notarized photocopies of documents proving legal status, including Decision of Enterprise Establishment, and Business License, or Investment License;

- Loan contracts signed with the foreign lenders and the loan registration approval from the State Bank;

- Documents proving the requirement of the foreign lenders of opening accounts at overseas banks;

- The plan for monthly foreign-currency revenues and overseas account expenditures; and

- Other documents as required.

II) Deposit accounts

a. Foreign-currency deposit accounts

FIEs may open and use foreign-currency deposit accounts to bring foreign investor’s capital and profits into and out of the country. Generally, FIEs have to exchange foreign currency for VND by selling it to a bank licensed to make such transactions.

FIEs can use the foreign currency stored in foreign-currency deposit accounts for the following purposes:

- Remittance from overseas;

- Revenues from the export of goods and services;

- Domestic transfers, including those resulting from the issuance of commercial papers in foreign currency and their interests, and buying foreign currency from credit institutions that are allowed to conduct foreign exchange activities;

- Cash deposits, including those for resident organization allowed by the State Bank to collect foreign currency through exporting commodities and services, and cross-bordered (with the certification of border customs);

- Payments, including those for imported commodities and services (including related costs arisen);

- Commodities and services to individuals and organizations who are allowed to collect foreign currency;

- Foreign currency loans (principal, interest and fees and other related costs arisen) borrowed from domestic banks and foreign loans in accordance with the current regulations;

- Organization’s staff who are sent abroad, to pay for salary, bonus, and other allowances to non-residents and foreign residents working for the organization;

- Fees and interest;

- Sale of foreign currency to credit institutions, which are allowed to do foreign exchange business;

- Investment in securities and commercial papers issued in a foreign currency and principal and interest payments;

- Exchange into other foreign currency payment instruments, including checks, payment cards and as regulated by the bank, which is allowed to do foreign exchange business;

- Capital contribution for implementing investment projects as regulated by the Law on Investment; and

- Other transactions, including those in the form of account transfer or cash deposit having license by the Governor of the State Bank.

Foreign-currency deposit accounts can receive bank interest according to account structure. For demand deposit, specialized or cash-cover accounts, interest is counted on the number of actual deposit days and incorporated into principal monthly or on the balance withdrawal date.

For fixed deposit accounts, interest is paid once at maturity. If FIEs do not withdraw at maturity, all the principal and interest will be transferred into a new account with a new period upon the account holder’s request at that moment; or into the current account if the licensed banks receive no notice from the account holder about the maintaining fixed deposit account.

b. Vietnamese Dong deposit accounts

All transactions relating to investment activities can be done through VND accounts, including:

- Receipt of revenues in VND for transactions in-country;

- Payment in VND for expenses incurred in-country;

- Purchase of foreign currency from credit institutions allowed to transfer overseas; and

- Other income and expenditure transactions related to investment in-country.

The procedures and materials required to open VND accounts are similar to those required for opening direct investment accounts and foreign-currency deposit accounts.

For newly established FIEs, after obtaining an investment license, normally all capital bank accounts and deposit accounts in both foreign currency and VND can be opened at the same time. The VND deposit account can receive bank interest according to the current interest rate structure.

Optimizing your remittance process

As Vietnam continues to attract record levels of investment, the importance of repatriation will only continue to increase, with banking playing a significant role. Those investing within the country are highly advised to maintain an up-to-date understanding of all regulations and procedures related to accounting, banking, and the general remittance process.

Given the rapidly changing nature of regulations within the Vietnamese market, it is also highly advisable to consult with government bodies or other professional service firms should any concern arise over compliance and related procedures.

Note: This article was first published in April 2017, and has been updated to include the latest developments.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam Eases Enterprise Registration: Decree 1

- Next Article Vietnam gründet Forschungsgruppe zur Untersuchung der Gesetzgebung zu Kryptowährungen