Vietnam’s Taxes on Business

May 20 – In a tough global economy, major foreign investors continue to prioritize their investments into Vietnam. Many small-medium sized enterprises are following in step, acting on the business potential that Vietnam holds for companies of all sizes and a variety of industries. It is thus increasingly important to understand the taxes which Vietnam imposes on business.

All taxes in Vietnam are imposed at the national level, as there are no local, state or provincial taxes. Enterprises should pay tax in localities where they are headquartered. Most companies and foreign investors in Vietnam are subject to the following major taxes:

RELATED: Dezan Shira & Associates’ International Tax Planning Services

RELATED: Dezan Shira & Associates’ International Tax Planning Services

a. Business license tax

b. Corporate income tax

c. Value-added tax

d. Special consumption tax

e. Foreign contractor tax

a. Business License Tax

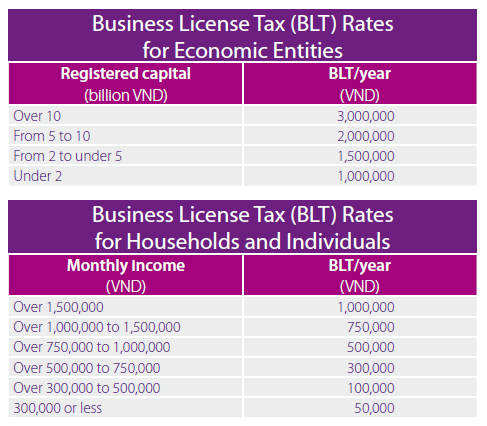

Business license tax (BLT) is an indirect tax imposed on entities conducting business activities in Vietnam, paid by enterprises annually for each calendar year that they do business in Vietnam. All companies, organizations or individuals (including branches, shops and factories) and foreign investors operating businesses in Vietnam are subject to BLT.

The amount of BLT due is based on the amount of charter capital, as shown in the accompanying table. For state-owned enterprises, limited liability companies and joint stock companies, the registered capital is the charter capital.

BLT rates are different for economic entities and for households/individuals doing business. For the latter, the BLT amount depends on monthly income.

b. Corporate Income Tax

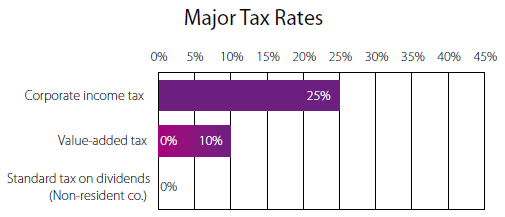

The Corporate Income Tax (CIT) Law was approved by the National Assembly in 2008 and came into effect in 2009. CIT is a direct tax levied on the profits earned by companies or organizations. All income arising inside Vietnam is subject to CIT, no matter whether a foreign enterprise has a Vietnam-based subsidiary or whether that subsidiary is considered a permanent establishment.

The standard CIT rate is 25 percent for both domestic and foreign-invested enterprises in most industries. In an effort to boost investment in Vietnamese businesses and to support struggling enterprises, Vietnamese lawmakers have recently approved the government’s proposal to reduce the current CIT rate from 25 percent to 23 percent (the new rates are expected to take effect starting January 1, 2014).

When calculating CIT, foreign-invested enterprises can deduct most expenses paid for production and business activities if supported by adequate lawful invoices and documents. Business establishments that suffer losses after tax finalization are entitled to carry forward those losses to future taxable income for a maximum period of five years.

An enterprise that conducts multiple business activities that are subject to different tax rates should calculate the income for each activity separately, multiplying income from each activity by the corresponding tax rate.

Corporate income tax incentives apply to investment projects in specific sectors and areas with difficult socioeconomic conditions, as well as those in high-tech zones and economic zones. In addition to tax incentives, tax reductions may be available for enterprises engaging in manufacturing, construction and transportation activities which employ numerous female staff or ethnic minorities.

c. Value-added Tax

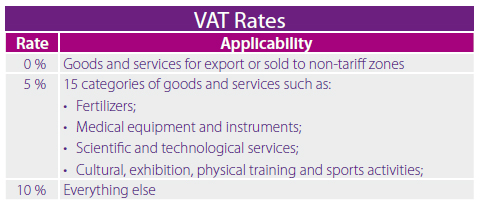

Value-added tax (VAT) is imposed on the supply of goods and services at three different rates: 0 percent, 5 percent and 10 percent (the standard rate).

Goods and services encouraged by the government are exempt from VAT. These include agricultural products, healthcare services and scientific activities, derivative financial and credit services, securities trading, insurance services, education and vocational training, printing and publishing newspapers.

All organizations and individuals producing and trading goods and services in Vietnam are liable to pay VAT, regardless of whether the organization has a Vietnam based establishment.

There are two different methods of calculating value-added tax: the credit method (also called the “deduction method”) and the direct method.

Most businesses are required to use the credit method, which applies to foreign invested enterprises, foreign parties to business cooperation contracts and business organizations established under the Vietnamese Law on Enterprises.

Credit Method (Deduction Method)

Payable VAT amount = Output VAT amount – Creditable input VAT amount

Under the credit method, payment and declaration of VAT is made on a monthly basis, where the taxpayer subtracts the input VAT from the output VAT, and pays or claims the balance to the relevant bodies. As the situation is normalized every month, no annual VAT finalization is required at the end of the year.

The direct method applies to business establishments and foreign organizations or individuals without resident offices and which have not implemented the Vietnamese Accounting System, but generate income in Vietnam, along with those in specific industries (such as gold, silver and gem trading activities).

Direct Method

Payable VAT amount = Added value of sold goods or services * VAT rate

Where:

Added value of sold goods or services =

Selling price – Purchasing price of said goods or services

According to this method, VAT depends on total revenues. As such, the monthly payments are just provisional and the total amount of VAT may be different at the end of the year. Therefore, when using the direct method of calculation, tax finalization procedures must be done within three months following the end of the year.

For goods and services purchased from abroad, VAT applies to the duty paid value (the sum of the value and the duty paid) of imported goods and services. The importer must pay VAT at the same time that they pay import duties to customs.

d. Special Consumption Tax

Special consumption tax (SCT) is a form of excise tax that applies to the production or importation of 11 categories of products and 6 types of services which are considered to be luxurious or non-essential.

SCT is levied on each item of goods only once. Generally, goods and services subject to the SCT are also subject to VAT. The basis of VAT calculation is selling price plus SCT. For imported products, VAT is imposed on the dutiable value plus import duties plus SCT.

SCT refunds are available for exported goods upon the request of taxpayers in certain cases, such as goods temporarily imported for re-export. In case items subject to SCT are produced from materials for which the SCT was already paid, the SCT already paid will be deducted.

e. Foreign Contractor Tax

Usually, foreign contractors are the winners of auctions or bid offerings organized by the Vietnamese government or organizations, and may be principal contractors, general contractors, partnership contractors or subcontractors.

Foreign contractors in Vietnam are liable to pay the same tax rates applicable to local companies, including import-export duties, personal income tax and other taxes required by authorities.

The calculation of CIT and VAT for foreign contractors can be done via the deduction method if the foreign contractor:

- Has a permanent establishment or resident status in Vietnam;

- Conducts business in Vietnam under a contractor or sub-contractor contract for a duration of 183 days or more from the effective date of the contract; and

- Applies the Vietnamese Accounting System.

Otherwise, a rate fixing method should be used.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email vietnam@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Vietnam by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

An Introduction to Doing Business in Vietnam

An Introduction to Doing Business in Vietnam

This new 32-page report touches on everything you need to know about doing business in Vietnam, and is now available as a complimentary PDF download on the Asia Briefing Bookstore.

Introduction to Double Taxation Avoidance in Vietnam

Tax Update: Vietnam Gov’t Approves Amendments to CIT Law

How Foreign Contractors are Taxed in Vietnam

- Previous Article Construction Continues on Vietnam’s Thu Thiem New Urban Area

- Next Article New TV Regulations Cause Loss of Foreign Channels