Vietnam’s Industrial Boom Has Outgrown the “One-Location” Investment Playbook

Vietnam’s manufacturing success story is often told through national aggregates like FDI inflows, export growth, and rising industrial output. But for investors on the ground, those headline numbers increasingly obscure a more complex reality: Vietnam is no longer one industrial market. It is a system of competing, converging, and evolving industrial ecosystems.

Vietnam’s next phase of industrial growth will not be defined by whether companies invest in the country but by where, how, and with what long-term operating assumptions they choose to invest.

Regional divergence is the strategy

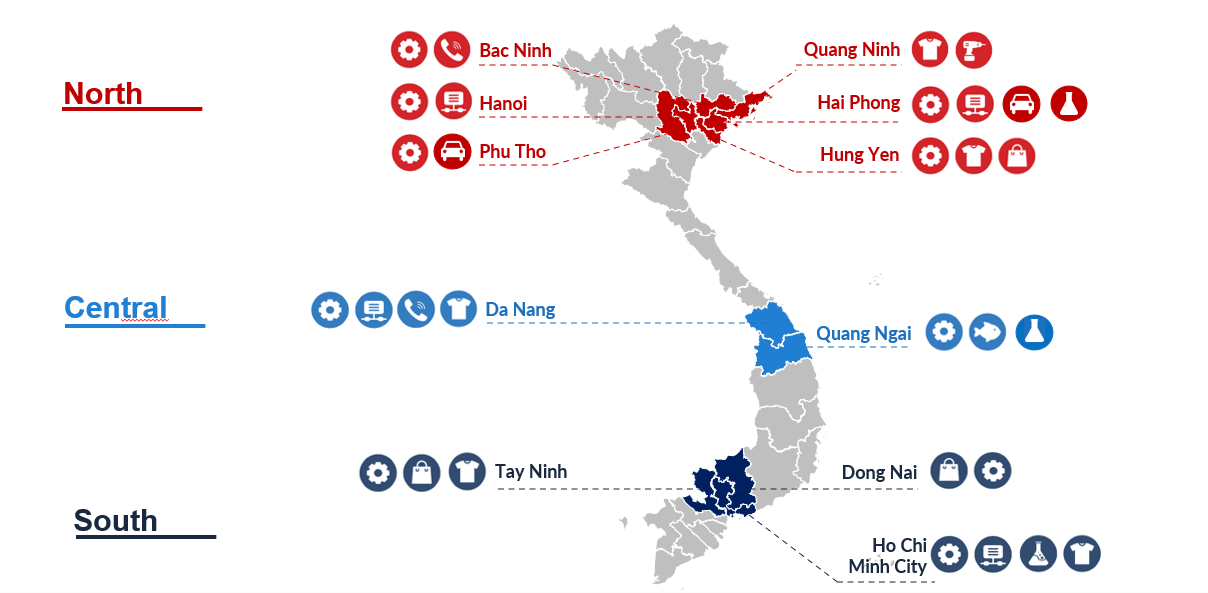

Northern Vietnam has cemented itself as a China-plus-one manufacturing hub, optimized for time-sensitive supply chains and cross-border component flows. Central Vietnam, long overlooked, is quietly positioning itself as a lower-cost, lower-congestion alternative for manufacturers willing to trade scale for efficiency and first-mover advantage. Southern Vietnam, meanwhile, continues to dominate in FDI volume, market access, and industrial diversity while simultaneously facing rising labor costs, congestion, and regulatory complexity.

These are not marginal differences. They fundamentally alter cost structures, workforce planning, logistics design, and risk exposure over the life of an investment.

Yet, too many investment decisions are still framed around simplified comparisons such as north versus south and cost versus scale rather than a deeper assessment of industrial cluster maturity, policy direction, and infrastructure alignment.

Infrastructure is reshaping the map faster than policy frameworks

Few projects illustrate this shift better than Long Thanh International Airport (LTIA). Designed to relieve congestion at Ho Chi Minh City’s existing airport, LTIA is already doing far more than that. It is redrawing southern Vietnam’s logistics and industrial gravity.

Dong Nai Province, long considered a secondary industrial destination, is now positioning itself as a high-tech and smart-logistics hub supported by airport connectivity, port access, and proposed Free Trade Zone development. Provincial authorities are prioritizing high-value, environmentally sustainable projects while actively discouraging labor-intensive and low-tech investments.

For investors, this creates opportunity but also timing risk. Infrastructure often moves faster than legal frameworks. FTZ proposals, provincial mergers, and industrial corridor integration may signal future advantages long before national regulations fully catch up. Understanding what is policy intent, what is pilot, and what is operational reality requires more than desktop research.

The real risk is not choosing the “wrong” province, it’s choosing blindly

Vietnam’s proposed provincial mergers and corridor-based planning reflect a shift away from siloed, province-by-province development toward integrated industrial ecosystems. Corridors such as Hanoi–Hai Phong–Quang Ninh or Ho Chi Minh City–Binh Duong–Ba Ria-Vung Tau are designed to function as unified production and logistics zones, not discrete jurisdictions.

This is positive for long-term competitiveness, but it complicates decision-making. Incentives, labor availability, land pricing, environmental scrutiny, and administrative efficiency can vary sharply within the same corridor, let alone across regions.

At this stage of Vietnam’s development, the biggest investment risk is no longer regulatory uncertainty but oversimplifying a rapidly diversifying market.

|

Vietnam’s Market Entry Locations Compared for Manufacturing Businesses |

|||

|

Category |

North |

Central |

South |

|

Key provinces |

Hai Phong, Quang Ninh, Bac Ninh, Hung Yen, Hanoi, Phu Tho |

Da Nang, Quang Ngai |

Ho Chi Minh City, Dong Nai, Tay Ninh |

|

Notable industrial parks |

Deep C, Yen Phong, VSIP Hai Phong |

Da Nang Hi-tech Park, VSIP Quang Ngai |

Long Hau, My Phuoc, Nhon Trach, VSIP Binh Duong |

|

Pros |

Close proximity to China, reducing logistics costs for companies importing components from China |

Low costs, room to relocate, along with suppliers and partners if required |

Diversified supplier base and close proximity to the rest of Asia |

|

Cons |

Production, infrastructure, and labor more specialized than in the south |

Supplier networks and many high-end industrial zones not yet fully established locally |

Congested logistics networks |

|

Investment strategy |

Companies seeking to quickly relocate operations and seeking high integration with Chinese supply chains |

Companies seeking low costs, long-term investment strategy, and willing to relocate the majority of supply chain over time |

Companies seeking to diversify supply chains and distribution networks; companies interested in targeting the domestic market |

Why tailored business intelligence now matters more than ever

As Vietnam’s industrial landscape matures, generic location comparisons and static cost tables lose relevance quickly. What investors increasingly need is tailored business intelligence – analysis that is sector-specific, location-specific, and time-sensitive.

That means asking harder questions:

- How will provincial policy priorities affect project approvals five years from now?

- Which industrial zones are aligned with future infrastructure and not just current access?

- Where will labor constraints emerge next, and how will wages and turnover evolve?

- Which incentives are headline promises, and which are realistically accessible?

Answering these questions requires on-the-ground insight, continuous policy tracking, and scenario-based analysis – not one-off feasibility studies.

Vietnam’s industrial opportunity remains compelling. But success in 2026 and beyond will belong to investors who recognize that location strategy is a competitive differentiator.

Those who treat Vietnam as a uniform manufacturing destination may still find growth. Those who invest in understanding its internal complexity will build resilience.

And in a market moving this fast, informed judgment backed by tailored advisory support may prove to be the most valuable asset of all.

For international investors, Vietnam's different localities offer favorable conditions across almost every sector, particularly as the country shifts toward higher value-chain manufacturing, high-tech industries, and innovation. Taking a closer look at Vietnam's provinces and investment destinations before committing capital can provide a decisive competitive advantage. A tailored market study, dedicated location selection, or business matchmaking can uncover factors that are often hard to assess—such as special incentives, skilled labor availability, and tax breaks.

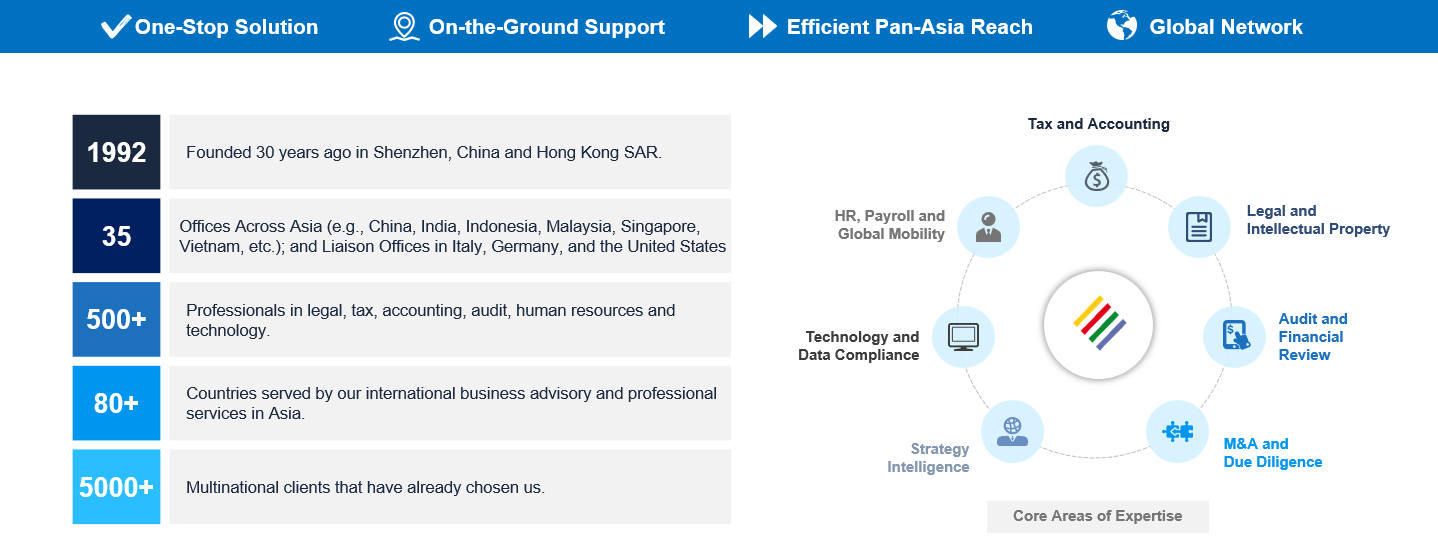

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com

- Previous Article Hai Phong After Merger: A Pioneering Model in Northern Vietnam

- Next Article