Annual Tax Finalization and Remittance in Vietnam

- All foreign-invested entities are required to have their annual financial statements audited before transferring profits to their respective markets.

- Businesses should be aware of deadlines and reporting compliances or face penalties and fines for late payments or under-declared tax payments.

- While Vietnam is a rising star in ASEAN, its tax systems can be time-consuming and complex.

Prior to transferring profits back to their home markets, foreign companies maintaining operations and taking in revenue in Vietnam must fulfill certain annual compliance requirements.

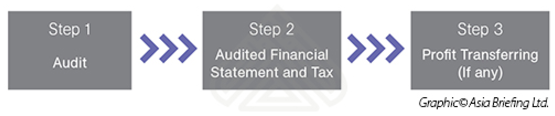

These involve a statutory audit, audited financial statements, and tax finalization filings. Annual compliance procedures are not only required by law but are also a good opportunity to conduct an internal financial health check.

Pursuant to compliance, all foreign-invested entities are required to have their annual financial statements audited by an independent auditing firm.

Statutory audits in Vietnam are performed in accordance with the Vietnam Standards on Auditing while financial reporting must be conducted in accordance with Vietnamese Accounting Standards (VAS).

Standards in Vietnam can often differ significantly from those utilized in a company’s home market and should, therefore, be studied closely to ensure that all aspects of reporting and review are in compliance. During this process, the manner in which reporting and review are conducted should also be considered in the context of any and all reporting and finalization requirements that a company may have in its home market.

Filling deadlines

Audited financial statements and tax finalization filing must be done within 90 days from the end of each financial year. After fulfilling these obligations, and giving notice to local managing tax offices at least seven working days in advance, foreign investors may remit profits abroad. It should be noted that annual compliance for ROs is different from that for other foreign-invested entities. An RO is required to report on its activities to a local department of trade prior to the last working day of January of the following year.

Reporting compliance

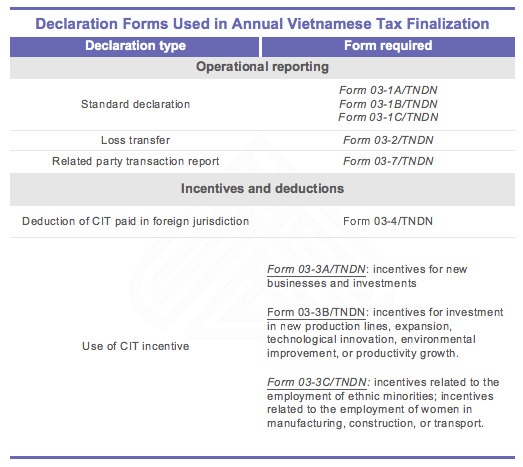

As part of the reporting process, all of the applicable forms outlined below should be submitted in relation to the operations of a given company. The company will also be required to file forms related to any corporate income tax (CIT) incentives that are claimed or other deductions that the company has utilized during the fiscal year.

Late payment and tax evasion penalties

A taxpayer who pays tax later than the deadline is to pay the outstanding tax amount plus a fine equal to 0.03 percent of the tax amount for each day the payment is late. Taxpayers that make incorrect declarations, thereby reducing taxes payable or increasing refundable tax amounts are to pay the full amount of the under-declared tax or return the excess refund, and will also pay a fine equal to 20 percent of the under-declared or excess refunded tax amounts together with a fine for late payment of the tax.

A taxpayer that commits acts of tax evasion or tax fraud is liable to pay the full amount of tax and a fine between one and three times the evaded tax amount.

Optimizing annual compliance

While Vietnam is one of ASEAN’s rising stars, the nation is also stuck with among the most complex and time-consuming tax systems within the region. Although many aspects of taxation can be complex, annual finalization places a particularly significant burden upon many investors.

To the credit of Vietnam’s government, there have been substantial improvements to the compliance process in recent years, however, there is still significant room for improvement. On top of this, the swiftly maturing nature of tax and compliance have and will continue to add to a degree of uncertainty in the years to come.

To maintain compliance with Vietnamese law, and ensure that profits can be remitted without issue, it is advisable for companies to direct any and all inquiries to Vietnam’s Ministry of Finance or professional service firms operating within the country. Both parties will be able to clarify the nature of prevailing compliance and often can provide a level of practical nuance that is not available within legislation or official guidance that has been issued to date.

Note: This article was first published in March 2017, and has been updated to include the latest developments.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article 3PL Networks in Vietnam: How to Engage Partners to Boost Sales

- Next Article Internal Audit in Vietnam: What Investors Should Know About Decree 5