Assessing Vietnam’s Labor Market and Payroll Considerations

Vietnam has become an increasingly attractive place for businesses of all types, given the country’s growing consumer class and dynamic workforce.

Much of this economic growth has come from the movement of people from traditional agriculture to the manufacturing and services industries, in addition to the increased mechanization of the agriculture sector itself.

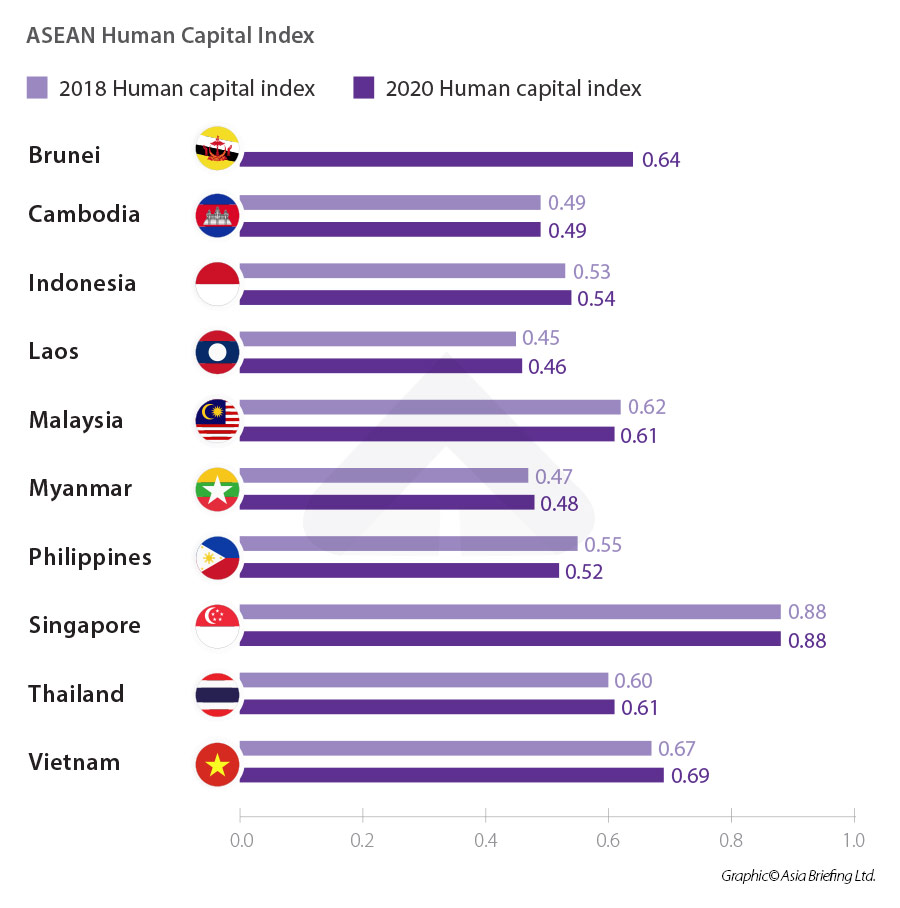

Vietnam has one of ASEAN’s largest labor markets, whose strength is approximately 56 million people, and with a labor participation rate of 76 percent. Due to the developing nature of the workforce in Vietnam, it is natural that there exists some difficulty in finding highly skilled employees — only 12 percent of Vietnam’s workforce are considered highly skilled.

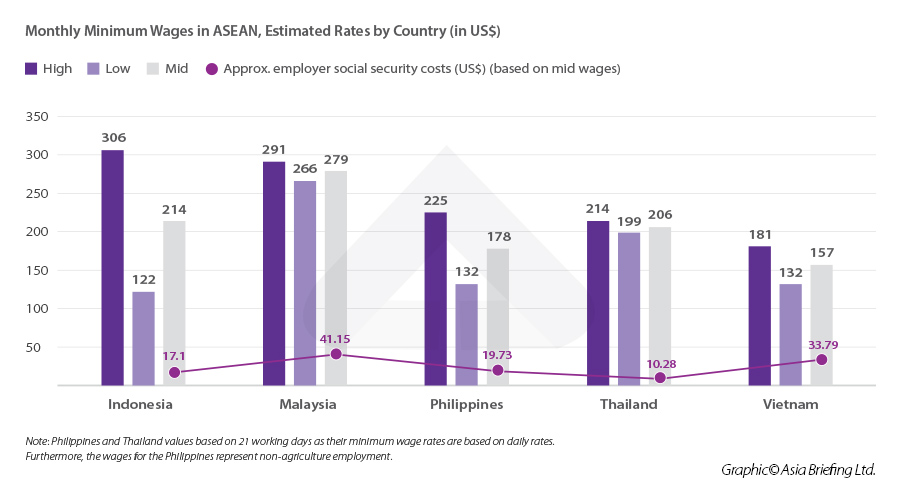

Competitive minimum wage

Vietnam sets a different minimum wage level across its four regions. Region I (urban Hanoi and Ho Chi Minh City) registered the highest minimum wage of VND 4,200,000 (US$190) while Region IV registered the lowest at VND 3,070,000 (US$132). Moreover, employees that have had vocational training must be paid at least seven percent higher than the applicable minimum wage rate.

Social insurance

There are three types of mandatory social security in Vietnam that must be covered by foreign enterprises seeking to hire local staff:

- Social insurance;

- Health insurance; and

- Unemployment insurance.

Employers register and pay insurance contributions monthly on behalf of their employees at the provincial Department of Labor, Invalids, and Social Affairs (DoLISA). Contributions are determined based on the employees’ monthly salary or wages.

Challenges

Skills and talent shortages are particularly acute in industries such as technology and banking. The country is currently lacking over 70,000 IT workers per year and the government is setting a target of creating a pool of 1.3 million IT workers by 2025.

Further, the US-China trade war has aggravated the existing shortage of quality labor as more companies shift all or part of their manufacturing to Vietnam, particularly for engineers, managers, and software developers.

Going forward

To address the challenges within its labor force, the Vietnamese government has announced it will prioritize adapting its industries to a digital future and will improve the accessibility of on-the-job training programs in these fields.

The vocational education system is also increasing its commitment to work with the private sector to establish more enterprise-based training programs. Vietnam’s business climate already encourages innovation and attracts foreign investment, so an enhanced learning ecosystem will allow the country to respond well to the latest technological disruptions.

The benefits of outsourcing payroll processing

For several years, multinational companies with operations in one or more Asian countries began transitioning to an outsourced model for handling their payroll and HR administration. Already in the US and Europe, the accelerating trend towards outsourcing payroll processing is unlikely to reverse due to the huge efficiency and savings it can deliver.

In Asia, however, the cost-benefit of outsourcing is significantly less clear-cut. In essence, the transition towards outsourcing in Asia is primarily being driven by three factors:

- The increased importance of Asia-based employees to their organization, and the importance of ensuring the handling of their payroll in a professional manner.

- The increasing number of Asia-based employees, and increased complexity of their compensation packages.

- The increasing virtualization of HR administration has allowed work that previously entailed locally-based employees working with government bureaus to be handled from an online location.

In countries like Vietnam, savings are now kicking in due to the virtualization mentioned above, but the main motivation for companies to choose an outsourced model is more related to the ability to achieve a higher level of consistency in data management, greater transparency for management, and improved confidentiality across their Asia-based entities.

As companies continue to expand their operations across Asia, not only does their headcount grow, but the number of legal entities they must maintain also increases. Such expansion poses a great challenge to these companies when seeking vendors able to comprehend and efficiently explain local payroll requirements and produce reports that seamlessly link to their specific accounting platforms.

“One-country” vendors can often do an efficient job but communicating with several such companies every month can be very time-consuming for HR managers based at HQ. On the other hand, “global” vendors (a managed model) can sometimes struggle to meet all the local statutory requirements and customs in faraway markets that change rules and regulations frequently.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam Business Forum 2022: Restoring the Economy and Developing Supply Chains

- Next Article Vietnam Outlines Progress on COP26 Commitments