Circular 59: Updates to Vietnam’s Social Insurance Scheme

By: Dezan Shira & Associates

Editor: Anais Robin

With social insurance related debts reaching a high of US$ 414 million in 2015, Vietnamese Authorities have initiated reforms intent on bringing outstanding obligations under 223 million by the end of the year. Rather than solely cutting social insurance programs, however, the increasing burdens of social insurance are in some instances being shifted to the private sector. While the resulting costs are unlikely to have a significant impact on competitiveness, vis-à-vis regional competitors, current and prospective investors should be cognizant of updates from a budgeting and compliance standpoint.

Passed December 29th and to be rolled out from January 1st, Circular 59/2015/ TT-BLDTBXH is the most important revision to existing guidance – outlined Decree 115/2015/ND-CP – on the implementation of Vietnam’s Social Insurance (SI) Law. As part of, and in addition to, measures aimed at reducing the governments outstanding fiscal obligations, these updates cover applicable salaries, covered employees, benefits, as well as the specific obligations of employers with regard to their employees. As these updates are likely to impact a variety of business lines within Vietnam, careful review of this update is of critical importance.

Although the following article provides an overview of relevant changes, relevant parties should contact relevant government agencies – in this case Vietnam’s Social Insurance Agency – or professional services with any questions or concerns.

RELATED: Human Resources & Paroll Services from Dezan Shira & Associates

RELATED: Human Resources & Paroll Services from Dezan Shira & Associates

Increased Coverage Under Circular 59

A key feature of Circular 59’s guidance is its inclusion of new types of employees within the social insurance scheme. Those currently employing or considering hiring the following types of employees should note their inclusion within the social insurance from 1 January 2018:

- Employees working under labour contracts with a term of between 1 and 3 months

- Expatriates working in Vietnam under a work permit, practicing licence, or practicing certificate issued by a competent body of Vietnam

Changing Salary Definitions

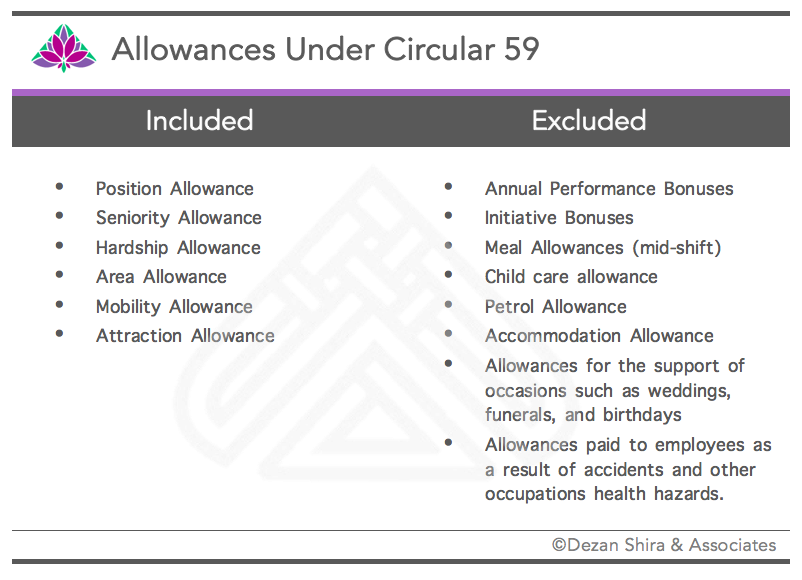

While Circular 59 largely upholds the current definition of salary – which is defined as an employees nominal wage plus allowances stated in their labor contract – the scope of the term allowances has seen critical reinterpretation under new guidance. For companies paying into SI on behalf of their employees, even slight adjustments in the calculation of employees’ salaries have the potential to significant alter the tax burden of the given firm.

The following allowances should be noted for their inclusion or exclusions from employees calculable salaries:

RELATED: Understanding Vietnam’s Recruiting Requirements

RELATED: Understanding Vietnam’s Recruiting Requirements

Paternity protection

Despite a long maternity leave period, Viet Nam was left behind in paternity protection. Indeed, men in Viet Nam were not entitled to any paternity leave as of 2015. Thanks to Decree 115/2015/ND-CP, paternity leave was developed. Circular 59/2015/ TT-BLDTBXH details the concept. Male employees contributing to the SI fund are entitled to paternity leave from 5 to 14 working days within the first 30 days from the birth.

Note: If only the father contributes to the SI fund, he will be entitled to a lump-sum allowance tantamount of two month’s basic salary during the month of childbirth.

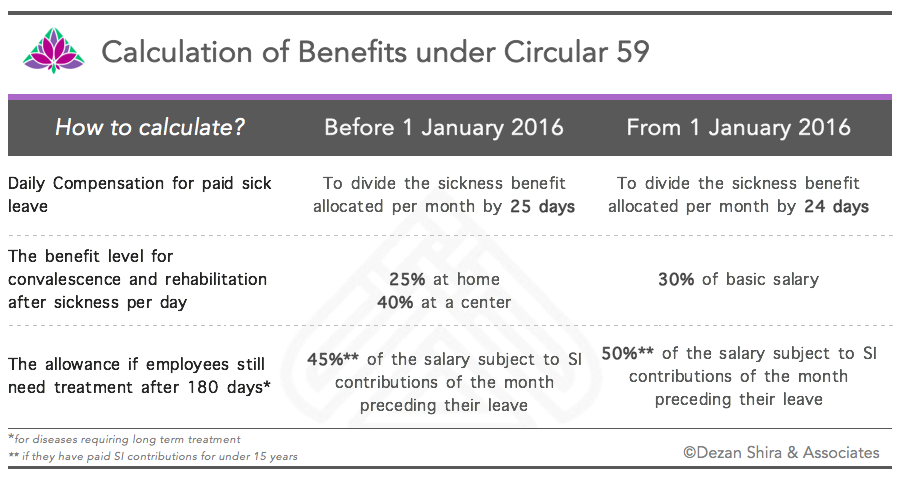

Evolution of Illness Benefits

Of great importance for employers, leave compensation has been increased under Circular 59. The specifics of these increases, which are outlined below, cover costs pertaining to general sick leave, rehabilitation following an illness or injury, and long term disability. The adjustment of these figures will disproportionally impact investors with operations involving substantial amounts of labor.

Good to know: The maximum period during which the employees are entitled to sickness benefit after 180 days equals the period during which the employees have made SI contributions.

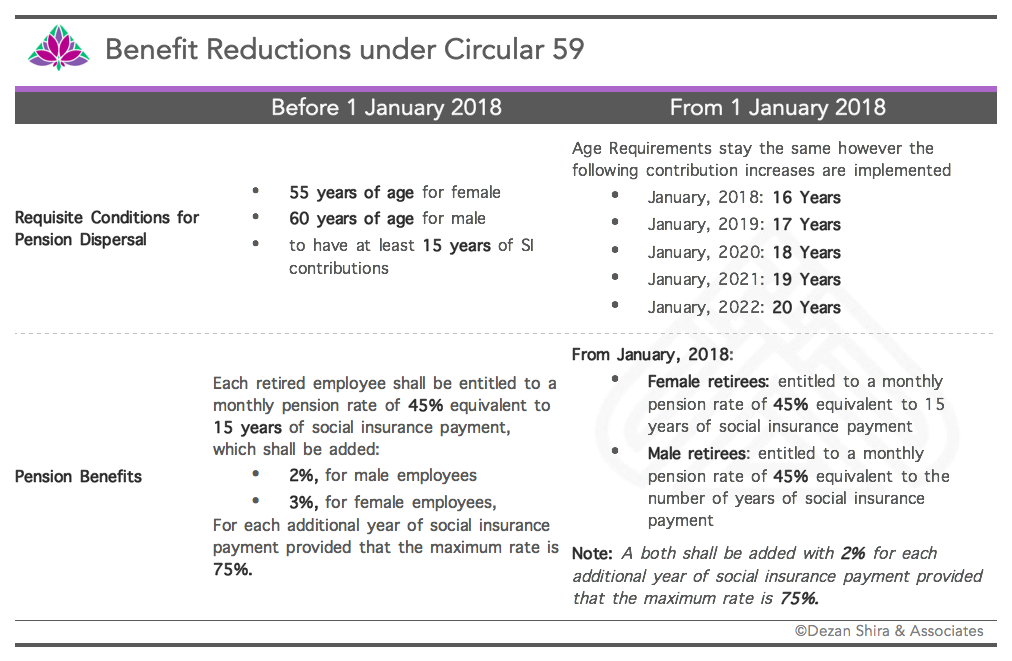

Pension benefits reduced

Ms. Tran Thi Thuy Nga, head of the Social Insurance Department, has indicated that the number of social insurance participants is only 20 percent of now, meaning the remaining 80 percent will not have pension after retirement. Despite share of the Vietnamese population receiving pensions being low, benefits have been reduced under the Circular 59. In particular, the requisite annual contributions have been increased in a manner that may postpone retirement.

Vietnam: Social Insurance & Compliance

The Vietnam Social Insurance Agency: responsible for implementing the government’s policies and managing the Social Insurance Fund. The new regulations attribute it inspection roles for social insurance, health insurance and unemployment insurance in order to avoid the evasion of social insurance contributions and the mounting social insurance debts of businesses.

Employers: have specific obligations with regard to their employees. They have to inform employees about social insurance contributions every 6 months and they also have to provide these information upon the trade union’s or employee’s request.

Vietnam is becoming increasingly aware of the fact that there is a real need to increase contributions to the country’s pension fund and it has received a large number of complaints from both businesses and workers.

Indeed, for a company, higher payment into social insurance means less money to spend for daily expenses. Moreover, this new policy comes on the heels of a 12.4 percent minimum wage increase. Together these policies will likely create short term adjustment and compliance costs for firms as they reorient their operations to accommodate these new policies.

Further Support from Dezan Shira & Associates

With over 23 years of experience helping foreign businesses succeed across Asia, the experts at Dezan Shira & Associates are well placed to advise on aspects related to staffing in Vietnam and across Southeast Asia. For further information please contact Vietnam@dezshira.com.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email Vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

Manufacturing Hubs Across Emerging Asia In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

Manufacturing Hubs Across Emerging Asia In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

- Previous Article Tax, Accounting and Audit in Vietnam 2016 – NEW PUBLICATION FROM VIETNAM BRIEFING

- Next Article Vietnam Market Watch: Thai Imports, Growing US trade, and the Emergence of E-commerce