Driving FDI Manufacturing Success in Vietnam with Microsoft Dynamics 365 Business Central

Foreign-invested manufacturers often face significant operational and compliance challenges when expanding to Vietnam’s market. To navigate these issues, many are turning to enterprise resource planning (ERP) systems to centralize processes, enhance visibility, and ensure compliance.

Vietnam has emerged as a major destination for manufacturing investment, supported by competitive labor costs and an expanding network of trade agreements. However, foreign-invested manufacturers often encounter operational and compliance challenges during market entry and expansion. These typically include complex accounting and tax requirements, fragmented supply chains, and multi-entity reporting obligations, all of which can increase administrative burdens and operational risk.

To address these challenges more effectively, many manufacturers are adopting enterprise resource planning (ERP) systems to centralize and automate core business processes. When properly implemented, ERP platforms can enhance visibility, improve internal controls, and support scalability as operations grow.

For small and medium-sized manufacturing enterprises, an effective ERP solution typically requires a centralized, scalable platform that can adapt to local regulatory requirements while remaining cost-efficient. Within this segment, Microsoft Dynamics 365 Business Central is commonly adopted by companies with revenues ranging from approximately US$5 million to US$300 million, particularly where integration with existing Microsoft tools is a consideration.

After assisting several foreign manufacturing SMEs in establishing operations in Vietnam, Dezan Shira & Associates has identified multiple benefits that Microsoft Dynamics 365 Business Central can provide.

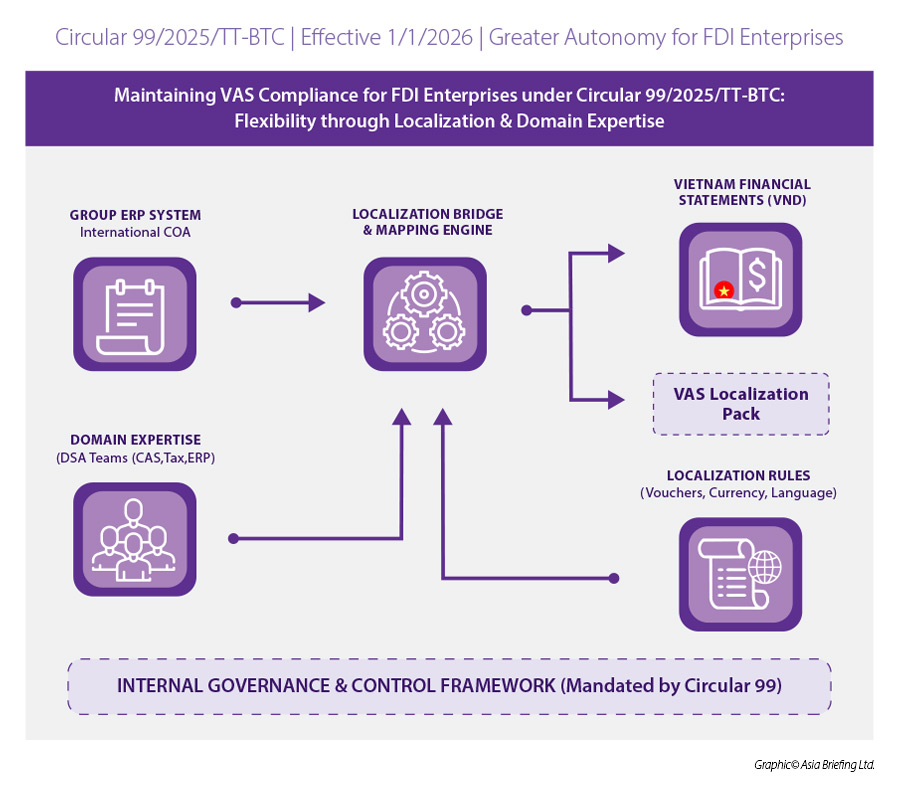

Maintaining compliance through localization and domain expertise

Vietnam’s regulatory framework places significant emphasis on compliance with Vietnam Accounting Standards (VAS), tax reporting obligations, and electronic invoicing requirements. For foreign-invested manufacturers, this is further complicated by the need to maintain consistency between local statutory reporting and group-level financial reporting.

A localized implementation of Microsoft Dynamics 365 Business Central can support these requirements through key features:

- Vietnam localization: Automated VAT and tax calculations, VAS-compliant financial statements, and E-Invoice integration.

- Workflow automation: Configurable approval processes to reduce manual errors and ensure compliance.

- Audit-ready reporting: Built-in tools for statutory submissions and internal controls.

This approach minimizes administrative overhead and mitigates regulatory compliance risks, allowing finance teams to focus on strategic tasks rather than paperwork.

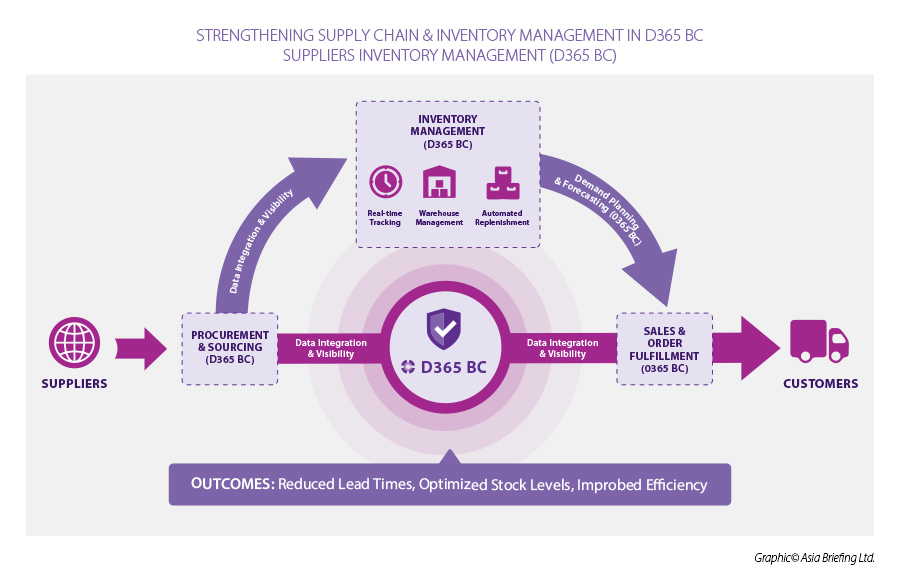

Strengthening supply chain and inventory management

Many FDI manufacturers in Vietnam rely heavily on imported raw materials, which exposes operations to supply disruptions, extended lead times, and cost volatility. Limited visibility across inventory locations can lead to production delays or excess working capital tied up in stock.

Microsoft Dynamics 365 Business Central’s supply chain management features include:

- Material requirement planning (MRP): Accurate planning based on BOM and production schedules.

- Vendor performance tracking: Monitor lead times, costs, and reliability to optimize procurement.

- Real-time inventory control: Visibility across warehouses to reduce safety stock and improve cash flow.

- Multi-currency support: Seamless handling of transactions in different currencies.

When these functions are integrated into daily operations, manufacturers can improve inventory turnover, reduce procurement risk, and maintain production continuity in more volatile market conditions.

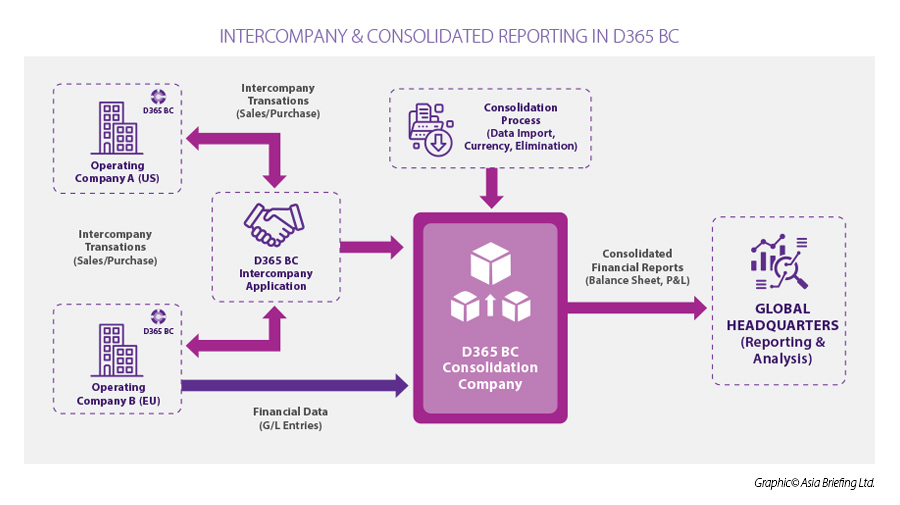

Managing ownership structures and intercompany transactions

Vietnam’s foreign ownership restrictions in certain sectors often require manufacturers to operate through joint ventures or multi-entity structures. These arrangements increase the complexity of intercompany transactions, profit allocation, and financial consolidation.

- Intercompany management: Streamlined processes for transactions between entities.

- Consolidated financial reporting: Accurate group-level reports for headquarters while maintaining local compliance.

These features ensure transparency and efficiency in joint ventures, reducing friction between partners and enabling better governance.

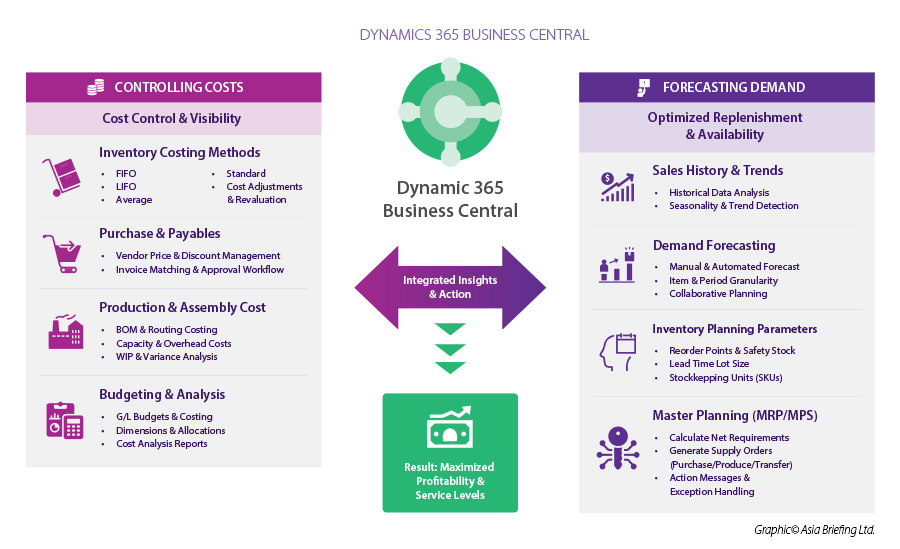

Cost control and demand forecasting

Volatility in raw material prices and logistics costs continues to put pressure on manufacturing margins. Without reliable cost and forecasting mechanisms, enterprises may struggle to manage profitability and respond to market changes. Microsoft Dynamics 365 Business Central offers:

- Costing methods (standard, actual, FIFO): Precise tracking of production costs.

- Demand forecasting: Predict future requirements using historical data and trends.

- Power BI integration: Visual dashboards for cost analysis and performance metrics.

This empowers decision-makers to anticipate changes, control costs, and respond proactively to market dynamics.

Supporting integration with global operations

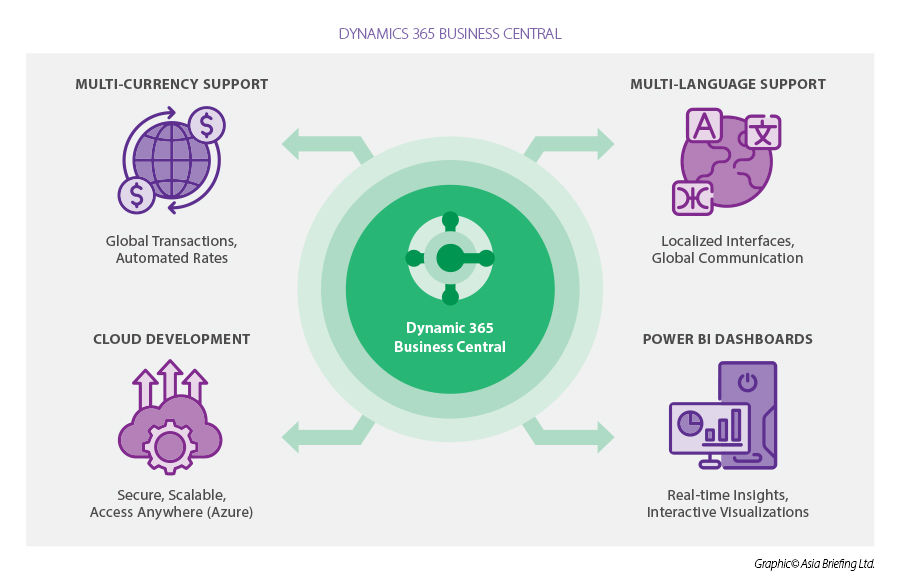

FDI manufacturers must report to global headquarters while complying with local regulations. Microsoft Dynamics 365 Business Central offers:

- Multi-currency and multi-language support: Simplifies global operations.

- Cloud deployment: Scalable infrastructure for future expansion.

- Power BI dashboards: Consolidated insights across finance, supply chain, and production.

With these capabilities, the system helps companies grow confidently in Vietnam while staying aligned with global standards.

Role of local implementation expertise

The quality of localization and implementation heavily influences ERP outcomes. Providers with a strong understanding of Vietnam’s accounting, tax, and regulatory environment, combined with technical ERP expertise, are better positioned to configure systems that are both compliant and operationally effective.

An implementation approach that integrates statutory requirements into system design can shorten deployment timelines, reduce compliance risk, and improve operational efficiency through automation and real-time data availability.

For foreign-invested manufacturers operating in Vietnam, such an approach can support more resilient operations and enable sustainable growth amid a complex regulatory environment.

ERP Implementation and Localization Support for Vietnam

Dezan Shira & Associates combines in-depth knowledge of Vietnam’s accounting and regulatory environment with hands-on ERP implementation expertise. This integrated approach enables the delivery of Microsoft Dynamics 365 Business Central solutions that are aligned with local compliance requirements while supporting operational efficiency and scalability.

Key advantages include:

- Faster deployment through pre-configured, localized templates;

- Reduced compliance risk by embedding statutory and tax requirements into system workflows; and

- Improved operational visibility and efficiency through real-time data and process automation.

For foreign-invested manufacturers operating in Vietnam, our Microsoft Dynamics 365 Business Central implementation offers a practical framework to navigate regulatory complexity and support data-driven, sustainable growth. Contact our Vietnam team to schedule a consultation: Vietnam@dezshira.com.

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com

- Previous Article Vietnam Manufacturing Tracker: As of February 2026

- Next Article Hai Phong After Merger: A Pioneering Model in Northern Vietnam