How to Establish a Trading Company in Vietnam

- A trading company is an ideal choice for companies looking to engage in import and export activities as well as domestic distribution.

- A trading company allows a business to retain more control over their operations and manage supply chain issues quicker.

- While there are no minimum capital requirements, investors need to review and maintain compliance with regulations for their business activities.

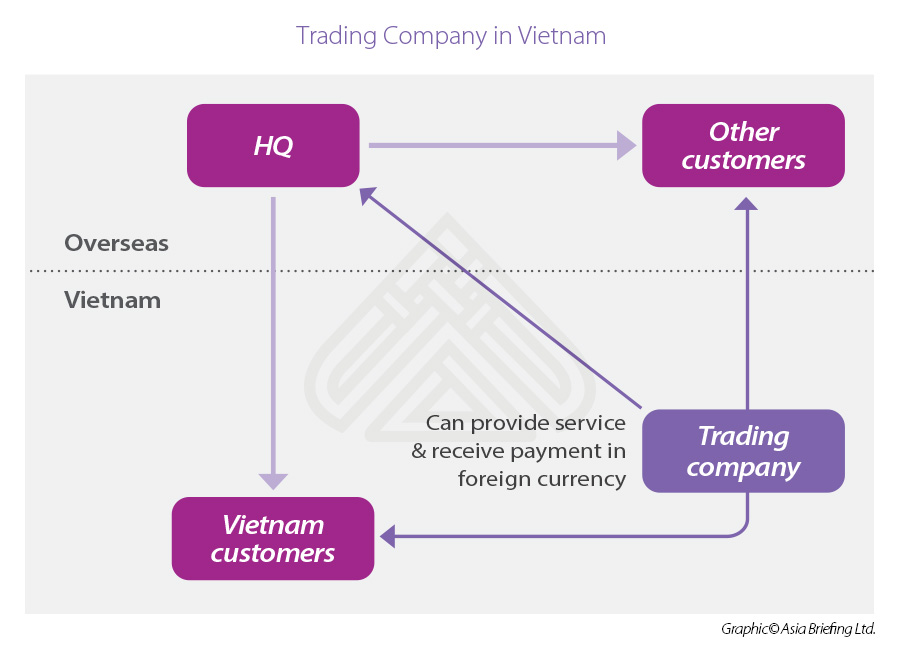

If a business wishes to engage in import and export activities as well as domestic distribution (i.e., retail, wholesale, and franchising trade activities) in Vietnam, the most common method chosen is to establish a trading company.

Generally, a trading company is inexpensive to establish and can be of great assistance to foreign investors by combining both sourcing and quality control activities with purchasing and export facilities, thus providing more control and quicker reaction times compared to sourcing purely while based overseas.

Trading companies are also the ideal choice for foreign companies that need to source in Vietnam in order to resell in Vietnam. Without a Vietnamese trading company, the alternative would be to buy from overseas and have the goods shipped out of Vietnam before then reselling back into Vietnam via local distributors (which would mean additional logistical costs, customs duties, and VAT).

Trading and distribution is still a sensitive sector for foreign investors. Therefore, the licensing process can vary between four to six months from the date of submitting the application dossier to the licensing authority, until the Investment Registration Certificate (IRC) can be issued.

While Vietnam does not require a company to have an import or export license, registration with the Ministry of Planning and Investment (MPI) is essential to import or export for businesses. Companies that only want to import without setting up a legal entity can use an importer of record. This process is preferred by many foreign businesses that have time constraints, wish to import without setting up a company, or only import a few times without dealing with logistical, regulatory, or language barriers.

What do you need to establish a trading company?

There are at least three steps involved in setting up a trading company:

- Obtain IRC;

- Acquire enterprise registration certificate (ERC);

- Obtain trading license; and

- Product approval (if applicable).

To set up a trading company (distribution company) without a retailing outlet or a trading company with its first retailing outlet, the investor must prepare an application dossier to apply for an IRC and submit to the licensing authority at the provincial level. The application dossiers after that will be submitted by the provincial licensing authority to the Ministry of Industry and Trade (MOIT) for approval. Once receiving the approval by MOIT, the provincial licensing authority will grant the IRC to the investors. In case the licensed foreign trading company want to have a second retailing outlet or more, they will be required to complete the procedure for setting up a retail establishment.

Under World Trade Organization (WTO) commitments, around 95 percent of goods can be distributed by businesses that are 100 percent foreign-owned. For certain types of investment projects, such as those that are deemed to have a significant impact on Vietnam’s national policies, environment, etc., the government must issue an official investment policy on the project.

What are the relevant applications?

The application for the IRC must contain the following documents:

- Application letter;

- Copy of identity card or passport of the individual; a copy of the business license or other equivalent documents;

- Investment analysis with the following contents: information of investors, target of investment, scale of investment, investment capital and planning of capital contribution, location, duration, schedule of investment, labor demand, investment incentives, impact assessment, economic-social efficiency of the project;

- A copy of one of the following documents: financial statements from the investors for the two most recent years; commitment of financial support by the parent company; commitment of financial support from a financial institution; guarantee of the financial capacity of the investors; bank reference letters explaining the financial capacity of the investors;

- Proposal for land use or copy of land leasing contract/office leasing contract; and

- Business Cooperation Contract (BCC) for projects invested under a BCC contract.

Foreign investors who wish to engage in import or export activities must obtain an IRC, or follow the procedures for the adjustment of their current IRC. It should be noted that the IRC also serves as the company’s business license. The application comprises the following documents:

- Dossier of verification for the granting of an IRC;

- A written explanation showing the satisfaction of the conditions laid out in Form MD-6 for goods trading and directly related activities; and

- Documents proving the financial capability and experience of the investor in the exercise of the right to export and right to import

The application for a license to engage in the activities of goods trading and directly related activities comprises the following documents:

- A written explanation showing the satisfaction of the conditions laid out in Form MD-6 relating to goods trading and other directly related activities; and

- Documents proving the financial capability and professional experience of the investor(s) in the exercise of operational targets relating to goods trading and other directly related activities.

Certain goods require the trading company to obtain import and export permits from the government as per Appendix II of Decree 187/2013/ND-CP. These include:

- Goods subject to export control in accordance with international treaties to which Vietnam is a contracting party;

- Goods exported within quotas set by foreign countries;

- Goods subject to import control in accordance with international treaties to which Vietnam is a contracting party; and

- Chemicals, explosive pre-substances, and industrial explosives.

All imports and exports must comply with the relevant government regulations on quarantine, food safety, and quality standards, and must be inspected by relevant government agencies before clearing customs.

Foreign-invested enterprises (FIE) are allowed to set up one retail establishment if they have received an IRC. However, if the FIE wishes to set up multiple retail establishments, it must apply for a license to set up these retail establishments. This application comprises the following documents:

- Application for the license to set up a retail establishment;

- A written explanation satisfying the conditions of the law on state management for retail activities and conforming with the related master plans of central-affiliated cities and provinces;

- Document from the provincial People’s Committee approving the economic demand of the additional retail establishment;

- Completed Form BC-3; and

- Vouchers, which are issued by the relevant tax agencies, about enterprise income tax liability for two consecutive years. If an enterprise has no vouchers, it can issue a written explanation clearly stating the reasons why.

Once the MOIT has accepted the application, the relevant state agency will grant the license for the setting up of retail establishments.

Note: This article was first published in February 2015, and has been updated to include the latest developments.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Representative Office in Vietnam: Procedures and Compliances for Setting Up and Dissolution – Latest Issue of Vietnam Briefing Magazine

- Next Article Q&A: Lebensmittel und Getränke in der EVFTA: Wie können sich ausländische Investoren für Vorzugstarife qualifizieren?