Guidelines on Vietnam’s Competition Law: Decree 35

- Vietnam issued the much-awaited Decree 35 on guidelines for implementing the Law on Competition.

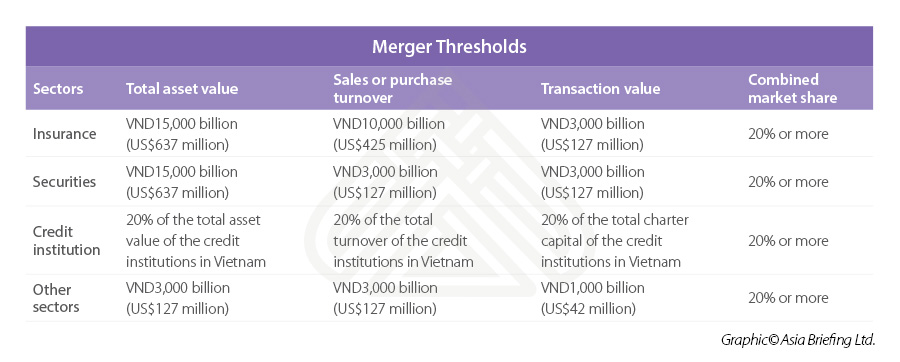

- The Decree gives clear definitions of mergers and acquisitions as well as the thresholds for triggering such transactions.

- The regulation went into effect on May 15, 2020, and will give businesses much needed clarity on M&A functions.

Vietnam recently released Decree 35/2020/ND-CP, providing guidance on the Law on Competition, which went into effect in July 2019. The Decree gives guidance on specific thresholds for merger notifications, anti-competition agreements, and market dominance among others.

Decree 35 took effect on May 15, 2020.

Clarification on Mergers and Acquisitions

The Decree particularly provides clarification on mergers and acquisitions (M&A). As per the Law on Competition, a merger is defined as the transfer by one or more enterprise(s) of all its lawful assets, rights, obligations, and interests to another enterprise and at the same time terminates the existence of the merging enterprise(s).

An acquisition is a purchase of all or part of the assets of another enterprise, sufficient to control or govern and enterprise or business line of the acquired organization.

Definition of ‘control’

Decree 35, gives a clear definition of the ‘control or influencing’ part of the organization involved in the M&A. We highlight them below:

- The acquiring company gains ownership of more than 50 percent of charter capital or more than 50 percent of the total voting rights of the acquired company;

- The acquiring company gains ownership or the right to use more than 50 percent of the assets of all or one business line of the acquired company; or

- The acquiring company has one of the following rights:

- the right to indirectly or indirectly decide on the appointment, dismissal or removal of a majority or all board members, chairman of the board, and the director or general director of the acquired company

- The right to decide on amending or supplementing the Charter of the acquired company; or

- The right to decide on important decisions regarding business operations of the acquired company, including the form of business organization, the industry, business lines, location, and business model, adjusting the scope of and business lines and selecting and using the business capital of the acquired company.

Therefore, in such a situation, the company acquiring the other will be subject to a merger notification requirement.

As per Decree 35, the thresholds that trigger a merger notification are:

For enterprises other than above, a notification must be sent to the newly formed National Competition Committee (NCC) prior to a transaction. The thresholds are:

- Total assets of one of the parties in Vietnam is at least VND 3,000 billion (US$128 million);

- Total turnover of one of the parties in Vietnam is at least VND 3,000 billion (US$128 million);

- The value of the transaction is at least VND 1,000 billion (US$43 million); or

- The combined market share of the enterprises is at least 20 percent of the relevant market.

Preliminary and official appraisals

After submitting a notification to the NCC, within 30 days the NCC will issue the results of the preliminary appraisal notifying that the M&A transaction is permitted or is subject to an official appraisal.

The preliminary appraisal will typically be done in 30 days, but an official appraisal may take an additional 90 days and be extended by another 60 days. As per Decree 35, if the NCC does not provide a response within 30 days, the M&A transaction will be allowed.

Anti-competitive agreements

Decree 35 also clarifies certain conditions where an anti-competitive agreement would not be considered:

- For businesses in the same relevant market – the combined market share of the enterprises intending to participate in the agreement is less than 5 percent;

- For businesses that intend to participate in the agreement in different stages of the same production chain, distribution, and supply of specific goods and services – the market share of each participating enterprise is less than 15 percent.

Decree 35: Details welcomed by businesses

The government is also likely to issue further clarification on the National Competition Commission and its establishment as well as further guiding documents on the competition law.

Decree 35 gives further guidance and clarity for businesses interested in M&As in Vietnam. As Vietnam kick starts the economy post COVID-19, M&A activity is likely to gain further traction. Investors should be aware of the latest regulations and seek professional advice if intending to invest in M&As.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Vietnams Autoindustrie und Chancen für die EU-Investoren

- Next Article Vietnam Adopts Amended Law on Enterprises and Law on Investment