How Emerging Economies Vietnam and India Complement Each Other

As tech giants, notably Apple, Google, and Samsung, are expanding operations outside of China, India and Vietnam are becoming the two most promising destinations. This article focuses on comparing the market of Vietnam and India in three aspects: politics, economy, and social factors to answer the question: in addition to the fierce competition to become an important link in the global supply chain, can these two countries utilize their resources to complement each other in the process of enhancing their manufacturing capacity?

Apple’s heavy reliance on Chinese factories is fraught with potential risks, especially in times of turmoil. The US-China trade war, the war in Ukraine, and the aftermath of COVID-19 restrictions have proven this warning justifiable. Against this backdrop, Apple is gearing up its manufacturing relocating process. India and Vietnam have become the most potential candidates.

According to JPMorgan’s evaluation, Apple will move 20 percent of iPads, five percent of MacBooks, 20 percent of Apple Watch, and 65 percent of AirPods to Vietnam by 2025. JPMorgan’s article also points out that Vietnam is emerging as a manufacturing hub for components (camera modules) and EMS of smaller-volume products (Apple Watch, Mac, iPad) and is already a major AirPods producer.

On India’s side, recently, Apple announced it would manufacture the iPhone 14 in India, marking an important milestone in its diversification strategy. Accordingly, five percent of the total iPhone 14 production is expected to be shifted to India this year. Previously, JPMorgan also predicted that by 2025, a quarter of all iPhones it manufactures could be labeled ‘Made in India.’

As a result of Apple’s relocation and diversification plan, both Vietnam and India are expected to become one of Apple’s major production centers and, thus, gain a more significant position within the global supply chain.

Furthermore, Apple is not the only company that has shown its determination to leave its production chain in China. Economists have pointed to a prominent trend of companies choosing a similar strategy. Needless to say, with salient advantages, both India and Vietnam have become the ‘sweet spots’ for various corporations.

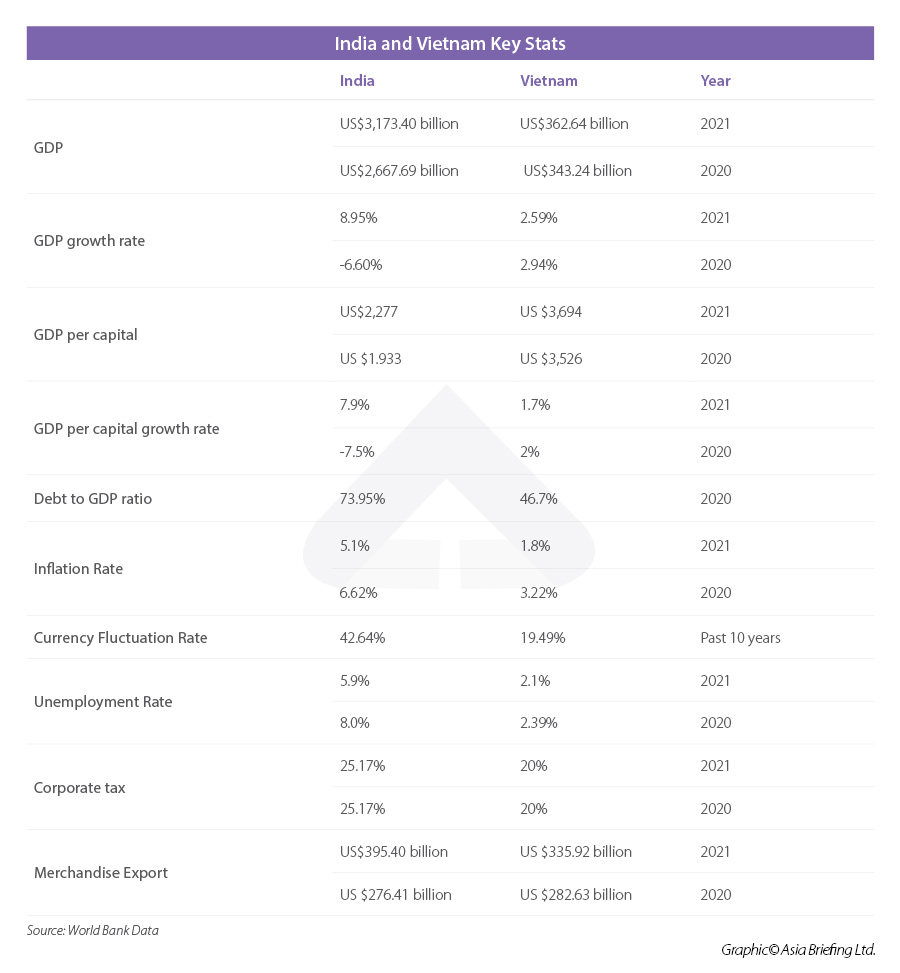

Economic factors

The fact that India is Asia’s third-largest economy alone gives the country a significant competitive advantage. With a large economy comes a great domestic market, wide range of consumers, and an abundant, low-cost workforce for foreign (as India’s unemployment rate is lower than Vietnam, skilled manpower in India will be available at a lower price).

In the aftermath of COVID-19, India’s GDP growth rate is around 8 percent, and its merchandise exports crossed US$400 billion, which makes the country a “better-performing major economies this year.” Moreover, India seems to be taking full advantage of its economic benefit by announcing the PM Gati Shakti – a $1.2 trillion project aiming at snatching factories from China.

Vietnam, on the other hand, has a significantly smaller economy. This factor certainly affects the country’s GDP and GDP growth rate, especially when compared to India. However, there are still bright spots worth mentioning about Vietnam’s economy.

For instance, Vietnam’s GDP per capita is higher than India’s. Meanwhile, Vietnam’s debt-to-GDP ratio (percent) is significantly lower than India’s, indicating a lower level of foreign dependence. In addition, the inflation rate in Vietnam is lower than in India, which can partly ensure the stability of raw material prices and other costs – a crucial factor in times of turmoil.

Moreover, Vietnam has a slightly lower corporate tax rate, enabling businesses to have lower tax expenses. Indeed, Vietnam has shown its flexibility toward the COVID-19 situation by quickly offering attractive corporate tax rates for large corporations that want to move to Vietnam. For example, for eligible large manufacturing projects, 10 percent and 20 percent favorable corporate tax rates apply for 15 or 10 years, respectively.

Foreign businesses also prefer Vietnam to avoid currency risks with its low currency fluctuation rate. In contrast, the Indian Rupee is rated as a “free-floating currency” with exchange rates determined by the market.

Last but not least, if the market size is considered, India can easily surpass Vietnam. However, economists also examine the Export Similarity Index, which measures the overlap of countries’ export baskets and, thus, their export competitiveness. According to this index, Vietnam has the most similar export basket to China, suggesting it could benefit better from replacing the China export basket.

As a result, although India’s economic structure is significantly larger, resulting in various sakes such as cheap labor and a large market, Vietnam obtains other notable advantages that promote stability for investors, global volatility notwithstanding.

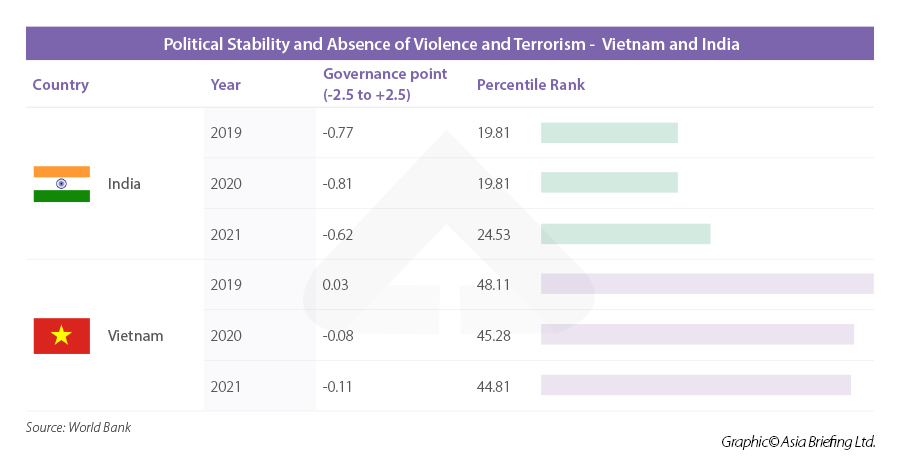

Political and regulatory factors

In the political section, this article focuses on three main aspects: political stability, the FDI Regulatory Restrictions Index, and the importance of strengthening the country’s position in the global supply chain on the national agenda.

First, India and Vietnam adapt significantly different political systems. India is a democratic country, a parliamentary republic with eight recognized parties and more than 40 regional parties. Meanwhile, Vietnam is a one-party state. In India, the government is elected by the people for a period specified in the constitution. Any changes in the ruling party leave an impact on the national agenda.

In this sense, India has lower political stability than Vietnam. Moreover, the World Bank’s political stability index, which reflects the possibility of a disorderly transfer of government power, armed conflict, violent protests, social unrest, tension, international terrorism, as well as ethnic, religious, or regional competitions, indicates the same argument:

The second aspect of politics that directly affects the direction of strengthening the nation’s position in the global supply chain is the FDI Regulatory Restrictions Index. According to the OECD’s assessment number, Vietnam’s score is 0.125, with some remarks about nationality restrictions for business managers and executives. Meanwhile, this number in India is 0.21 (with one being the most restrictive).

Although Vietnam has a higher level of political stability and a softer FDI restriction, India performs more practical and drastic policies to enhance the country’s status within the global supply system.

Accordingly, one of the prominent goals of the Modi government is to boost India’s manufacturing capacity with the “Make in India” initiative launched in 2014 to boost investment and development of more than 20 industries, underpinning India’s growth as a manufacturing hub. Following this, India launched the “Self-Reliant India Scheme” in May 2020 to boost domestic production. In addition, the government heavily spent $20 billion to entice foreign companies to shift production to India. In October 2022, Modi recently approved the “PM Gati Shakti” project with a budget of US$1.2T to seize factories from China.

Social factors

In the social section, this article first deals with two issues: geography and human resources. Regarding geography, Vietnam has a clear advantage because it is located near Shenzhen, China, which means businesses will save both time and capital for relocating production plants. In addition, Vietnam is also geographically located near Apple’s supply chain hot spots, such as Taiwan, Japan, South Korea, and other Southeast Asian countries.

In terms of labor, India will likely retain its abundant yet affordable workforce advantage. Meanwhile, this aspect of Vietnam is expected to be altered soon. Japan International Cooperation Agency (JICA) predicted that Vietnam would soon lose its comparative advantage in cheap labor due to the effects of aging and rising labor costs. As a result, the most effective solution is to increase labor productivity, yet this is highly challenging and time-consuming for the Vietnamese government.

Vietnam – India: allies or competitors?

When placing India and Vietnam on the scale in three aspects: political, economic, and social, it is easy to conclude that each country has its pros and cons. If India is a large economy with market and workforce advantages, Vietnam is emerging as a stable manufacturing hub.

As global affair remains disrupted – the US-China conflict, the Russia-Ukraine conflict, and the consequences of COVID-19, with signs of stabilization, it seems that no country wishes for unnecessary confrontations. India and Vietnam are no exceptions. Indeed, the two governments put the current situation under the lens of collaboration, where India and Vietnam can complement each other through bilateral cooperation policies.

For instance, Mr. Sanjaya Baru, former Secretary General of the Confederation of Indian Chambers of Commerce and Industry, regards Vietnam as a potential partner in India’s new supply chain process. Through the connection with Vietnam, India hopes to increase exports of Indian goods to Southeast and East Asia through a joint venture.

When looking at the diplomatic journey of the past two decades, the bilateral trade relationship between India and Vietnam has grown steadily from US$200 million in 2000 to US$12.3 billion in the financial year 2019-2020. The increased cooperation reflects how the two countries regard their diplomatic affair: a mutually beneficial relationship. For example, a shift to Vietnam could potentially reduce India’s trade deficit with China.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam’s Food Service Industry: Consumer Behavior, Challenges, and Opportunities

- Next Article Vietnam’s Consistent Performance in the Global Innovation Index