Il Vietnam sta valutando possibili restrizioni sui conti bancari esteri

A cura dell’Italian Desk di Dezan Shira & Associates

La Banca Centrale dei Vietnam (State Bank of Vietnam, SBV) ha pubblicato la bozza di una Circolare volta a limitare la possibilità per gli stranieri di aprire conti correnti vietnamiti. Considerate le generose possibilità di guadagno sui tassi d’interesse, l’annuncio ha suscitato reazioni contrastanti.

Cosa prevede la bozza

In base alla bozza della Circolare, “i depositi in valuta straniera e vietnamita” saranno permessi ai cittadini vietnamiti. Seppur non citando esplicitamente un divieto per gli stranieri, è chiaro che la Circolare miri a mettere in questione gli attuali rapporti interbancari all’interno del Paese. Attualmente, disponendo dell’appropriata documentazione – generalmente passaporto e visto – gli stranieri in Vietnam possono aprire e utilizzare un conto corrente locale. Tuttavia, negli ultimi anni, le restrizioni per questo tipo di operazioni si sono intensificate. In base ad un Decreto in materia del 2014, è possibile avere conti bancari esteri riconosciuti solo se i depositi sono denominati in Dong vietnamiti. Il timore è dunque che l’omissione degli stranieri dalla Circolare possa tradursi nell’impossibilità di aprire conti correnti.

Servizi correlati: Servizio di adempimento fiscale di Dezan Shira & Associates

Servizi correlati: Servizio di adempimento fiscale di Dezan Shira & Associates

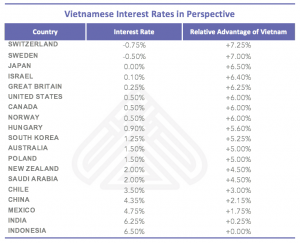

Stime dell’impatto sugli investimenti

Per coloro che investono e lavorano in Vietnam, gli elevati tassi d’interesse e la stabilità del Dong negli ultimi anni fanno sì che il possesso di denaro all’interno del Paese costituisca esso stesso un investimento. Il valore corrente dei tassi d’interesse in Vietnam è del 6,5 per cento, il che si traduce in interessanti realizzazioni per gli investitori che possono sfruttare le differenze nei tassi di cambio. Il grafico sottostante sottolinea i vantaggi derivanti dalle differenze nei tassi d’interesse in diversi mercati.

Se il divieto sui depositi esteri verrà applicato, molti investitori che attualmente traggono vantaggio da queste opportunità saranno costretti a guardare altrove. Sebbene il limite sui depositi esteri in Vietnam rimanga poco chiaro, i conseguenti deflussi di capitali potrebbero spingere il VND al ribasso, aprendo così temporanee opportunità per gli investimenti diretti esteri.

![]() Per saperne di più: Procedure doganali in Vietnam

Per saperne di più: Procedure doganali in Vietnam

Cosa fare

È bene notare che il documento costituisce solo una bozza. Tuttavia, sia dal punto di vista individuale che dal punto di vista societario, la versione preliminare della Circolare va monitorata con attenzione. Con ogni probabilità, ulteriori chiarimenti sulle restrizioni e sui piani da implementare verranno resi noti nei prossimi mesi.

|

Asia Briefing Ltd. è una controllata di Dezan Shira & Associates. Dezan Shira & Associates è una società di consulenza specializzata nell’assistenza agli investimenti diretti esteri per le società che intendono stabilire, mantenere e far crescere le loro operazioni in Asia. I nostri servizi includono consulenza legale e strategica all’investimento, costituzione e registrazioni societarie, tenuta contabile con redazione di bilanci periodici ed annuali, consulenza fiscale e finanziaria, due diligence, revisione contabile, gestione tesoreria, libri paga e personale, transfer pricing, consulenza IT, sistemi gestionali, deposito marchi e servizio visti. Per maggiori informazioni vi invitiamo a contattarci al seguente indirizzo: italiandesk@dezshira.com o a visitare il nostro sito: www.dezshira.com. Per rimanere aggiornati sugli ultimi trend degli investimenti e del business in Asia, iscrivetevi alla nostra newsletter per ricevere notizie, commenti, guide e risorse multimediali.

|

Rimpatriare gli utili dal Vietnam

La rimessa degli utili dal Vietnam può rivelarsi un processo complesso e laborioso anche per gli investitori più esperti. In questo numero di Vietnam Briefing, presentiamo i regolamenti esistenti in materia di trasferimenti degli utili e forniamo una guida su come rispettare le relative norme. Inoltre, introduciamo gli organi governativi competenti e forniamo consigli esperti sulla gestione delle perdite.

Revisione fiscale e compliance in Vietnam

In questo numero di Vietnam Briefing, mostriamo le più recenti modifiche alle procedure di revisione e forniamo indicazioni su come garantire che le attività di compliance siano completate in modo efficiente ed efficace. Ci soffermeremo in particolare: all’avvicinamento dei VAS vietnamiti agli IFRS, all’emergere del pagamento elettronico delle imposte (e-filing), e alle procedure di audit e compliance per le imprese di proprietà straniera e per gli uffici di rappresentanza.

Import & Export in Vietnam: settori chiave e accordi di libero scambio

In questo numero di Vietnam Briefing, discutiamo dei vantaggi del mercato di questo Paese rispetto ad altri nella regione ed evidenziamo dove e come realizzare investimenti di successo. Esaminiamo i programmi di riduzione tariffaria previsti dal NAFTA e dal la TPP, avanziamo considerazioni per quanto riguarda le norme sull’origine e mostriamo i vantaggi ad investire nelle zone economiche del Vietnam. Infine, forniamo un’opinione esperta sulla costituzione di società a capitale interamente straniero in Vietnam.

- Previous Article Il Vietnam propone nuovi standard di sicurezza per l’industria pesante

- Next Article Il settore delle bevande in Vietnam