Italian Investment in Vietnam – How to Leverage the EVFTA

- The EVFTA is a modern free trade agreement between the EU and Vietnam, expected to boost economies of both trading partners as they emerge out of the COVID-19 pandemic.

- The agreement is an ambitious pact eliminating almost 99 percent of customs duties between the EU and Vietnam.

- The FTA presents significant opportunities for Italian investors looking to expand business opportunities by leveraging the agreement and Vietnam’s growth.

On June 8, 2020, both the European Union Vietnam Free Trade Agreement (EVFTA) and the EU Vietnam Investment Protection Agreement (EVIPA) were ratified by Vietnam’s National Assembly.

Expected to take effect by July or August 2020, the EVFTA will eliminate almost 99 percent of customs duties between the EU and Vietnam, as well as provisions on intellectual property rights, investment, and sustainable growth.

Why Vietnam?

Vietnam has experienced a 6-7 percent yearly growth in the last 20 years, successfully reducing the poverty rate from a worrying 49 percent in 1992 to only 3 percent according to the latest estimate.

According to the Global Competitiveness Index 2019 report by the World Economic Forum, Vietnam ranks 67 out of 141 countries and shows a largely stable business environment according to the World Bank’s Doing Business 2020 report.

Today, with almost 100 million people – including about 55 million workers – and an emerging middle class, Vietnam is the EU’s second trading partner in ASEAN and one of the most promising economies in the world.

Vietnam’s economy is export-focused and labor-intensive, with key industries being smartphones and electronic products, textiles, footwear, and agriculture. It is likely the EVFTA will foster the expansion of such industries in terms of capital expenditure and employment.

EVFTA impact – Near-complete removal of custom duties

65 percent of duties on EU exports to Vietnam will be eliminated when the agreement takes effect, while the remaining will gradually be phased out over a 15-year period. On the other hand, 71 percent of duties on Vietnam exports to EU countries will be eliminated immediately, with the remaining being eliminated in seven years.

Investors can check whether and when specific products can benefit from customs exemption by checking the Harmonized System (HS) codes in the related documents of the European Trade Commission. The European Trade Commission classifies A-products (immediate duty exemption) and B-products (duty exemption within three to 15 years).

Other changes

Apart from the elimination of most custom duties between the EU and Vietnam, the agreement contains provisions on intellectual property (IP) rights, investment, and sustainable development.

- Reduction of non-tariff barriers and simplified customs procedures: Vietnam will align with international standards on motor vehicles and pharmaceuticals – which means EU products will not require additional testing and certification procedures in Vietnam – and a single document will be used for completing all formalities for placing goods under customs procedures (lower costs and complexity);

- Remanufactured goods: The text of the agreement allows remanufactured goods to be imported and will open up trade for high-value products such as medical devices and car parts to serve the aftersales market;

- Repaired goods: No custom duties will apply to goods re-entering the country after being temporarily exported while there will be no customs duties to goods imported temporarily;

- Geographical indications: recognition and protection of geographical indications for wines, spirits, agricultural products and foodstuffs; and

- Contractual service suppliers: If EU companies without a presence in Vietnam conclude a service contract with a Vietnamese company, their employees (contractual service suppliers) are granted the entry and temporary stay in Vietnam for a period of no more than six months or for the duration of the contract (whichever is less). The following services are allowed:

- Architectural services;

- Urban planning and landscape architecture services;

- Engineering services;

- Integrated engineering services;

- Computer and related services;

- Higher education services (only privately funded services);

- Foreign language training; and

- Environmental services.

Opportunities for Italian companies

Italy has highly specialized industries such as textiles, foodstuffs, machines, eyewear, and so on while being the third economic power in the European continent. In addition, Italy ranks ninth among EU countries that have invested in Vietnam.

The majority of investment in Vietnam is wholly owned by Italian companies. Most Italian firms in Vietnam are in the pharmaceuticals, transportation, machines, and foodstuff industries.

Further, according to the Observatory of Economic Complexity (OEC), Italian products exported to Vietnam amounted to US$1.53 billion in 2018. The main industries exported were machines, animal hides, chemical products, textiles, and foodstuffs.

Overall, there is significant potential and opportunities for Italian products and companies in Vietnam.

The EVFTA will cut almost 99 percent of customs duties on Italian products exported to Vietnam over a period of 15 years. This will thus make Italian products able to compete with local and Asian products. Indeed, most products imported in Vietnam come from China (32.9 percent), South Korea (19.2 percent), Japan (6.15 percent), and other Asian countries. US products imported to Vietnam account for only 3.19 percent of total imports in Vietnam. As far as EU products, German products stand on top (1.86 percent), while Italian products are the second most imported products (0.61 percent).

We highlight three key industries that present significant opportunities for Italian investors.

Textile

The Italian textile and footwear industry is of significant importance to the apparel and fashion industry, and strongly export-oriented. Vietnam’s textile and garment leverages low labor costs to produce items with high competitiveness in the global market.

Most tariffs on textile and footwear will be eliminated when the EVFTA takes effect, while the remaining over a five-year period. It is likely that trade volumes will increase significantly if Vietnam is able to develop and expand its local supply chain to comply with Made in Vietnam rules (right now most of the fabrics are imported from China).

Vietnam’s market is appealing for Italian manufacturers, which target different consumer segments compared to the local industry with fashion and luxury items. At the same time, Italian companies can find new incentives to relocate part of their manufacturing facilities to Vietnam to leverage low labor costs and tap into the local market, or restructure their global supply chain by including Vietnamese Cut-Make-Trim (CMT) subcontractors (or OEM subcontractors depending on the products and if Vietnam successfully develops a local supply chain for fabrics and raw material sourcing).

Pharmaceuticals

The COVID-19 pandemic has changed consumers’ behaviors, likely for the medium and long term. Specifically, consumers are likely to increase their consumption for household cleaning and personal hygiene products, as well as health foods like fruits and juices that increase immunity. In addition, cosmetics and beauty care products are expected to register double-digit growth in the next few years, especially if accompanied by robust growth of local GDP.

The local pharmaceutical market still only meets 52 percent of local demand, constituted mostly by generic drugs. With the EVFTA in effect, about half of EU pharmaceutical imports will be duty-free immediately, with the rest exempted from customs duties over a period of seven years. This will bring fair and equal access to the market, enabling Italian companies to further expand their business.

Foreign pharmaceutical companies will be allowed to establish a company to import pharmaceutical products that have been authorized to be sold in Vietnam to local distributors or wholesalers.

But the biggest opportunity comes from the reduction of non-tariff barriers in the industry: pharmaceutical products already certified in the EU will not require additional testing and certification in Vietnam, thus reducing costs and time to market.

Foodstuffs

One of the main strengths of the Italian economic system is foodstuffs such as wine, cheese, ham, vinegar, pasta, processed tomatoes, and so on. Italian cuisine and the Mediterranean diet are renowned worldwide.

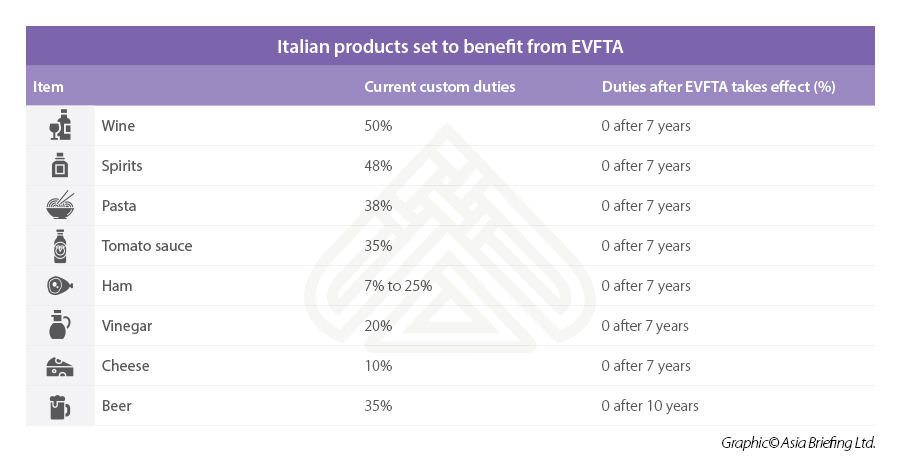

Current high tariffs – together with local consumers’ preferences – are hindering the penetration of Italian foodstuffs in Vietnam. Current custom duties for wine, spirits, pasta, tomato sauce, ham, vinegar, and cheese will be gradually reduced and eliminated over a period of seven years. An exception is beer with custom duties to be eliminated in ten years to protect local breweries.

In addition, 38 Italian geographical indications will be protected under the EVFTA framework: wine, cheese, ham, vinegar, spirits, beef, and fruits. That said, the use of “Asiago”, “Fontina” and “Gorgonzola” by any person who made actual commercial use in good faith of those indications about products in the class of cheeses will still be allowed if started prior to January 1, 2017.

Other opportunities

The Italian economic system has strong opportunities for growth in many industries, particularly the ones with a high level of specialization such as eyewear (20 percent, eliminated in three years), home decor (10-25 percent, eliminated in three years), machines (leather machines, stone working machines, vending machines, electrical lighting, and signaling equipment, etc.) and remanufactured goods (aerospace, heavy-duty and off-road equipment, motor vehicle parts, IT, medical devices, tires, etc.), as well as specialized services such as architectural and engineering services.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Q&A: Relocating Your Supply Chain to Vietnam

- Next Article Vietnam’s Southern Key Economic Region: Opportunities for Investment