Opportunities in Vietnam’s Northern Key Economic Region

- The Northern Key Economic Region of Vietnam has emerged as an important investment destination offering potential opportunities for foreign investment.

- Each city and province in the region has different strengths and factors to be considered, especially for investors looking to relocate and complement their China manufacturing operations in Vietnam.

- Vietnam Briefing explores the Northern Key Economic Region and highlights the economic performance of each city and province in the region.

Vietnam has emerged as an important investment destination for foreign investors. With a strong GDP and ideal investment conditions, choosing the right location for your operations is an important factor when planning a relocation.

Vietnam can be divided into four key economic regions (KERs): Northern, Central, Southern, and Mekong Delta regions. These four KERs consist of 24 provinces and municipalities, playing an extremely important role in promoting Vietnam’s economic growth.

In this article, we will look at and focus on the Northern KER.

Overview of the Northern KER

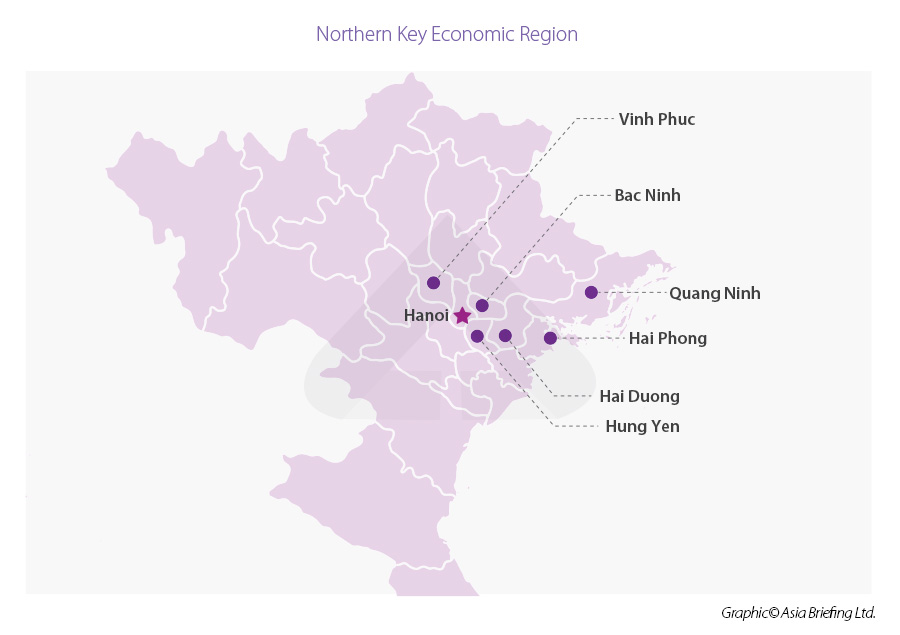

The Northern KER comprises seven cities and provinces, including Hanoi, Hai Phong, Quang Ninh, Vinh Phuc, Bac Ninh, Hai Duong, and Hung Yen. As a whole, it contributes to more than 32 percent of the national GDP (ranked second after the Southern KER) and accounts for 26 percent of the total FDI capital of the country.

In the 2016-2018 period, the Northern KER’s average GRDP growth rate was 9.08 percent, making it the fastest-growing region in all four KERs. The region’s GRPD per capita in 2018 was US$4,813, which was 1.6 times higher than the national average. The average export growth rate of the Northern KER in the 2016-2018 period reached 25.6 percent and made up 32 percent of Vietnam’s export. The region’s export turnover in the period of 2016-2020 also increased by 57 percent, which is much higher than the national growth rate of 38 percent.

In 2020, all seven cities and provinces of the Northern KER had positive GRPD growth rates. In particular, Hai Phong and Quang Ninh respectively ranked second and third in terms of having the fastest GRDP growth rate nationwide.

The Northern KER’s economic structure has been gradually shifting towards industrialization. The industry and construction sector continues to be the growth pillar of the region, contributing 40 percent to the country’s GDP in the 2016-2018 period. The key sectors include electronics, electricity, automobile, shipbuilding, textiles, and supporting industries.

Foreign Direct Investment (FDI)

Following Resolution No. 128/NP-CP by the Government on tasks and solutions to promote the development of key economic regions, the Northern KER focuses on attracting investments from high-tech industries and high-tech services, financial banking, specialized medical and supporting industries. With its proximity to China, competitive labor costs, and the manufacturing and processing industry, the Northern KER has positioned itself as an ideal location for China plus one manufacturing.

According to the MPI, as of 2020, the Northern KER received a total registered investment capital of US$101 billion with more than 10,000 projects across seven cities and provinces. Major foreign investors are mainly from South Korea, Japan, the US, Taiwan, and the EU.

The region is home to large FDI enterprises with high export value, playing an extremely key role in the country’s export growth. The long lists include large multinational foreign firms such as Samsung, LG, Fujico, Denso, Microsoft, Canon, Bridgestone, Chevron, Pegatron, and so on. The FDI firms in the Northern KER account for more than 80 percent of the region’s total exports. Large-scale industrial zones attracting significant FDI investments are concentrated in major cities and provinces such as Hanoi, Hai Phong, and Bac Ninh.

Nevertheless, while all seven cities and provinces of the Northern KER are developing towards electronics and hardware industries, most of the activities are low-value add such as hardware assembling; research and development of high-tech products is still very limited. Similarly, software and digital content industries are mostly concentrated in Hanoi, but are of small scale and low competitiveness.

Infrastructure

Multiple major infrastructure and transportation networks are increasingly upgraded to improve connectivity between localities within the region. One of the most important projects of the Northern KER, for example, is the construction of the Van Don – Mong Cai Expressway in Quang Ninh, which upon completion this year will connect the Hanoi – Hai Phong, Hai Phong – Ha Long, and Ha Long – Van Don highways to create the longest highway in Vietnam. It is expected to reduce transportation time and costs, promoting cross-border transit trade between Vietnam and China and other ASEAN countries.

The improvement and expansion of major international ports for container traffic in the Northern KER have contributed to the development of the logistics industry and enhanced the region’s competitiveness with the Southern KER. According to the Ministry of Planning and Investment (MPI), the Northern KER has 27 logistics centers, accounting for 55 percent of the total number of logistic centers in the country (14 centers in Bac Ninh, 11 in Hanoi, and two in Hai Phong).

Each city or province in the Northern KER has its own advantages and key economic sectors with a different economic policy and development. We explore these below.

Hanoi

Overview

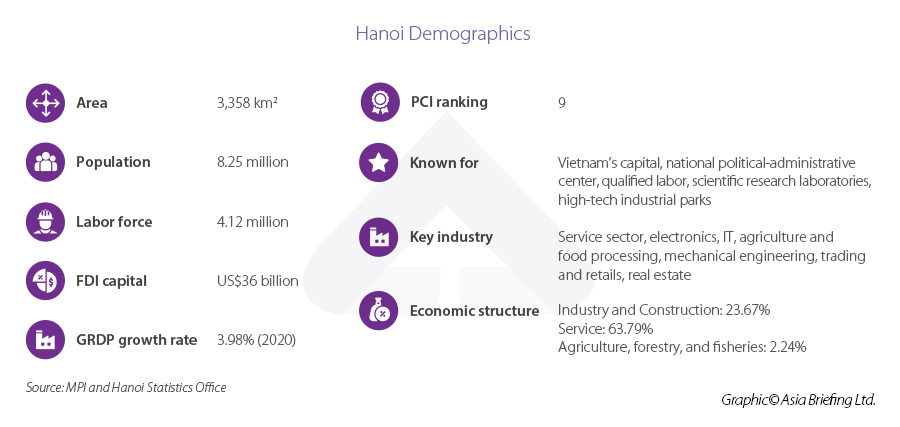

Hanoi is the capital of Vietnam and also the largest economy of the Northern KER. It is home to 8.25 million people, making it the second-largest city in Vietnam, only after Ho Chi Minh City. It is also the city that has the highest percentage of trained labor force in Vietnam at 48.5 percent.

In 2020, according to the Hanoi Department of Planning and Investment, the city’s GRDP was worth US$45 billion, and GRDP per capita was US$5,420, which was 1.5 times higher than that of 2015. As the second-largest economy of the country, Hanoi contributed to more than 16 percent of the national GDP, 18.5 percent of the state budget, and 8.6 percent of the total import and export turnover of Vietnam.

Economic sectors

As opposed to other cities and provinces in the Northern KER, the service sector accounted for the highest share of the city’s output at 62.79 percent, followed by the industry and construction sectors at 23.67 percent.

The processing and manufacturing industry currently accounts for about 91 percent of industrial output. Hanoi’s industry sector is gradually shifting towards developing high-tech industries with great export value, such as digital control, automation, robotics, nano, plasma, laser, and biotechnology. In 2020, there were about 11,000 IT companies in Hanoi with total annual revenue of US$10 billion, and accounting for more than 20 percent of the export turnover of the city.

FDI performance

Up until 2020, Hanoi ranked second in attracting foreign investment with a total registered capital of US$35.9 billion for 6,384 licensed projects. It is considered one of the cities in Vietnam that has the most favorable investment environment for high-tech investors. For example, the Hoa Lac Hi-Tech Park, which is the first and largest hi-tech park in Vietnam with a total area of 1,586 hectares, enjoys various investment incentives regarding corporate income tax and preferential tariffs.

Hai Phong

Overview

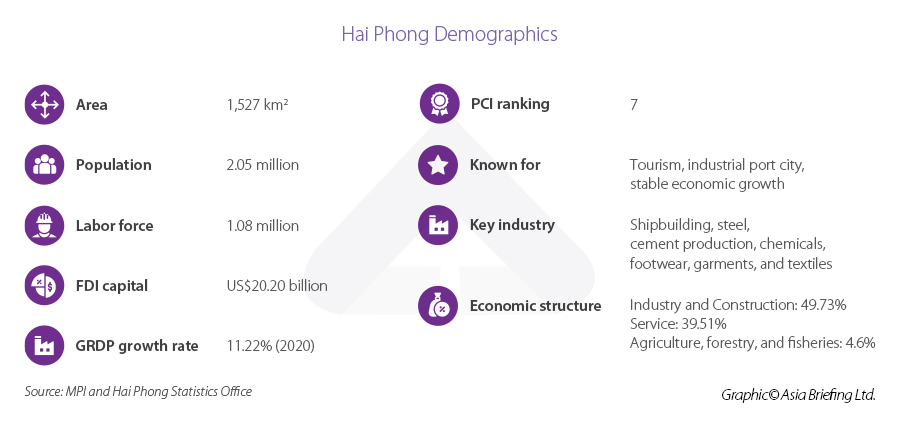

Hai Phong, the biggest port city in the Northern region and the third-largest city in Vietnam is home to more than two million people. Being close to Hanoi and the only city in the North that has five modes of transportation: railways, roadways, airways, inland waterways, and maritime, it is an indispensable player in promoting the economic development of the region.

Economy

Since 2018, Hai Phong has consecutively ranked second in terms of GRDP development, maintaining a growth rate above 10 percent annually. In comparison with 2019, the Index of Industrial Production (IPP) of Hai Phong in 2020 increased by 14.6 percent, ranking second after Bac Giang.

The industry and construction sectors have the highest share of the city’s GDP at 49.73 percent, followed by the services sector at 39.51 percent. The agriculture, forestry, and fisheries sectors only accounted for 4.6 percent.

Despite the impact of COVID-19, in 2020 the manufacturing industry of Hai Phong such as the manufacturing of automatic equipment, mobile components, electric motorcycles, and automobiles for example, still managed to maintain high growth rates.

FDI

As of 2020, Hai Phong received a total registered investment capital of US$20.20 billion, becoming the six-largest FDI recipient of the country. The city is popular with investors from Japan, South Korea, China, the EU, the US, and Taiwan. Leading FDI projects include Samsung (South Korea), Bridgestone (Japan), and Pegatron (Taiwan).

With its geographical location, improved infrastructure, and numerous government incentives to attract FDI, Hai Phong is an ideal investment location for foreign investors considering the China plus one strategy operation in Vietnam.

Quang Ninh

Overview

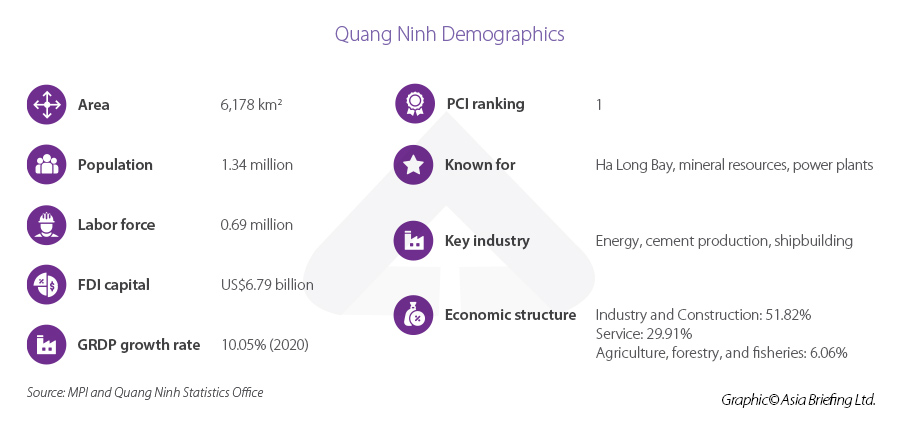

Located in the northeast region of the country, Quang Ninh is the only locality in Vietnam that shares both land and sea borders with China. Quang Ninh together with Hanoi and Hai Phong create the economic triangle in the North. It is also home to the UNESCO World Heritage Site Ha Long Bay.

Economy

Quang Ninh’s economy has received a lot of attention for its outstanding achievements. In 2020, Quang Ninh was in the top three fastest GRDP growing localities, only after Bac Giang and Hai Phong. The province also has the highest GRDP per capita of the Northern KER at US$6,700. Since 2017, Quang Ninh has consistently ranked first in the Provincial Competitiveness Index (PCI) for four years in a row. The IPP growth rate in 2020 of Quang Ninh was at 8.9 percent, coming third after Bac Giang and Hai Phong.

The industry and construction sectors continue to dominate with 51.82 percent share of the province’s GDP. The service sector comes second at 29.91 percent, followed by agriculture at 6.06 percent.

Quang Ninh is well known for many advantages in natural resources, especially coal. As long as the demand for fossil fuels continues to rise, the energy industry in Quang Ninh has potential. The sector has, therefore, attracted a great deal of attention from the government and foreign investors. Other mineral resources such as limestone, clay, and kaolin are also available in large quantities, serving the needs for raw construction materials of the domestic market and even exports.

FDI

Until June 2021, Quang Ninh lured around 150 FDI projects with total registered investment capital of more than US$7.5 billion. FDI projects in Quang Ninh mainly focus on real estate business (infrastructure of industrial zones, or factories for lease), textiles, mechanical engineering, electrical and electronic equipment assembling, and food processing.

Most investors are from the US, Japan, Singapore, and Thailand. Some major projects are Amata (Thailand), Rent A Port (Belgium), TCL (China), Foxconn (Taiwan), Bumjin (South Korea), Toray, Yazaki (Japan), and Wilmar (Singapore).

The weaknesses of FDI investment in the Northern KER are best reflected in Quang Ninh’s investment problems. For instance, the model of the province’s industrial zones is mainly focused on multi-sectoral and multi-field development but not much attention has been given to high-tech industry and supporting industries. Moreover, compared to the neighboring cities and provinces, Quang Ninh’s FDI projects have a relatively small scale of investment capital.

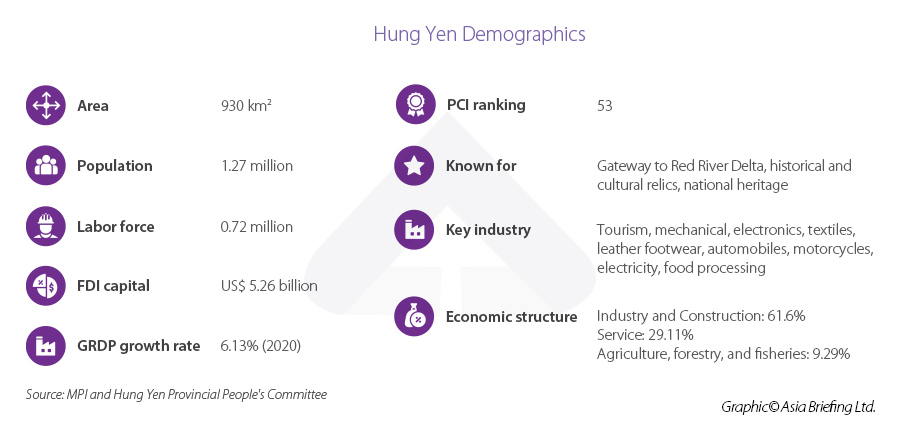

Hung Yen

Overview

Located over 60 kilometers northwest of Hanoi, Hung Yen has many important traffic routes, connecting Hanoi with other provinces of the southern Red River Delta region. With an area of 930 square kilometers, Hung Yen province is home to more than 1.27 million people, ranking fourth for cities and provinces with the highest population density in Vietnam, with 1,364 residents per square kilometer (after Ho Chi Minh City, Hanoi, and Bac Ninh).

Economy

In 2020, Hung Yen’s GRDP growth rate was lower compared to 2019 due to the impact of the pandemic, however, at 6.26 percent it still managed to rank 11th nationwide. The industry and construction section grew the fastest at 7.71 percent. The services sector increased by 4.46 percent. The agriculture, forestry, and fisheries sectors increased by 3.53 percent.

The province’s economy is dominated by industrial activities, which account for 61.31 percent of the provincial GRDP. It is followed by the service sector at 22.76 percent and the agriculture sector at 9.3 percent.

FDI

Hung Yen currently has 13 industrial parks in operation, with a total area of over 3,000 hectares. The industries that attract FDI investment are textiles and garments, manufacturing of electronics, computers and optical products, rubber and plastics, manufacturing of automobiles, and other motor vehicles.

According to Hung Yen Statistics Office, until 2020, the province attracted 487 FDI projects with a total registered capital is US$5.2 billion. The top foreign investors are from Japan with 166 projects worth US$3.22 billion, accounting for 61.32 percent of the total registered capital; second is South Korea with 143 projects worth US$764.61 million, accounting for 14.52 percent; and third is China with 75 projects worth US$349.78 million, accounting for 6.62 percent.

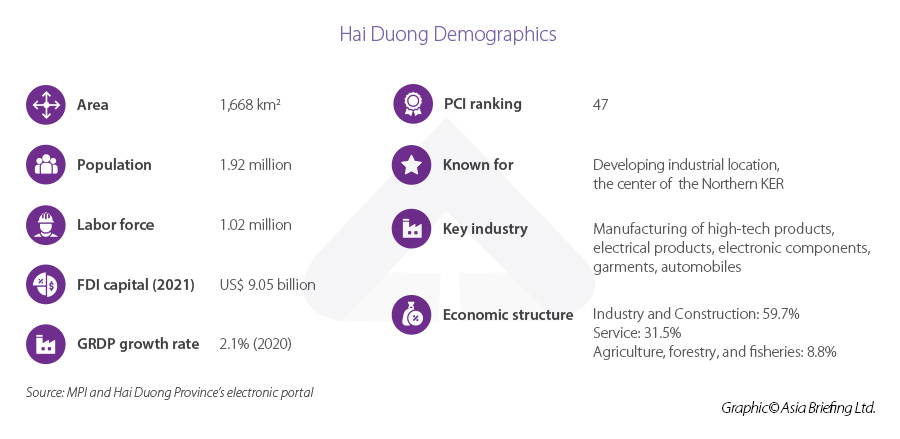

Hai Duong

Overview

Hai Duong province is located in the Red River Delta of north-eastern Vietnam, about 57 kilometers east of the capital Hanoi, and 45 kilometers west of Hai Phong City center. With an area of 1,668 square kilometers, it is home to a population of 1.92 million people.

Economy

Based on the report of Hai Duong Provincial People’s Committee, the average annual growth rate of Hai Duong in the 2016-2020 period was 8.8 percent, higher than the national average. The province’s GRDP in 2020 was 1.6 times higher than that of 2015, ranked 11th nationwide.

Hai Duong’s economic structure continues to shift in a positive direction, which means reducing the share of agriculture while increasing the shares of the industry – construction, and service sector.

FDI

Despite the fourth wave of COVID-19 in Vietnam, the total FDI investment in Hai Duong in the first five months of 2021 reached US$244.7 million, up 12 percent year on year. As of June 2021, Hai Duong was home to 488 FDI projects with a total registered investment capital of US$9 billion.

The general FDI investment capital per project in Hai Duong is relatively equal in size, which an average of US$10 million. The total export turnover of FDI enterprises in Hai Duong in the past five years has contributed to over 90 percent of the province’s export turnover. Top investors are from South Korea, China, Hong Kong, Japan, and Singapore.

Those FDI projects focus primarily on the industrial sector, accounting for 81.5 percent of the total registered capital. Key investment industries in Hai Duong are high-tech products, electrical products, electronic components, garments, agriculture products (for export), and automobiles.

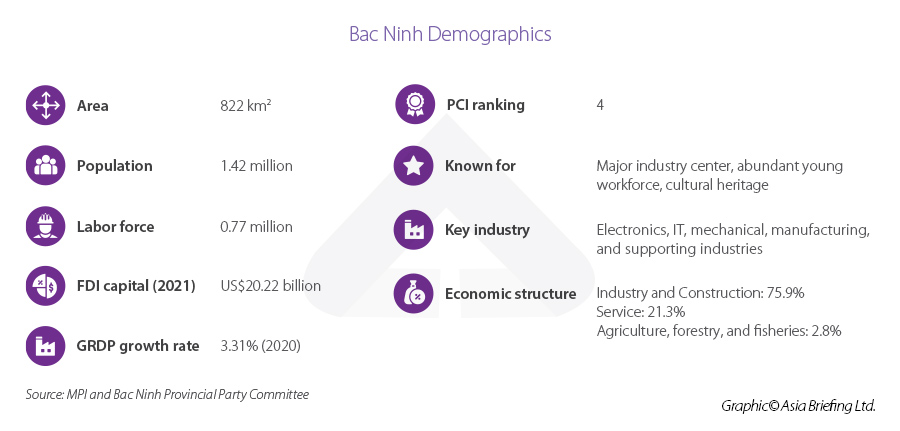

Bac Ninh

Overview

Although being the smallest province of Vietnam with a landmass of just 822 square kilometers, Bac Ninh is home to more than 1.42 million people, and to various impressive economic development achievements. As the northeast gateway of Hanoi, Bac Ninh serves as a bridge between the capital and the Northern midland and mountainous provinces.

Economy

Bac Ninh is a province with an outstandingly strong industrial production. The industry and construction sector dominates with the highest share of 75.9 percent of the province’s GDP, being well above the service sector at 21.3 percent and the agriculture sector at 2.8 percent.

Despite the low GRDP growth rate in 2020 because of COVID-19, Bac Ninh’s average annual growth rate in the 2016-2020 period was 6.6 percent. In 2020, Bac Ninh ranked first in the industrial production value nationwide, reaching the amount of US$48.9 billion. It was also the second-largest exporting province of Vietnam, with an export turnover at US$38.9 billion, only after Ho Chi Minh City.

FDI

By June 2021, Bac Ninh was the seventh-largest FDI recipient, attracting 1,862 projects with a total registered investment capital of US$20.22 billion. Electronics is the most important industry, accounting for more than 80 percent of the industrial production value of Bac Ninh.

Top investors are from Japan, South Korea, the EU, and the US. Some of the biggest FDI projects in Bac Ninh are the Samsung Group’s complex with a total investment of over US$9 billion (South Korea), the mobile phone assembly and manufacturing project of Foxconn’s Fushan with an investment of US$227 million (Taiwan), and Canon’s US$130 million project of manufacturing printers and electronic components (Japan).

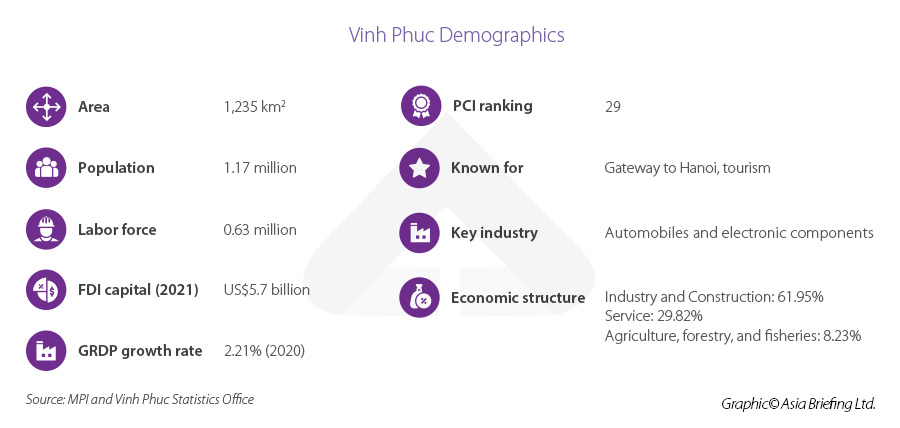

Vinh Phuc

Overview

Vinh Phuc province is located in the Red River Delta region, part of the Northern midlands and mountains, bordering Hanoi via the Red River. Vinh Phuc, therefore, is the bridge connecting the Northwest provinces with Hanoi and the Red River Delta. With an area of 1,235 square kilometers, its population is about 1.17 million people.

Economy

Similar to other provinces in the region being affected by the pandemic, while the GRDP growth rate in 2020 of Vinh Phuc was comparatively low, its average annual growth rate in the 2016-2020 period was 8.05 percent. The industry and construction sector has the highest share of the economy at 61.95 percent, followed by the service sector and agriculture sector respectively at 20.82 percent and 8.23 percent.

FDI

As of June 2021, Vinh Phuc has attracted 461 FDI projects with a total investment of US$5.7 billion. The province currently has 18 industrial parks approved by the Prime Minister with a total area of 5,228 hectares. Projects attracting foreign investment mostly focus on the manufacturing of automobiles, motorcycles, and electronic components. Japan and South Korea are the major investors of the province, with large enterprises such as Toyota, Honda, Sumitomo (Japan), and Daewoo Bus (South Korea).

To enhance the competitiveness of the economy and attract more capital, the local authority of Vinh Phuc has encouraged foreign investment in the high-tech industry, or “the industry 4.0”, such as digital, bio-industry, new materials, for instance, in addition to those industries which the province has advantages over.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam’s High Growth Import and Export Industries

- Next Article US Vice President Visit Underlines Growing US-Vietnam Ties