Debate Continues Over Reducing Import Tariffs for Vietnam’s Automobile Industry

HANOI – As Vietnam’s auto market continues to see strong growth in sales, uncertainty remains around the policies that will be applied to the importation of foreign manufactured autos, as separate branches of the government support different policy packages.

Vietnam’s Ministry of Industry and Trade (MoIT) has announced support for the tax on imported automobiles remaining at 50 percent until then end of 2017, and has proposed a range of incentives to stimulate the country’s domestic auto industry. However, the Ministry of Finance is backing a continuation of the 50 percent rate in 2015, followed by a reduction to 40 percent in 2016, and 30 percent in 2017.

RELATED: Dezan Shira & Associates’ International Tax Planning Services

RELATED: Dezan Shira & Associates’ International Tax Planning Services

The two ministries have formally made their proposals to the National Assembly, however, it is not yet clear which will be approved. Vietnam is seeking to build up its domestic auto industry and is using the import tariffs as a tool to protect its local producers as they seek to become competitive with neighboring countries such as Thailand.

According to the Binh Duong customs administration, the Finance Ministry issued an order this month amending the vehicle import tariff in compliance with Vietnam’s tax reduction obligations under World Trade Organisation rules. Tariffs coming into effect on January 1, 2015 include a reduction in tariffs on motorcycles, sidecars, and mopeds from 47 to 40 percent, and a reduction on the duty of four-wheel-drive vehicles from 70 to 59 percent.

RELATED: Vietnam Sees Strong Growth in Auto Sales

Vietnam will also cut its car import tariff incrementally over the next four years for goods originating in ASEAN countries, according to the ASEAN Trade in Goods Agreement. The current import tariff of 50 percent is expected to be reduced to 35 percent in 2015, 20 percent in 2016, 10 percent in 2017, and will be zero in 2018. Despite these tariff reductions, the National Assembly has announced that the special consumption tax will remain at current levels.

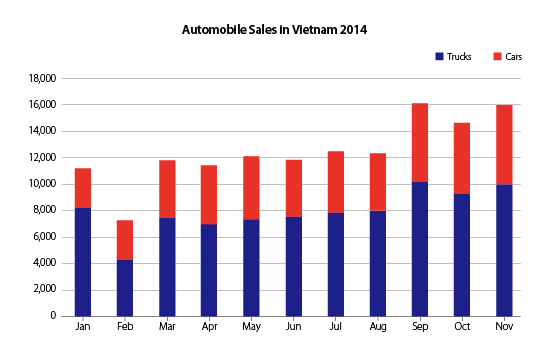

Automobile sales have climbed throughout the year, with an average of 12,500 units per month sold in 2014. This number peaked in September, reaching 16,149 cars sold. November took second place, with 15,954 cars sold. February, considered Vietnamese ‘New Year month’, recorded the year’s lowest sales – 7,314 cars.

Vietnam’s capital Hanoi represents a key growth market for auto companies. This year saw coveted automobile companies Bentley, Jaguar, Infiniti, and Mini launch their first dealerships in Hanoi. Other giants present in Vietnam include Audi, Lexus, Rolls-Royce and Porsche. Meanwhile, Mercedes-Benz Vietnam, which opened a manufacturing plant in Ho Chi Minh City in 1995, has seen stable growth throughout 2014 and sold 2,324 cars from January to November 2014. Vietnam has an estimated of two million cars and 37 million motorcycles on the road.

To learn more about import duties in Vietnam and how your business can capitalize on these developments, please email us at vietnam@dezshira.com

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Developing Your Sourcing Strategy for Vietnam

Developing Your Sourcing Strategy for Vietnam

In this issue of Vietnam Briefing Magazine, we outline the various sourcing models available for foreign investors – representative offices, service companies and trading companies – and discuss how to decide which structure best suits the sourcing needs of your business.

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition) provides readers with an overview of the fundamentals of investing and conducting business in Vietnam. Compiled by Dezan Shira & Associates, a specialist foreign direct investment practice, this guide explains the basics of company establishment, annual compliance, taxation, human resources, payroll, and social insurance in the country.

- Previous Article Vietnam Coffee Production to Decline in 2015

- Next Article Vietnamese Seafood Exports Strong in 2014 but Difficult to Maintain in 2015