Vietnam and Canada Trade: Leveraging the CPTPP

- Vietnam-Canada trade relations reached almost US$9 billion in 2020, an all-time high, thanks in part to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) signed in 2018.

- The CPTPP aims at promoting trade and maintaining open markets between member countries representing close to 13.4 percent of the world’s GDP.

- Looking forward to bilateral trade between Canada and Vietnam, Canadian investors should be proactive, gain sufficient knowledge about the current tax and regulations in Vietnam, and also about the Vietnamese market and economic landscape to achieve the best possible return on investment.

Vietnam is Canada’s largest trade partner in ASEAN. Despite the establishment of diplomatic ties in 1973, relations between the two countries have only recently strengthened reaching almost US$9 billion in trade in 2020.

In March 2018, Canadian Prime Minister Justin Trudeau signed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), representing a step towards greater engagement with ten other economies across Asia, including Vietnam.

As one of the largest free trade agreements in the world, businesspeople in Canada will find greater transparency in emerging markets, along with a wider array of competitive investment and trade options across the Asia-Pacific.

With Vietnam already Canada’s largest trading partner in the region, the CPTPP changed the scope of Canada-Vietnam relations, particularly for Canadian businesses that want to participate in Vietnam’s current growth trajectory.

In light of this, the Canadian-ASEAN Business Council (CABC) has urged Canada to engage with Vietnam as a key factor in Canada’s Indo-Pacific strategy. The CABC notes that Vietnam has become Canada’s largest trading partner. As Canada faces growing calls to diversify its relationships in Asia and develop a clear comprehensive Indo-Pacific strategy, it can further build on its relationship with Vietnam as exporters and importers now enjoy increased market access and tariff reduction in this trading environment.

The CPTPP and Canada

Since the CPTPP agreement entered into force, Canada was the only G7 nation to have free trade access in North America, Europe, and the Asia Pacific.

The terms and conditions outlined in the CPTPP create a framework for trade that enables greater market access between member states. Ever since the agreement was ratified, the elimination of tariffs abroad has been stimulating Canadian foreign business activities.

More specifically, the CPTPP benefits Canadian corporations by eliminating tariffs on 99 percent of current Canadian exports to other member nations in the agreement. Further, the agreement also simplifies procedures for permitting goods through customs, enhancing transparency during trade activities, hence improving Canadian export and import landscape as a whole.

Vietnam and Canada trade relations

According to the Vietnam Chamber of Commerce and Industry (VCCI), the CPTPP brought about impressive trade outcomes between Vietnam and Canada since the agreement came into effect.

The CPTPP establishes duty-free access for trade in goods between Canada and Vietnam, along with the elimination of tariffs for Canada in crucial export areas. The agreement also serves to help Vietnamese consumers purchase high-quality products from Canada at affordable and reasonable prices.

Canada has eliminated 94 percent of tax lines for Vietnamese imports, and Vietnam has eliminated approximately 66 percent of tax lines for Canadian imports. The Vietnamese market share in Canada is 1.1 percent in Canada, compared to 3.1 percent in Japan, 1.9 percent in Australia, and 1.6 percent in New Zealand.

This demonstrates further room for improvement and opportunities between Vietnam and Canada to further bolster trade activities between the two countries.

Bilateral trade landscape

In 2020, bilateral trade between Canada and Vietnam reached a figure of US$8.9 billion, up 12 percent from 2019, and 37 percent from 2018. On this issue, the VCCI Chairman claimed that though the bilateral trade growth rate slowed down in 2020 due to the COVID-19 pandemic, it still remains to be twice the figure of Vietnam’s export average.

Since 2015, Vietnam has been Canada’s largest trading partner in the ASEAN region. In 2020, Vietnam was the second-largest destination in ASEAN for Canadian agricultural and seafood products.

Further, statistics reveal that the total value of Vietnamese exports to Canada increased by 16 percent in 2020, with major growth for mobile phones, footwear, furniture, and apparel. These benefits are expected to continue to grow as the CPTPP agreement expands and more member nations such as the UK join the agreement in the future

During January and February of 2021, Vietnamese exports to Canada increased by 14.8 percent, reaching US$663.45 million. This is a 78.67 percent increase compared to the same period in 2018 before the CPTPP came into effect.

Major Canadian import industries

The Canadian industry is competitive in some of Vietnam’s top import areas, such as telecommunication equipment, wood products, and agri-fishery products. These products represent new opportunities for Canadian businesses.

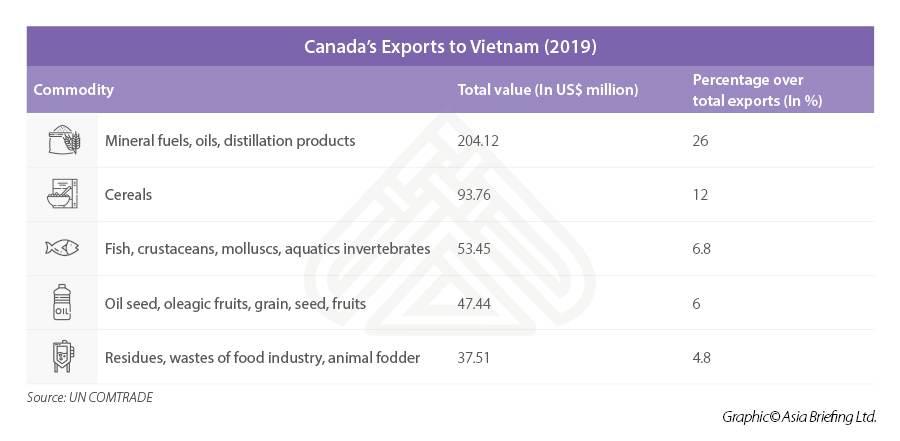

Canada’s top five exports to Vietnam in 2019 were mineral fuels (26 percent, US$ 204.12 million), cereals (12 percent, US$ 93.76 million), fish and aquatics (6.8 percent, US$ 53.45 million), oilseed and fruits (6 percent, US$ 47.44 million), and residues (4.8 percent, US$ 37.51 million).

However, Canada’s top exports to Vietnam do not contribute directly to Vietnam’s growing infrastructure system. Although machines are among Canada’s top exports, it represents only a fraction of the amount that China and South Korea export into the country.

Opportunities for Canadian investors

Investors that target sectors that align with Vietnam’s development goals, such as the shift towards sustainability, are the most viable long-term investment projects. For example, former Prime Minister Nguyen Xuan Phuc publicly requested Canadian support in solar energy to develop clean technology, where investment from Canada remains quite low, despite is competitiveness in the sector.

On similar grounds, the government of Canada has brought attention to emerging opportunities such as the education industry in Vietnam. Vietnam spends US$3 billion per year on overseas study.

Similarly, information and communications technology (ICT) has become the foundation of Vietnam’s modern development: the 4G network was established in 2017, leading to the growth of big data and analytics, as well as finance and technology. Meanwhile, Vietnam’s development continues to create opportunities for Canadian businesses in infrastructure, planning and design as new materials, construction, operation, and project management will be required.

The CABC has called for increased support to small and medium-sized businesses looking to take advantage of the CPTPP while expanding Canada-Vietnam business collaborations in prioritized sectors such as agri-food, aerospace, infrastructure, financial services, and the digital economy

Through the two-year period that the CPTPP came into effect, Canadian businesses have been obtaining a competitive advantage. While Vietnam holds a prominent place among other ASEAN countries in relation to Canada, exploring opportunities that already exist in Vietnam is worthwhile given the progress already made.

However, successful integration into the market requires a strategic approach to Vietnam’s low costs, young and growing population, and increasingly open economy. In addition to identifying key industries, Canadian investors should become familiar with the current legal and tax environment. Canadian business leaders can play a key part in the development of the modern economy in Vietnam if they become more proactive.

Note: This article was first published in April 2021, and has been updated to include the latest developments.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Reducing Business Costs in Vietnam amid the Pandemic

- Next Article Vietnam Issues Preferential Tariffs, Rules of Origin Guidelines for UKVFTA