ERP Application Landscape in Vietnam

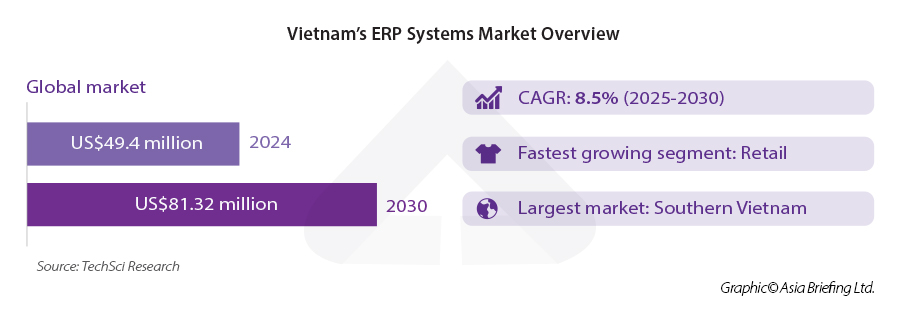

As the enterprise resource planning (ERP) application continues to gain prominence in the Asia-Pacific region (APAC), Vietnam is emerging as a fast-growing market, projected to reach a compound annual growth rate (CAGR) of 8.5 percent by 2030.

Vietnam’s ERP market on the up

According to Statista, Vietnam’s enterprise software market is projected to generate US$277.58 million in revenue by 2025 and grow to US$414.50 million by 2030, with a robust CAGR of 8.35 percent. Additionally, other forecasts indicate that the country’s ERP market will experience a strong 8.5 percent CAGR during the same period.

The market has recently seen substantial growth due to increased digital technology adoption across sectors as Vietnamese businesses pursue operational efficiency and improved decision-making through ERP solutions.

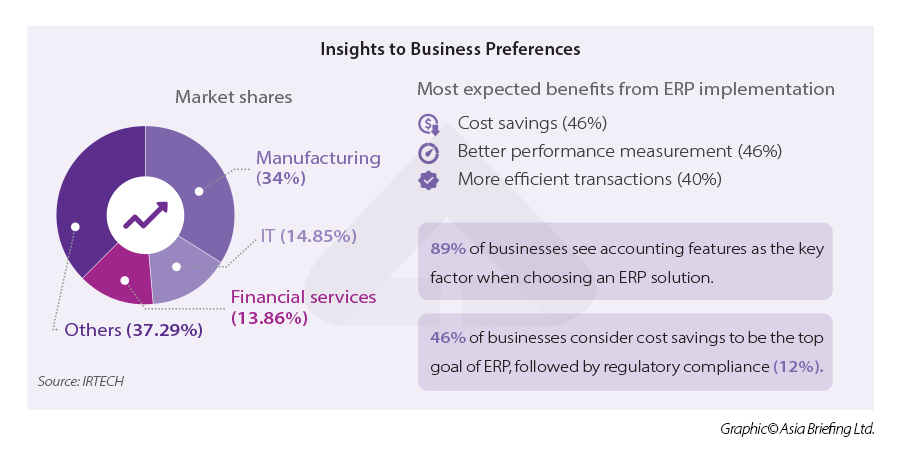

The trend indicates a significant rise in the adoption of ERP systems among small and medium-sized enterprises (SMEs), in tandem with large companies seeking advanced, scalable solutions. Leading sectors like manufacturing, retail, logistics, and financial services are the top adopters, emphasizing improvements in supply chain operations, inventory management, and customer relations. Furthermore, both domestic and global ERP providers are enhancing their services to cater to the unique requirements of Vietnamese businesses, leading to increased competition and innovation.

Market dynamics

Vietnam’s digital transformation is significantly enhancing the ERP market as enterprises strive to improve operational efficiency. In alignment with the country’s embrace of Industry 4.0, demand for ERP systems is expected to rise. According to Vietnam’s Ministry of Information and Communications (MIC), there are now over 1,500 Vietnamese digital technology enterprises offering services and products to foreign markets.

The MIC has also reported a 30 percent increase in the number of these companies and a 32 percent growth in the industry’s revenue from 2019 to 2023.

Growing demand

A primary driver of the demand for ERP solutions is the increasing need for industry-specific and localized applications.

Localization is essential for accommodating local practices, ensuring regulatory compliance, and addressing linguistic needs, thereby attracting more businesses to ERP solutions. As various industries recognize the benefits of specialized ERP systems, this customized approach is expected to stimulate market growth.

Tech-savvy population

As of early 2024, DataReportal reported that Vietnam had 78.44 million internet users and an internet penetration rate of 79.1 percent, while the Vietnam Internet Association (VIA) anticipates that Vietnam will surpass 100 million internet users by 2029. These figures reflect the population’s capability to adopt and leverage digital revolutions, which will further drive ERP adoption among businesses in Vietnam.

Governmental support

Governmental support for digital transformation is essential for the expansion of the ERP market. The Vietnamese government has provided financial incentives, training programs, and funding opportunities to promote digital transformation among SMEs, which includes the adoption of ERP systems. These initiatives encompass tax incentives, grants, and partnerships with international organizations to strengthen technological capabilities.

Infrastructure enhancement

Additionally, efforts to enhance digital infrastructure, including high-speed internet access and e-government services, are facilitating the seamless integration of ERP systems. The Vietnamese ERP market is well-positioned for growth, with the digital economy valued at US$23 billion in 2022, reflecting a 28 percent increase from the previous year. Forecasts suggest the market will reach US$45 billion in 2025.

Risks of ERP systems

Cyberattacks

An ERP system is a lucrative target for hackers due to the enormous centralized data it contains from different departments of a company. These cyberattacks can come in multiple forms, such as phishing, malware, or ransomware, and can pose a wide range of risks to business operations. These include:

- Loss of critical data: Hackers can steal important information such as customer data, financial information, or trade secrets, leading to legal consequences and loss of trust.

- Business disruption: Cyberattacks, such as ransomware, can paralyze ERP systems, halting critical processes like production and supply chain management.

- Financial loss: Cyber incidents can result in significant financial costs, including recovery expenses, ransomware payments, and lost revenue. Companies may also have to invest more in security solutions post-incident.

- Reputational damage: A major security breach can severely harm a company’s reputation, causing a loss of customer trust and market share.

- Legal and compliance risks: Failing to protect data adequately can lead to violations of data protection regulations, resulting in hefty fines and lawsuits.

- Long-term business strategy impact: An attacked ERP system can disrupt long-term strategic plans, such as market expansion or digital transformation.

Unauthorized access

Unauthorized access, where unauthorized individuals gain access to sensitive data, poses a serious threat to ERP systems. This threat arises from both external sources (hackers) and internal ones (employees or partners), with potentially severe consequences if not controlled. Poor access management contributes significantly to unauthorized access, as many companies lack clear policies or fail to regularly review permissions, which can allow inappropriate access to sensitive data.

Weak or compromised passwords worsen this issue, as users often choose easily guessable passwords or reuse them across multiple accounts, making them vulnerable to brute force or credential stuffing attacks.

Software vulnerabilities

Software vulnerabilities are a primary reason why ERP systems are targeted, as they allow hackers to gain unauthorized access, steal data, or disrupt operations. These systems are especially susceptible if not managed properly. Outdated or unpatched ERP versions increase this risk, and vendors will issue patches for new vulnerabilities. However, businesses often delay updates due to cost, time, or lack of awareness, exposing themselves to known threats. A common exploit is SQL injection, where malicious code is inserted into input fields to access or alter ERP databases. This risk can be efficiently addressed by choosing a credible and experienced provider.

Insider threats

Not all threats come from external sources. Employees may inadvertently or deliberately harm the ERP system through data leakage, either due to a lack of knowledge or by intentionally stealing or sabotaging information for personal gain.

Data loss

Data loss can result from system errors, cyberattacks, or insufficient backups. When data is lost, businesses face not only financial damage but also a loss of trust from customers and partners.

How to successfully implement an ERP system

To establish an efficient ERP system, businesses must take proactive steps to manage all challenges and risks, safeguard compliance, and ensure that goals are achievable. The best approach should include:

- Clear analysis of goals and the business’s current state: To adopt an ERP system, a business must understand its challenges now and in the next three to five years, in order to pinpoint investment needs and project scope.

- Well-prepared implementation plan: An implementation plan is essential for successful ERP adoption. The business should set specific milestones before deploying the ERP and share this plan with all participants to ensure clarity on tasks and prioritization. A poorly arranged task list can lead to missed deadlines and cost overruns, increasing the risk of ERP project failure.

- Qualified ERP implementation team: The project manager must acquire in-depth knowledge of business processes. The implementation team should include a main consultant and others focused on project management, ensuring the timely achievement of goals.

- Comprehensive user training: Proper training for both administrators and staff is essential for the system’s effective use, necessitating a combination of theoretical knowledge and hands-on experience.

- Choosing a trusted implementation partner: After setting your goals, select a seasoned provider with experience in similar projects and in your industry.

|

Top ERP Providers in Vietnam (2024) |

|||

|

ERP Provider |

Key Products/Solutions |

Target Clients |

Competitive Advantages |

|

SAP |

SAP S/4HANA, SAP Business ByDesign, SAP Business One |

Mid-sized and large businesses; industries such as manufacturing, retail, and public services |

Global leader, AI & IoT integration, scalability |

|

Oracle |

Oracle NetSuite, Oracle Fusion Cloud ERP, JD Edwards |

Mid-sized and large businesses; industries such as finance, healthcare, and retail |

Strong cloud ERP, multi-industry support |

|

Microsoft Dynamics |

Dynamics 365 Finance & Operations, Dynamics 365 Business Central, Dynamics 365 Customer Engagement |

SMEs; industries such as consumer goods, retail, and manufacturing |

Seamless Microsoft ecosystem integration |

|

Odoo |

Odoo ERP (Enterprise, Community) |

Startups, SMEs, e-commerce & service companies |

Affordable, modular, user-friendly |

Vietnam’s regulations on ERP application

As ERP systems provide compliance solutions for all enterprise functions, they also require a unique set of regulations to control and protect their implementation and operation, ensuring data security for all stakeholders. Although ERP applications are a relatively new area in business operations, Vietnam already has effective regulations governing their implementation and application.

Cybersecurity Law

Effective January 1, 2019, Vietnam’s Law No. 24/2018/QH14 on Cybersecurity (“Cybersecurity Law”) represents a critical shift in the nation’s digital security strategy. This legislation aims to safeguard national security and maintain social order in cyberspace while protecting the legitimate rights and interests of organizations and individuals.

The law’s key provisions include requirements for data localization of certain data types, obligatory cooperation with authorities during cybersecurity investigations, mandatory removal of content deemed a threat to national security, and stricter user data protection and privacy regulations.

Accompanied by Decree 53/2022/ND-CP, the Cybersecurity Law specifies particular data that must be stored in Vietnam. This demands that enterprises using cloud-based ERP establish local data storage or obtain government approval for offshore data processing.

Personal Data Protection Law

On June 26, 2025, the Vietnamese National Assembly officially passed the Personal Data Protection Law (“PDPL”), establishing the country’s first comprehensive legal framework solely dedicated to the protection of personal data. This legislation replaces Decree No. 13/2023/ND-CP, which had served as the interim legal basis for regulating data privacy since its issuance.

The PDP Law aims to strengthen data privacy and governance in Vietnam, aligning with global standards while supporting the government’s broader goals for digital transformation. It applies to both domestic and international entities that process personal data in Vietnam or of Vietnamese individuals, regardless of where the processing physically occurs.

The new law addresses key issues in protecting personal data and regulating how this private information is used. Some of its most important provisions include mandatory registration of certain data processing activities with the MPS, rights of data subjects, consent requirements, data protection impact assessments (DPIAs), and controls on cross-border data transfers.

Data Law

Vietnam’s Data Law, effective July 1, 2025, governs overall data processing, extending beyond just personal data. It introduces essential terms such as digital data, important data, and core data. The law also regulates the development, protection, processing, management, and use of digital data related to business activities. Its goal is to create a national database and data center while opening new market opportunities for local enterprises by recognizing data-related products and services.

Although clarifications for these new areas are still pending, comprehensive guides and regulations are expected soon. The law is part of a wider network of data regulations in Vietnam, which also includes the Cybersecurity Law, the Law on Electronic Transactions, and the PDPL.

Other regulations

In addition to regulations directly addressing data handling, ERP systems must comply with industry-specific rules in Vietnam, such as regulations on electronic transactions, data protection, cybersecurity, tax, and accounting standards.

For example, Vietnam’s Law on Electronic Transactions establishes the legal validity of electronic records, contracts, and digital signatures, provided they satisfy security and authentication standards. For ERP systems, this means that stored documents – such as contracts, invoices, and approvals – must ensure data integrity, non-repudiation, and authenticity to be legally enforceable. Meanwhile, the Law on Electronic Signatures mandates that ERP systems incorporate certified digital signatures from authorized providers for legally binding transactions.

Conclusion

Vietnam’s ERP market is poised for significant growth, driven by increasing digital transformation, demand for localized solutions, and government support initiatives. As businesses recognize the importance of operational efficiency and data management, the adoption of ERP systems is rising across various sectors, from SMEs to large enterprises.

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com

- Previous Article Vietnam Introduces National Blockchain Platform: Enhancing Data Protection

- Next Article Leverage Incentives in Da Nang for High-Tech Investments