Vietnam – Eurasia Economic Union Free Trade Agreement Comes into Force

By: Harry Handley

In May 2015, Vietnam became the first nation to sign a free trade agreement (FTA) with the Russian-led Eurasian Economic Union (EEU) – which also includes Armenia, Belarus, Kazakhstan and Kyrgyzstan. Over a year after it was signed, the FTA finally came into force on October 6th, 2016. Previous Russia Briefing and Vietnam Briefing articles have discussed the background of the deal; now, it is important to assess the impact the FTA is having and will have in future.

Which goods does the FTA cover?

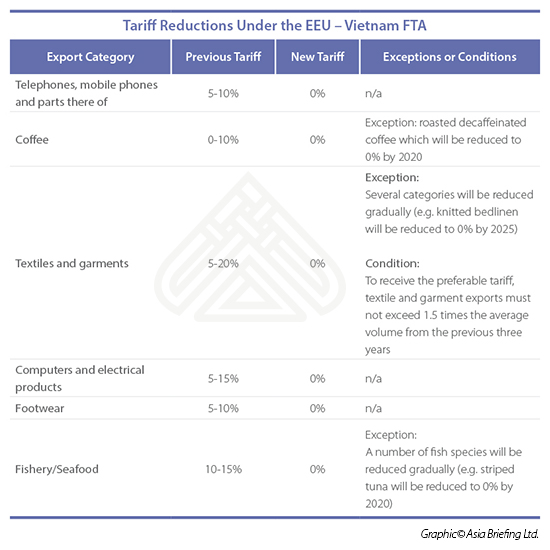

At its core, the Vietnam – EEU FTA will reduce tariffs on 90 percent of goods, with the tariff on 56 percent of goods already having been removed completely as soon as the agreement came into effect. Remaining tariffs will be reduced gradually over a number of years. The table below highlights the reductions in a number of key export categories for Vietnamese companies. All changes are effective immediately unless otherwise stated.

![]() RELATED: Dezan Shira & Associates’ Corporate Establishment Services

RELATED: Dezan Shira & Associates’ Corporate Establishment Services

Current Trade Levels

According to data provided by Vietnamese General Department of Customs, in the first 11 months of 2016, Vietnam exported US$1.5 billion worth of goods to Russia (up to date figures regarding the other EEU members are unavailable). Despite an 11 percent increase from the 2015 level, exports to Russia still account for less than one percent of Vietnam’s total exports which are expected to reach US$170 billion by the end of 2016.

In the two months since the FTA came into force, Vietnamese companies have exported almost US$332 million worth of goods to Russia. Compared to the same two months in 2015, in which US$281 million were exported, this is an 18 percent increase. Even more impressively, the figure since the FTA became active is 27 percent higher than the two months prior to its introduction (US$262 million of exports in August and September 2016). Although it is difficult to say whether this drastic increase is as a direct result of the FTA, it shows promising signs for Vietnamese firms and their trade relationship with Russia.

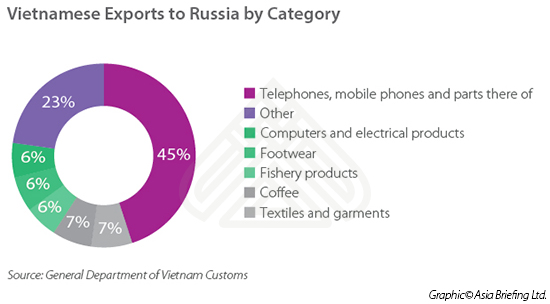

So far in 2016, 24 categories of goods have been exported to Russia in substantial quantities. Telephones, mobile phones and their constituent parts have been the largest segment, with US$682.5 million in exports (45 percent of total exports to Russia). This is followed by coffee (US$108 million; 7 percent), textiles and garments (US$99 million; 6.6 percent), computers and electrical products (US$94 million; 6.2 percent), footwear (US$92.5 million; 6 percent) and fishery products (US$86 million; 5.7 percent).

The most up to date data available for the remaining EEU members (except Kyrgyzstan which has no data available) is from 2014. Kazakhstan received by far the most exports from Vietnam in 2014, with US$220 million; followed by Armenia (US$21.5 million) and Belarus (US$14 million). According to the Vietnam News Agency, Kazakhstan’s demand for Vietnam’s agriproducts makes up a majority of the trade between the two nations.

![]() Making Use of Shareholder Meetings in Vietnam

Making Use of Shareholder Meetings in Vietnam

Expected Trade Levels

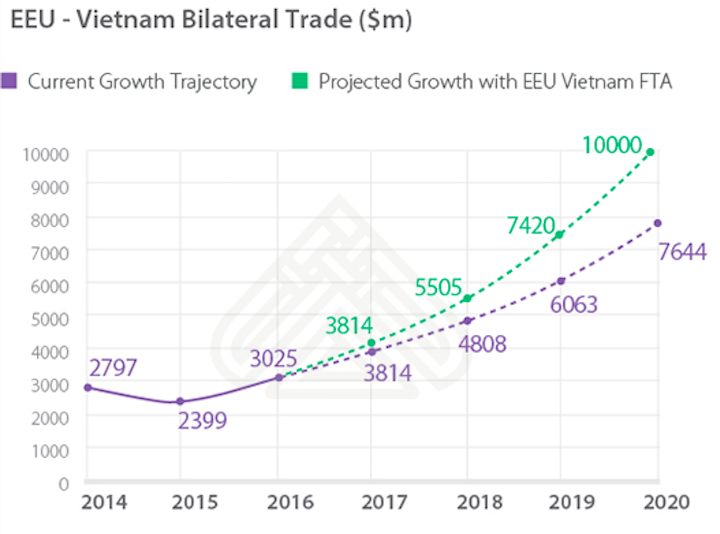

Ambitiously, Russian and Vietnamese officials have set a target of achieving US$10 billion of bilateral trade annually by 2020. As the graph below shows, trade growth rate will have to increase significantly if this target is to be met. At current levels of growth (26 percent year-on-year), bilateral trade will surpass US$7.5 billion per year in 2020 but will miss the target by over US$2 billion. In order to reach the goal set, trade will have to average 35 percent annual growth over the coming four years; a tall task, but a feasible one according to officials on both sides.

Although the FTA removes tariffs on a vast majority of goods traded between Vietnam and the EEU, it does not solve the issue of non-tariff barriers. A number of experts from the Ministry of Industry and Trade (MOIT) have highlighted these as limiting factors to the growth potential of the FTA. For example, the quarantine of Vietnamese farm produce and food safety regulations may restrict the amount of foodstuffs successfully exported to the EEU member states. This makes it increasingly difficult to achieve the target of US$10 billion of bilateral trade by 2020.

What does the FTA mean for Vietnamese businesses?

The EEU presents a market of 181 million consumers which Vietnamese businesses can now access tariff-free; this is expected to increase demand and create savings of up to US$10 million for exporters each year. The influx of imports and competition in the domestic market will also drive Vietnamese firms to be more innovative, hence, increasing their chances overseas.

However, according to the Vietnam Investment Review, ‘technical barriers imposed by the EU and EEU, together with commitments to social responsibility, environmental protection and procedures to enjoy tax preferences, will increase business costs’. Consequently, these increasing costs may ultimately offset the savings afforded by the FTA.

Although exports to the EEU currently make up only a small proportion of Vietnam’s total exports, this is an important agreement for both sides. The Vietnam – EEU FTA could prove to be the catalyst that builds on historic ties to strengthen trade ties and propel the partnership towards the US$10 billion trade target. Only time will tell if trade will grow at a sufficient rate to hit the target and if the removal of tariffs will be enough to overcome the non-tariff barriers that still restrict the trade relationship between Vietnam and the Eurasian Economic Union.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Annual Audit and Compliance in Vietnam 2016

In this issue of Vietnam Briefing, we address pressing changes to audit procedures in 2016, and provide guidance on how to ensure that compliance tasks are completed in an efficient and effective manner. We highlight the continued convergence of VAS with IFRS, discuss the emergence of e-filing, and provide step-by-step instructions on audit and compliance procedures for Foreign Owned Enterprises (FOEs) as well as Representative Offices (ROs).

Navigating the Vietnam Supply Chain

Navigating the Vietnam Supply Chain

In this edition of Vietnam Briefing, we discuss the advantages of the Vietnamese market over its regional competition and highlight where and how to implement successful investment projects. We examine tariff reduction schedules within the ACFTA and TPP, highlight considerations with regard to rules of origin, and outline the benefits of investing in Vietnam’s growing economic zones. Finally, we provide expert insight into the issues surrounding the creation of 100 percent Foreign Owned Enterprise in Vietnam.

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

This edition of Tax, Accounting, and Audit in Vietnam, updated for 2016, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate Vietnam’s complex tax and accounting landscape in order to effectively manage and strategically plan their Vietnam operations.

- Previous Article Vietnam Market Watch: Prospects for Big Steel, New SEZs, and Open Bidding for a State Beer Manufacturer

- Next Article Vietnam Market Watch: Government Contracts, E-Visa Services, and Tax Competitiveness