Vietnam’s Logistics Industry: How Vietnam’s Expanding Economy is Boosting Growth

- Vietnam’s logistics industry is seeing significant growth due to the country’s expanding economy, manufacturing, and e-commerce sectors.

- Aviation, maritime, and road networks carry the bulk of freight, contributing to the industry’s growth.

- New opportunities have opened for technical innovations to improve logistical efficiency.

Vietnam’s logistics industry has been boosted by the country’s booming GDP, rising manufacturing, and e-commerce sectors. In addition, the rapid adoption of e-commerce by the country’s young demographic has increased the demand for expansion in logistic services.

Vietnam aims to develop itself as an export-driven economy. By establishing economic zones and industrial parks, the government is proactively taking steps to foster manufacturing investments, which is another reason why Vietnam’s logistics industry has strong potential.

Logistics on fast-growing trajectory

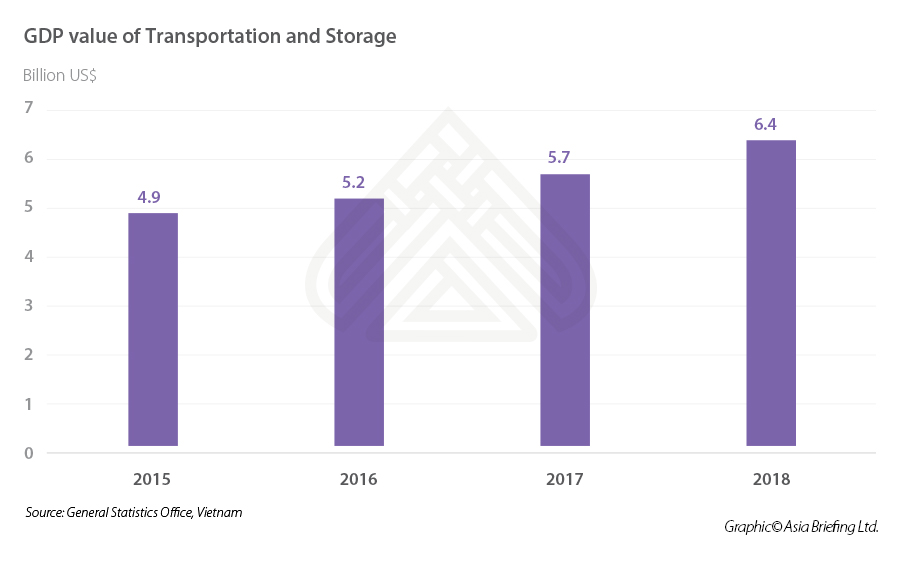

Logistics is one of the fastest expanding sectors of Vietnam’s economy, whose growth may outpace GDP. The country’s import-export revenues reached close to US$390 billion in the first three quarters of 2020. This is a 1.8 percent growth compared to the same period last year as per the General Statistics Office (GSO). The Vietnamese government aims to achieve an annual logistics growth rate close to 20 percent by 2025.

Aviation, maritime, road transport contribute to logistics growth

As per World Bank rankings in 2018, Vietnam demonstrated a significant improvement in its Logistics Performance Index (LPI). It ranked 39 out of the 160 countries, rising 25 places above its position in 2016. Data from the Ministry of Industry and Trade showed that Vietnam’s logistics sector grew by over 12 percent in 2018.

In terms of weight, Vietnam’s cargo throughput has steadily grown between 2010 and 2018, achieving an 8.4 percent compound annual growth rate (CAGR). Over three-fourths of freight tonnage in Vietnam was transported by road, growing five percent in this period. Meanwhile, the share of water transport fell from a quarter portion of cargo tonnage to one-fifth. Railway and aviation sub-sectors together transport less than one percent of cargo by weight.

In terms of freight ton-kilometers, Vietnam’s freight traffic achieved a growth of 9.6 percent CAGR between 2010 and 2018. With a 150 percent growth in this period, the aviation sub-sector was the main driver of growth. Aviation, maritime, and road transport sub-sectors steadily carried about 95 percent of freight traffic.

Rising manufacturing industry

In the past two decades, Vietnam has evolved into a leading manufacturing hub in ASEAN. As the country aims to be an export-driven economy, it requires importing raw materials and then exporting finished goods.

The increasing movement of goods to and from Vietnam has necessitated further development in its logistics sector. Vietnam’s participation in several free trade agreements (FTAs) has further helped augment its manufacturing growth.

Manufacturers diversifying from China

The US-China trade war and the pandemic have forced manufacturers to diversify their supply chains and shipping networks. This has resulted in businesses relocating their operations from China to Vietnam over the last few years. This is also known as the China plus one strategy.

Due to its low labor cost, Vietnam has received a large influx of capital for establishing labor-intensive industries. Thus, the country’s assembling and manufacturing industries have shown significant growth.

Logistics players in Vietnam

Vietnam’s logistics market involves numerous SMEs that provide low-value-added service. Over 90 percent of the country’s 3000-plus logistics firms have their registered capital below US$430,000. The other five percent have capital exceeding US$860,000, while the remaining companies play between these amounts.

Domestic logistic companies face intense competition among themselves and from foreign players. Vietnam’s logistics market is dominated by foreign players, who account for about three-fourths of its revenue.

In Vietnam, over 30 companies provide international logistics services including big names like DHL, FedEx, and Maersk.

Major local players include Vinalines, PetroVietnam Transport (PV Trans), and Viettel. Vinalines mainly offers services in port operations, shipping, and logistics, while PV Trans focuses on maritime transport and services for the oil and gas industry. State-owned Viettel Post provides a broad spectrum of services such as courier and warehouse rental.

The logistics services tend to be outsourced in Vietnam – characterized by basic and specialized services. Basic services include transport and warehousing. Specialized services include higher-order services such as the management of warehouse, inventory, and vendor; processing of orders; liaising with customs; and reverse, and climate-controlled logistics.

Logistic companies in Vietnam are established as follows:

- MNC and JV – Multinational and joint venture companies typically attract foreign investments. They target international clients in Vietnam by providing logistics packages;

- State-owned companies or corporations, which dominate the local logistics market; and

- Joint-stock and private companies, which primarily rely on private-sector customers. These are small companies with limited capital that have the potential to develop.

Government’s push for maritime transport

Vietnam’s geography gives it a logistical advantage that comes from its proximity to China. A long coastline that spans over 3000 kilometers and a vast network of rivers gives Vietnam a significant potential to develop its maritime transport.

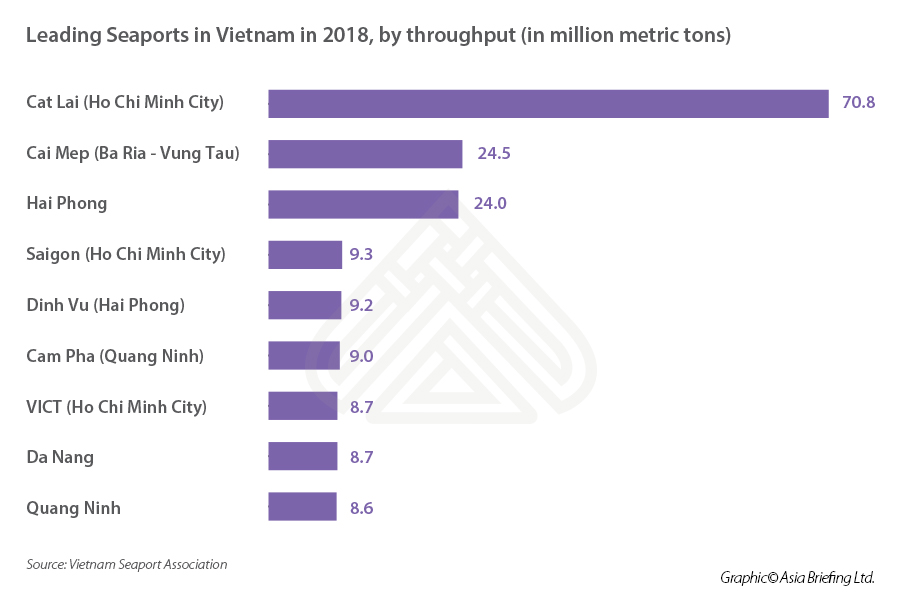

Vietnam’s current maritime network includes 44 major seaports. However, Vietnam has a number of smaller ports as well, which takes the total number of ports in the country up to 320. Ho Chi Minh City’s Cat Lai is the biggest and most advanced port in Vietnam. In 2018, it handled nearly a quarter of the country’s 293 million metric tons of sea cargo. Its 71 million metric tons throughput exceeds that of the next four largest ports combined.

The throughput of the country’s seaports increased by one-fifth between 2017 and 2018. These seaports handled over 520 million metric tons of cargo in this period. Vietnam has over 1300 SMEs engaged in maritime logistics, which fulfill a small fraction of market demand.

The Vietnamese government is empowering its maritime industry to raise contribution to a tenth of GDP by 2030. This includes raising the maritime sector’s GDP contribution of coastal cities and provinces from 60 percent in 2017 to over 65 percent by the next decade.

Further, there are plans to enhance the country’s maritime throughput at over 1000 tons per year. These efforts complement the government’s vision to reduce the country’s reliance on road networks. Nevertheless, Vietnam’s maritime sector will require significant investment for further development.

Opportunities in logistics

The logistics sector presents a whole range of opportunities, which include:

Storage and distribution: Opportunities exist for developing warehousing infrastructure and distribution centers. There is a need to integrate existing storage infrastructure with other logistic functions, such as transportation, inventory management, cold chain, customs facilities, and warehouse management.

Software solutions: Most of Vietnam’s warehouses and distribution centers lack software packages like Warehouse Management System (WMS) and Transport Management System (TMS). A WMS is essential for modern supply chain management, as it automates the process of order fulfillment from accepting raw materials to dispatching finished goods.

The WMS takes care of routine tasks such as picking-and-placing goods, scanning barcodes, and RFID tags, and updating inventory records in the ERP system instantaneously. The TMS system, helps shippers in scheduling, fulfilling, and optimizing the delivery process.

Learning resources: The rapid expansion of the country’s logistics has increased the demand for a skilled and experienced workforce. The industry needs advanced and reasonably priced logistics programs. Local universities also have opportunities to introduce such programs.

Temperature controlled logistics: Import and export of perishable items like food and drugs have created a demand for climate-controlled logistics. In light of the pandemic, the need for the transportation of vaccines will provide further opportunities for temperature-controlled logistic operators.

Last-mile delivery: The massive boom in Vietnam’s e-commerce has created several opportunities in the delivery sector. Services like two-hour and one-day delivery have great potential as the country’s growing middle-class can afford such value-added services.

High costs, infrastructure leading barriers

The logistics industry in Vietnam continues to face high costs. Logistics costs are 6 to 12 percent higher than that of Thailand, China, and Malaysia. These high costs may affect the manufacturing sector’s competitiveness that import raw materials and export finished goods. However, the Vietnamese government has been proactively taking actions to reduce these by improving its transport infrastructure. These efforts have resulted in a significant decrease in logistics costs, from 25 percent to 16 percent of GDP in the last decade.

Underdeveloped infrastructure has restricted the capacity of several seaports in the country. For solving this issue, certain seaports have started collecting fees for using infrastructure and service facilities. In 2017, Haiphong set this trend, with Ho Chi Minh City following by announcing similar fees from July 2021.

These fees should supplement an additional revenue of US$130 million to Ho Chi Minh City and US$70 million to Haiphong. The government aims to use this collected revenue to develop transport infrastructure to ease jams at seaports.

The widespread fragmentation in Vietnam’s logistics market may be a considerable bottleneck in tapping its full potential. Also, customs procedures are largely manual, slow, and will need work on improving efficiency. However, the government has introduced several measures including the online submission of documents to ease customs procedures.

The country will also need to standardize the cargo inspection process in seaports and airports. The highways linking industrial centers with ports are heavily congested, and their expansion can further benefit the industry.

Currently, not all logistics facilities are located close to ports and manufacturing hubs. Thus, new warehouses and distribution centers will need to be positioned closer to such hubs to facilitate the movement of goods.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Warum Vietnams Aussichten für 2021 rosig aussehen

- Next Article Vietnam beschließt Arbeitsgesetzbuch für 2021