Reshaping Vietnam’s Socio-Economic Zones: A Post-Merger Outlook

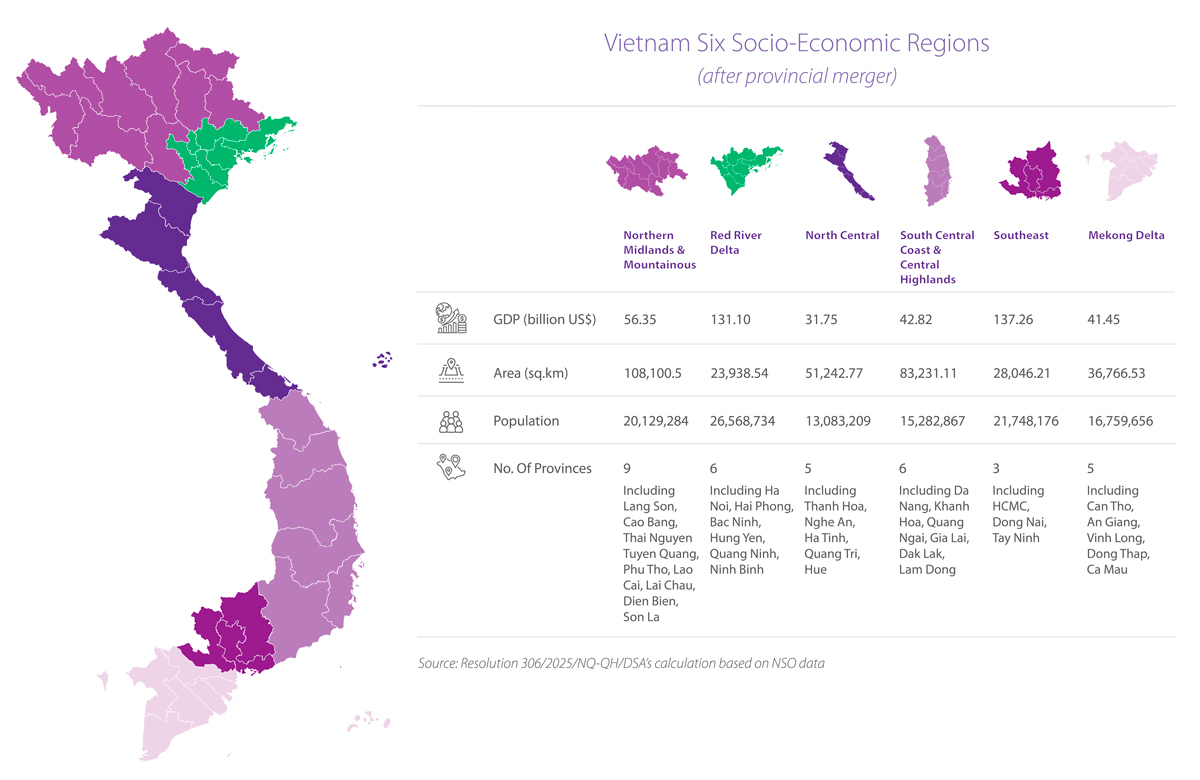

Vietnam has recently announced plans to reorganize six integrated socio-economic zones. The restructuring is set to create stronger development corridors, enhance regional complementarities, and improve competitiveness.

On October 5, 2025, the government approved Resolution No. 306/NQ-CP on adjusting the National Master Plan for the 2021-2030 period, with a vision toward 2050. One of the key developments is the reorganization of provinces within the Central region.

Specifically, the Central Coastal region will be detached from the North Central Coast region and merged with the Central Highlands. This results in the establishment of two new regions, including:

- The North Central Coast region; and

- The South Central Coast and Central Highlands region.

This reallocation of provinces aligns with the previous rollout of provincial consolidation plans, aiming to optimize North-South regional connectivity across the country.

To better understand the Government’s strategic orientation in regional planning, this article examines the reorganization of these regions, evaluates their economic prospects, and provides insights to support businesses in navigating emerging opportunities within Vietnam’s rapidly evolving market.

Why does Vietnam restructure its six socio-economic regions?

Vietnam occupies a strategic position at the heart of the Asia-Pacific region, with its coastline facing the East Sea (also known as the South China Sea). The country serves as a maritime gateway for Laos, Northeast Cambodia, and Southwest China, while also functioning as a bridge between China and ASEAN.

Originally, under Resolution No. 81/2023/QH15 (“Resolution 81”) on the National Master Plan for 2021–2030 (with a vision toward 2050), Vietnam was divided into six key socio-economic regions with clear separation between mountainous and coastal areas.

A significant shift occurred with Resolution No. 60-NQ/TW (“Resolution 60”), adopted on April 12, 2025, which approved a major restructuring of administrative boundaries, consolidating provinces and cities into 34 provincial-level units nationwide. The new planning framework merges mountainous and inland provinces with coastal areas to leverage regional resources, establish complementary development pathways, and promote mutual support. This integrated approach aims to stimulate economic growth across all administrative units following the restructuring.

See also: Vietnam Officially Consolidates from 63 to 34 Provinces and Cities

With the official reorganization plan, Vietnam’s six socio-economic regions are undergoing a profound transformation, not only in geographical boundaries but also in their internal potential, unlocking new avenues for growth and development.

Northern Midland and Mountainous region

Following the recent administrative restructuring, the Northern Midlands and Mountainous Region now comprises nine provinces: Thai Nguyen, Cao Bang, Dien Bien, Tuyen Quang, Phu Tho, Lai Chau, Lao Cai, Lang Son, and Son La.

Despite a reduction in natural area, it remains Vietnam’s largest region, accounting for over 33 percent of the national territory and holding abundant mineral and rare earth reserves.

The region has strategic significance for economics, politics, security, and foreign relations, given its proximity to China’s Southern Economic Corridor, which is home to major global manufacturing and technology hubs. This location provides strong potential for developing an open economy and expanding trade through improved transport networks.

The area is particularly rich in mineral resources, including coal, iron, lead, zinc, copper, apatite, pyrite, limestone, and clay used in cement, bricks, refractory materials, and other industrial products. Large rare earth deposits are concentrated in Lai Chau, Lao Cai, and Yen Bai, with the Lai Chau mines holding the largest reserves in the country, suitable for industrial-scale extraction. However, development remains constrained by mountainous terrain, limited infrastructure, and a shortage of skilled labor, ranking only 5/6 regions in FDI attractiveness. The poverty rates of this region’s provinces are still high, while the population density remains low.

The government has set a GRDP growth target of 9-10 percent per year for the period 2026-2030, with a focus on establishing the Thai Nguyen – Phu Tho industrial belt as a key growth driver of the entire region. These two provinces are also among the most attractive destinations for FDI within the region. Specifically:

- Thai Nguyen leads national smartphone output, producing 102.45 million units in 2022 (70.5 percent of Vietnam’s total), driven by major projects from Samsung (South Korea); and

- Phu Tho, on the other hand, has attracted large-scale investments in textiles, renewable energy, and electronics, including projects from INOUE (Japan, US$90 million), Yida (China, US$113 million), Regent Vietnam (US$180 million), BYD (China, US$269 million), and VSUN (Japan, US$200 million).

Red River Delta

The Red River Delta has been reorganized from 11 provinces into six localities, including Hanoi, Hai Phong, Ninh Binh, Bac Ninh, Hung Yen, Quang Ninh, and Ha Nam.

This area includes Bac Giang, which is expected to boost the region’s competitiveness in electronics, logistics, and high-tech manufacturing. The region also has direct access to international seaports in Hai Phong and Quang Ninh, facilitating both domestic and international trade.

With 26 million residents, accounting for 23 percent of the national population across 23,938 km2, the Red River Delta is Vietnam’s most densely populated region and aims to achieve an average annual GRDP growth rate of 11 percent in the next five years. It benefits from a prime location, rich resources, a skilled labor force, and strong private sector growth, ranking second nationwide in both enterprise numbers and FDI attraction.

The region’s manufacturing landscape post-merger maintains the old robustness, yet experiences a clearer refocus. Specifically:

- Bac Ninh, expanded to over 4,700 km2 and 3.4 million people after merging with Bac Giang, is now home to more than 30 industrial parks, the largest concentration in northern Vietnam. It anchors the country’s electronics and semiconductor supply chain, hosting global leaders such as Samsung, Foxconn, Amkor, Hana Micron, Canon, Goertek, and Luxshare. In addition, the government is planning for a mega project – Gia Binh International Airport. The first phase is scheduled for implementation in 2030, expected to accommodate 30 million passengers and handle 1.6 million tons of cargo annually;

- Hai Phong and Hung Yen ranked third and fourth in FDI nationwide, with US$1.24 billion and US$1.1 billion in newly registered capital; and

- Hanoi and Quang Ninh recorded US$273.2 million and US$181.3 million, respectively.

The region has emerged as a high-tech manufacturing and logistics hub, attracting major investors including Samsung, LG, Hyundai, Skoda, Fujifilm, Foxconn, Goertek, and Amkor. The concentration of global technology players in these provinces continues to create a powerful ecosystem effect, drawing suppliers and partners and reinforcing the Delta’s role as a premier investment destination in Vietnam and Southeast Asia.

North Central Coast

After the merger, the North Central region comprises eight localities, including: Thanh Hoa, Nghe An, Ha Tinh, Quang Tri, and Thua Thien Hue.

It covers 15.5 percent of the country’s territory and is home to 13.1 million people, as of 2024. The region possesses a long coastline, offering vast potential for the development of the marine economy. However, it continues to face major challenges, including frequent natural disasters such as storms and floods, significant disparities between coastal and western mountainous areas, and underdeveloped east–west transport infrastructure.

For the 2026-2030 period, the region targets an average annual GRDP growth rate of 10 -10.5 percent, prioritizing to enhance the efficiency of seaports, coastal economic zones, and industrial parks, especially between Thanh Hoa (Nghi Son Economic Zone), Nghe An (Dong Nam Economic Zone), and Ha Tinh (Vung Ang Economic Zone), which is expected to serve as the industrial heartland of the region. Specifically:

- Thanh Hoa currently leads the Central region in FDI attraction, driven by the US$9 billion Nghi Son Refinery and Petrochemical Project, which has positioned the province as Vietnam’s national hub for energy and petrochemical industries.

- Nghe An has emerged as a center for high technology, electronics, and supporting industries. As of 2024, the province has attracted over US$1.5 billion in investments from six leading global technology corporations (Foxconn, Luxshare, Goertek, Everwin, Juteng, and Sunny).

- Ha Tinh has attracted US$12 billion in investment for the Formosa Ha Tinh Steel Complex, transforming the province into a global-scale steel production hub. In addition, Ha Tinh is attracting new projects in LNG power generation and renewable energy, paving the way for diversified growth in line with Vietnam’s ongoing energy transition.

Meanwhile, Thua Thien Hue is expected to emerge as a center for cultural industries, science and technology, higher education, quality healthcare, seaport services, and international finance.

South Central Coast and Central Highlands

Vietnam’s Central Coast and Central Highlands consist of six provinces: Da Nang, Quang Ngai, Gia Lai, Dak Lak, Khanh Hoa, and Lam Dong. The Central Highland, which used to be the least populated and most isolated mountainous area in the country, has now been integrated with coastal provinces, creating a direct connection between mountains, forests, and the sea. Experts note that this integration helps the Central Highlands avoid isolation caused by mountainous terrain while opening up new development opportunities.

The region targets an average annual GRDP growth rate of 9.5-10 percent through 2030, with the main focus on expanding the expressway network, upgrading intra-regional transportation infrastructure, and developing key road corridors connecting major urban centers, including the Southeast region, southern Laos, and northeastern Cambodia.

Key highlights of the restructured Central Coast and Central Highlands include:

- Da Nang City: Da Nang has become a leader in attracting foreign direct investment (FDI) with several high-profile projects, such as the AIDC DeCenter data center by IPTP Networks (US$200 million), the semiconductor Fab-Lab (US$80 million), and the ICT VINA III manufacturing facility of Dentium (US$177 million). Looking ahead, Da Nang is expected to experience significant transformation through strategic projects like the Da Nang Free Trade Zone (FTZ), the Da Nang International Financial Centre (IFC), and the Lien Chieu Deep-Sea Port, along with major upgrades to transportation infrastructure. These developments offer substantial opportunities for urban expansion, industrial growth, and logistics services;

- Gia Lai: The province is expected to provide raw materials and energy for processing industries, with exports facilitated through seaports, two airports, and border gates linking to the Indochina region;

- Lam Dong: The province can export agricultural products through Phan Thiet Port, reducing logistics costs; and

- Binh Thuan and Ninh Thuan: Coastal provinces such as Binh Thuan and Ninh Thuan benefit from Central Highlands resources to drive industrial development.

Together, these linkages foster a tightly connected regional ecosystem that enhances complementarities between the highlands and the coast.

Southeast region

The Southeast Region currently comprises Ho Chi Minh City (HCMC), Dong Nai, and Tay Ninh.

Although the number of provinces has been reduced by half, the region has expanded in both population and area, notably with the merger of Long An from the Mekong Delta with Tay Ninh. In total, the region covers 28,046 km2 and is home to 21.74 million people, making it the most urbanized region nationwide. It also generates the highest GDP in Vietnam, accounting for 31 percent of the national total GDP (approximately US$137.26 billion).

The region’s strengths lie in its deep labor pool, integrated supply chains, mature supporting industries, strategic proximity to major seaports, and robust logistics infrastructure. These advantages underpin its role as Vietnam’s leading economic engine.

In the first eight months of 2025, the Southeast region continues to demonstrate strong FDI attraction, with inflows reaching US$1.35 billion in HCMC, US$990 million in Dong Nai, and US$767.3 million in Tay Ninh. This performance underscores the region’s status as a golden destination for international investors, even amid administrative restructuring. Industrial clusters are concentrated in electronics, furniture, machinery, textiles, and packaging, while key global investors include Intel, Nestlé, Coca-Cola, Hyosung, Bosch, Suzuki, Toshiba, Lego, and Pandora.

The mega-metropolis of HCMC

Notably, when Vung Tau and Binh Duong are integrated into HCMC, the expanded city is expected to emerge as a mega-metropolis of more than 6,770 km2 with nearly 14 million residents, becoming the country’s largest urban and industrial hub. Following the merger, HCMC also possesses nearly one-third of Vietnam’s seaports, which is 2.5 times its current capacity, and will boast the most extensive port system nationwide. The city will now own Thi Vai – Cai Mep deep-sea port of Vung Tau, the largest in Vietnam and ranked 19th globally, cementing the city’s role as the nation’s premier maritime and logistics gateway.

Mekong Delta

The Mekong Delta region now consists of five provinces: Can Tho, An Giang, Vinh Long, Dong Thap, and Ca Mau, covering approximately 6,700 km2 with a population of about 16.8 million people.

After the administrative merger, most provinces in the region will gain direct access to the sea. Provinces once considered “inland,” such as Can Tho, An Giang, Dong Thap, and Vinh Long, will now have coastal land. Experts highlight that this transformation opens the door for international trade and creates vast opportunities for the development of marine-based industries, including fisheries, aquaculture, renewable energy, coastal tourism, and the establishment of seaside industrial parks.

The Mekong Delta is already recognized as Vietnam’s leading hub for agriculture and aquaculture, and with ongoing improvements in logistics and connectivity, as well as strong government support for offshore wind development, the region is poised for accelerated growth. Industrial activity is concentrated in food processing and agro-industry, while major investors such as Trungnam Group, Thaco, Orsted, Wilmar International, and Cargill continue to reinforce their role as key players in both domestic and international supply chains.

Importantly, the Mekong Delta’s expanded coastal access strengthens its economic linkages with the Southeast region and the Red River Delta, ensuring greater integration into national supply chains and enhancing Vietnam’s connectivity to global markets.

Takeaway

As Vietnam navigates this transition, the country stands to benefit from stronger regional complementarity, more efficient governance, and enhanced competitiveness on the global stage. With each region shaping a distinctive economic profile, Vietnam is strategically positioning itself for the next phase of sustainable and balanced growth in an increasingly competitive global environment. Investors are encouraged to seize these opportunities and leverage the evolving landscape to maximize their presence in Vietnam’s dynamic market.

For support with your Vietnam strategy, get in touch with our experts on the ground.

(This article was originally published on September 19, 2025. It was last updated on November 3, 2025.)

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com

- Previous Article Vietnam’s Tax Digitalization Progress in 2025: Highlights for Businesses

- Next Article Vietnam Coffee Market: A Deep Dive into Its Consumers, Challenges, and Prospects