Why Vietnam is Increasingly Focusing on Digital Accounting

Digital accounting is expected to save businesses time and money, contributing to greater efficiency for both businesses and government agencies. In light of this, Vietnam is increasingly focusing on digital accounting as it strives to digitalize its middle-income economy and attract revenue-generating FDI.

The COVID-19 pandemic has accelerated the shift toward digitalization for many businesses not only in Vietnam but globally. It highlights the importance of technology and digital transformation to the survival and evolution of businesses of all sectors. Of that, further development in digital accounting will play a role in modernizing the business environment in Vietnam, which in turn will help generate revenue and attract foreign investors.

What is digital accounting?

Digital accounting refers to the creation, representation, and transfer of financial information into an electronic format. Instead of using a physical paper and pen, all accounting transactions are conducted electronically.

Digital accounting is performed on digital accounting systems. Essentially, digital accounting systems allow users to sync their business bank accounts, transactions, and credit cards with the relevant software.

The system then syncs all these and transactions flow into the accounting software where they are separated into different categories and accounts. Once a business syncs its bank accounts and credit cards with the appropriate accounting software, financial transactions start to show in a queue and are classified into various categories.

Using such digital accounting systems, a company can save time and run a financial report to compare costs and revenue, review profitability, check bank and loan balances, as well as predict tax liabilities.

Fundamental functions that a digital accounting system can provide include:

- Invoicing;

- Accounts payable;

- Bank and credit card syncing;

- Accounts receivable;

- Online payment collection from customers;

- Financial reports generation; and

- User access for tax professionals.

Despite common concerns, digital accounting complements accountants rather than replacing them. By enhancing technology, digital accounting frees accountants from repetitive tasks like compiling, managing, and categorizing data while allowing accountants to focus on more strategic tasks allowing for better decision making.

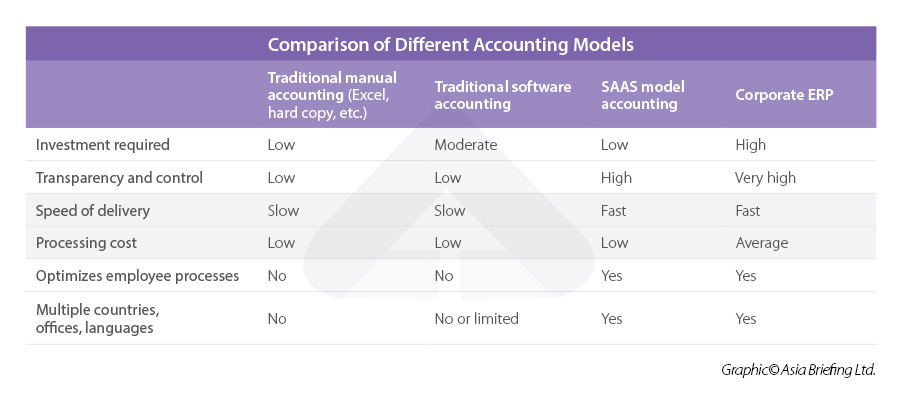

Different approaches to a digital accounting system

A digital accounting system can be achieved through integrated software solutions set up by the company itself or through the software as a service (SAAS) approach, or through other cloud-based system approaches. However, whatever approach is used, there will always be flexible platforms available, which provide digital accounting solutions for free or with upfront fees.

Digital accounting in Vietnam

Digital accounting has gradually become a norm in Vietnam, where many businesses, financial institutions, and household businesses have tried to implement digital accounting into their accounting process. However, there is still room for development and standardization.

The Vietnamese government recently approved the National Digital Transformation Program by 2025, with an orientation toward 2030. The initiative will help accelerate digital transformation through changes in awareness, enterprise strategies, and incentives toward the digitalization of businesses, administration, and production activities.

This signals a significant effort made by the Vietnamese government to bring authorities, business owners, financial institutions, and technology experts to leverage the potential of digital innovation as a whole, which will also provide a significant opportunity for the country to improve and better implement digital accounting.

Tools used in digital accounting

Cloud technology

Cloud technology is what sets digital accounting from other conventional accounting approaches. Centralizing data management provided by the use of cloud technology makes it easier to capture, access, share and analyze data. Besides, data are processed in seconds and business owners can also access this data to make business decisions

AI technology

Similarly, by converting raw data into more manageable formats and identifying connections between disparate data sources, artificial intelligence (AI) can play a supporting role by making data more digestible and comprehensible for accountants.

Accountants, for example, can collaborate with their colleagues from other business units to leverage financial data in order to drive innovation, build supply chains and develop business plans that promote better growth and productivity for the businesses.

Others

Virtual, augmented, and mixed reality technologies as well as blockchain are among technologies that also have powerful accounting potential. These can be augmented into digital accounting systems to create supply chain optimization and better data comprehension.

Vietnam is moving into e-invoices

One aspect of digital accounting that Vietnam is moving into is e-invoices. This year, a list of new regulations and instructions are made simultaneously by the government concerning the use and implementation of e-invoices for enterprises and cooperatives across the country. E-invoices will be mandatory in Vietnam from July 2022.

Particularly, the Ministry of Finance (MoF) issued Circular 78/2021/TT-BTC (Circular 78) guiding the implementation of e-invoices including Decree 123.

As a follow-up to Circular 78, Vietnam also issued Official Dispatch No. 4144 which discusses invoice form numbers, symbol numbers, serial numbers, and guidances for correction of the issued e-invoices.

The latest development reflects the government’s move to reform tax administration and overhaul the informal economy. E-invoices will not only save time and costs, but will also reduce the administrative burden and help in account reconciliation, minimizing billing frauds, and maintaining transparency.

The benefits that digital accounting has to offer for business owners when compared to conventional accounting, can be discussed in three main areas: accuracy, accessibility, and better integration.

Accuracy

When compared to the traditional, manual system, in which columns had to be added up, numbers had to be moved from one page to the next, and trial balance had to be manually compiled, computerized systems have dramatically increased calculation accuracy.

For conventional accounting, should errors occur, many hours would have to be spent attempting to locate and correct them. This issue can be resolved using accounting software.

Last but not least, when relying on an old system, the risk of losing data is significantly high. If important documents are damaged or destroyed, the work may have to be recreated. Copies of the original work are possible but they are likely to be costly and time-consuming.

Accessibility

Another major benefit of a digital accounting system is that it provides you with real-time access to your company’s financial data. This means that professionals do not have to be at the office or carry their laptops to access critical information.

With cloud-based solutions, digital accounting software packages allow employees to log in to the system from anywhere and at any time to track results and data.

This is particularly helpful for cash flow management, investment decisions, and tax liability tracking especially after the pandemic as businesses lean towards a more hybrid work style.

Better integration and syncing

One of the biggest challenges associated with manual accounting systems is poor compatibility with other tools used in the business. The best digital accounting solutions offer flexibility in terms of integration with other business tools such as the point of sale system, payroll, website order fulfillment, and more.

The cost of these integrations is often zero or negligible. These applications comprise ecosystems of hundreds of business applications that enable data sharing freely.

However, not all accounting software offers high flexibility in terms of integrations and two-way data syncing. It is, therefore, important that business owners do their due diligence and examine their accounting system carefully before fully implementing it into their business ecosystems.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam’s Economy to Benefit Most from RCEP: World Bank

- Next Article Q&A: The RCEP Advantage – New Trade Opportunities in Vietnam