Vietnam’s Dong Nai Province: Investment Hub of the South

- Vietnam’s Dong Nai province, located in close proximity to Ho Chi Minh City is an investment hub, part of Vietnam’s southern key economic region.

- Industrial zones remain the backbone of Dong Nai’s investment attractiveness. In 2021, foreign firms invested US$1.17 billion in Dong Nai’s industrial zones. 7,537 hectares of new industrial zones are expected to be added to the current 10,200 hectares.

- Dong Nai has attracted investments in electronic component manufacturing, textile and garment production, and tech-intensive industrial goods manufacturing.

Located in Vietnam’s southern key economic region in Vietnam, Dong Nai has emerged as a hub for foreign direct investments in supporting industries and high-tech manufacturing. The province offers efficient logistics networks and connectivity to Ho Chi Minh City in addition to a wide array of targeted investment incentives.

Numerous factors have contributed to Dong Nai’s emergence as a hub for FDI. These include consistent economic growth, infrastructure assets, the province’s industrial zones, and a supportive investment policy.

Economic growth

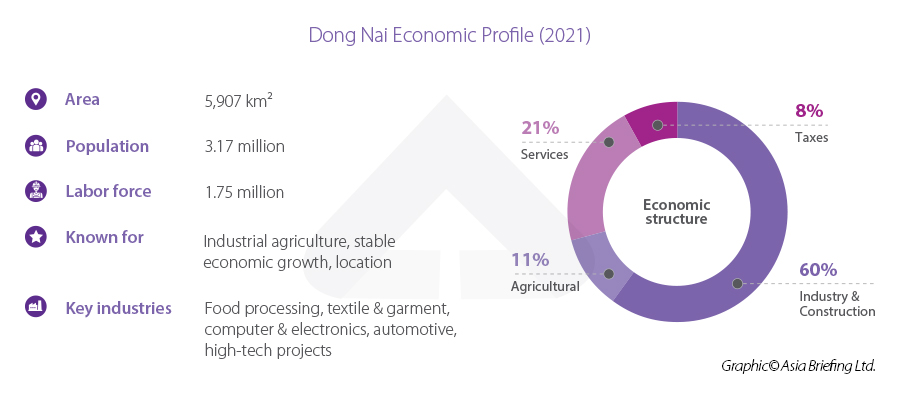

In 2021, Dong Nai’s GRDP was estimated at VND 214.37 trillion (US$9.2 billion). The industry and construction sector grew by 3.21 percent while services contracted by 1.4 percent and agriculture, forestry and fisheries sectors grew by 3 percent due to the effects of the pandemic.

Vietnam Briefing discusses the key drivers of Dong Nai’s economic growth.

Infrastructure

Dong Nai’s location and connectivity is a vital component of its investment attractiveness. In terms of transport connectivity, the province is 62 km (38 miles) away from Ho Chi Minh City’s Tan Son Nhat International Airport. Five national highways (1A, 1K, 20, 51, and 56) pass through the province in addition to the North-South Railway. Numerous road connectivity projects such as the Ben Luc – Long Thanh expressway, and Dau Giay – Da Lat expressway are currently under development.

As is Long Thanh International Airport which will be located in Dong Nai but will serve and eventually replace Ho Chi Minh City’s Tan Son Nhat International Airport. Once completed this airport will considerably shorten travel time between the province and major urban centres in Vietnam. By 2025, expected capacity of the airport is 25 million passengers and 1.2 million tonnes of cargo per annum.

The project plan also includes projects in the surrounding areas including hotels, hospitals, and rail networks. By some estimates, the airport could join the ranks of Singapore’s Changi Airport and Thailand’s Suvarnabhumi Airport as a major cargo and transport hub in Southeast Asia.

The province is also well served by waterway routes and seaports. Dong Nai hosts the Long Binh Tan seaport while the Thi Vai river hosts the Go Gau A and B seaports. These ports handle more than 3.5 million tonnes of annual cargo. The upcoming Phuoc An Port in Nhon Tract district will allow ships with tonnage capacity of 60,000 DWT.

FDI and industrial zones

In 2021, Dong Nai attracted the seventh-largest portion of FDI in Vietnam. Data shows that in 2021, despite the pandemic, foreign firms invested US$1.36 billion in the province, with US$1.17 billion of these investments targeted at industrial zones.

At present, the province’s land use plans reveal that in addition to the current 10,200 hectares of industrial zones, 7,573 hectares of new zones will be added in the years ahead. A majority of these will be concentrated in the Long Thanh, Cam My, Nhon Trach, and Trang Bom.

Demand for spaces in industrial zones has been rising in 2020 and 2021. This is primarily because the pandemic has increased demand for warehouse assets. In the first quarter of 2022, rents in the Southern Key Economic Region rose 9 percent year-on-year. In Dong Nai, average land rents are above US$125 per square meter, which is 60 percent lower than average rents in Ho Chi Minh City. Demand from sectors such as e-commerce and logistics has resulted in occupancy levels as high as 80 percent.

FDI in the province is concentrated in electronic component manufacturing, textile and garment production, and tech-intensive industrial goods manufacturing. Firms from South Korea, Japan, China, Singapore, and Thailand are major investors in the province.

Regional competitiveness

Over the last five years, Dong Nai has consistently improved its ranking in the Provincial Competitiveness Index (PCI). Currently, it ranks 22 in the index, compared to 34 in 2016. Areas of significant improvement include land access, time costs, informal costs to businesses, and rule of law.

Improvements in the business environment over the past five years have supported infrastructure efficiency, investment incentive roll-outs, and industrial zone expansion strategy. For instance, time and informal costs to business are lowered when connectivity is increased, land access in industrial zones is streamlined and businesses have better access to investment incentive schemes.

Dong Nai is also known for its young, dynamic, and capable human resources. The province has seven universities, 10 colleges, and 13 technical schools along with around 50 vocational training centers. The province has also invested in education and healthcare.

For employees working at industrial parks, the province has invested in building housing for workers with supermarkets, restaurants, schools, and other facilities close by.

Investment incentives

Dong Nai’s ability to attract investments in high-tech manufacturing and supporting industries rests on a set of investment incentives. In industries such as electronic components, tools, and machinery equipment, the policy goal is to increase the localization ratio of export products.

This will allow firms to benefit from preferential tariffs through numerous free trade agreements such as the EU-Vietnam free trade agreement (EVFTA). The localization ratio is a crucial measure in determining product origins. Firms such as Bosch, Hyosung, Fujitsu, and Vision Group are invested in such industries.

To attract investment into supporting industries, Dong Nai offers numerous incentives. These include an initial four-year tax exemption followed by a 50 percent reduction in taxes over the next nine years. In addition, the government offers 50 percent expenditure support for pilot projects in supporting industries. In addition, investors who build houses for workers are exempt from paying land rent and corporate income tax.

The province’s Supporting Industries Development Program also offers funding schemes for workforce development, research and development, and technology transfer. These investment incentives have led to Dong Nai growing into a hub of domestic material supply.

Challenges remain, but Dong Nai’s growth trajectory remains intact

While Dong Nai’s growth is positive challenges remain. As investors look to alternate land for investment, land rents in Dong Nai are also increasing with most industrial zones nearing capacity. While the authorities have planned for additional industrial zones, setting up these zones may take time and thus existing structures may be overburdened.

While the investment climate has significantly improved, bureaucratic hurdles and red tape may further add to the challenges. The province has also called for additional investment in high-tech manufacturing as most projects are currently using simple technological innovations for manufacturing.

In addition, many mid-level and foreign expats typically work in Ho Chi Minh City and commute to Dong Nai which leads can lead to long commute times. Dong Nai would need to develop its own cities with large shopping malls and entertainment centers that can match Ho Chi Minh City so that employees can reside there and have an adequate work-life balance. The upcoming Long Thanh airport may encourage the development of such cities in Dong Nai.

Nevertheless, given consistent economic growth despite the pandemic, Dong Nai remains an investment hub and a dynamic locality for foreign investors.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam – Australia Trade and Investment: CPTPP Helps Fuel Growth

- Next Article Lang Son And Guangxi: Picking Your China+1 Destination