Vietnam’s Governance, Admin Reforms Improve: Provincial Competitive Index 2021

Vietnam Briefing highlights key features of Vietnam’s Provincial Competitive Index 2021. For the fifth year in a row, Quang Ninh province topped the list making the province a role model for growth with a positive business environment. Vietnam’s business landscape continues to demonstrate positive signals for both domestic and foreign investors despite the effects of the pandemic.

The Provincial Competitive Index (PCI) introduced in 2005 is a collaborative report developed by the Vietnam Chamber of Commerce and Industry (VCCI) and the United States Agency for International Development (USAID).

The PCI methodology is periodically recalibrated every four years to reflect changes in the business and regulatory environment as well as developments in the business community in Vietnam.

The PCI measures 10 sub-indices:

- Low entry costs for business start-ups;

- Easy access to land and security of business premises;

- A transparent business environment and equitable business information;

- Minimal informal charges;

- Limited time requirements for bureaucratic procedures and inspections;

- Minimal crowding out of private activity from policy biases toward the state, foreign, or connected firms;

- Proactive and creative provincial leadership in solving problems for enterprises;

- High-quality business support services;

- Sound labor training policies;

- Fair and effective legal procedures for dispute resolution and well-maintained law and order.

This year, the PCI was included as a key indicator to evaluate provincial performance in administrative reform as per Decision 288/GQ-TTg issued by the Prime Minister on specifying a framework for assessing the implementation of established socio-economic development goals.

This speaks volumes for the increasingly important role of PCI as an effective tool to measure economic governance and promote administrative reforms at the provincial level.

Highlights from PCI 2021

Quang Ninh tops list for five years in a row

For the fifth consecutive year, Quang Ninh province led in provincial competitiveness among all of Vietnam’s 63 provinces and cities. This achievement resulted from significant efforts Quang Ninh made in 2021 when the provincial government issued Resolution 05-NQ/TU on strengthening administrative reform and improving the business environment and provincial competitiveness.

In 2021, Quang Ninh conducted reviews to improve and simplify administrative procedures, reducing the regulated processing time by 40 to 50 percent.

One of the most remarkable initiatives of Quang Ninh is the introduction of an investment enabling task force, known as the Investor Care panel, which aims to facilitate non-state investments into the province by helping investors address difficulties and obstacles related to investment and land procedures, land clearance, and project operation-related procedures. The provincial authorities also expanded the use of digital media and social networks to actively gather information from businesses and promptly address emerging issues.

Regarding the province’s response to the COVID-19, Quang Ninh effectively implemented the central government’s policy and directions, initiating measures to help businesses safely resume operations, especially in the tourism industry. Aside from tax incentives, fees, social insurance, and credit access, the province also worked with businesses to assure the circulation of goods to facilitate manufacturing, and prevent supply disruption.

Top provinces

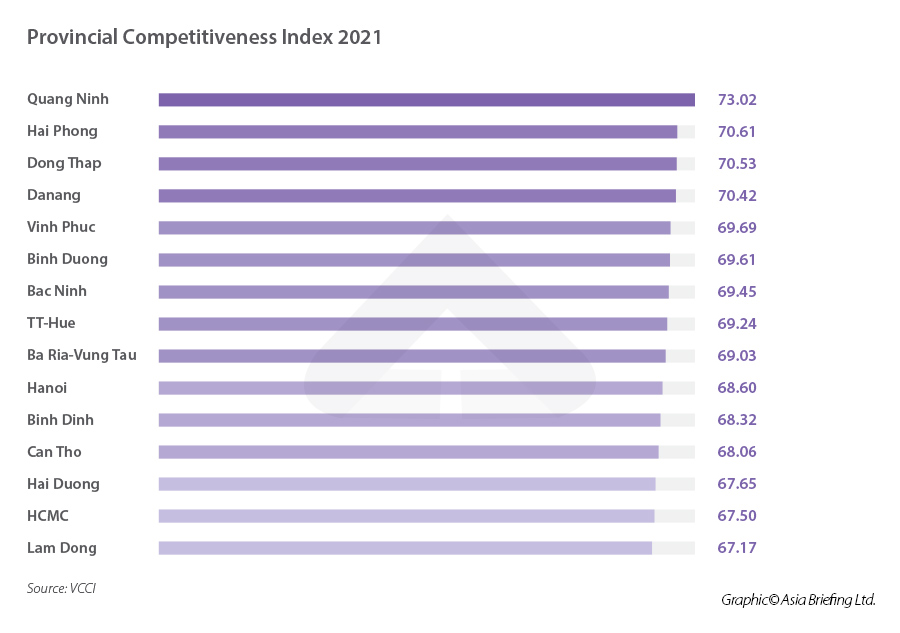

Hai Phong came in at second place for the first time, with a score of 70.61, moving up five places. The province sealed its highest PCI ranking ever, thanks to its improved local business environment.

Dong Thap province maintained its leading status among the Mekong Delta provinces by extending its portfolio to activities supporting entrepreneurship and start-ups and investing in capacity-building to strengthen governance skills for household businesses. This model proved to be an effective medium to strengthen links in local supply chains, particularly those in agricultural produce.

In fourth place was Danang (70.42 points), followed by Vinh Phuc with 69.69 points. The remaining positions in the top 10 were Binh Duong (69.61 points), Bac Ninh (69.45), Thua Thien Hue (69.24), Ba Ria – Vung Tau (69.03), and Hanoi (68.6).

Compared to PCI 2020, two other centrally-run cities, Ho Chi Minh City and Can Tho were not in the top 10. Can Tho ranked 12th with a score of 68.06, while Ho Chi Minh City stood at 14th place with a score of 67.5.

Five localities at the bottom of the PCI 2021 rankings were Ha Giang, Kien Giang, Kon Tum, Hoa Binh, and Cao Bang.

As can be seen in the ranking, Vietnam’s major commercial and industrial cities like Hanoi and Ho Chi Minh City only rank 10th and 145th this year while the top positions belong to Quang Ninh, Hai Phong or the Mekong Delta province – Dong Thap. For investors, the PCI ranking underlines diverse investment options apart from typical destinations such as Ho Chi Minh City and Hanoi.

For new investors, starting a business in Ho Chi Minh City or Hanoi is associated with high costs such as rent fees, land price, and cost of production, which are getting higher due to growing demand. Therefore, Quang Ninh, Hai Phong, and Dong Thap, with their favorable business environments as well as investor-friendly regulations, can be affordable alternatives for investors.

Key features in provincial governance quality

Changes in provincial governance quality can be summarized in the below seven findings:

- Local governments continue to promote proactivity and private sector support;

- Informal charges continue to decline in most policy areas;

- Administrative procedures and settlement efficiency improved, but more reform efforts are needed;

- Compliance with conditional business sublicensing procedures remains burdensome;

- Land access is declining;

- The impact of the Law on Support for Small and Medium Enterprises has had a modest impact on businesses; and

- Information and dissemination of guidance to firms about integration opportunities remain.

Changes in business environment

The areas that receive the most positive remarks from respondents include business registration, access to electricity, procedures related to social insurance, property registration, contract enforcement, and paying taxes.

Nevertheless, there is still room for development and attention in areas like import/export, access to loans and credits, and investor protection. One area that shows significant progress while still needing further attention is bankruptcy settlement procedures.

Additionally, the recent PCI reports show bias toward state-owned enterprises (SOEs) declined significantly in recent years, however, favoritism toward “backyard” firms (those with a certain proportion of State capital) that have close connections with local officials remained relatively widespread.

Further, provincial administrations also became increasingly interested in subjects such as international economic integration and green growth.

Major challenges for the economy

Finding customers and getting credit or loans remain the top challenges businesses faced in 2021. These difficulties were even more pronounced in the two years of COVID-19. Other reported challenges were finding suppliers, finding suitable business sites, and poor quality of infrastructure.

Interestingly, firms’ positive perceptions of the regulatory environment improved noticeably despite some difficulties caused by abrupt regulatory changes and administrative issues.

The government, however, has made effort to ease the pressure on businesses and enterprises. More recently, the government has issued Resolution 11/NQ-CP, which provides businesses a chance to access loans from commercial banks at an annual interest rate of 2 percent to finance business activities in a number of areas.

Positive outlook remains

In 2021, only 34 percent of firms planned to increase operations, continuing the decline from 41 percent in the previous year. At the same time, as many as 16.59 percent of firms reported planning to downsize or close within two years, a record high in PCI history.

Nevertheless, as Vietnam officially set its response policy to “safely adapt with flexibility, and effectively prevent COVID-19,” the number of firms registering establishment and resuming operation recorded in the first quarter of 2022 increased by 36.7 percent year on year.

Total registered capital also increased by 21 percent, including additional capital registered by firms already in operation, which also surged by 34.5 percent. These figures signal a brighter outlook for Vietnam in the coming years and the economy as a whole.

Takeaways

2021 has seen one of the most challenging times due to the prolonged pandemic, disrupted supply chains, and economic turmoil. Nevertheless, provincial economic governance has shown strong improvements in this challenging time with the collaboration of the private sector.

In particular, on a national scale, informal charges continue their downward trend while administrative procedure reforms also receive recognition from businesses and enterprises.

However, further improvements are required regarding business establishment, land, and land access procedures. Provincial governments can also increase their support and guidance to take advantage of the country’s international economic integration and provide support programs that fit small and medium-sized businesses.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam Strives for Full Public Investment Disbursement for 2022-2023

- Next Article Vietnam Approves Tax System Reform Strategy to 2030