Establishing a Manufacturing Presence in Vietnam

Nov. 12 – When looking to expand your manufacturing business into Vietnam, there are a variety of key issues for which extra attention needs to be paid. You need to be aware of not just your potential location, but also what establishing a presence in that location means – specifically with regard to different zone types and any relevant tax or administrative issues.

RELATED: Dezan Shira & Associates’ Corporate Establishment Services

RELATED: Dezan Shira & Associates’ Corporate Establishment Services

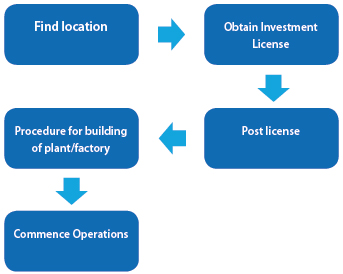

Here are the typical step-by-step procedures for setting up a manufacturing base in Vietnam:

Vietnam has a number of different zones throughout the country in which you can establish a manufacturing presence (e.g. industrial zones and economic zones), and you may be subject to different implications and/or tax rates or incentives when you establish your presence there.

The use of these zones has been beneficial for Vietnam as foreign-owned enterprises located within have created many new jobs for local Vietnamese workers, which has reduced the country’s unemployment rate. As of December 2011, these zones have created over 2 million new jobs, with more than 1.2 million in areas with foreign-invested capital.

Location, Location, Location

Throughout the world, especially in developing countries such as Vietnam, different types of zones play a major part in a country’s economic development.

The use of development zones started in Vietnam about 20 years ago when the United States lifted its trade embargo on the country. Firms investing in these zones typically enjoy preferential governmental policies and advantages like modern infrastructure and greater access to utility services on top of preferential tax and/or tariff rates.

Specifically, the different types of zones in Vietnam are:

- Industrial zone (IZ): A zone that specializes in the production of industrial goods or the provision of services for industrial production and manufacturing. Tax rates for IZs located in an area with “difficult to especially difficult socio-economic conditions” are subject to a 10-20 percent corporate income tax (CIT) in addition to tax exemptions for up to two years and a 50 percent reduction in taxes for a certain number of years (depending on circumstances);

- Export processing zone (EPZ): An industrial zone that specializes in the production of goods to be exported, the provision of services for goods to be exported and any other related export activities. There are currently four EPZs in Vietnam, three of which (Tan Thuan and Linh Trung I, II) are in Ho Chi Minh City, and the fourth and newest one (Linh Trung III) is in Tay Ninh Province;

- Economic zone (EZ): A zone that has a separate economic space with a particularly favorable investment and business environment for investors that is established under the conditions and in accordance with the procedures as specified in the relevant governmental economic zone decree; and

- Hi-tech zone (HTZ): A zone that specializes in the research, development and application of high technologies, nourishment of hi-tech enterprises, training of hi-tech human resources staff and the manufacturing and trading of hi-tech products. There are currently three HTZs in Vietnam: Hoa Lac HTZ in Hanoi, Da Nang HTZ in Danang and Saigon HTZ in Ho Chi Minh City.

In Vietnam, many foreign investors establish their initial presence in one of these types of zones as a way to start up their manufacturing endeavors. Each option has its own unique strengths and weaknesses that you, as a foreign investor, should assess depending on your business needs. For furthermore insight into which zones will suit your specific business, please contact Vietnam@dezshira.com.

Each type of zone, however, tends to have the same basic administrative procedures to follow.

Administrative Procedures

Typically, when investing in one of the above-listed zones, the administrative procedures to set up your initial manufacturing facilities should be done in accordance with the requirements of the local Management Board of Industrial Zones (Board) in the province/city you choose.

Typically, they are as follows:

- Registration to verify your investment (i.e., the Board will issue the relevant investment certificates);

- Issuance of construction permits;

- Issuance of work permits (for both foreign and local Vietnamese employees);

- Issuance of labor books for its Vietnamese employees;

- Compliance with the relevant labor regulations with regard to agreements and contracts;

- Issuance of the relevant commodity origin certificates/licenses; and

- Appraisal/approval of the requisite environmental impact assessment report.

When investors establish manufacturing in areas that are not within a zone, they will be subject to the following administrative procedures:

- Issuance of investment certificates by the Department of Planning and Investment in the province/city where the investor is setting up a manufacturing base;

- Issuance of company seals by the local police department;

- Issuance of a tax registration certificate by the relevant provincial tax department;

- Approval of the requisite environmental impact assessment report; and

- Obtaining the relevant construction permits from the department of construction.

Tax Incentives

When investing inside a zone, investors are entitled to certain tax incentives based on the special tax incentive policies of that particular zone. Specifically:

- For newly set up enterprises in geographical areas with extreme socio-economic difficulties, EZs or HTZs are entitled to an annual tax rate of 10 percent for their first 15 years of operations; and

- For newly set up enterprises in geographical areas with extreme socio-economic difficulties, EZs or HTZs are entitled to tax exemptions for no more than four years and also a 50 percent reduction in payable tax amounts for no more than nine subsequent years.

The duration of the tax exemptions, reductions and incentives is counted starting from the first year in which an enterprise has taxable income or actual turnover. If an enterprise has no taxable income over its first three years of operations, then the relevant tax exemption or reduction duration will start during the beginning of the fourth year of the enterprise’s existence.

Other Taxes

Enterprises that operate in Vietnam are also subject to the following taxes:

- Licensing tax: Paid annually and within the first 10 days of the commencement of the enterprise’s investment certificate;

- Value added tax: Paid on a monthly basis;

- Corporate income tax: Paid on a monthly or quarterly basis;

- Personal income tax: Paid on a monthly or quarterly basis;

- Import/export tax: Paid during the actual import/export of goods;

- Special consumption tax: Paid by enterprises that conduct business relating to special goods (e.g. tobacco, alcohol, and automobiles); and

- Land use tax.

Portions of this article came from the September 2013 issue of Vietnam Briefing Magazine titled “Manufacturing in Vietnam to Sell to ASEAN and China,” which is currently available as a complimentary PDF download in the Asia Briefing Bookstore for a limited time only. In this issue of Vietnam Briefing Magazine, we introduce our readers to manufacturing in Vietnam as a key part of their business strategy within the ASEAN region and beyond. Specifically, we explain the new ASEAN Free Trade Area, outline what foreign investors can look forward to when creating their manufacturing presence in the country, and introduce the country’s key tax points.

Portions of this article came from the September 2013 issue of Vietnam Briefing Magazine titled “Manufacturing in Vietnam to Sell to ASEAN and China,” which is currently available as a complimentary PDF download in the Asia Briefing Bookstore for a limited time only. In this issue of Vietnam Briefing Magazine, we introduce our readers to manufacturing in Vietnam as a key part of their business strategy within the ASEAN region and beyond. Specifically, we explain the new ASEAN Free Trade Area, outline what foreign investors can look forward to when creating their manufacturing presence in the country, and introduce the country’s key tax points.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email vietnam@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Vietnam by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Are You Ready for ASEAN 2015?

Are You Ready for ASEAN 2015?

ASEAN integration in 2015, and the free trade agreements China has signed with ASEAN and its members states, will change the nature of China and Asia focused manufacturing and exports. In this important issue of Asia Briefing we discuss these developments and how they will impact upon China and the global supply chain.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double taxation agreements, and free trade agreements – all of which directly affect businesses operating in Asia.

An Introduction to Development Zones Across Asia

An Introduction to Development Zones Across Asia

In this issue of Asia Briefing Magazine, we break down the various types of development zones available in China, India and Vietnam specifically, as well as their key characteristics and leading advantages.

Expanding Your China Business to India and Vietnam

Expanding Your China Business to India and Vietnam

This issue of Asia Briefing Magazine discusses why China is no longer the only solution for export driven businesses, and how the evolution of trade in Asia is determining that locations such as Vietnam and India represent competitive alternatives. With that in mind, we examine the common purposes as well as the pros and cons of the various market entry vehicles available for foreign investors interested in Vietnam and India.

- Previous Article Business Leaders Meet to Tackle Corruption in Vietnam

- Next Article Vietnam to Introduce Digital Signatures for Customs Declarations