How to Plan a Supply Chain Shift to Vietnam: 3 Guiding Factors

Global supply chain networks have been disrupted since the US-China trade war began in January 2018, prompting several foreign investors to look for manufacturing alternatives. Vietnam Briefing highlights three key steps if planning a supply chain shift to Vietnam.

Vietnam is not without its share of challenges. In the short-term, manufacturers may find the production shift daunting as supply chains have to realign. Companies often struggle to decide what to relocate, how they plan to enter the Vietnamese market, and where they will establish operations within the country.

Those that understand these issues will have a leg-up over their competition in the immediate term, but they will also make more informed decision that will position their operations for success over the their first few years of in-country business operations.

Step 1: Choose production elements to relocate

Companies should approach Vietnam, or any other China plus one investment destination, with a clear understanding of the production that they intend carry out in this market. For most companies, China plus destinations are chosen because of their lower costs, which are well suited for basic manufacturing and assembly.

Those targeting more complex manufacturing should conduct a thorough review of Vietnam’s current labor force, sourcing networks, and infrastructure to ensure that this production will prove feasible.

Companies planning to export finished goods from Vietnam to the US, the EU, or other markets should also have a clear understanding of how the processes carried out in Vietnam will influence the origin of the finished product, and how this will influence tariff exposure.

Step 2: Pick your entry strategy

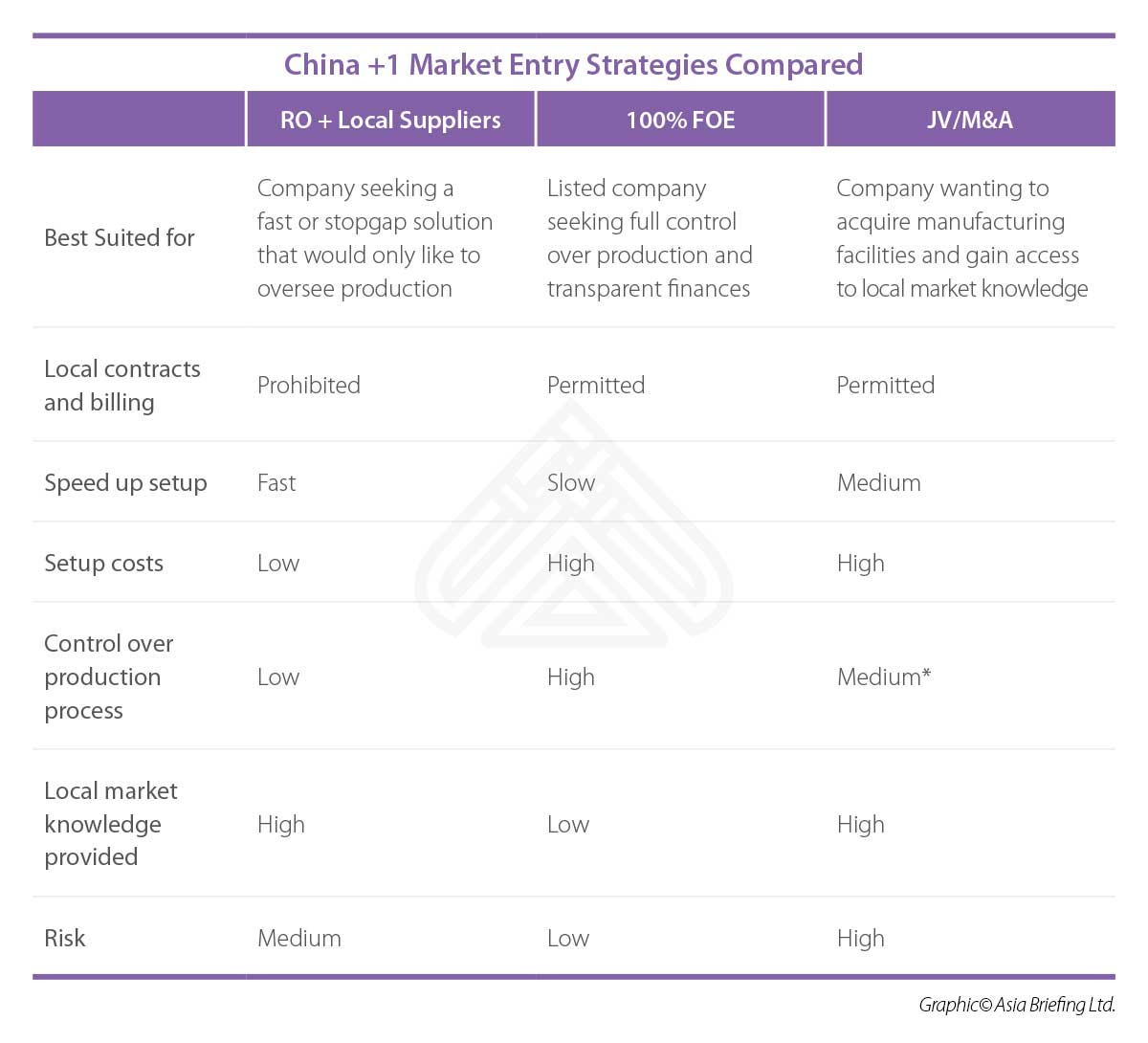

Vietnam provides three main options for market entry: engaging local contractors to fulfill elements of production, establishing a new manufacturing facility, or conducting a Mergers and Acquisitions (M&A) deal with an existing factory.

Representative Office plus local supply partner

Supply partners are a fast solution for companies seeking to restructure supply chains as quickly as possible. Under this model, the foreign company enters into a contract with a local factory to manufacture a set amount of goods meeting the foreign company’s specifications.

Ordering from a local supplier does not require the presence of a local entity. Depending on the supplier in question, it may be possible to find a partner with a good understanding of local logistics and customs clearance.

Companies seeking to work with multiple suppliers on a long-term basis often choose to set up a Representative Office (RO) to oversee production within these facilities, and to act as a cost center for sales activities. This is particularly popular in the garments industry.

Unlike China, Vietnam’s supplier market still developing. Companies that are interested in entering Vietnam through vendors should understand the capacity of the local market to support their production needs.

100 percent Foreign Owned Enterprises

Foreign Owned Enterprises (FOEs) provide the greatest level of access to and maneuverability within the Vietnamese market, allowing investors to engage in profit generating activities across all unconditional investment sectors.

100 percent FOEs let foreign investors maintain full control of their Vietnamese entity. Companies that are listed, have strong supplier networks in China, or are targeting Vietnam as a long-term investment opportunity tend to prefer this method of entry.

Executives that elect to establish their own facilities will forge the ability to tap into the market knowledge of local partners. Companies should develop a clear understanding of Vietnam’s investment environment and make several trips to the country to vet potential locations, logistics providers, and infrastructure networks.

Manufacturing companies overwhelmingly choose to set up factories in Vietnam within Industrial Zones (IZs). The time to set up a legal entity for a 100 percent FOE takes between 4 to 6 months, while full production can take up to a year to get off the ground.

Companies that require a quick relocation often choose to work with local factories during the interim period and transition to full production upon completion of manufacturing facilities.

M&A

A M&A allows investors to gain access to the Vietnamese market quickly by acquiring the business licenses, factories, workforce, and connections of a local company.

The second potential benefit of an M&A strategy lies in the knowledge of the local company, since local partners can provide greater access to suppliers, customers, and sometimes improve a foreign brand’s reputation within the domestic market.

The setup time for M&A is two to four months. However, this does not include the lead-time needed to negotiate an agreement between Joint Venture (JV) stakeholders. Negotiations over stakes, leadership, and structure of stakeholder obligations can often delay setup; however, they are integral to a successful JV and should not be rushed.

Foreign investors engaged in M&A or JVs are exposed to the liabilities of the company that has been acquired and, in the case of a joint venture, may face operational constraints.

Vietnam’s legal and financial reporting systems are opaque and make it easier to conceal ongoing legal disputes and financial liabilities than may be the case in a company’s home market. Companies considering an M&A entry strategy are strongly advised to thoroughly vet any targets.

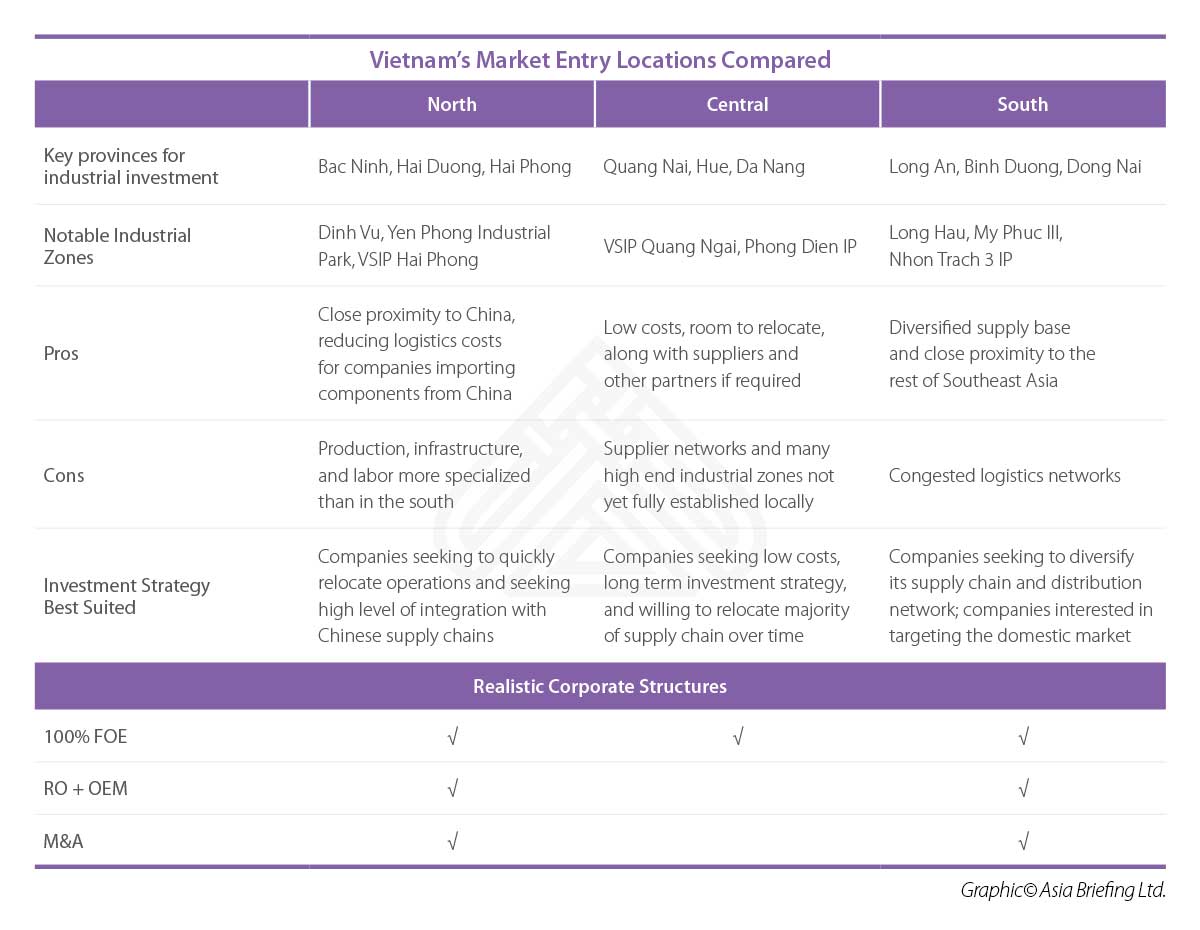

Step 3: Identify an optimal location for investment

Vietnam has three Key Economic Regions (KERs) that host the majority of foreign investment and industrial activity within the country. Each KER provides a unique set of production conditions that lend themselves to different investment strategies. Companies should develop a clear understanding of each zone, the specific provinces within this zone and where industrial activity is carried out.

North

The Northern KER covers the provinces of Hanoi, Hai Phong, Quang Ninh, Hung Yen, Hai Duong, Bac Ninh, and Vinh Phuc. Together, these provinces account for roughly 16.2 percent of Vietnam’s total population and 4.7 percent of its landmass.

Vietnam’s Northern KER is best positioned as hub for China plus one manufacturing investors with time sensitive production chains, especially when shipping components between factories in China.

Central

The Central KER covers the cities Da Nang, Thua Thien Hue, Quang Nam, and Binh Dinh. As of the latest census data taken on a regional level, the region accounted for roughly 7 percent of the national population.

The Central KER yields an investment environment with comparatively less competition than investment hubs in the north and south of the country. In recent years, the region’s largest city Da Nang has benefited from good urban planning and development.

Investors increasingly identify central Vietnam as a low-cost destination because the north and south have become saturated with investment, driving up costs and congesting logistics networks.

South

The Southern KER encompasses the provinces of Binh Duong, Binh Phuoc, Long An, Ho Chi Minh City, Tay Ninh, Dong Nai. Vietnam’s Southern KER is economically diverse. As a result, businesses from more niche sectors are likely to find that the south provides a more suitable environment for investment.

This is particularly true for small and medium sized enterprises (SMEs), since they are likely to benefit from a great degree of balance between support for small and large-scale investment. In recent years, Ho Chi Minh City has become a hub for start-ups and tech entrepreneurs for this exact reason.

Consumption is another major advantage for the southern region. Investors seeking to establish brand identity with Vietnamese consumers are sure to be able to find opportunities in the south, where the country’s largest city, Ho Chi Minh City, offers access to a large consumer base.

For this reason, Ho Chi Minh City is the preferred destination for companies trialing food and beverage products, pharmaceuticals, and luxury goods.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article 越南从6月15日起禁止进口二手机器

- Next Article Vietnam’s Industrial Zones – 3 Locations for Your Business