An Introduction to Double Taxation Avoidance in Vietnam

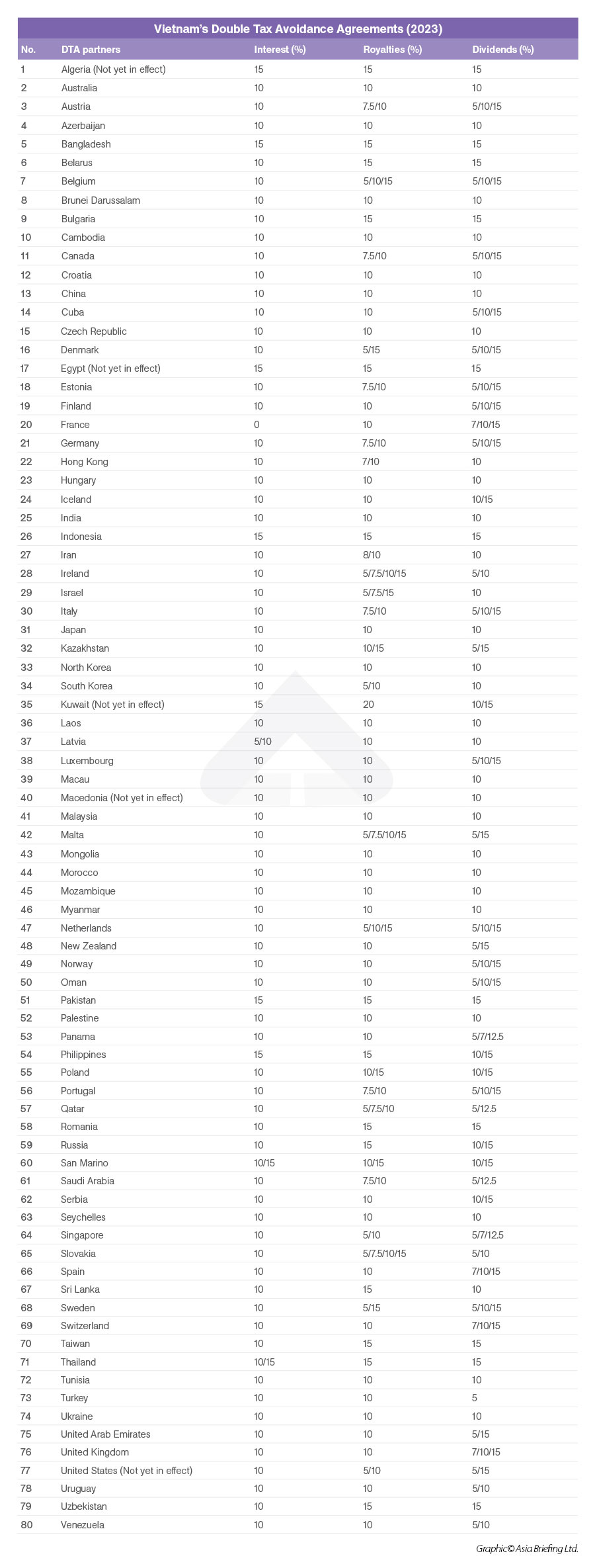

In Vietnam, double taxation avoidance agreements (DTAAs) play a crucial role in preventing businesses, professionals, legal entities, and foreign investors from being double-taxed on their income. Vietnam has signed 80 DTAAs to date although some are not in effect. Vietnam Briefing explores the benefits of these DTAAs and the various types of taxable income that are impacted by its provisions.

Regarding international trade, various countries’ tax systems often put global investors in the unfavorable position of facing redundant taxes on their income—i.e., double taxes. For example, a company may be subject to taxes in its country of residence and also in the countries where it earns income through foreign investments for the provision of goods and services.

Therefore, it is extremely worthwhile for foreign investors to be aware of the existing double taxation avoidance agreements (DTAAs) between Vietnam and various countries, as well as how these agreements are applied. These treaties effectively eliminate double taxation by identifying exemptions or reducing the amount of taxes payable in Vietnam.

List of Vietnam’s double taxation avoidance agreements

Who do DTAAs apply to in Vietnam?

DTAAs apply to individuals and corporations who are residents of Vietnam or the country that Vietnam has signed a DTAA with, or both.

Residents of countries that are signatories to DTAAs with Vietnam are subject to the relevant taxes in their native countries. Someone is considered a resident if they own residential property, have resided in the country for a certain amount of time, or satisfy any other relevant criteria.

On the other hand, residents of Vietnam must satisfy at least one of the following:

- Stayed in Vietnam for 183 days or more within one calendar year or a consecutive 12-month period from the first date of arrival;

- Obtained and registered for permanent residence status; or

- Leased a residence in Vietnam for at least 90 days within the tax assessment year. Applicable residences include hotels, boarding houses, rest houses, lodgings, and working offices.

Organizations are considered residents of Vietnam if they have established a business in Vietnam and operate under Vietnamese law. Examples include state companies, cooperatives, limited liability companies (LLCs), joint-stock companies, and private enterprises.

How do DTAAs apply?

If there is a direct conflict between domestic tax laws and the tax provisions in a DTAA, the provisions in the DTAA will prevail. However, domestic tax laws will take precedence when the relevant tax obligations included in the DTAA do not exist in Vietnam or when the tax rates in the agreement are higher than the domestic tax rates. For example, if a signatory country is entitled to impose a type of tax that Vietnam does not recognize, then Vietnam’s tax laws will apply.

DTAAs typically apply only to income taxes. However, in Vietnam, DTAAs impact both corporate and personal income taxes.

Types of taxable income

Corporate income

For foreign-invested enterprises (FIEs), corporate income is what is earned from carrying out production and business activities in Vietnam.

The tax obligations of FIEs are determined as follows:

- Legal entities (e.g., wholly foreign-owned enterprises or joint ventures) – such entities are taxed on incomes arising from business activities according to the corporate income tax law. The current standard tax rate in Vietnam for corporate entities is currently 20 percent.

- Non-legal entities – those who operate without forming legal entities will be subject to withholding tax or partially taxed if they own a permanent establishment (PE) in Vietnam to which income can be directly or indirectly attributed.

A PE is defined as a fixed place of business where operations are wholly or partially carried out. An FIE is said to be a PE in Vietnam if it maintains a building, office or equipment (either wholly or in part) that must be set up at a specified place and/or maintained permanently.

Investors with PEs who are licensed to conduct business in Vietnam are subject to the laws of the prevailing corporate income taxes in Vietnam. Those who conduct business under contract with Vietnamese organizations or individuals will be subject to withholding tax according to foreign contractor withholding tax regulations.

Income earned from Vietnam by FIEs

Dividends

No treaty benefit applies to dividends under DTAAs as there is no withholding tax on dividends in Vietnam. Companies are required to fulfill their financial and tax obligations in Vietnam before remitting dividends to their overseas parent companies. This means that the remitted dividends are after-tax profit which can be taxed again in the other signatory countries. Most tax and revenue jurisdictions allow tax offset for tax paid in other countries on dividends received.

Interest & royalties

Interest and royalties are taxed at 5 percent and 10 percent, respectively. Tax on the interest is usually exempt under most DTAAs while tax on royalty income is often reduced and ranges from 5 percent to 15 percent.

Technical, management, and consulting services

Tax on service fees is often withheld at 10 percent, in which 5 percent is of value-added tax (VAT) and the other 5 percent portion is CIT. Under DTAAs, only the CIT portion is subject to an exemption.

Personal income

Residents of countries that have a DTAA with Vietnam that earn income in Vietnam are required to pay income taxes subject to Vietnam’s personal income tax laws. However, these residents may be exempted from taxation if they satisfy all of the following conditions:

- The resident is in Vietnam for fewer than 183 days over a 12-month period of any taxable year;

- The resident’s employer is not a resident of Vietnam, regardless of whether the wages are paid directly by the employer or through the employer’s representative; and

- The wages are not paid by the PE of the employer in Vietnam.

Income raised from the provision of independent services is also subject to corporate income taxes, and foreign individuals that earn income this way must pay the relevant income taxes. If individuals or companies provide independent services without a business license, they are also required to pay personal income taxes.

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com

- Previous Article Vietnam Seafood Exports Soar in Q1 2024, Sets Up Annual Target of US$9.5bn

- Next Article Prospects in Vietnam’s F&B Market in 2024