Vietnam’s Key Economic Zones: Performance and Investments

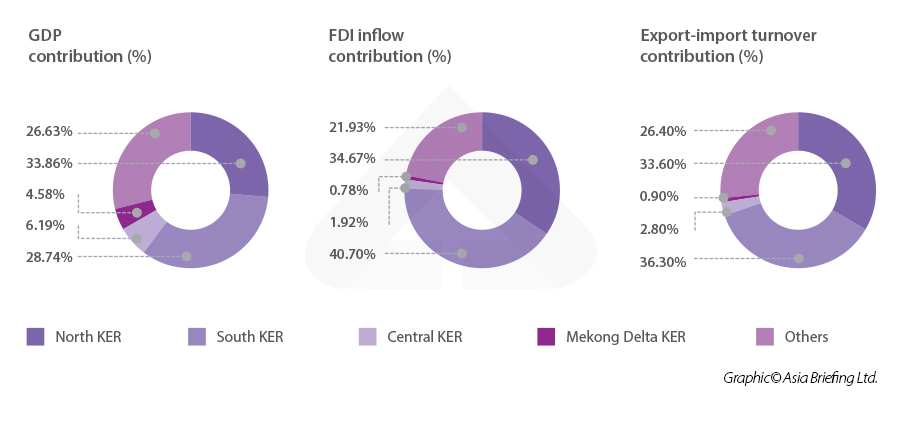

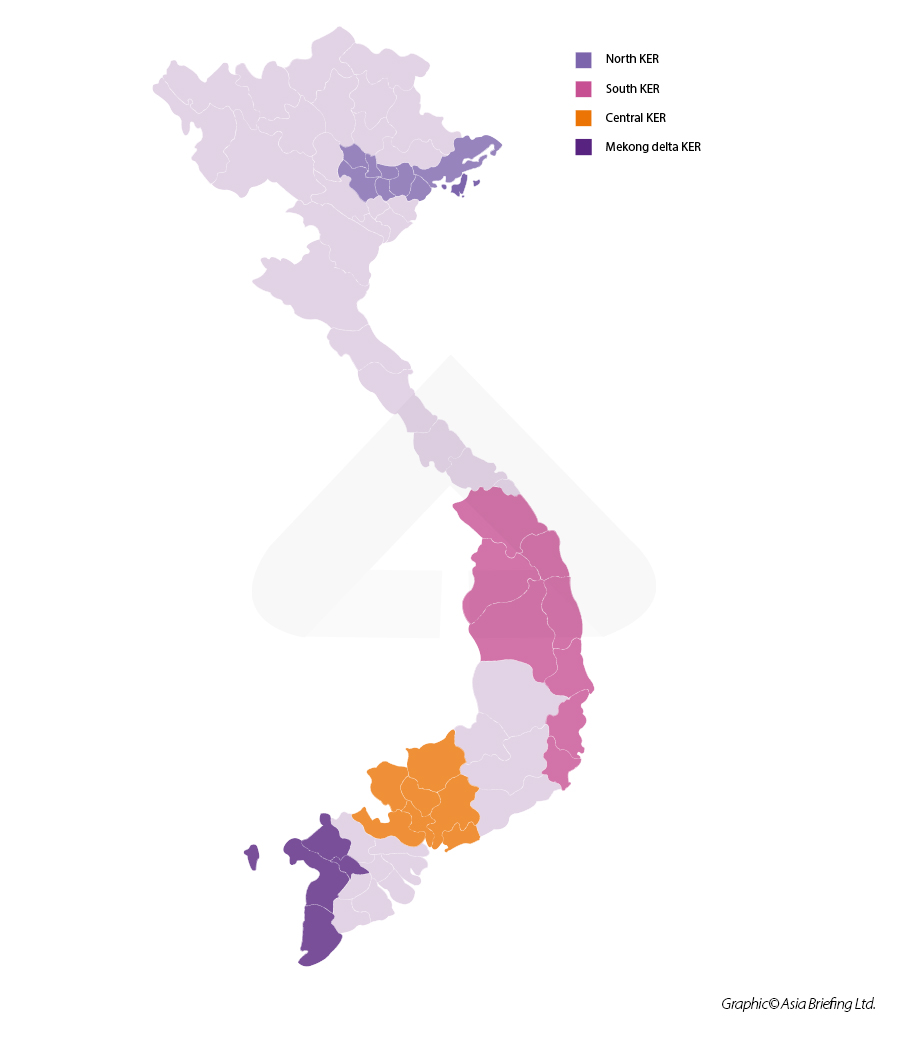

Vietnam has four key economic regions (KER) in the north, south, central, and Mekong Delta areas. Each plays a pivotal role in Vietnam’s economic growth and development. Here’s how they performed in 2022 in terms of trade and investment.

In 2022, Vietnam recorded over US$27 billion in foreign direct investment and over US$700 billion in imports and exports. This was a marked improvement on 2021 in which Vietnam’s economy suffered under the weight of prolonged pandemic related lockdowns.

The new investment and booming trade in 2022 went all over Vietnam but was mostly concentrated in Vietnam’s four KERs. Here’s a breakdown of trade and investment in those regions last year.

Notably, the southern region retained its overall lead as an FDI magnet and trade powerhouse, followed by the northern. The remaining two regions didn’t fare as well but still hold promise for investors looking for less mainstream areas to grow their operations.

Vietnam’s Northern Key Economic Region in 2022

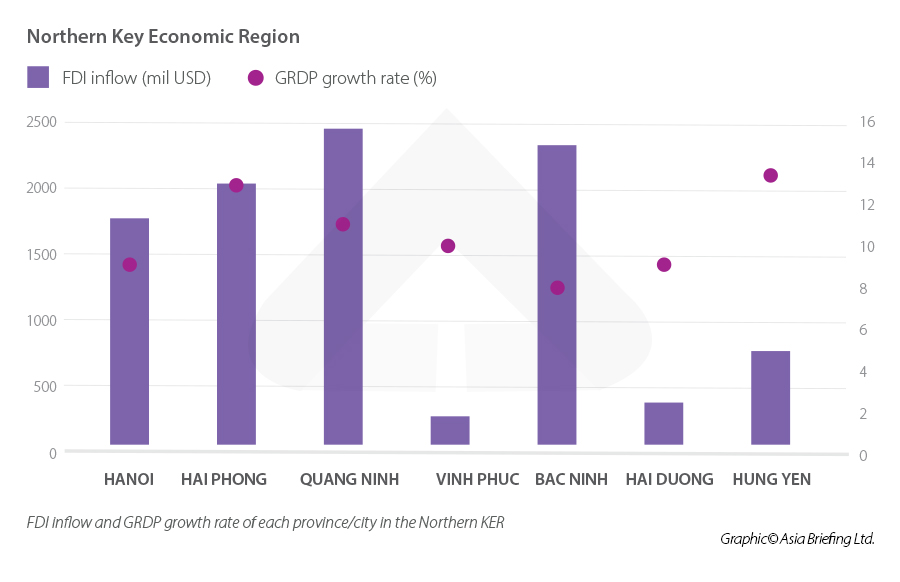

The northern KER comprises seven cities and provinces, including Hanoi, Hai Phong, Quang Ninh, Vinh Phuc, Bac Ninh, Hai Duong, and Hung Yen. This is a dynamic economic center and an important economic locomotive for the north.

Of the cities in the northern KER Hanoi contributed the most to the gross regional domestic product (GRDP), accounting for 47.22 percent. This was four times higher than Hai Phong. It also recorded a growth rate in the range of 9 to 13 percent.

In terms of import and export turnover, the Northern KER saw an increase of 7.84 percent compared to the year 2021. Notably, Bac Ninh recorded the highest trade turnover at US$83.4 billion, or 33.89 percent of the total for the region. Quang Ninh and Vinh Phuc also achieved year-on-year growth rates of 28.79 percent and 26.99 percent, respectively.

In terms of FDI, the northern KER attracted more than US$9.61 billion. With a growth rate of 18.1 percent, the region’s newly registered capital investment totaled 37.43 percent of the whole country. The two provinces contributing the most to regional FDI were Quang Ninh and Bac Ninh, with 24.64 percent and 23.35 percent, respectively.

Hanoi accounted for more than half of the area’s new projects but ranked fifth out of seven in terms of newly registered capital.

In 2022, Northern KER mainly attracted industrial projects but wants to attract high-tech, environmentally friendly projects in 2023. In fact, the northern KER is well known for electronics manufacturing with the bulk of both Apple and Samsung’s operations located in the region.

Northern KER import and export turnover 2022 (US$ billion)

| Provinces | Import | Export | Total | Increase (%) | Contribution to KER (%) |

| Hanoi | 41.00 | 17.10 | 58.10 | 114.82 | 23.61 |

| Hai Phong | 21.40 | 24.90 | 46.30 | 104.99 | 18.81 |

| Quang Ninh | 4.40 | 4.10 | 8.50 | 128.79 | 3.45 |

| Vinh Phuc | 12.00 | 8.70 | 20.70 | 126.99 | 8.41 |

| Bac Ninh | 38.40 | 45.00 | 83.40 | 100.36 | 33.89 |

| Hai Duong | 8.30 | 10.40 | 18.70 | 106.86 | 7.60 |

| Hung Yen | 5.10 | 5.30 | 10.40 | 104.00 | 4.23 |

| Total | 130.60 | 115.50 | 246.10 | 107.84 | 100 |

Investments in Vietnam’s Northern Key Economic Region in 2022

Stavian Quang Yen Petrochemical

Stavian Quang Yen Petrochemical’s has committed to investing US$1.5 billion in a polypropylene resin production project in Bac Tien Phong Industrial Park. It will have a scale of 600,000 tons of polypropylene per year.

Goertek Vina Science and Technology Company Limited (Goertek)

Goertek announced plans to develop a factory for manufacturing electronic equipment, network equipment and multimedia audio products in Que Vo Industrial Park, Bac Ninh province. The company has adjusted capital in the project from US$260 million to US$565 representing an additional US$305.7 million.

JD Future Explore V Limited

An e-commerce warehouse project being developed by JD Future Explore V Limited from Hong Kong in the Non-Tariff Zone and Nam Dinh Vu Industrial Park (Hai Phong City) will attract an estimated US$32 million of investment.

Vietnam’s Southern Key Economic Region in 2022

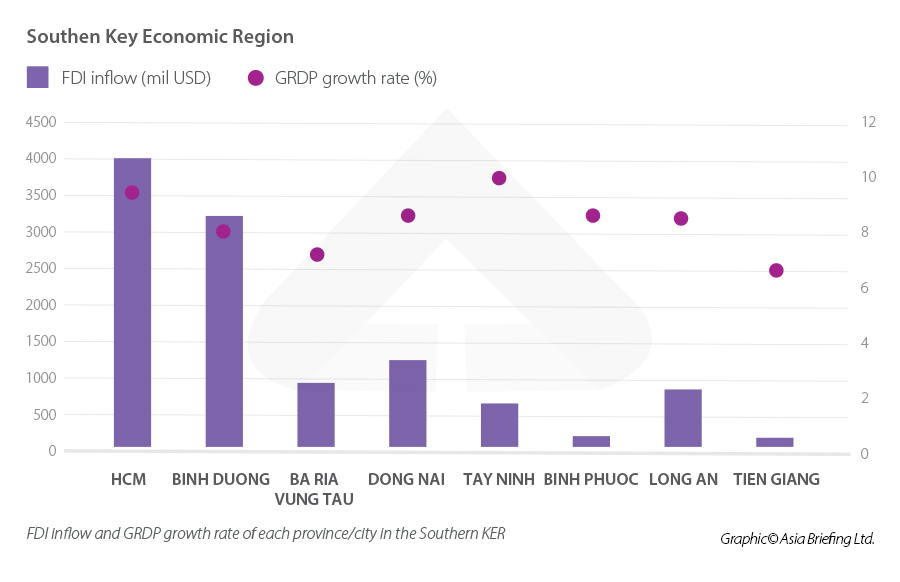

The southern KER includes eight provinces and cities: Ho Chi Minh, Binh Duong, Ba Ria- Vung Tau, Dong Nai, Tay Ninh, Binh Phuoc, Long An, Tien Giang. It is home to a large number of industrial parks, supermarkets, and commercial centers of many major retail groups.Ho Chi Minh contributes 15.5 percent of Vietnam’s GDP and 46 percent of the southern KER’s GRDP, which is three times higher than Binh Duong, the second-largest province in the region. In 2022, all eight provinces had growth rates ranging from 7 to 9 percent.

In terms of import and export turnover, the region recorded growth of 5.7 percent, of which Ho Chi Minh continued to lead with US$110.3 billion, contributing 41.47 percent to the region. Tien Giang and Tay Ninh also showed strong year-on-year growth of 42 percent and 23.6 percent, respectively.

As for FDI, Ho Chi Minh is still at the top of the whole region as well as nationwide. The city contributed 34.92 percent to regional FDI. In terms of capital, Ho Chi Minh accounted for 13.5 percent, 52.9 percent and 45.6 percent of the regional FDI inflow in new projects, capital increase, and capital contribution and share purchases, respectively.

Some other provinces that also recorded strong growth are Ba Ria – Vung Tau and Dong Nai.

Vietnam’s southern KER is also known for its manufacturing prowess with the bulk of both Nike and Adidas operations in Vietnam located in the region.

See also: Where Adidas Footwear and Apparel is Made in Vietnam

Southern KER import and export turnover 2022 (US$ billion)

| Provinces | Import | Export | Total | Increase (%) | Contribution to KER (%) |

| Ho Chi Minh | 62.80 | 47.50 | 110.30 | 105.05 | 41.47 |

| Binh Duong | 24.80 | 34.30 | 59.10 | 101.55 | 22.22 |

| Ba Ria – Vung Tau | 7.40 | 6.10 | 13.50 | 95.07 | 5.08 |

| Dong Nai | 18.90 | 24.60 | 43.50 | 107.67 | 16.35 |

| Tay Ninh | 6.27 | 7.60 | 13.87 | 123.62 | 5.21 |

| Binh Phuoc | 2.24 | 4.10 | 6.34 | 99.69 | 2.38 |

| Long An | 5.20 | 7.00 | 12.20 | 109.91 | 4.59 |

| Tien Giang | 2.50 | 4.67 | 7.17 | 141.98 | 2.70 |

| Total | 130.11 | 135.87 | 265.98 | 105.74 | 100 |

Investments in Vietnam’s Southern Key Economic Region in 2022

Lego

A new Lego factory in Binh Duong will utilize an investment of US$1 billion. This is the largest investment project by the Danish enterprise in Vietnam. It is expected to create 4,000 jobs when it becomes operational in 2024.

LOUVRE

LOUVRE’s high-class fabric production project in Thanh Thanh Cong industrial is being funded by the Libra International Investment Company from Singapore to the tune of US$210.

Coca-Cola Vietnam

Coca-Cola Vietnam factory project in Long An with an investment of 136 million USD. In a total area of 19 ha, the factory in Long An is expected to come into operation with a maximum capacity of 1 billion liters of product per year.

Pandora Group

Pandora Group, the world’s largest jewelry brand, in partnership with Vietnam – Singapore Industrial Park Limited Company (VSIP 3), intends to build a jewelry manufacturing facility in Binh Duong for around US$100 million.

Vietnam’s Central Key Economic Region in 2022

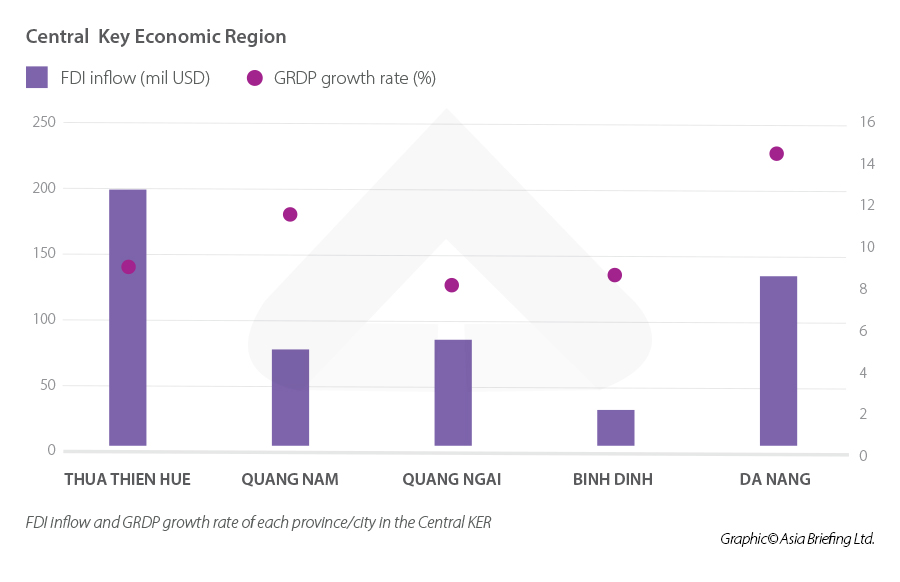

The central KER includes five provinces and cities: Thua Thien Hue, Quang Nam, Quang Ngai, Binh Dinh, and Da Nang. This is the third-largest economic region in Vietnam. This region has a vast seaport, which offers great potential for shipping and tourism.

The contribution of all five provinces to the GRDP is relatively even with an average of 20 percent. Da Nang is currently leading with a growth rate of more than 14 percent.

The central KER showed a growth rate of 17.1 percent in import and export turnover over the previous year. Particularly, Quang Nam which reached US$7.4 billion making it the regional leader, accounting for 35.6 percent of the region’s total trade turnover.

As for FDI, Central KER received US$531, or 2 percent of Vietnam. With a 47.7 percent share of the total registered investment capital, Thua Thien Hue now leads the region. However, in terms of the total number of newly registered projects, Da Nang accounted for 47 of a total of 64 projects.

Central KER import and export turnover 2022 (US$ billion)

| Provinces | Import | Export | Total | Increase (%) | Contribution to KER (%) |

| Thua Thien Hue | 0.79 | 1.40 | 2.19 | 107.353 | 10.53 |

| Quang Nam | 3.27 | 2.14 | 5.41 | 138.718 | 26.01 |

| Quang Ngai | 4.90 | 2.50 | 7.40 | 109.467 | 35.58 |

| Binh Dinh | 0.50 | 1.70 | 2.20 | 112.245 | 10.58 |

| Da Nang | 1.50 | 2.10 | 3.60 | 116.505 | 17.31 |

| Total | 10.96 | 9.84 | 20.80 | 117.183 | 100 |

Investments in Vietnam’s Central Key Economic Region in 2022

KURZ Group

KURZ Group from Germany is set to establish a high-tech emulsification and thin film factory project in VSIP Binh Dinh Industrial Park. Its total investment will be some US$40 million.

Vietnam’s Mekong Delta Key Economic Region in 2022

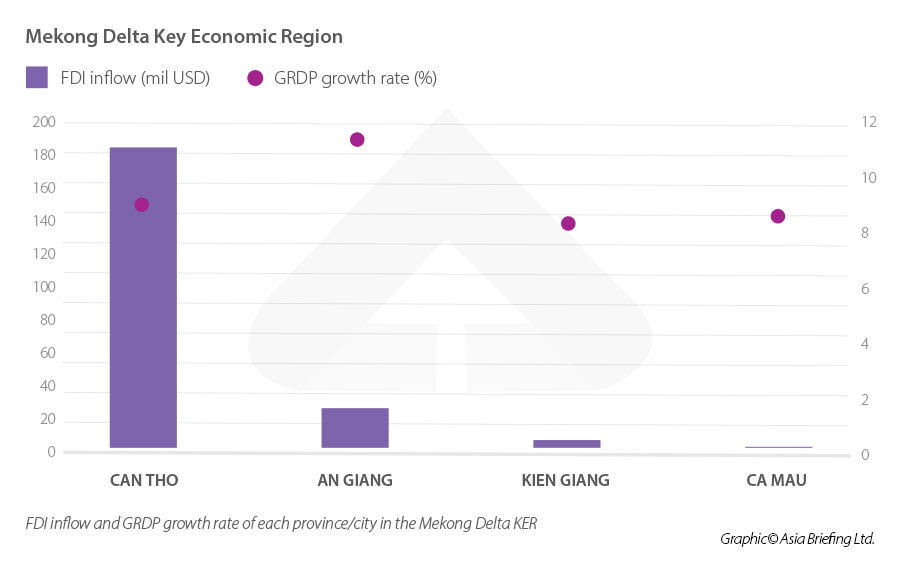

The Mekong Delta region includes four provinces, namely Can Tho, An Giang, Kien Giang and Ca Mau. Located at the pole of the country and bordering the East Sea, the Mekong Delta is in an important geo-economic position.

All four provinces in the Mekong Delta have fairly equal contributions to GRDP, and growth rates range from 8 to 11 percent.

In terms of import and export turnover, the Mekong Delta KER accounts for 0.9 percent of the national total, of which Can Tho contributes the most. That said, An Giang and Ca Mau have shown momentous growth of 29.4 percent and 27.8 percent, respectively.

Can Tho, which is considered the center of the Mekong Delta, attracted US$185.96 million accounting for 86.3 percent of the total regional FDI inflow.

Mekong Delta KER import and export turnover 2022 (US$ billion)

| Provinces | Import | Export | Total | Increase (%) | Contribution to KER (%) |

| Can Tho | 0.57 | 1.71 | 2.28 | 38.00 | 35.24 |

| An Giang | 0.67 | 1.00 | 1.67 | 129.46 | 25.81 |

| Kien Giang | 0.16 | 0.80 | 0.96 | 106.67 | 14.84 |

| Ca Mau | 0.25 | 1.31 | 1.56 | 127.87 | 24.11 |

| Total | 1.65 | 4.82 | 6.47 | 68.76 | 100 |

Investments in Vietnam’s Mekong Delta Key Economic Region in 2022

VSIP Can Tho

The VSIP Can Tho project will utilize US$160 million. This project will enhance the infrastructure of Vinh Thanh Industrial Park – Phase 1 (VSIP Can Tho Industrial Park) for Vietnam – Singapore Industrial Park Limited Company (VSIP JV).

Sphere Denmark

Sphere Denmark is establishing a project to produce outdoor sportswear in An Giang. The total investment will be US$17 million.

Vietnam’s Key Economic Regions in 2023

Last year was a challenging year for attracting foreign investment due to the carry over effects of COVID-19 and the implications of political conflicts in the world. However, Vietnam’s KERs have demonstrated their significance to the economy. These areas are focusing on improving the business environment and quality of their facilities to attract international investors, especially those with cutting-edge and environmentally friendly projects.

See also: Vietnam FDI Tracker

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Eurasia, including ASEAN, China, India, Indonesia, Russia & the Silk Road. For editorial matters please contact us here and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates provide business intelligence, due diligence, legal, tax and advisory services throughout the Vietnam and the Asian region. We maintain offices in Hanoi and Ho Chi Minh City, as well as throughout China, South-East Asia, India, and Russia. For assistance with investments into Vietnam please contact us at vietnam@dezshira.com or visit us at www.dezshira.com

- Previous Article Where are Adidas’ Factories Located in Vietnam?

- Next Article Investing in Vietnamese Startups: Quick Guide 2023