Vietnam’s Phu Quoc Island: A Key Investment Destination for the Tourism Industry

- Phu Quoc is the largest and most populated island of Vietnam located in the Gulf of Thailand, a strategic geographical location with proximity to most major capital cities in Southeast Asia.

- In recent years, Phu Quoc has grown exponentially and has become one of the fastest-growing localities in Vietnam with the tourism sector being the mainstay of the island’s economy.

- Despite its unprecedented growth, Phu Quoc is at the dawn of its development. Investors interested should quickly seize opportunities as Phu Quoc becomes more prominent on the map.

Once being isolated and underdeveloped, Phu Quoc island is underway to become an engine for Vietnam’s tourism sector and a leading luxury tourist destination in Southeast Asia, expected to rival the likes of Indonesia’s Bali and Thailand’s Phuket.

The heart-shaped Phu Quoc Island also known as ‘Pearl Paradise Island (“đảo ngọc”) by the Vietnamese, is famous for its beautiful beaches where warm, turquoise waters lap against the beautiful white sand.

In light of Phu Quoc’s emergence as the new hot destination for tourism in the region, Vietnam Briefing examines the island’s economic profile and its tremendous potential for foreign investors eyeing to invest in this rising tourist paradise.

Phu Quoc’s ideal location and demographics

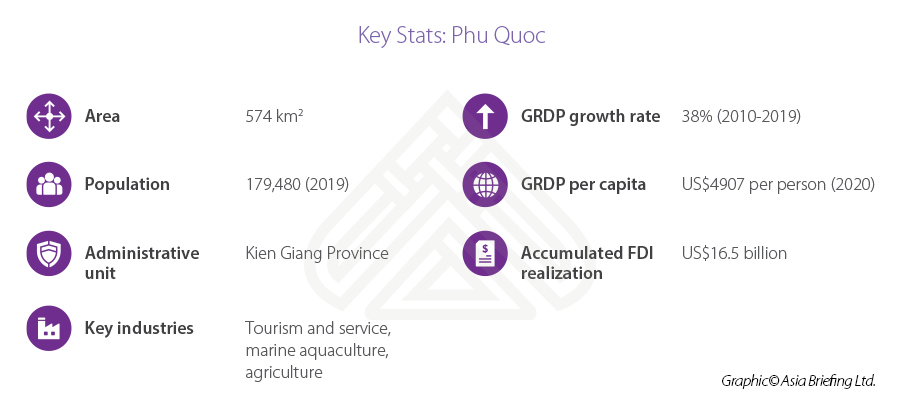

Phu Quoc island, including Phu Quoc City, and part of Kien Giang province, is the largest island in Vietnam, with a total area of 574 square kilometers – almost the same size as Singapore – a 150 km long coastline, and a population of approximately 179,480 people as of 2019.

Located in the Gulf of Thailand, just 4 km from nearby Cambodia, and 45 km from the southern tip of mainland Vietnam, Phu Quoc boasts a strategic geographical location with proximity to most major capital cities in Southeast Asia. It is also part of several international freight routes and has relatively good connectivity with Vietnam’s mainland and other countries in the region thanks to Phu Quoc International Airport and An Thoi International Seaport, with a passenger capacity of four million and 360,000 arrivals respectively.

Economic profile

Once being a wild island that was only known for traditional fish sauce and green peppers, Phu Quoc has grown exponentially in recent years and become one of the fastest-growing localities in Vietnam. In the 2010-19 period, the island recorded an average regional gross domestic product (RGDP) growth rate of over 38 percent, six times higher than the average annual growth of Vietnam. In 2020, Phu Quoc’s RGDP per capita stood at VND113 million (US$4,907) per person per year, almost double the national income rate.

Tourism by far is at the forefront of the economic sector of Phu Quoc thanks to its stunning beaches, unspoiled jungles, attractive year-round climate, and explosively growing infrastructure for luxury tourism. When combined with the service sector, revenue from the island’s tourism made up 70 percent of its RGDP and represented an average yearly growth rate of 25 percent from 2010 to 2019. From 2016 to 2019, the number of tourist companies increased from 219 to 726.

In 2019, Phu Quoc welcomed 5.1 million visitors, an increase of 26.9 percent compared to 2018. Revenue from tourism hit VND5,700 billion (US$247.6 million). The sector provides jobs for about 70 percent of the island population. As the number of tourists and revenue from tourism dropped significantly due to COVID-19, Phu Quoc is planning to fully vaccinate its residents by September and reopen for fully vaccinated foreign tourists by September or October this year as part of a vaccine passport pilot program. It is expected that the program will create a boost to the tourism industry of the island in light of a potential year-end foreign tourism surge.

Alongside tourism, Phu Quoc also possesses significant advantages for marine aquaculture and deep seaport development due to its long coastline, bountiful fishing grounds, and deep-sea water areas. As of now, Phu Quoc has five major fishing ports with around 10,000 fishing vessels operating in the area. An Thoi archipelago, located at the southernmost tip of the island, is a crucial area of the city with the busiest fishing port and the An Thoi International Port, the largest seaport on the island with the capacity of 500,000-700,000 tons per year.

Phu Quoc’s growth potential and investment

Much of the success in Phu Quoc’s tourism can be attributed to the significant investment into the infrastructure of the island, made by many major corporations such as Vingroup, Sungroup, BIMgroup, CEOgroup, MIKgroup, and Milltol since Vietnam’s Prime Minister issued a formal decision to transform Phu Quoc into the largest tourism center in the Mekong Delta region in 2004.

A range of world-leading hotel companies such as InterContinental, Hyatt, Movenpick, Pullman, Novotel, JW Marriott, and Melia have also established a presence on the island, cementing the island’s position as a new world-class tourist destination in Southeast Asia. Altogether, there have been over 600 lodgings, including hotels and resorts, with nearly 20,000 rooms on the island since mid-2020.

According to the local authorities, the island prioritizes investments that contribute to the technical and social infrastructure development of the city. Prioritized industries include tourism, service, infrastructure development, renewable energy along with marine aquaculture. Up to January 2021, Phu Quoc has attracted 372 investment projects with total capital of US$16.5 billion. Real estate on Phu Quoc remains healthy with land prices continuing to increase despite COVID-19.

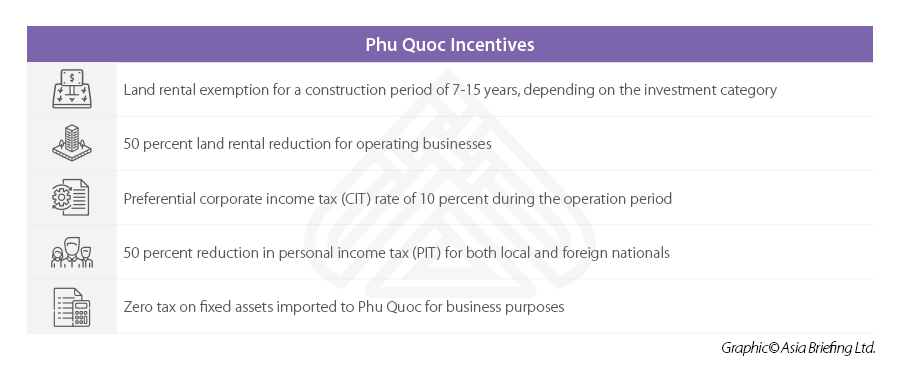

Although the island has experienced unprecedented growth over the last ten years, the best is yet to come. To capitalize on its tremendous potential, the government and local authorities have created various favorable incentives to attract investment into the island. Among others, these include:

In addition, according to the revised Law on Entry, Exit, Transit, and Residence of Foreigners in Vietnam, which came into effect on July 10, 2020, investors with an investment of VND100 billion (US$4.3 million) will be allowed to reside up to 10 years in Phu Quoc. Further, tourist visas are not required for foreign visitors staying for less than 30 days.

While the plan to turn Phu Quoc into a special economic zone (SEZ) has been put on hold due to lack of provisions in the current law on SEZ, if the law is passed, Phu Quoc has the potential of becoming one of only three SEZs in Vietnam and will be likely to bring further investment to the island.

Poised for further growth

With government and local support, increasing tourism and its rising stature internationally, Phu Quoc is set to be one of the leading investment and tourism destinations in Southeast Asia.

In the 2021-2025 period, Phu Quoc will focus on developing socio-economic infrastructure, transport, power, water, waste management as well as schools and hospitals. Local authorities also plan more favorable policies for immigration, land rentals, and land use. All these factors contribute and have made the island more attractive to investors. While Phu Quoc has its limitations, investors are advised to do their due diligence and assess whether this location is ideal for their investments.

Note: This article was first published in February 2015, and has been updated to include the latest developments.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Q&A: Wie sich Vietnams Lieferketten von denen anderer Länder unterscheiden und wie es an globalen Wertschöpfungsketten teilnimmt

- Next Article Q&A: Electronics and Semiconductor Industry in Vietnam