Why Your Market Entry Strategy Matters in Vietnam?

Op/Ed by Dang Trinh, International Business Advisory, Dezan Shira & Associates

When it comes to investing in Vietnam, foreign investors have been deluged with information on the prospects of the local economy in terms of the long-known indicators such as political stability, a young population, coupled with a fast-growing middle class, trade openness, and so on. These factors together contribute to Vietnam as an attractive investment destination for international businesses looking for market expansion, or supply chain diversification.

Nevertheless, the majority of articles on investment in Vietnam have focused on exploiting Vietnam’s economic potential rather than informing foreign investors of major market entry decisions they must be aware of to achieve long-term success.

With local teams on the ground in Vietnam and offices across Asia, we provide some key insights into what foreign investors should be aware of, to fully capitalize on Vietnam’s market prospects.

Firm strategy and firm resources that matter

Chronically speaking, no issue in doing business in Vietnam has attracted the same level of attention from investors as the market entry mode. Yet, decision-makers often hesitate to determine a decisive choice of market entry, which is directly linked to the firm’s future in-market strategies such as marketing, production, and so on.

Firstly, there is no exact formula for a successful market entry strategy. The entry performance of foreign-related enterprises in Vietnam is significantly dependent on a variety of factors, necessitating investors’ astute execution, tailor-made to perfectly match the firm’s own resources for long-term competition.

In a research paper conducted in 2007 examining the drivers of success and failure for market entry into the world’s most popular markets at the time – China and India, Joseph Johnson and Gerard J. Tellis came up with some significant findings in relation to the strategies in international entry, which mainly focused on the entry mode and the entry timing. Such concepts, are still relevant to the current context of Vietnam’s market and might be valuable to foreign investors’ consideration for more decisive actions.

There are typically a significant number of market entry methods, currently being addressed under various names by investors. These modes, generally speaking, may be grouped into five broad classes, listed in order of increasing control as follows:

- Export

- License and franchise

- Alliance

- Joint venture

- Wholly owned subsidiary

To say the least, deciding which of these options to choose may be extremely challenging. As we know, a proper organizational structure is important for investors to efficiently manage their international operations and any mistakes, in the beginning, could be costly at a later stage.

Therefore, these decisions should not be based on a single mode of entry but may incorporate a combination of factors. The distinction between these forms resides in the degree of control, or the extent to which they allow entrepreneurs to control key resources, and also in the level of risks the firm bears in the host country.

In light of firm differentiation, it turns out that there is no black-and-white answer to the best entry mix, but the following ideas may provide several useful hints:

- An increase in the degree of control enables the firm to better manage its complementary resources, such as its own distribution channel, while still improving internal operational control. However, due to the high level of resource commitment, this could be exceedingly costly.

- A decrease in the degree of control, on the other hand, entails an outcome opposing the above-said analysis.

Take one of the most popular market entry modes in Vietnam, a limited liability company (LLC, categorized as a wholly-owned subsidiary). This provides foreign investors with significant benefits in terms of being able to completely control most of the firm’s internal management concerns from the start.

Still, the setup expenses and procedures that the investor must go through are significantly expensive and cumbersome. These higher costs imply that higher levels of investments are required for the firm to reach a break-even point and then start making a profit.

As a decision-maker for your international business venture, it’s worth remembering that the market entry selection must be made with your eyes open with the due diligence required. Such a decision, undeniably, demands greater attention to detail due to future business scenarios and costs related to ongoing compliance.

Inaccurate anticipation of your business growth, as well as a lack of sufficient market research, may result in changes to your corporate structure at a later stage, which could become more costly than the originally expected plan.

In addition to the form of market entry mode, the role of entry timing in a complex country like Vietnam is as important and can not be underestimated despite its unclear effects.

Indeed, some entrants are reportedly more into being pioneers to make use of the early access to key resources, and to exploit governmental concessions as a result of their FDI-focused incentives; while others prefer the wait-and-see approach to learn from others’ errors.

Based on the fact that Vietnam is not a newly opened emerging market associated with untapped potential and under-developed infrastructure, there is more or less a fine line between early entrance and later entrance. In the context of a volatile, uncertain, complex, and ambiguous world, investor decisions on entry timing have been based on their assessment of market-related changes influenced by macro-environment factors.

To give you a better idea, Vietnam’s Central Government’s shift in policy orientation from attracting FDI in quantity to attracting FDI in quality is somewhat a macro-environmental variable that may affect investors’ entry timing decision. For example, forcing firms with limited resources to enter earlier than they originally planned to avoid stricter restrictions on capital investment.

Investors are consequently urged to frequently make more detailed evaluations of the potential effects of the country’s economic variations to find out the perfect timing for entry.

Firm-specific advantages in terms of financial and organizational resources are critical in international trade, particularly in a firm’s market entry choice. The scale of a company, together with its resources, actually represents its capacity to endure significant expenses as well as risks associated with certain entry strategies.

In our experience, a firm’s size has a positive correlation with its desire to expand into overseas markets, and its propensity to adopt highly committed modes of market entry, such as sole and joint venture methods.

To illustrate, the incorporation of an LLC in Vietnam entails a significant amount of paperwork, the majority of which is in Vietnamese. Barriers such as this unavoidably require foreign investors to rely on third parties which can prove expensive.

This has contributed to the growing perception that investors with limited financial and personnel resources scarcely stand a chance to tap into Vietnam through market entry with the highest level of control – forming a wholly-owned subsidiary.

In practice, such a perception turns out to be somehow erroneous in Vietnam owing to the country’s specific economic characteristic – SMEs are the backbone of the local economy. The outstanding role of SMEs proves that Vietnam has an SME-friendly business environment, which is likely to smoothen the entry mode decision of investors with resource constraints and allow these businesses to operate under a low-cost structure.

Interestingly, there is no minimum investment capital required in Vietnam, which partly reflects how open Vietnamese lawmakers are to foreign investors. This, however, is going to change soon due to a potential shift to FDI projects of higher quality, which could potentially bring in competitive advantages for Vietnam in the race for FDI attraction among Southeast Asian countries.

Vietnam’s specific characteristics which influence market entry strategy

Cultural differences are frequently underestimated by foreign investors. In other words, foreign investors do not pay enough attention or make sufficient effort to bridge the cultural gap in business norms and practices. Indeed, cultural differences are further pronounced in Vietnam which can significantly impact a firm’s performance adding to challenges in this diverse market.

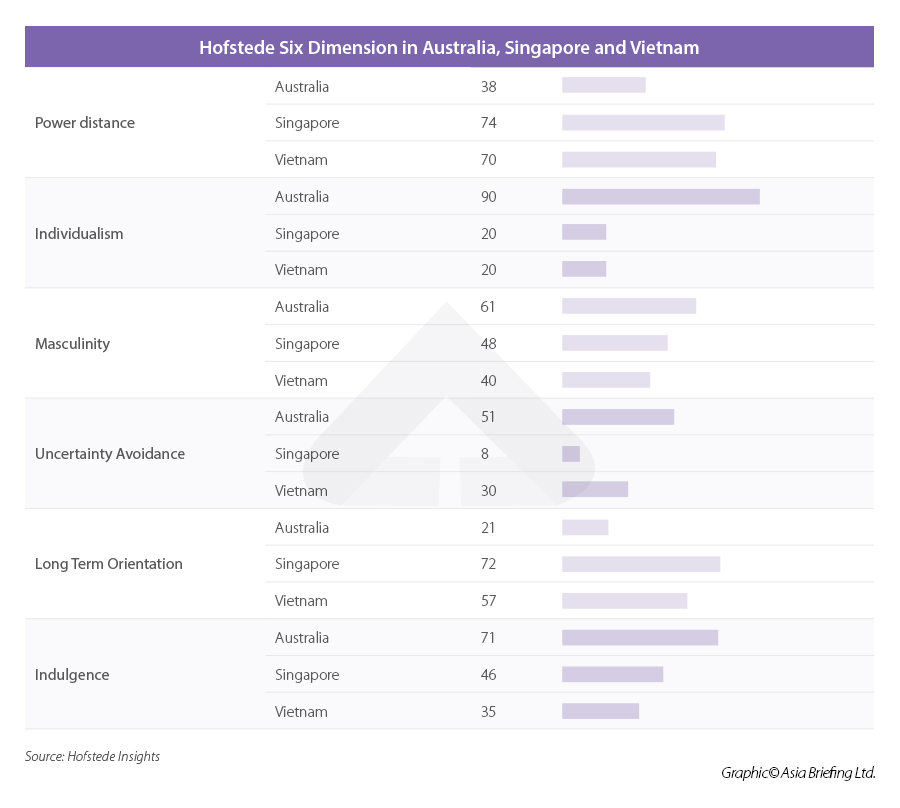

To highlight the cultural distance between Vietnam and some other countries, we hereby take advantage of Hofstede’s cultural dimension theory. A comparison of Vietnam, Singapore, and Australia will be made to clarify the impact of cultural disparity on market entry performance.

A glance at the below chart reveals some major differences between Vietnam and particularly Western countries in terms of various cultural indicators. Overall, Vietnam is a collectivist society that fosters strong relationships, commitment, and compromise (low individualism). That society, in general terms, accepts a certain hierarchical order in which everybody has a place and challenges to leadership are not well-received (high power distance).

In comparison, Vietnam’s culture indices observe many discrepancies relative to that of Australia while having comparatively identical characteristics to Singapore.

What does this imply?

As a matter of fact, Singapore was Vietnam’s top foreign investor for the second year in a row in 2020 and 2021, as well as the first quarter of 2022, with 221 newly registered FDI projects in 2021, while Australia had just 35. This evidence demonstrates international corporations’ tendency to commence their expansion plans in markets similar to their own – particularly given that Vietnam and Singapore share-alike cultural backgrounds, in comparison with Australia.

Half a century ago, several studies also reported a similar idea that the sequential path of internationalization is determined by the cultural distance to increase the odds of successful entry, recorded in Joseph Johnson and Gerard J. Tellis’s paper.

Thus, provided that you’re not from a nation similar to Vietnam in terms of socially acquired values, beliefs, and rules of conduct, getting yourself prepared with the sensitivity to local culture is absolutely a basement to be culturally close to Vietnam and thus to enhance the opportunities for successful entry.

To a broader extent, the underlying cultural dimensions of society also affect the execution and implementation of marketing and management strategies. The concrete partnership, joined by foreign investors and the local firms, in a short-term business project or a business structure heavily depends on how well all parties interact over this cultural divide.

Business norms and etiquettes in Vietnam

For first-time entrants, getting familiarized with the country’s vibrant culture and traditions could be troublesome and require a significant amount of effort and time.

Generally speaking, Vietnam has one of the oldest cultures in Southeast Asia. While national identity can be complex given Vietnam’s history, locals are proud of their language and its complexities, as well as the distinctiveness of their society and culture.

Therefore, business norms and etiquettes can go bountiful ranging from business attire to management relations, which are thoroughly covered on Vietnam Briefing. Here, we highlight a few major business norms and etiquettes in Vietnam that investors should bear in mind.

- Social connections are crucial, and Vietnamese may base the majority of their business decisions on how they see you as a person outside of the business. In contrast to the West, where first interactions tend to remain on a business level, the first several meetings will entail getting to know each other.

- Besides, investors need to keep in mind that the final decision will go through extensive deliberation and red tape in Vietnam, so be patient.

- Business gift-giving is fairly usual at the end of a meeting or during a meal in honor of your business associates. Small and inexpensive gifts are appropriate. Something with your company logo or from your country of origin both make excellent gifts.

- Cold calling is not recommended. A shared acquaintance or third-party reference should be used to introduce you to a prospective business contact.

- Business meetings should be scheduled in advance and avoid major public holidays, such as Tet, the Vietnamese New Year celebration.

Conclusion

Vietnam, once one of the smaller economies in Southeast Asia, has grown rapidly and aims to become a high-income country by 2045. Even with the impact of the pandemic, the country’s tremendous prosperity has brought in a rush of foreign firms into Vietnam. Despite a strong correlation to a firm’s future in-market operations, small and medium enterprises’ market entry strategies are frequently lacking research and are not based on critical criteria as previously examined – which I perceived was due to a lack of cultural and economic sensitivity, furnished by an inaccurate assessment of its corporate resources.

In the context of this brief article, our advice is simply the tip of the iceberg, but it should assist international investors in better preparing for their upcoming venture to Vietnam.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Changing Your Company Name in Vietnam: A Guide to Online Registration

- Next Article Vietnam Approves National Strategy on Foreign Investment: Decision 667