State By State: Vietnam and Wisconsin Trade

By Andrew Salzman and Charles Small, Dezan Shira & Associates

In this Vietnam Briefing article, we review the growing trade relationship between Wisconsin and Vietnam, strategically positioned in the heart of Asia. Vietnam’s US$824 million trade surplus with Wisconsin results from its position as the fifth most important source of imports for the state by value.

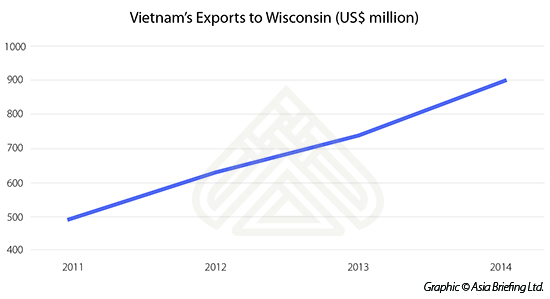

Vietnam’s exports to Wisconsin totaled US$898 million in 2014, having grown in value by 21.9 percent since 2013. To put this into perspective, in 2014 Wisconsin imported more from Vietnam than it did from Asian economic giants India and Japan.

RELATED: State by State: ASEAN and Wisconsin Trade

RELATED: State by State: ASEAN and Wisconsin Trade

Wisconsin exported over US$23.4 billion in goods and services to the world in 2014. Overall, exports to the ASEAN country are growing; from 2013 to 2014 Wisconsin’s exports to Vietnam grew 46.38 percent, but still only reached US$73.98 million. Wisconsin exporters are far from balancing the trade deficit with Vietnam. The top exports from Wisconsin to Vietnam in 2014 were food, chemicals, industrial machinery, animals, and miscellaneous manufactured commodities.

Opportunities for Wisconsin Companies

There are opportunities in this market for Wisconsin-based companies. Vietnam’s 90 million-strong population show an overwhelming preference for owning motorcycles over other vehicles, with Vietnam’s Ministry of Transport recording 37 million registered motorbikes in 2013, compared to two million cars owned. It is no wonder that Harley-Davidson, headquartered in Milwaukee, has an established presence in Vietnam.

According to U.S. Census Bureau data, of the US$7.73 billion in U.S. exports Vietnam received in 2014, US$1.30 billion were agricultural products. Wisconsin acted on the impetus to leverage its competitive advantage in agriculture when it sent its first ever trade delegation to Vietnam in 2012. The delegation, headed by Wisconsin Department of Agriculture, Trade and Consumer Protection Secretary Ben Brancel, sought out opportunities to expand Wisconsin’s dairy and livestock industries into the Vietnamese market. The trip’s schedule included meetings with the US Dairy Export Council, the Vietnam Feed Association, and the Ministry of Agricultural and Rural Development.

RELATED: State by State: China and Wisconsin Trade

RELATED: State by State: China and Wisconsin Trade

The Wisconsin Department of Agriculture, Trade and Consumer Protection recorded US$0.48 billion of dairy product exports in 2014. According to Vietnam Customs, Vietnam imported US$0.37 billion of milk and milk products from January 1 to May 15 2015 alone. More of these imports could be from Wisconsin, which ranked first of all U.S. states in 2014 in whey exports totaling US$164 million, which had increased in value by eight percent since 2013.

There is room for far more synergy between the two economies. Wisconsin exported US$6.37 billion of industrial machinery and US$2.14 billion of electrical machinery in 2014. Vietnam Customs recorded US$10.45 billion of machinery, equipment, tools and instruments in the year to 15 May 2015.

RELATED: Dezan Shira & Associates’ Pre-Investment, Market Entry Strategy Advisory

RELATED: Dezan Shira & Associates’ Pre-Investment, Market Entry Strategy Advisory

As the U.S. and Vietnam negotiate the Trans-Pacific Partnership, there are a number of key tariffs to watch out for which could boost bilateral trade. As of 2012, Vietnam imposed a 30 percent tariff on Wisconsin corn imports. As of 2013, tariffs or 32 percent were imposed by Wisconsin on Vietnam’s male fiber sweaters, and 18.7 percent on baby clothes made in Vietnam.

Overall, trade relations between Vietnam and Wisconsin are one-sided in Vietnam’s favor. It does not have to be this way. As Wisconsin expands its core markets, those involved in manufacturing and technology in the state would do well to take another look at the Vietnamese market.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Import and Export: A Guide to Trade in Vietnam

In this issue of Vietnam Briefing Magazine, we provide you with a clear understanding of the current business trends related to trade in Vietnam, as well as explaining how to set up your trading business in the country. We also attempt to give perspective on what will be Vietnam’s place in the Association of Southeast Asian Nations (ASEAN) in 2015, and look at some of the country’s key import and export regulations.

Using Vietnam’s Free Trade & Double Tax Agreements

Using Vietnam’s Free Trade & Double Tax Agreements

In this issue of Vietnam Briefing we explore how Vietnam’s Free Trade Agreements – and especially those via its membership in ASEAN – will affect foreign investment into Vietnam. We also go a step further and examine the specific, bilateral Double Tax Agreements that Vietnam has enacted, and how these can be further used to minimize profits and withholding taxes that would otherwise be levied upon foreign investors.

Developing Your Sourcing Strategy for Vietnam In this issue of Vietnam Briefing Magazine, we outline the various sourcing models available for foreign investors – representative offices, service companies and trading companies – and discuss how to decide which structure best suits the sourcing needs of your business.

Developing Your Sourcing Strategy for Vietnam In this issue of Vietnam Briefing Magazine, we outline the various sourcing models available for foreign investors – representative offices, service companies and trading companies – and discuss how to decide which structure best suits the sourcing needs of your business.

- Previous Article Vietnam to See Strong Trade Growth through 2030

- Next Article Future Merger of HCMC and Hanoi Stock Exchanges Likely as Vietnam’s Markets Mature