Vietnam to See Strong Trade Growth through 2030

HCMC – Vietnam’s strategic geographic location, low wages, and beneficial trade deals are set to make the country an increasingly important export destination both in Asia and throughout the world. In a recent report released by the bank HSBC, it has been revealed that Vietnam will see strong export growth through the year 2030.

The HSBC report has highlighted a number of important areas that point to a rosy export future for Vietnam. Chief among these is the country’s close location to some of the fastest growing economies in Asia, such as China, India, and Malaysia. These three countries will be Vietnam’s fastest growing export destinations, at a rate of at least 14 percent per year, through the year 2030. In fact, China is expected to overtake the United States as Vietnam’s largest export destination by 2030.

RELATED: Dezan Shira & Associates’ Pre-Investment, Market Entry Strategy Advisory

RELATED: Dezan Shira & Associates’ Pre-Investment, Market Entry Strategy Advisory

An additional reason for the optimism about Vietnam is the Trans-Pacific Partnership (TPP), a US-led trade agreement involving 12 countries. Upon completion, the TPP trade area would comprise a region with US$28 trillion in economic output, making up around 39 percent of the world’s total output. Once implemented, tariffs will be removed on almost US$2 trillion in goods and services exchanged between the signatory countries. Thus, Vietnam has much to gain from the implementation of the trade agreement, including drastically reduced tariffs in some of the world’s largest markets.

RELATED: Yarn Forward’s Effect on the Trans-Pacific Partnership and Vietnam

RELATED: Yarn Forward’s Effect on the Trans-Pacific Partnership and Vietnam

Additional trade deals with the EU and other countries, as well as further ASEAN integration, are also set to help boost Vietnam’s economy. As a result of this plethora of trade deals, HSBC confidently predicts a GDP growth rate of more than five percent per year through 2030 for Vietnam.

However, HSBC has also highlighted potential risks to Vietnam’s growth, these include possible resistance from the country’s ruling party to structural reforms, setbacks to infrastructure investment, delays to the free trade deals, and possible slower growth in China.

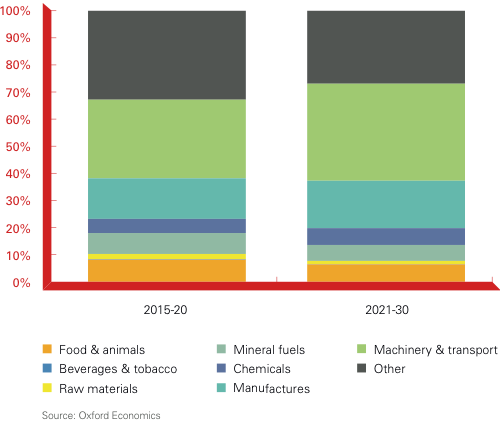

Exports

HSBC expects that clothing and apparel will also continue to be among the main drivers of Vietnam’s growth – contributing almost 20 percent of the projected export growth through 2030. However, with the large investments by companies such as Samsung, Vietnam has also become an attractive location for the telecommunications industry – HSBC believes that this will put the country in a prime position to meet increasing demand for consumer goods in Asia.

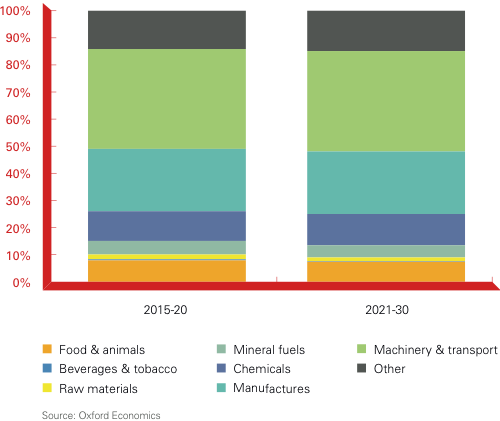

Imports

According to HSBC’s predictions, China and South Korea will remain Vietnam’s largest import partners. Industrial machinery will continue to be Vietnam’s largest import sector through 2030 and will contribute around 25 percent of the country’s import growth. Textiles and wood manufactures will be the next largest import sectors, followed by information and communication technology (ICT) equipment.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Import and Export: A Guide to Trade in Vietnam

In this issue of Vietnam Briefing Magazine, we provide you with a clear understanding of the current business trends related to trade in Vietnam, as well as explaining how to set up your trading business in the country. We also attempt to give perspective on what will be Vietnam’s place in the Association of Southeast Asian Nations (ASEAN) in 2015, and look at some of the country’s key import and export regulations.

Using Vietnam’s Free Trade & Double Tax Agreements

Using Vietnam’s Free Trade & Double Tax Agreements

In this issue of Vietnam Briefing we explore how Vietnam’s Free Trade Agreements – and especially those via its membership in ASEAN – will affect foreign investment into Vietnam. We also go a step further and examine the specific, bilateral Double Tax Agreements that Vietnam has enacted, and how these can be further used to minimize profits and withholding taxes that would otherwise be levied upon foreign investors.

Developing Your Sourcing Strategy for Vietnam In this issue of Vietnam Briefing Magazine, we outline the various sourcing models available for foreign investors – representative offices, service companies and trading companies – and discuss how to decide which structure best suits the sourcing needs of your business.

Developing Your Sourcing Strategy for Vietnam In this issue of Vietnam Briefing Magazine, we outline the various sourcing models available for foreign investors – representative offices, service companies and trading companies – and discuss how to decide which structure best suits the sourcing needs of your business.

- Previous Article Positive Results for European Chamber’s Vietnam Business Climate Index (BCI)

- Next Article State By State: Vietnam and Wisconsin Trade