Vietnam’s FDI Drops Slightly in 2021, but Reopening Measures Boosting Economy

- Vietnam’s FDI and GDP figures suffered and dropped slightly in 2021, due to stringent lockdowns and movement restrictions caused by the pandemic.

- Nevertheless, Vietnam still recorded a positive GDP, and with the country slowly reopening, economic prospects are bright for 2022.

- Vietnam Briefing looks at FDI figures for 2021, which industries were impacted, and the outlook for 2022.

Vietnam suffered a challenging and trying 2021, due to strict lockdowns and movement restrictions for almost half the year in 2021. This resulted in a significant economic downturn, causing job losses and businesses closures. It furthered added to supply chain snarls, affecting global MNCs as demand in western markets peaked due to factory closures and strict quarantine requirements.

Nevertheless, Vietnam still recorded a positive GDP growth rate of 2.58 percent and now seems poised to return to its typical 6 percent annual growth rate in 2022 as the government gradually reopens the country. Vietnam’s government abandoned its zero covid approach last year, moving to a ‘live with the virus’ approach allowing businesses and production plants to resume operations.

FDI maintains positive scorecard but pandemic dampened high scores

The latest figures by Vietnam’s Ministry of Planning and Investment (MPI) give an overview of Vietnam’s FDI for 2021.

As of December 20, 2021, foreign investment projects disbursed US$19.74 billion a slight decrease by 1.2 percent over the same period in 2020. However, the total newly registered, adjusted, and paid-in capital for share purchase by foreign investors reached US$31.15 billion or 9.2 percent higher than the same period last year.

Out of this, there were 1,738 new projects which were granted investment registration certificates, a year-on-year increase of 31.1 percent. Thus, total registered capital reached over US$15.2 billion.

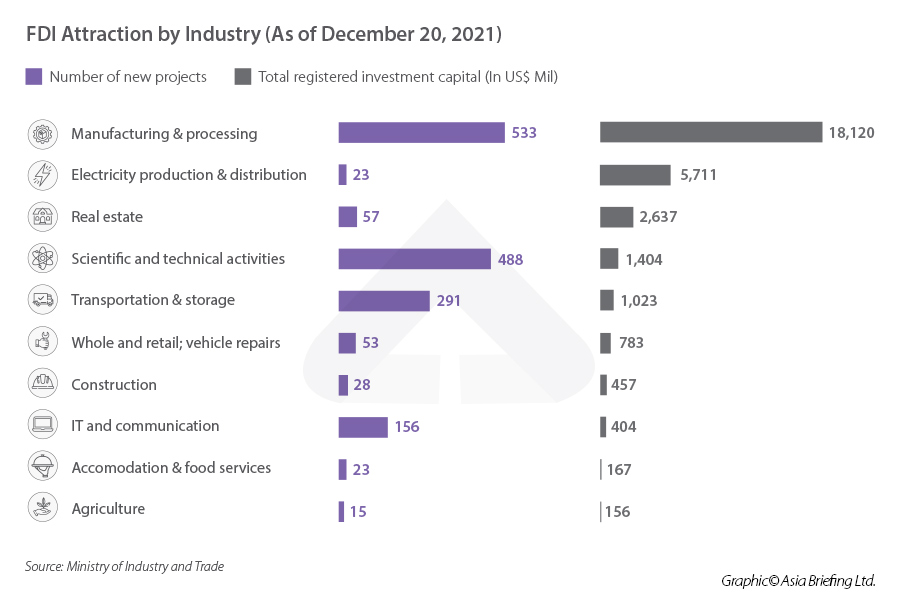

As with previous years, manufacturing and processing led with total investment capital of US$18.1 billion and accounted for 58.2 percent of total registered investment capital. While electricity production and distribution attracted a small number of new projects, they were large-scale, and thus ranked second with an investment capital of US$5.7 billion and accounting for 18.3 percent of total registered investment capital. This was followed by real estate and wholesale and retail at US$2.6 billion and US$1.4 billion respectively.

Asian countries lead FDI

106 countries invested in Vietnam in 2021. Similar to last year, Asian countries represented the lion’s share of FDI into Vietnam. Singapore led, accounting for more than 34.4 percent of total investment capital, and up 19.1 percent compared to the same period. This was followed by South Korea at US$5 billion, Japan with US$3.9 billion, followed by China, Hong Kong, and Taiwan. Japan piped China to third place increasing its investment in 2021.

This could also be in part due to recent government incentives by Japan to diversify its supply chains and also bring back manufacturing to the country. Vietnam remains a favorable destination for Japanese manufacturers. Apart from investment from firms such as Toyota, Honda, Canon, Suzuki, Marubeni, and Mitsui, Japanese companies are also eyeing the retail sector with Meji keen on expanding operations. Muji, Matsumoto Kiyoshi, and Miki House have also opened stores in major cities in Vietnam.

In terms of the number of FDI projects, South Korea topped the list, followed by Japan, Singapore, Taiwan, and Hong Kong.

This wide range of sectors indicates a wide range of possible sources of Vietnam’s FDI competitiveness. The domination of the manufacturing and processing sector reflects the efficiency gains offered by Vietnam to foreign firms. An increasing number of firms have shifted their manufacturing operations to Vietnam or have adopted a China+1 model.

Hai Phong tops FDI list

Hai Phong topped the list with total registered investment capital of US$5.26 billion surpassing Long An province from last year and accounting for 16.8 percent of the total investment capital. Long An thereby came in second with US$3.84 billion followed by Ho Chi Minh City, Binh Duong, Bac Ninh, and the capital Hanoi.

This year Hai Phong led the list in part due to the LG Display Project by South Korean investors with investment capital adjusted to increase by about US$2.15 billion. Hai Phong has also granted investment licenses to five projects including three foreign-invested ones worth US$140 million. Other major FDI projects across the country include the LNG Power Plant Project in Long An by Singaporean investors, a thermal power plant project in Can Tho, and a paper factory in Vinh Phuc by Japanese investors.

Important to note that foreign investors are still focused on investing in bigger cities that have good infrastructure as shown by the number of projects. While Hanoi didn’t make it in the top five, it still ranked second in the number of new projects.

Import and exports showed strong resilience despite factory shutdowns and lockdowns

Exports in 2021 increased in the first 11 months of the year. Exports reached around US$246.7 billion, up 20.7 percent compared to the same period last year and accounting for 73.6 percent of export turnover. The US remained Vietnam’s largest importer in 2021 with an import value of over US$96.2 billion up 24.9 percent year on year.

As we saw, demand for electronics such as computers and mobile phones skyrocketed during the pandemic helping Vietnam’s exports. The US imported smartphones and accessories from Vietnam worth around US$96.2 billion rising by 10 percent year on year. The US was also Vietnam’s largest importer of computers and electronic products with a value of US$12.7 billion. Apart from this, the US imported machinery and equipment and also took the lead in apparel imports from Vietnam at US$16.1 billion contributing to Vietnam’s GDP.

Imports of the foreign investment sector were over US$218.3 billion up by 29.2 percent over the same period last year. The FDI sector had a trade surplus of around US$28.5 billion.

Manufacturing likely to attract FDI, aid economy in 2022

After recording a negative GDP in Q3 of 2021 and experiencing a contraction in manufacturing, Vietnam’s manufacturing rebounded and expanded from Q4 2021. As per IHS Markit, Vietnam’s Purchasing Managers Index (PMI) increased to 52.5, a slight increase from 52.2 in November, but nevertheless, showing improved business conditions. A score of 50 or more indicates expansion in manufacturing. New orders continued to increase at the end of the year, while exports orders also increased in December to an eight-month high.

While a lack of labor and the pandemic stunted the industry, manufacturing output continued to increase as Vietnam further opened its economy. This underlines Vietnam’s position as a manufacturing hub. Despite restrictions and factory closures, foreign investors continue to remain positive on Vietnam’s future prospects.

2022 Outlook

Vietnam is expected to continue to main robust FDI investment in 2022. The government has forecast a GDP of 6 to 6.5 percent for 2022. While the country has been attracting FDI in virtually all sectors the government is pushing for investment in high-tech and digital economy sectors. In addition, the government has also launched incentives to help businesses affected by the pandemic. These include tax breaks, delayed tax payments, land fee rentals, and support policies for employers and employees.

While future variants and pandemics are difficult to predict, Vietnam has fully vaccinated 76.6 percent of its population, while around 25.5 percent have also been given a third dose or booster shots as of January 26, 2022.

While Vietnam has faced challenges, its economy remains resilient. While the current crisis is far from over, as Vietnam further opens up and the government works on business reforms, foreign investors are likely to continue their expansions and production shifts as they diversify supply chains and look at new markets. In this context, Vietnam is likely to continue to gain from supply chain restructuring aided by its network of free trade agreements and business environment.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnams ausländische Direktinvestitionen sinken 2021 leicht, aber die Wiedereröffnungsmaßnahmen kurbeln die Wirtschaft an

- Next Article Scotland Eager to Support Offshore Wind Power Projects in Vietnam